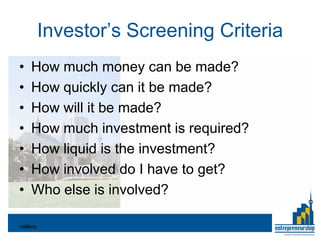

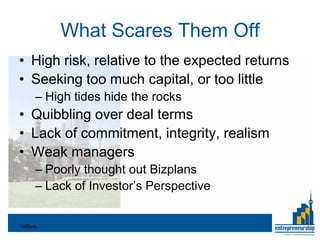

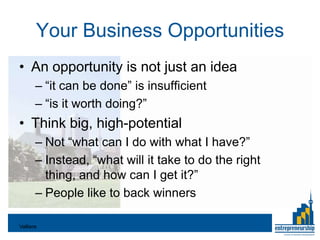

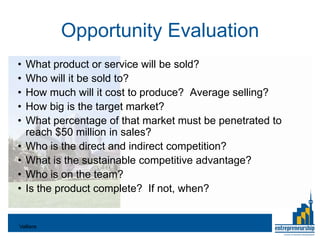

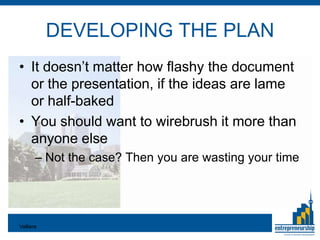

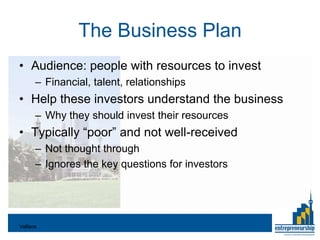

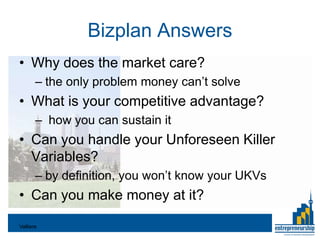

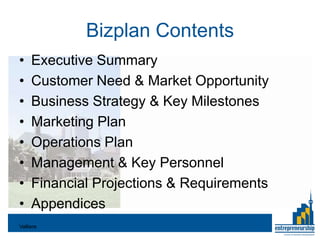

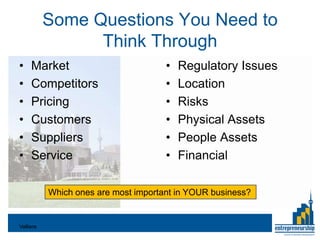

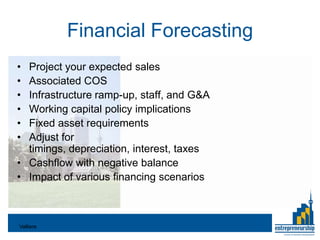

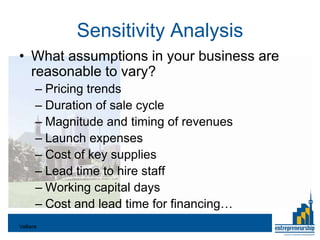

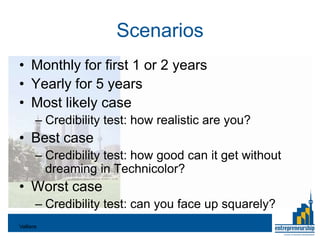

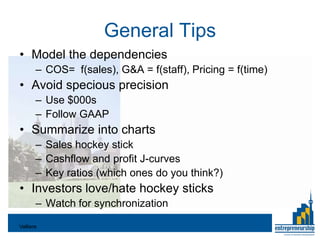

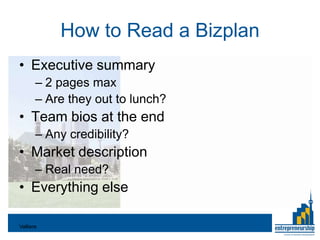

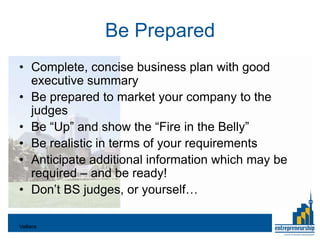

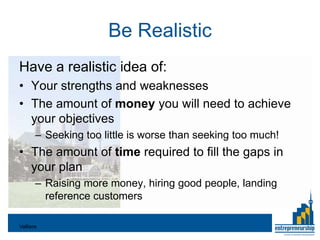

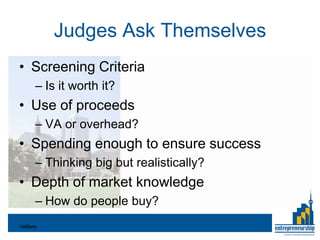

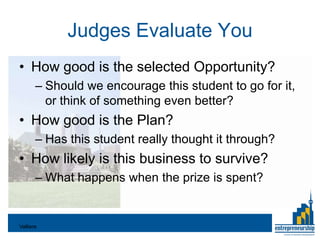

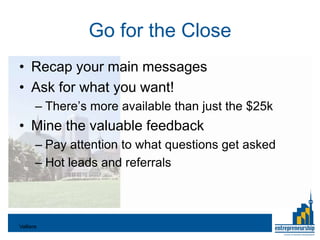

This document summarizes the key points from a seminar on developing a successful business plan and pitch for investors. The presenter outlines the criteria investors use to evaluate opportunities, including potential returns, required investment, and strength of management team. Advice is provided on how to evaluate market opportunities, develop financial forecasts, and package the business plan and pitch to appeal to investors. The importance of thoroughly thinking through all aspects of the business is emphasized.