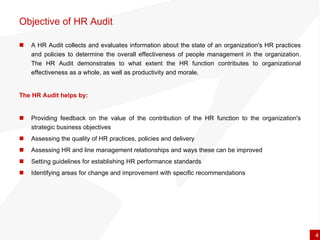

The document summarizes the findings of an HR audit conducted for a financial services group in Pakistan. The audit reviewed the group's HR structure, policies, procedures and systems. Key recommendations included streamlining the HR function by adopting a new structure, revising outdated policies like medical benefits and training, improving compensation, and automating HR processes by upgrading the existing HR information system. The audit found that most current policies were aligned with market standards but some areas needed changes to remain competitive.