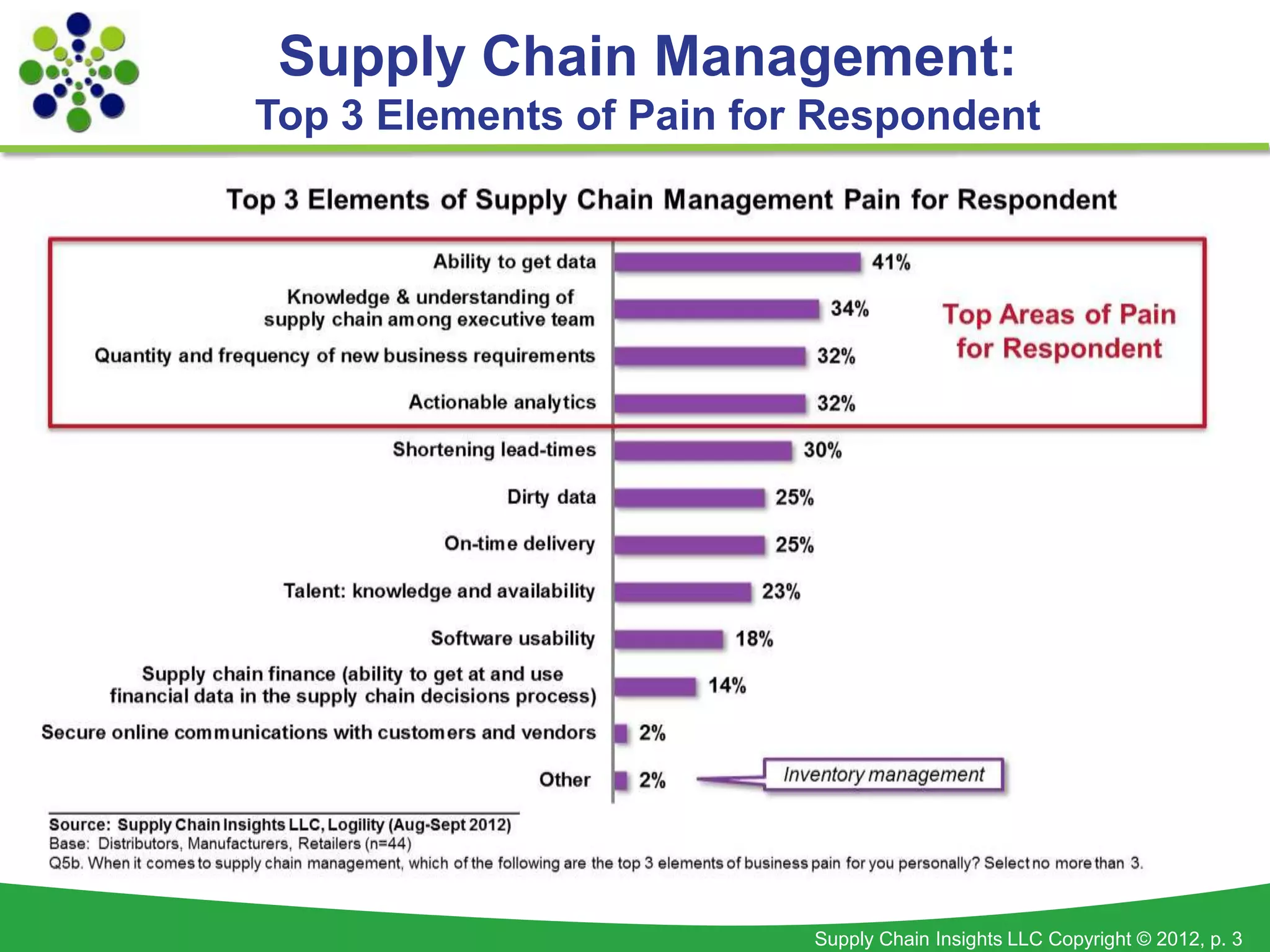

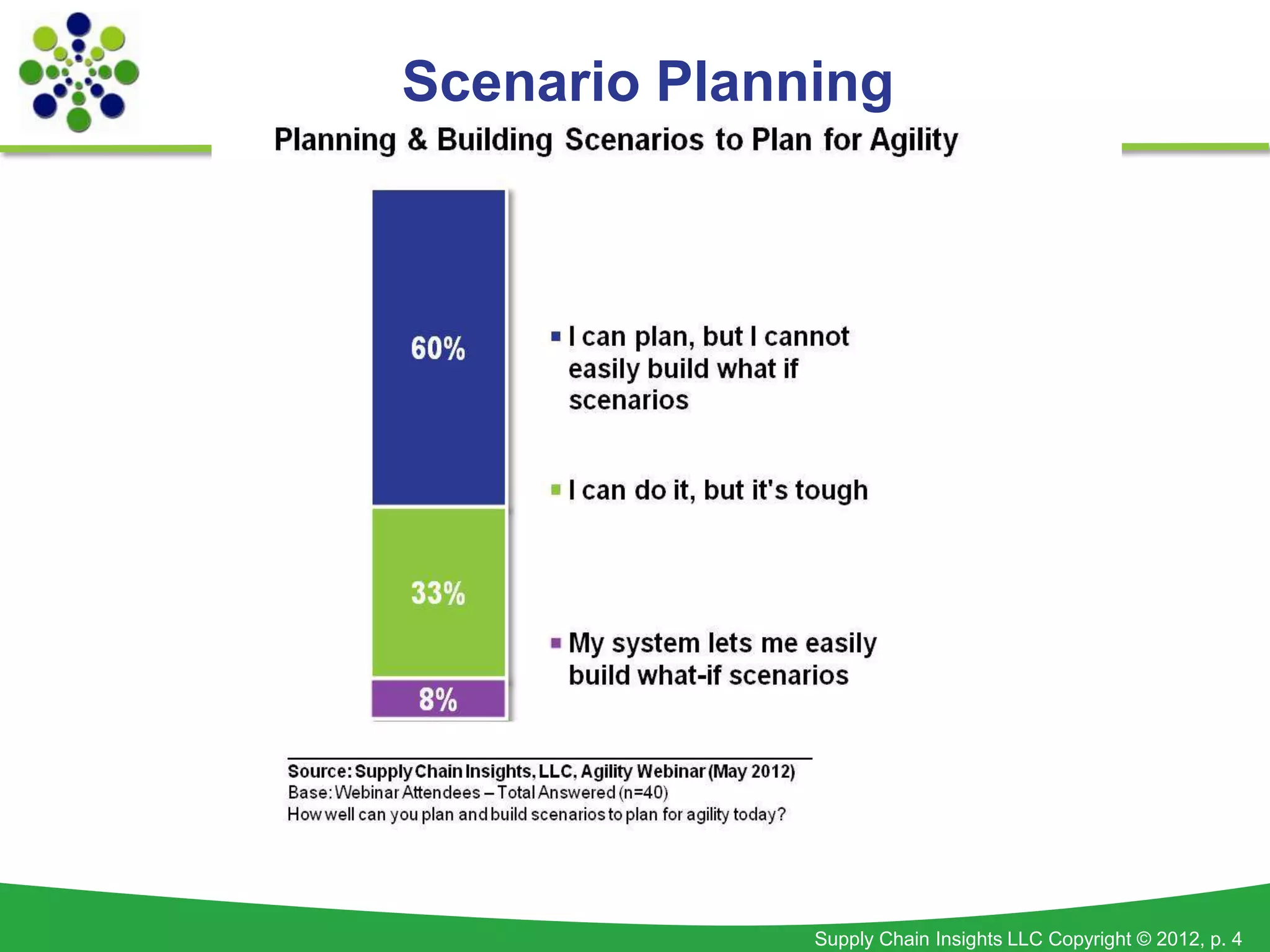

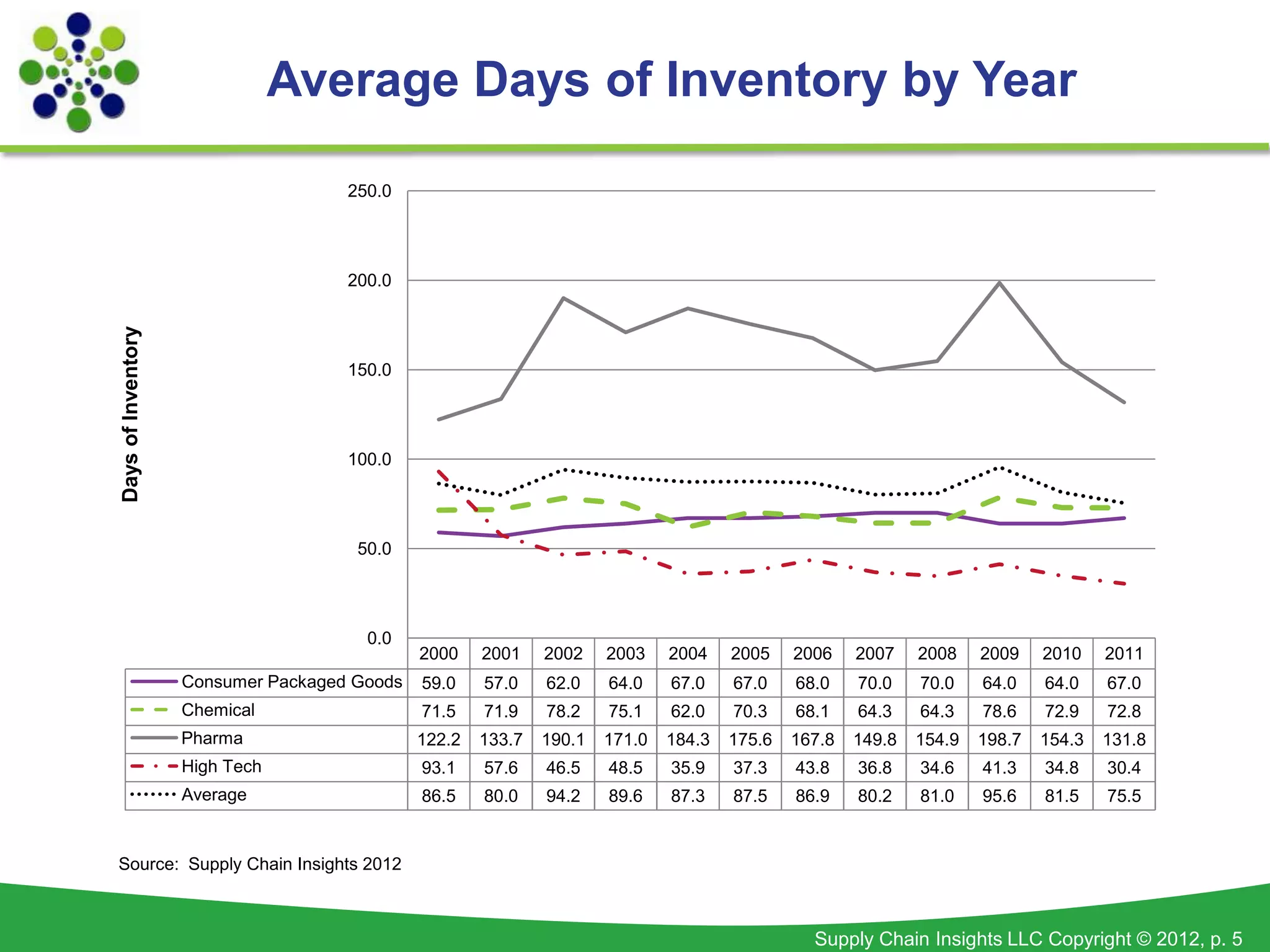

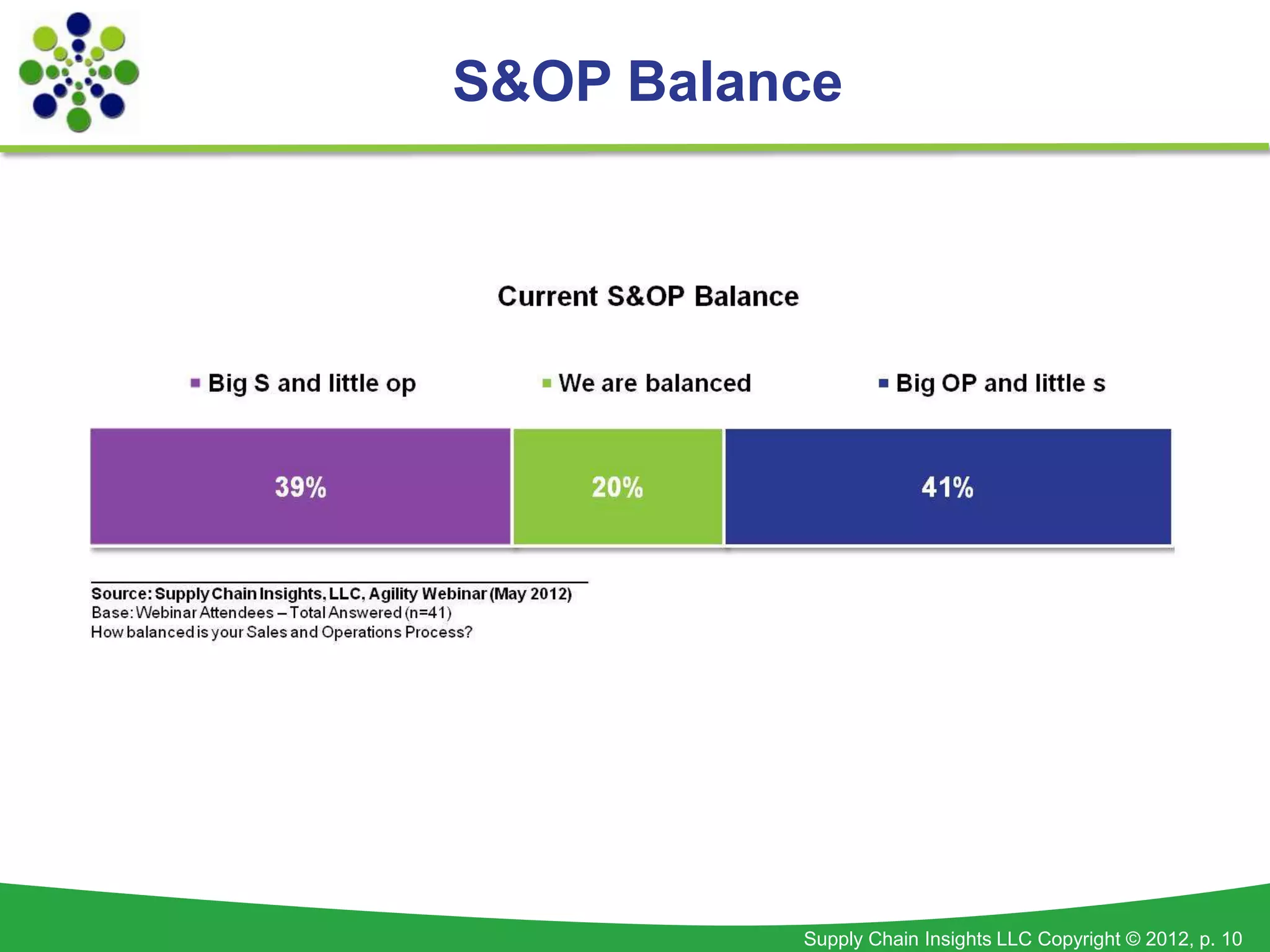

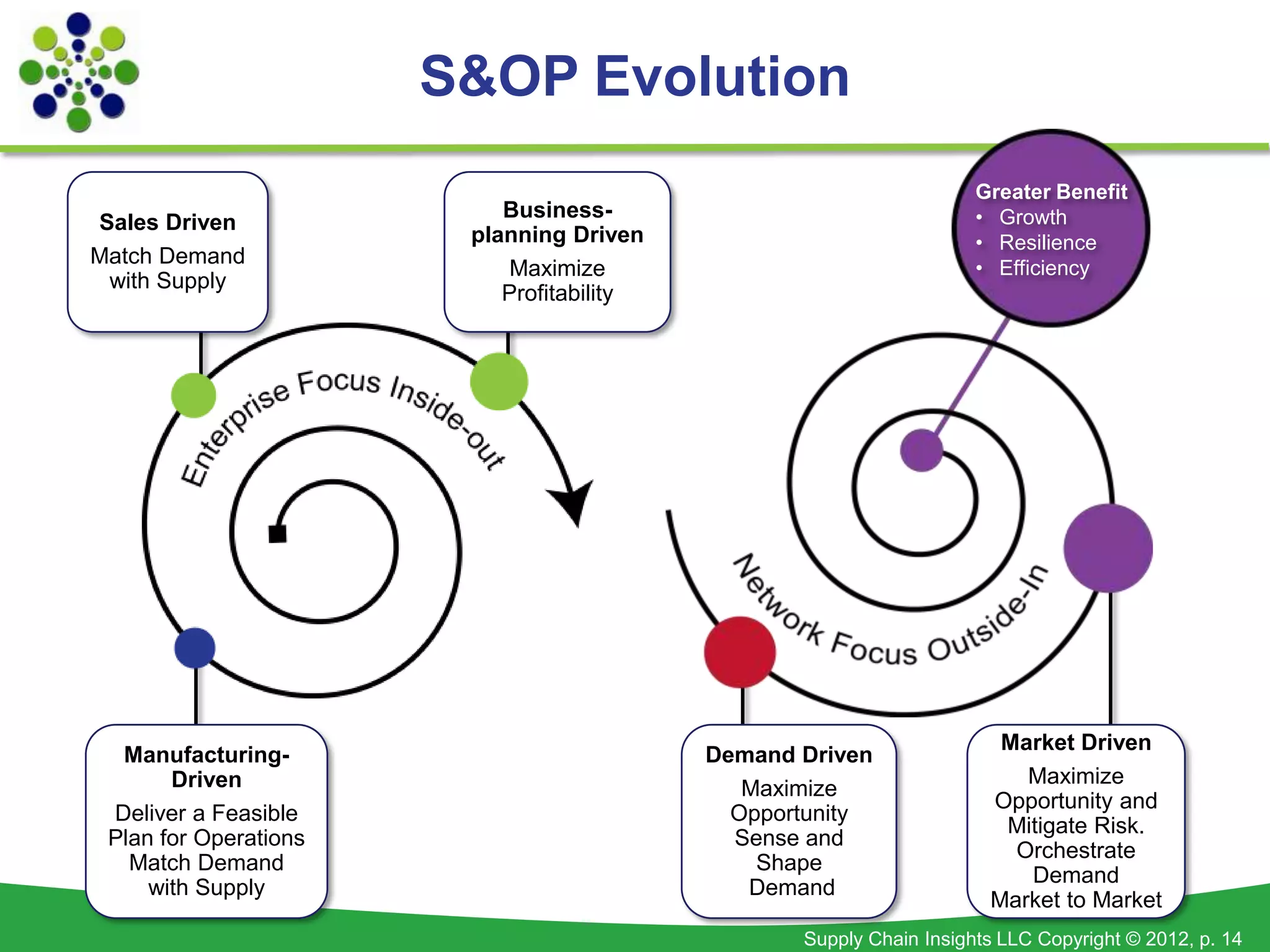

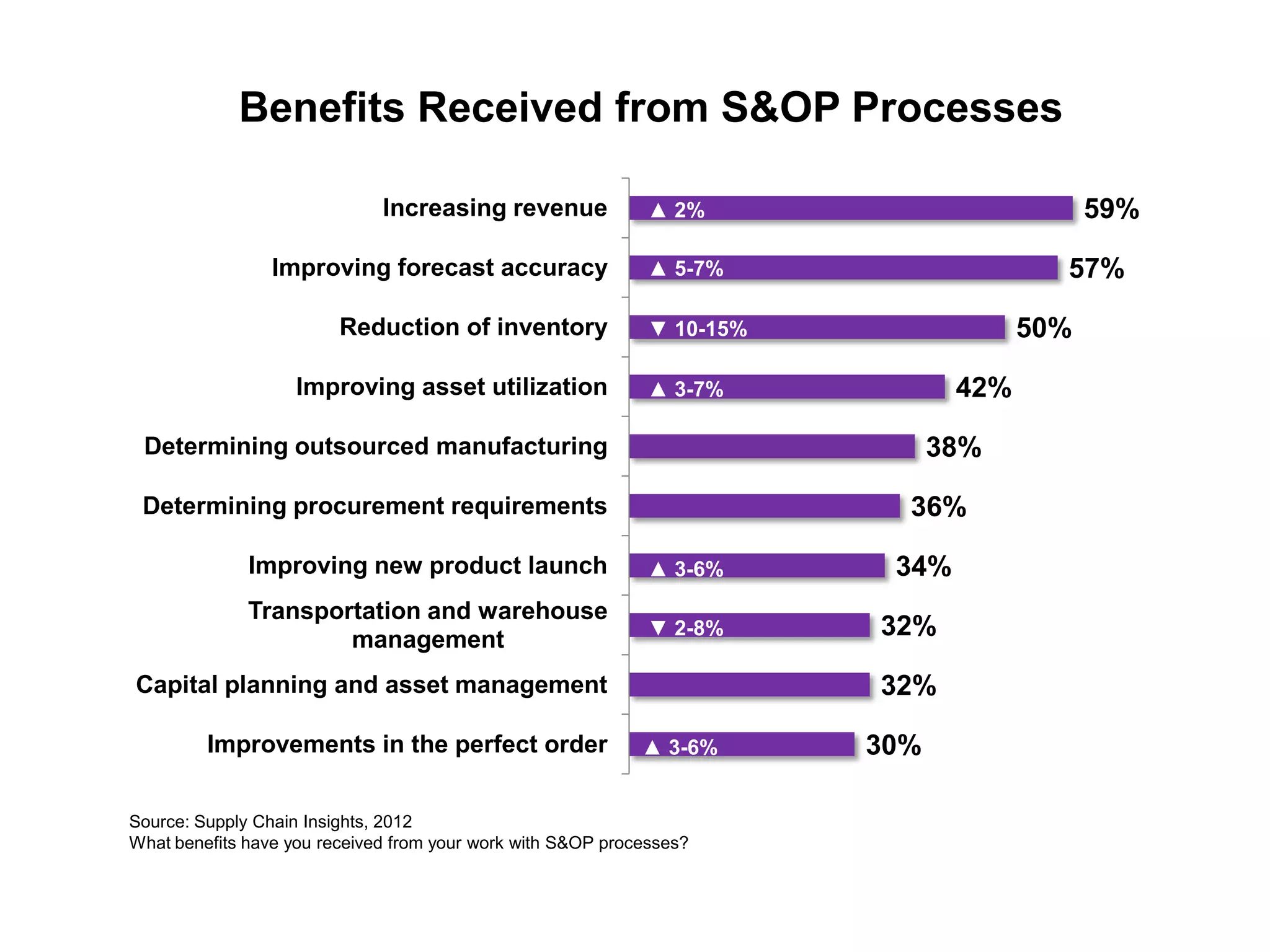

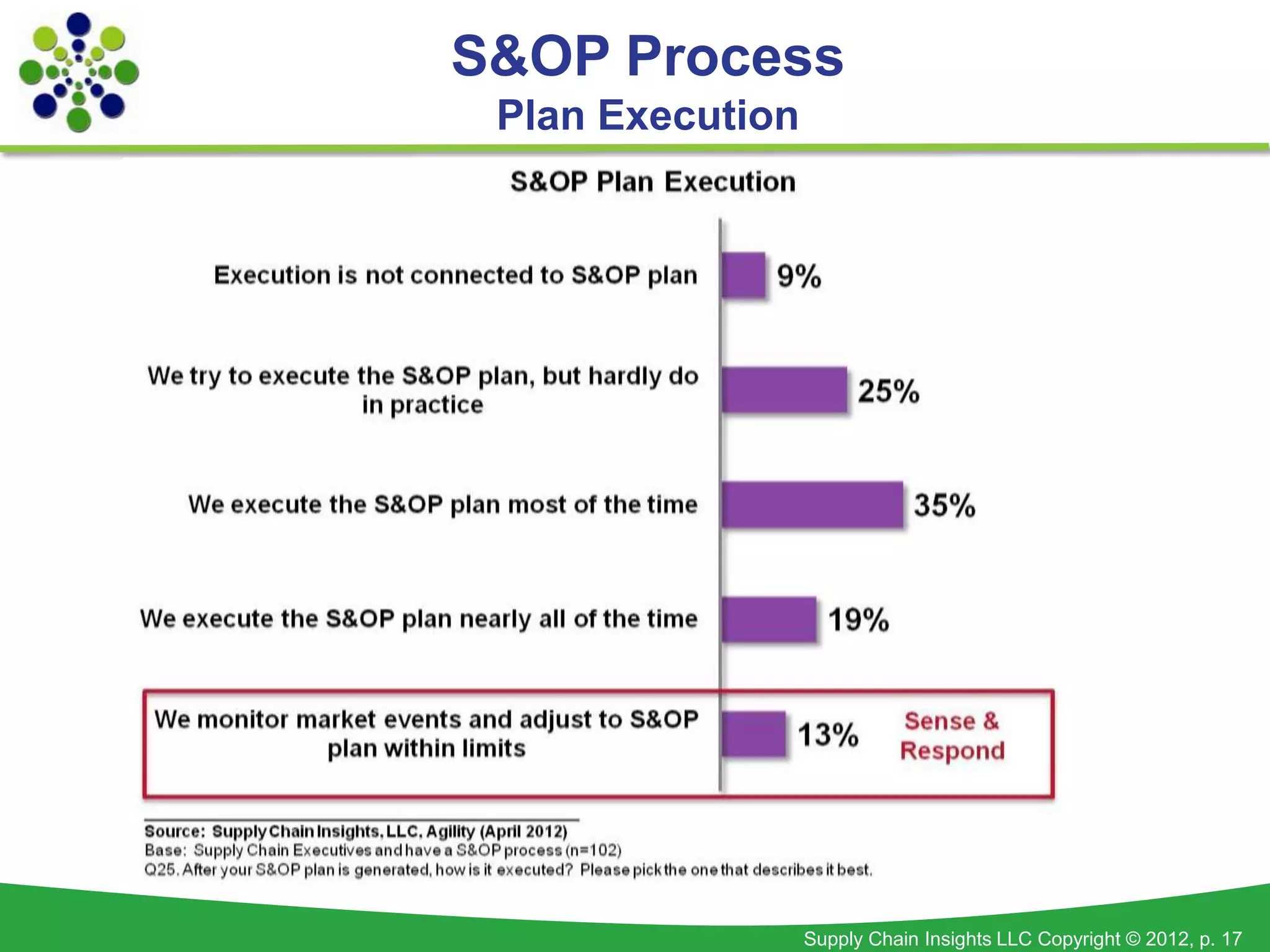

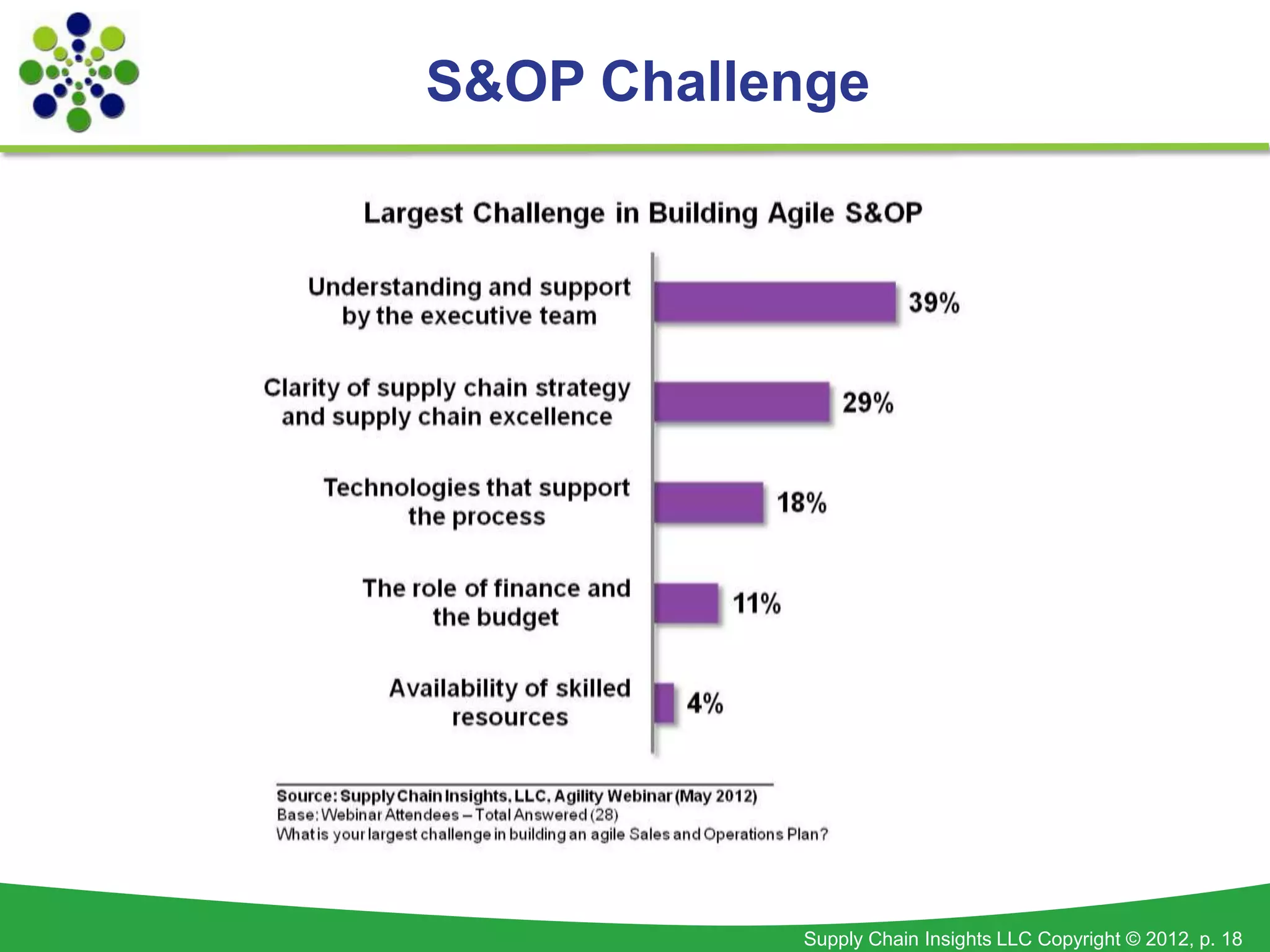

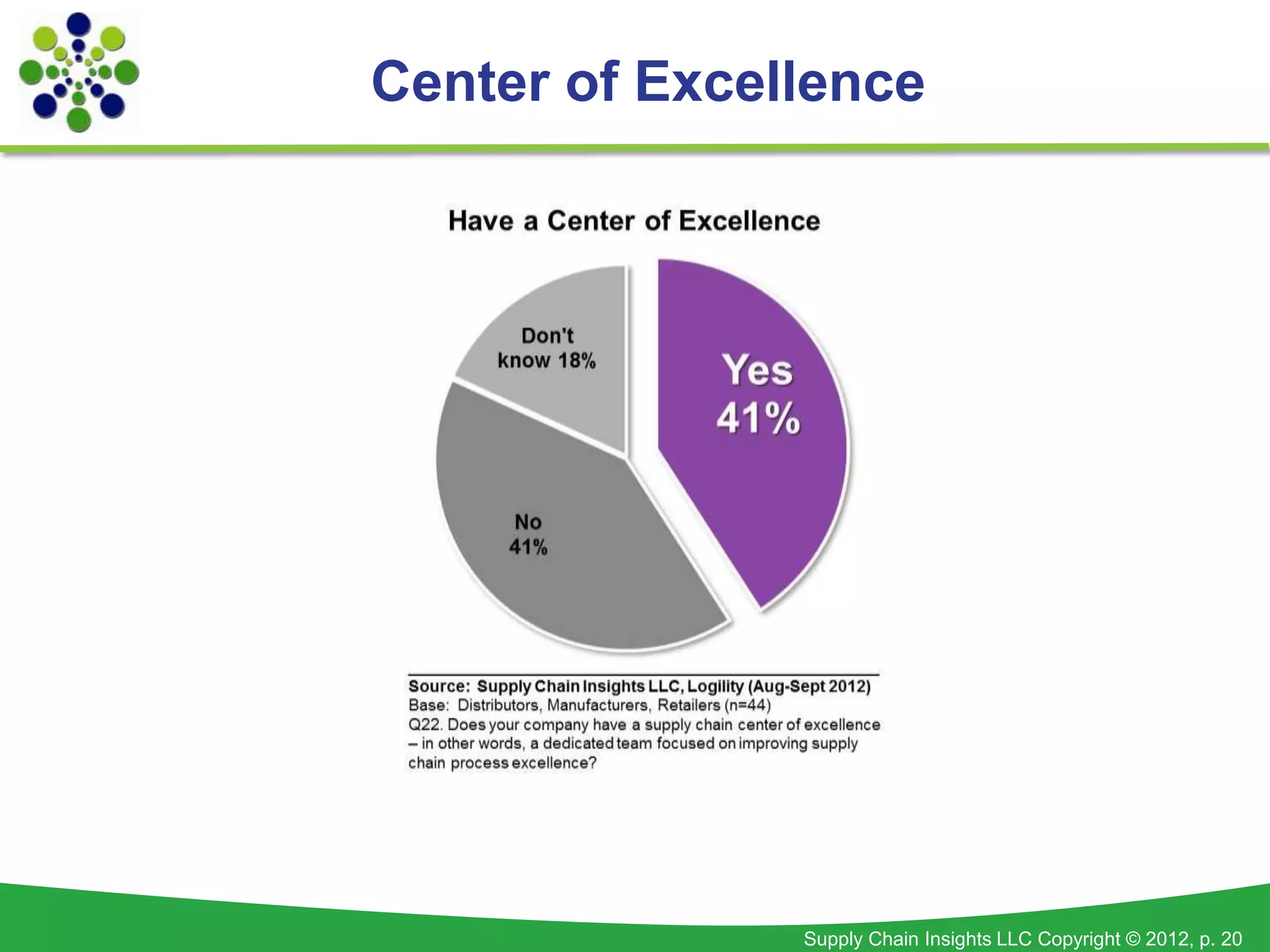

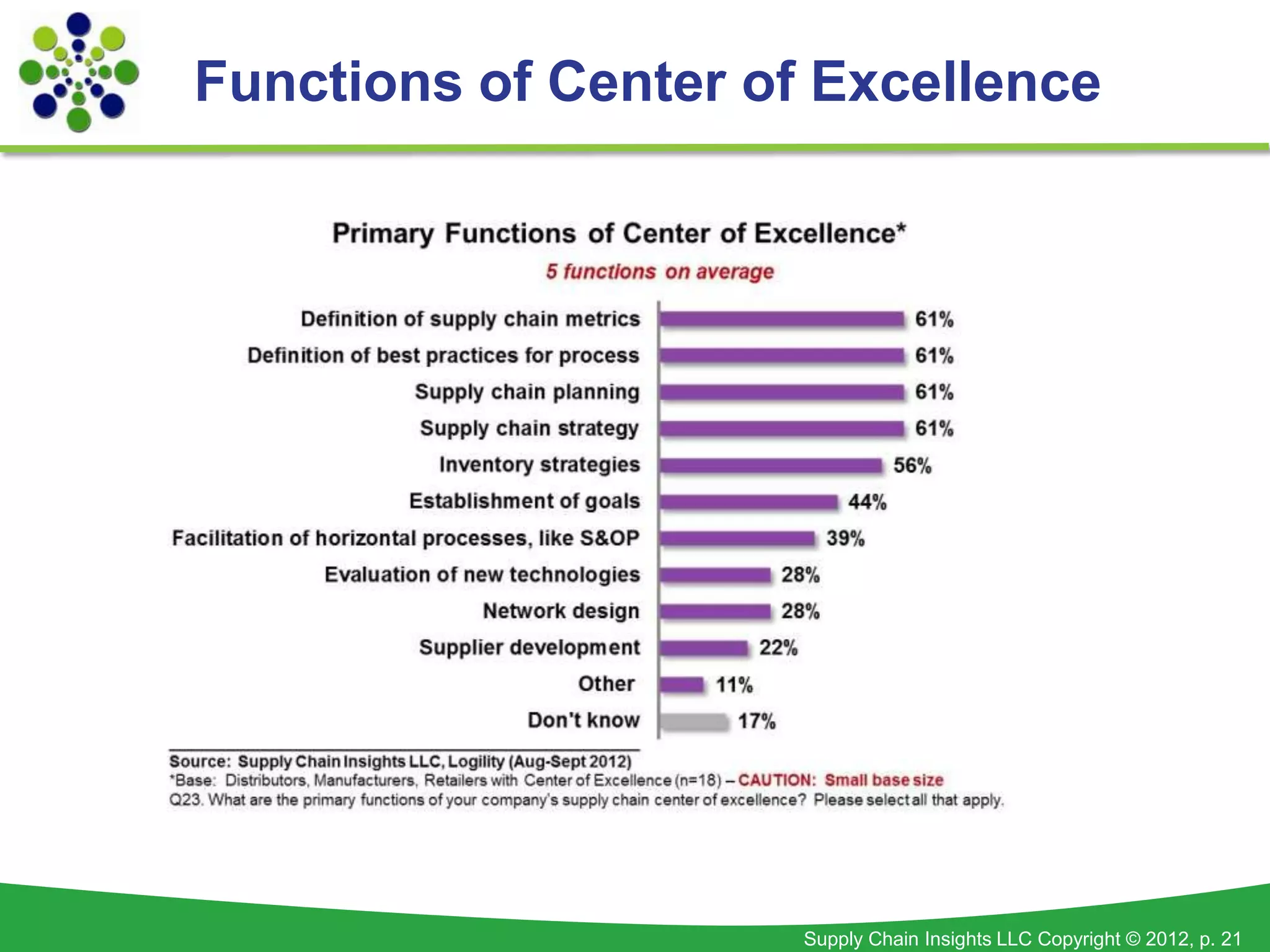

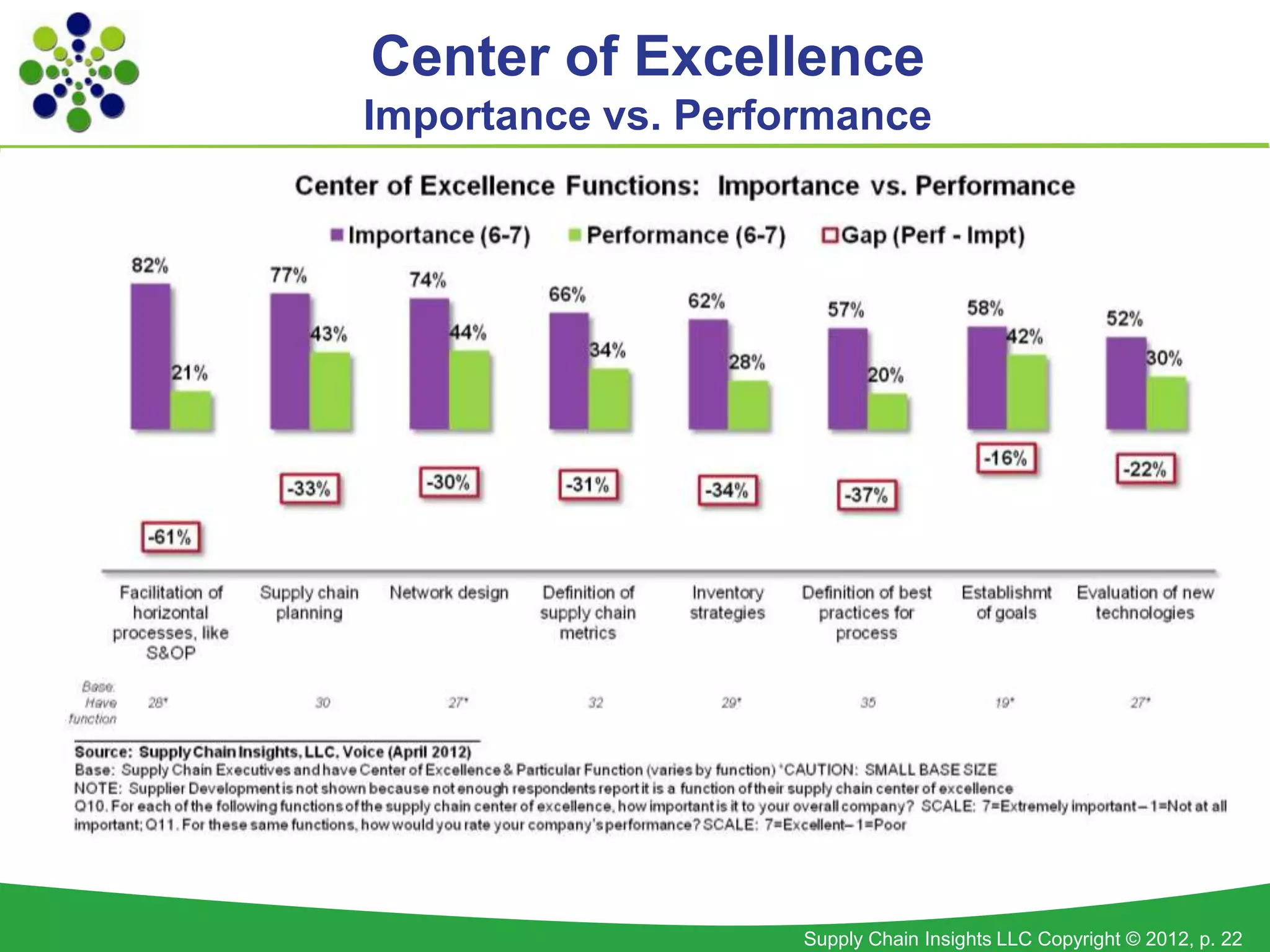

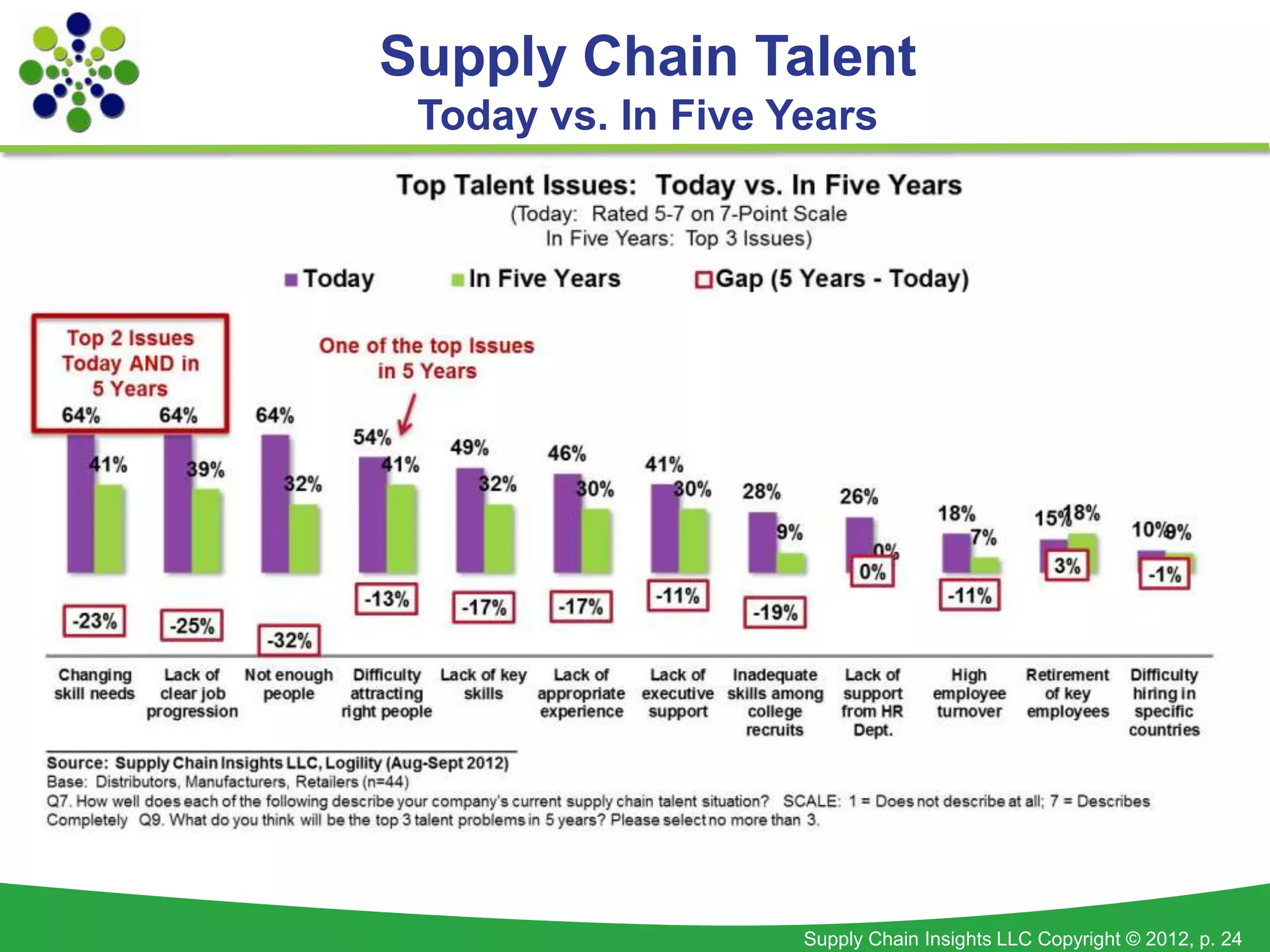

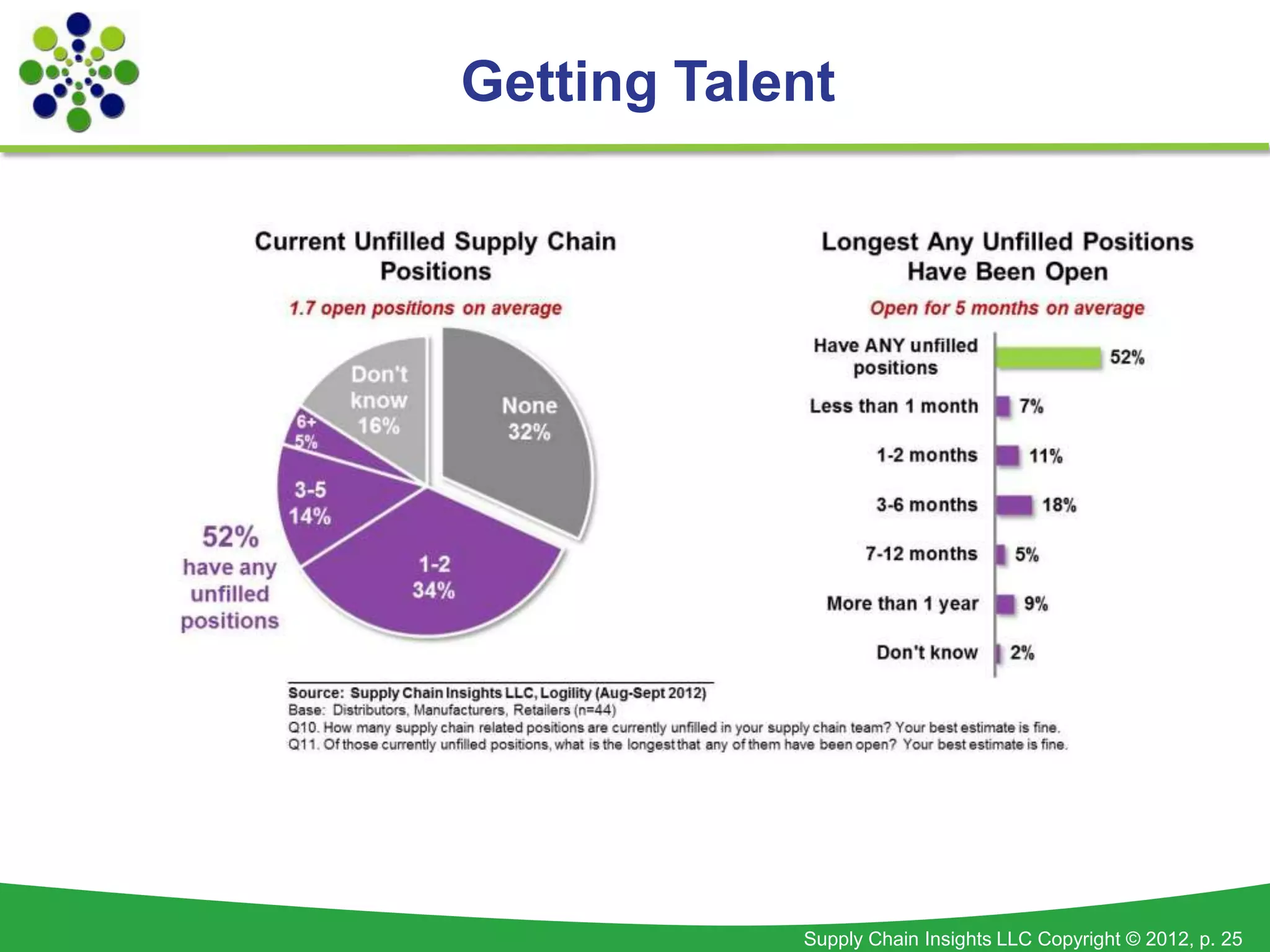

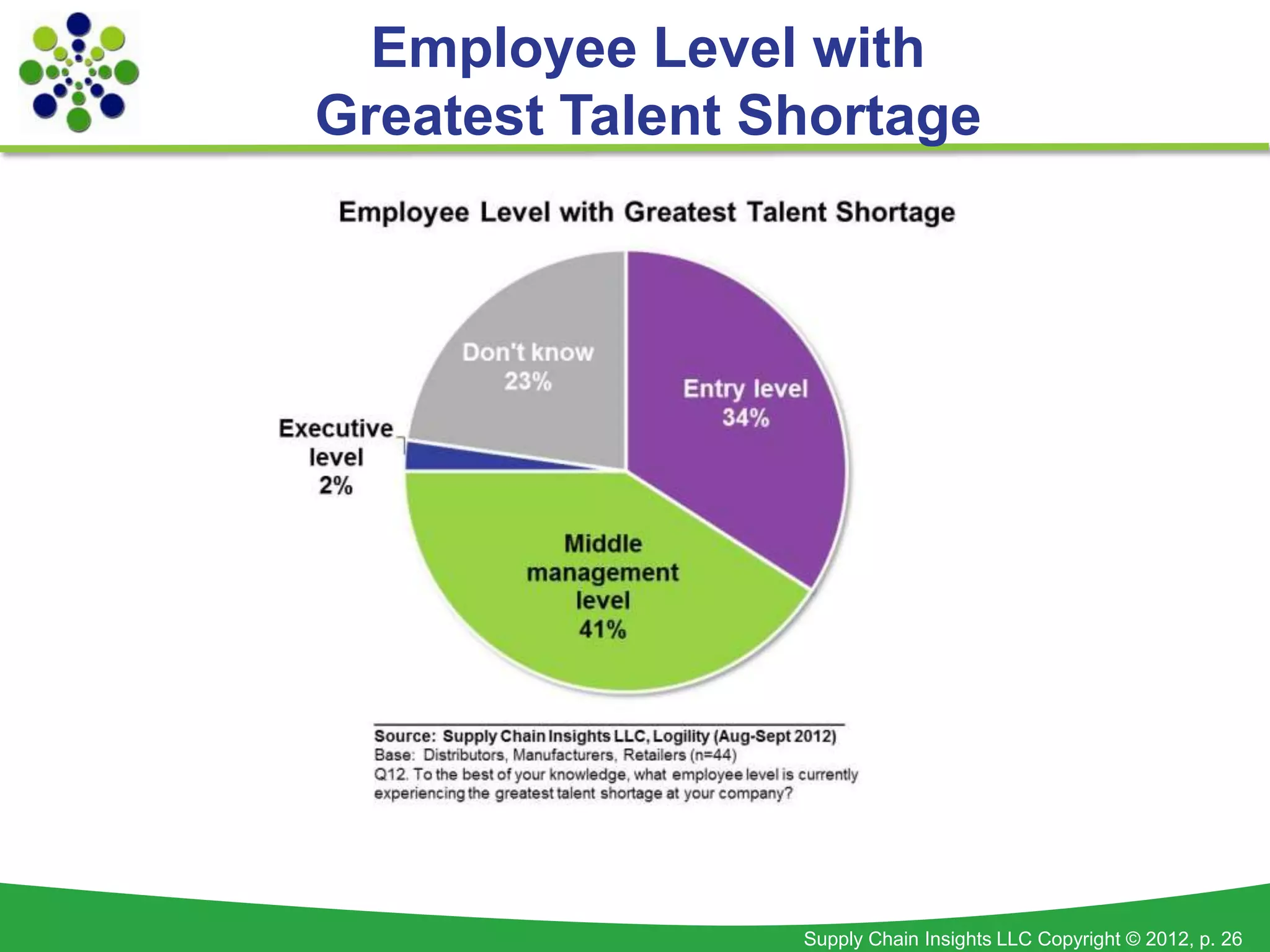

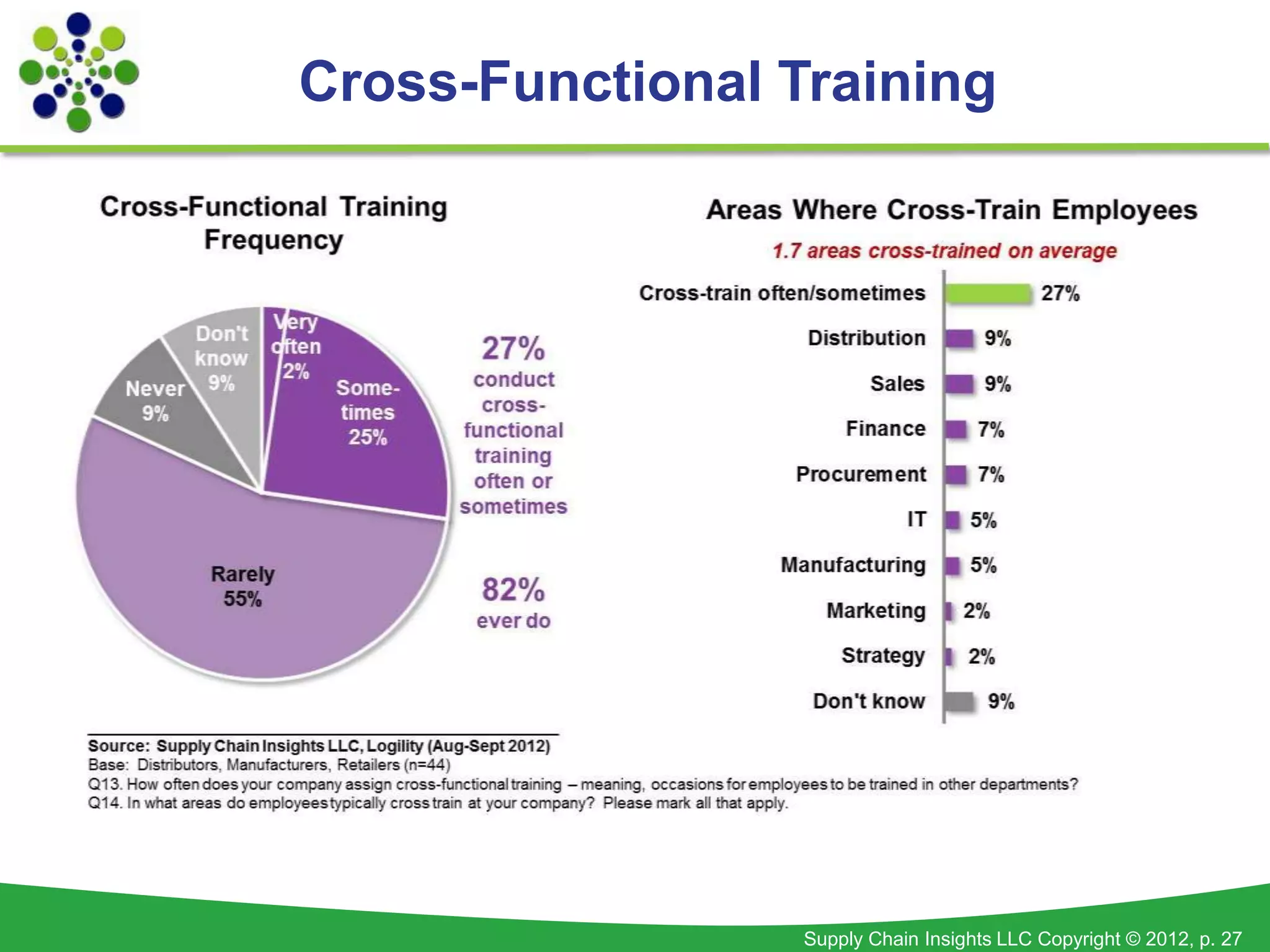

The document summarizes key topics from an S&OP panel discussion. It discusses challenges with S&OP processes, including execution of S&OP plans. It also covers the importance of a center of excellence to support S&OP and addresses talent shortages. Additionally, it provides an overview of the founder of Supply Chain Insights, Lora Cecere, and where to find her online.