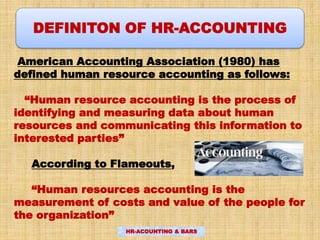

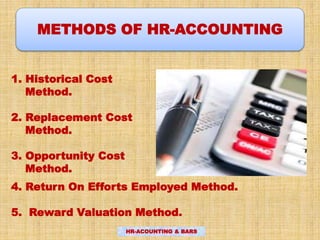

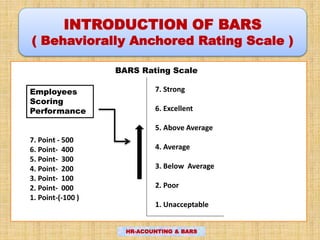

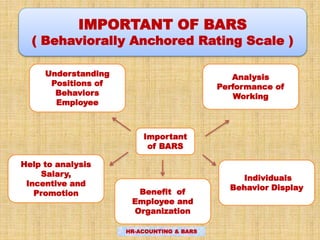

The presentation covers human resource accounting (HRA) and behaviorally anchored rating scales (BARS), defining HRA as the process of measuring and communicating the value of human resources in an organization. It outlines the objectives, methods, and importance of HRA, including improving management decisions and productivity, while also addressing its disadvantages. BARS is introduced as a performance rating tool focused on employee behavior to aid in salary and promotion analyses.