This document discusses housing affordability in the UK. It summarizes that:

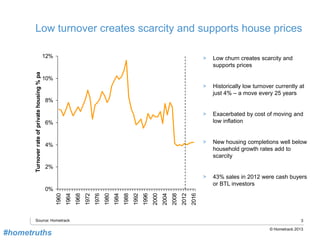

1) House prices have not seen a major correction and low housing turnover supports high prices.

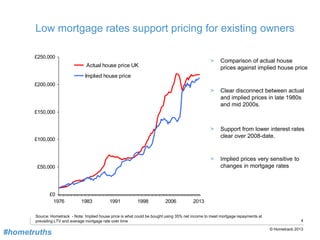

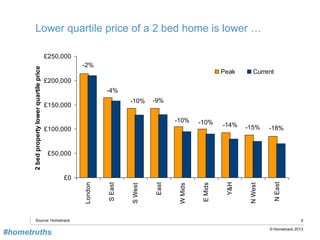

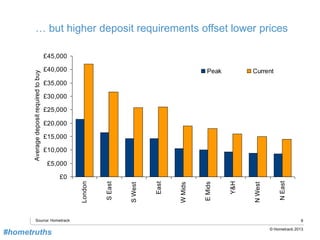

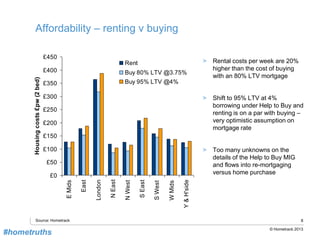

2) Low mortgage rates have supported prices for existing owners but higher deposit requirements offset lower home prices.

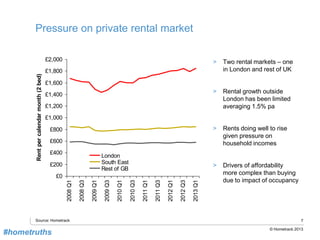

3) There is pressure on the private rental market with rental growth limited outside of London.

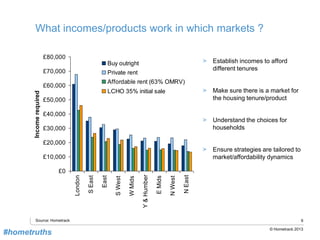

4) Solutions to housing affordability issues need to come from local housing markets and their dynamics.