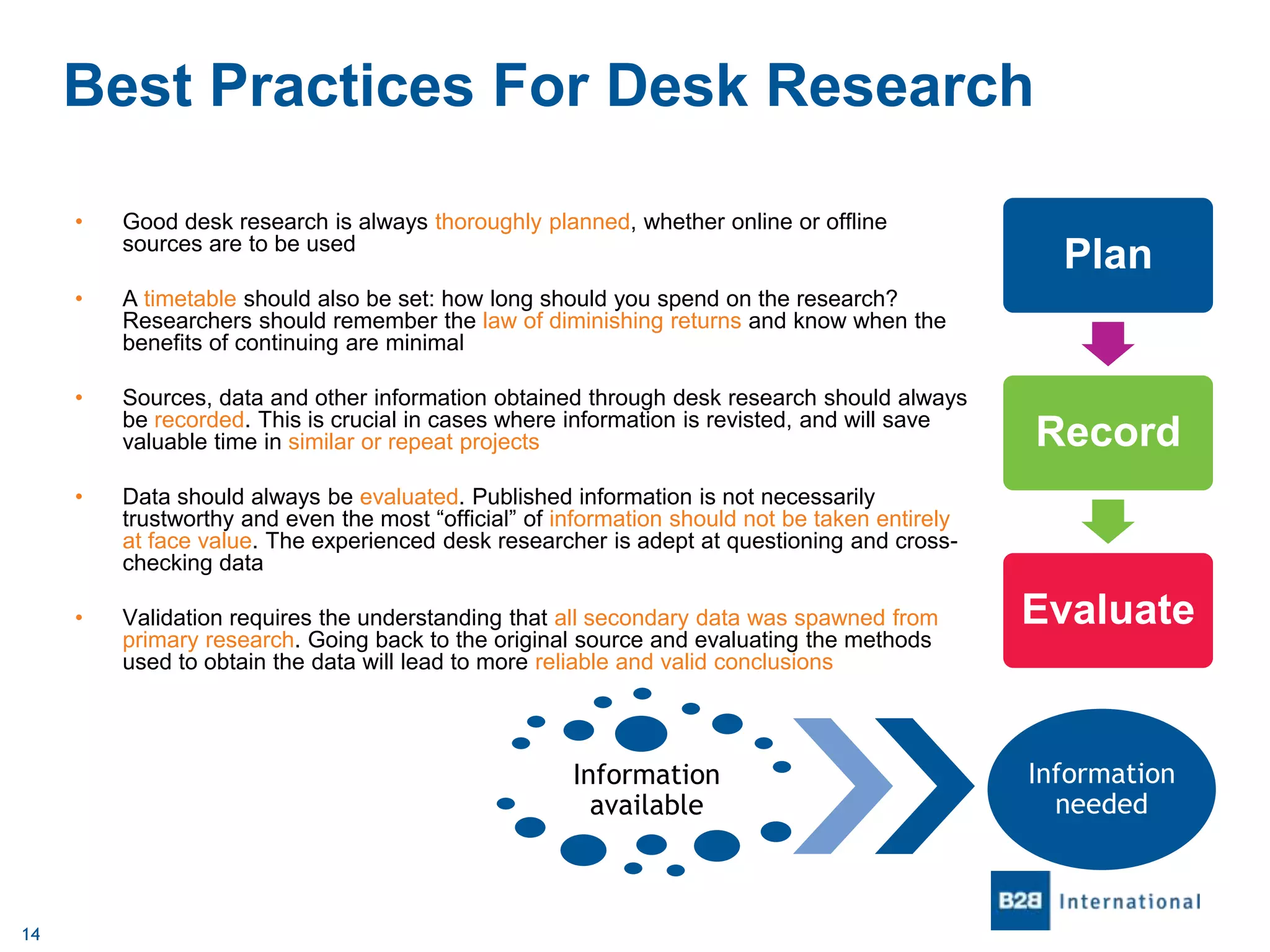

The white paper by B2B International emphasizes the importance and methods of desk research, highlighting its role in collecting secondary data from various sources such as government statistics, industry reports, and expert interviews. It discusses the challenges researchers often face in locating relevant information online and offers best practices for effective research, including the validation of sources. The document concludes by recommending a balanced approach that combines both desk and primary research to achieve comprehensive results.