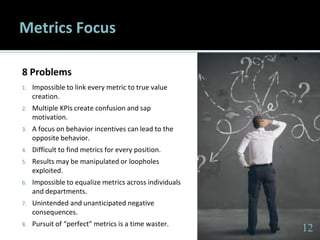

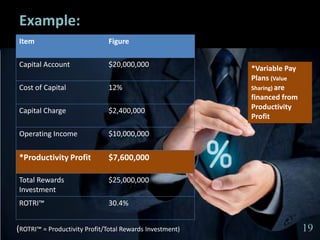

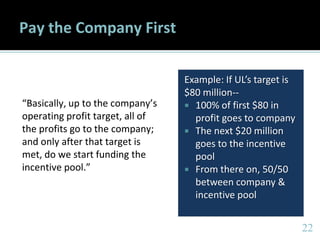

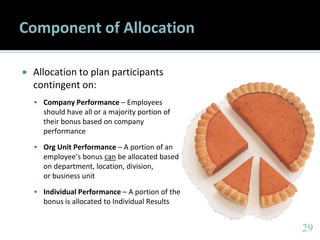

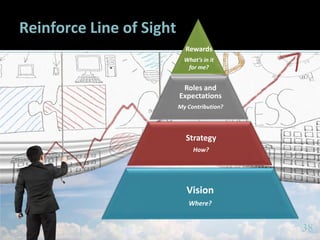

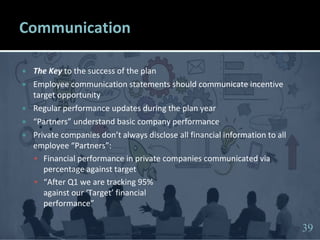

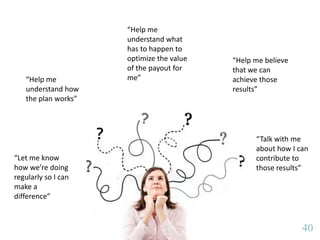

The document discusses three reasons why incentive plans often fail, highlighting issues such as poor metrics selection, mismanagement of individual performance roles, and lack of proper communication. It emphasizes the importance of aligning incentive plans with company goals and employee contributions while advocating for clearer communication about the plan's mechanics. Solutions include focusing on value sharing, understanding employee performance contributions, and engaging employees in a partnership for business success.