The document provides an overview of key components and considerations for an effective business plan, including:

1) A business plan pulls together operational and financial details, marketing opportunities, and management capabilities into a written summary that helps take a realistic look at a proposed business and guide or convince investors.

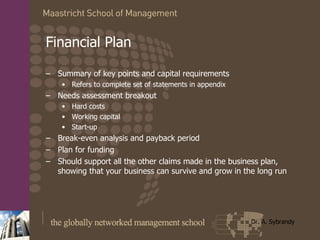

2) Key sections include an executive summary, business concept, management team, market analysis, financial plan, and growth plan.

3) When seeking funding, investors are most interested in the founding team's track record and potential for growth, while lenders focus on repayment abilities like margins, cash flows, and collateral.