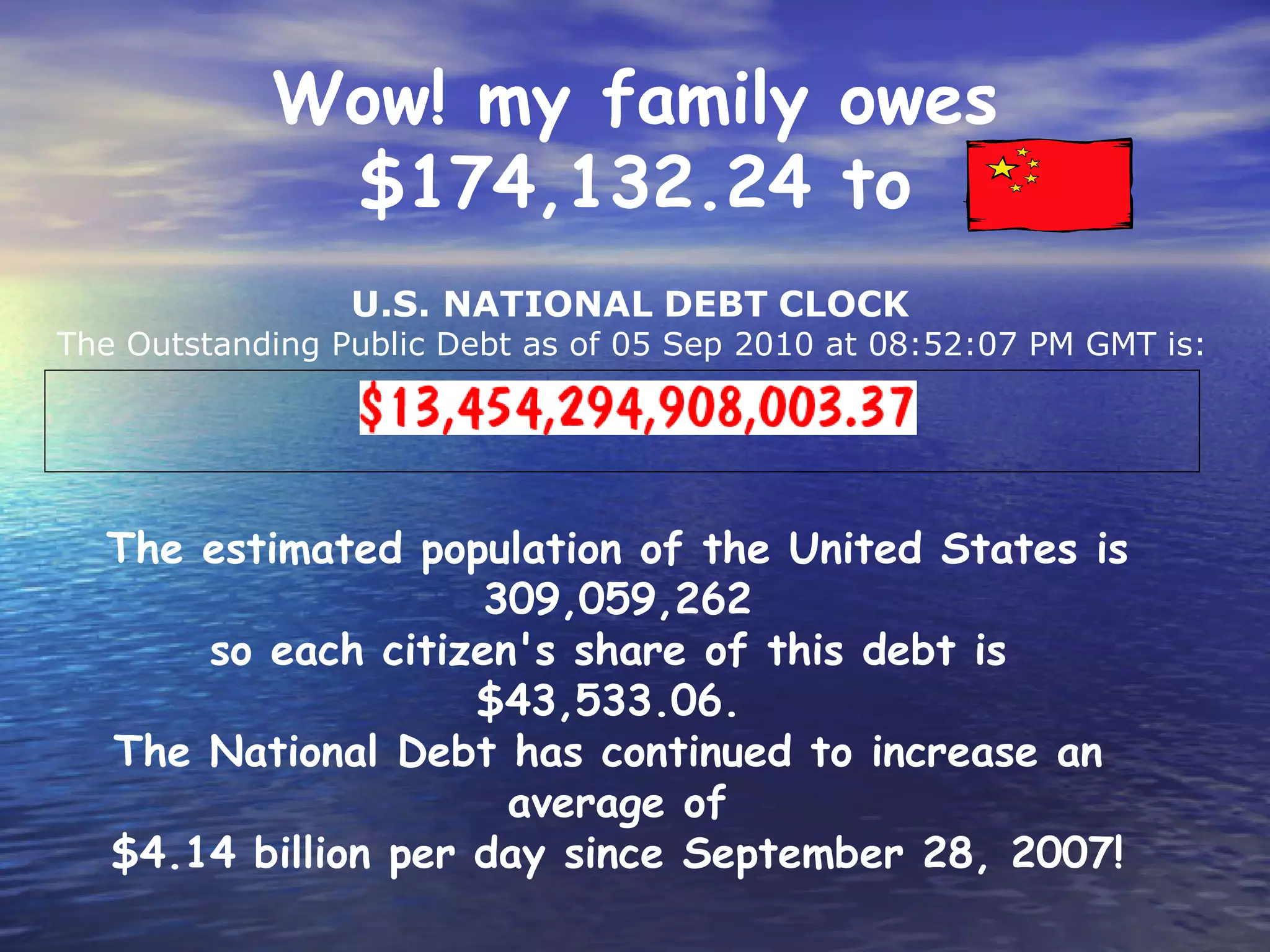

The document discusses the challenges and opportunities faced by financing companies in the medical sector, particularly in the context of a changing global economy and healthcare reforms. It highlights the issues with the current venture capital model and emphasizes the need for innovation, strategic planning, and a focus on unmet needs in order to effectively raise capital and succeed. The document concludes with a realistic perspective on adapting to these changes and fostering creativity and resilience in business strategies.