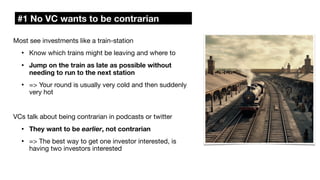

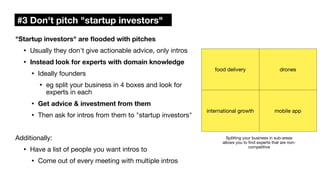

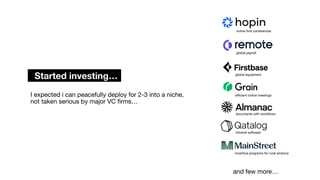

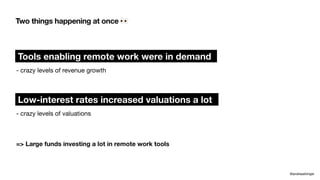

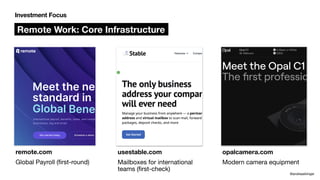

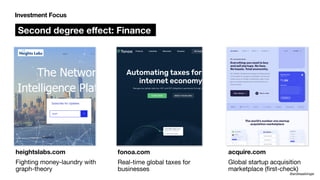

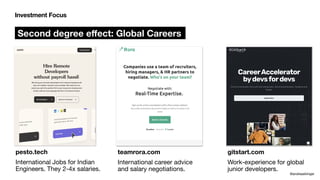

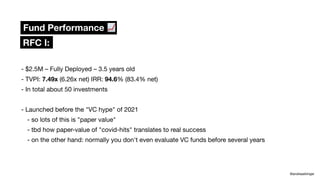

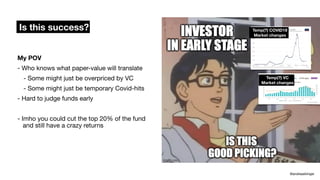

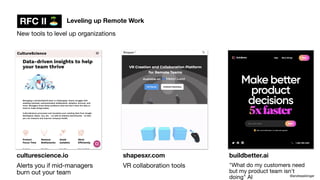

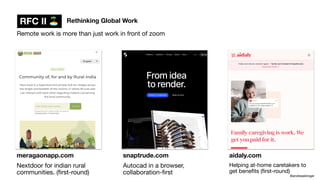

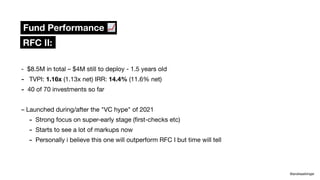

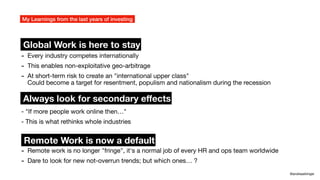

Andreas Klinger discusses his journey of starting a venture capital fund focused on remote work tools and the subsequent learnings from his investments. He highlights the significant demand for remote work solutions during the COVID-19 pandemic, resulting in a rapid increase in valuations and funding opportunities in the sector. Klinger shares key insights on investment strategies, the evolving landscape of remote work, and advice for founders on navigating fundraising in the current market.

![- Countries can't rely on Ukraine, China, USA, etc on resources and production

- Outcomes: Micro-powerplants; Micro-factories; Automated resource extraction, etc

Next Big [not yet overrun] Trends (all imho)

@andreasklinger

De-globalization of resource dependence

Opensourcing Enterprise

- Data-compliance laws, self-hosting and customization will favor solutions built open-source

- Outcomes: Global enterprise (eg HR) software winners be open-source; Self-hosting will become common again

Death to Desktop Apps

- The web has won; Desktop and operating-system dependent apps are dead

- The next frontier is local-

fi

rst webgpu-enabled web-apps with hyper-performant backends

Roll Ups

- During the recessions a lot of Micro-PE

fi

rms will acquire companies.

- Smb and blue collar businesses could be especially interesting here (economies of scale)](https://image.slidesharecdn.com/lessonslearned-230426074632-f9dd051e/85/I-started-a-VC-fund-here-is-what-happened-35-320.jpg)