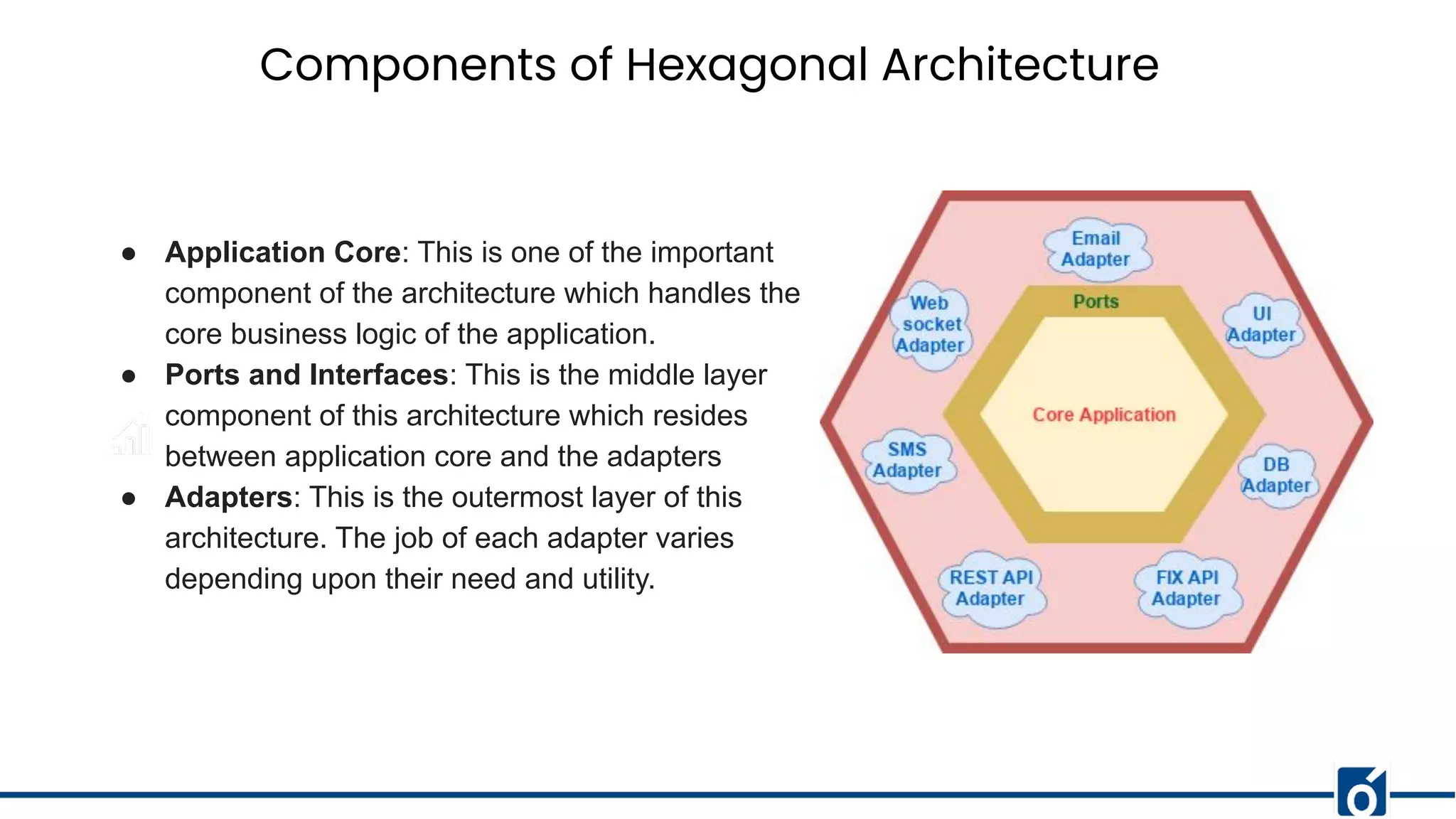

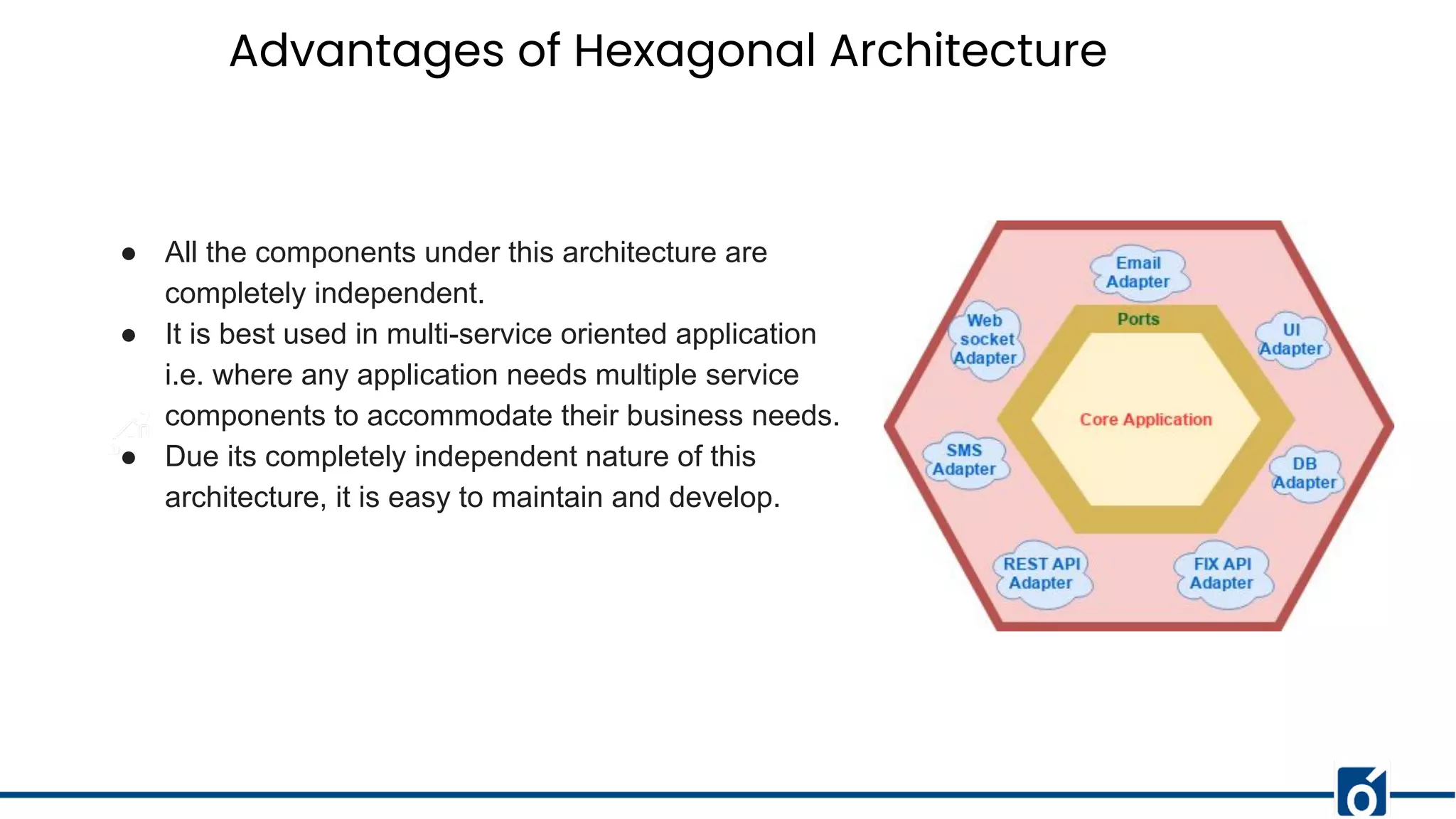

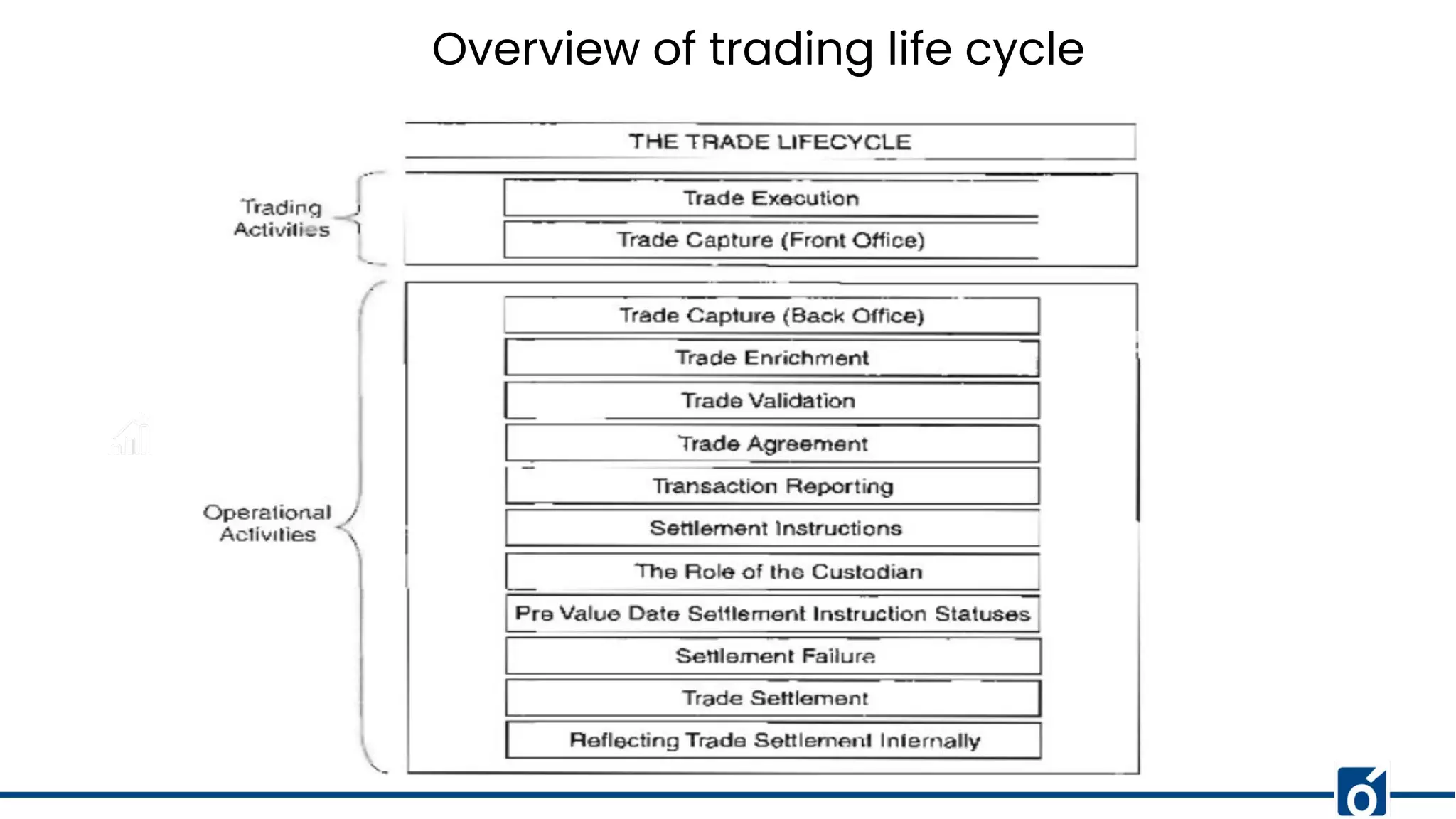

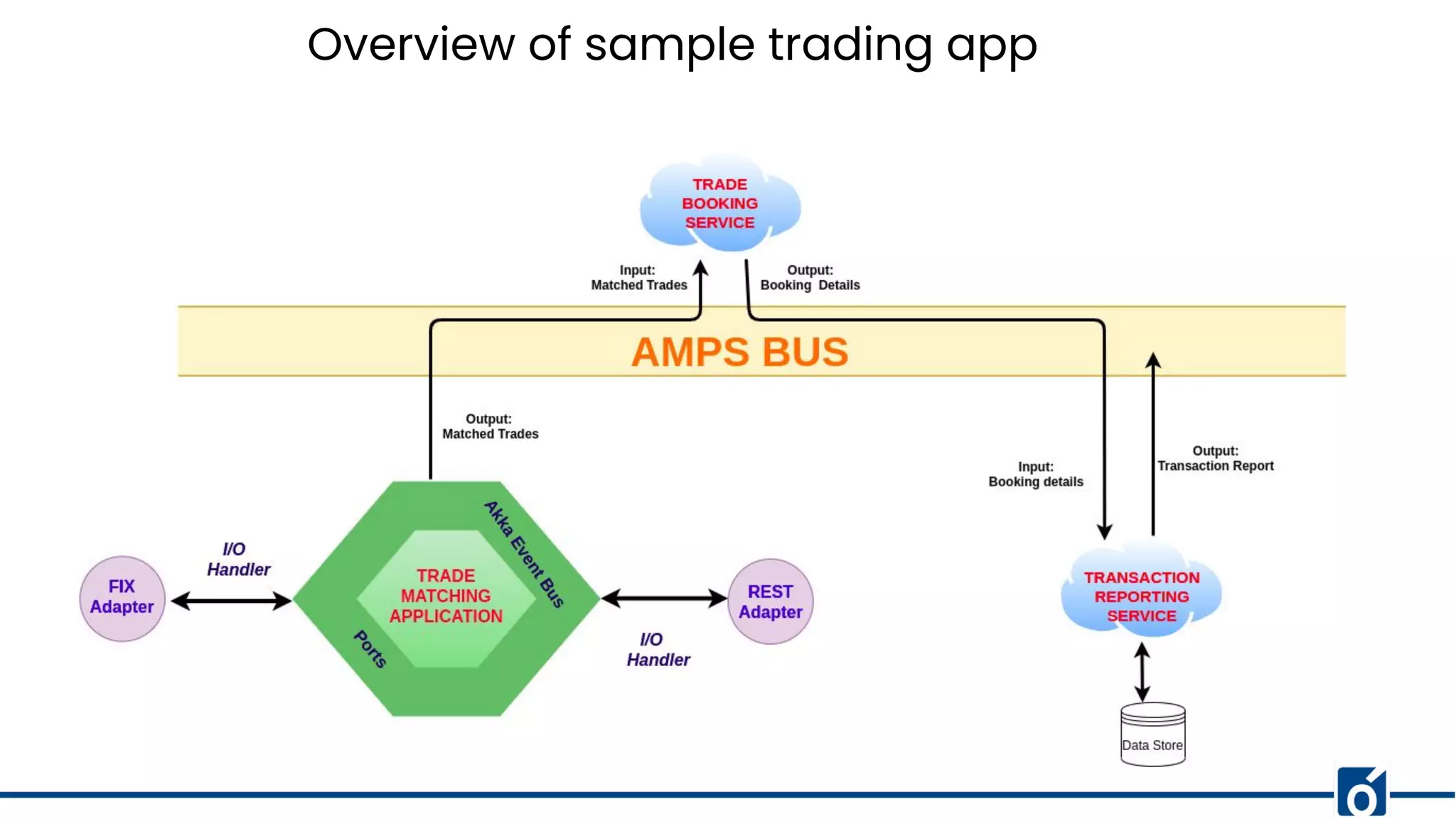

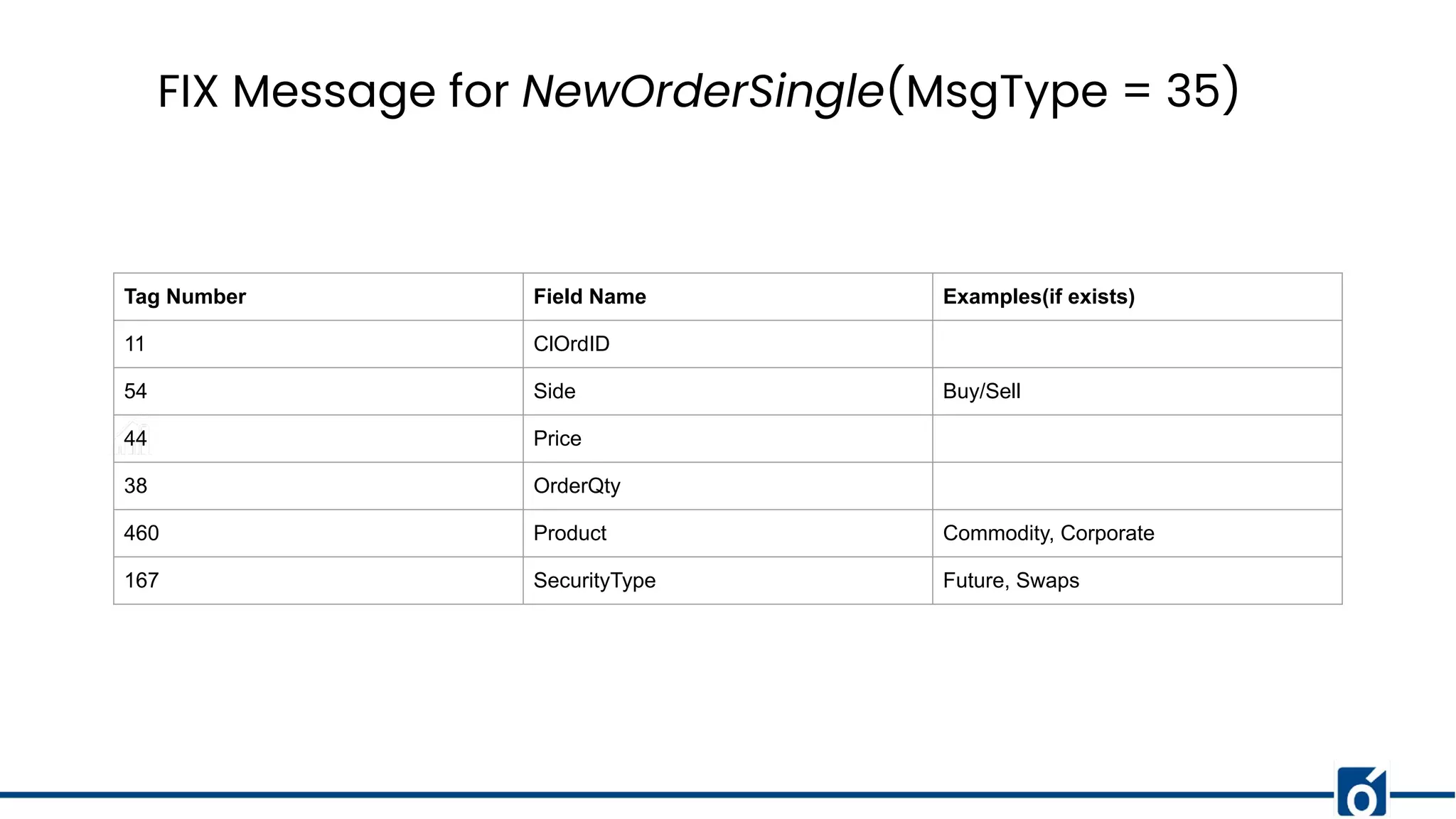

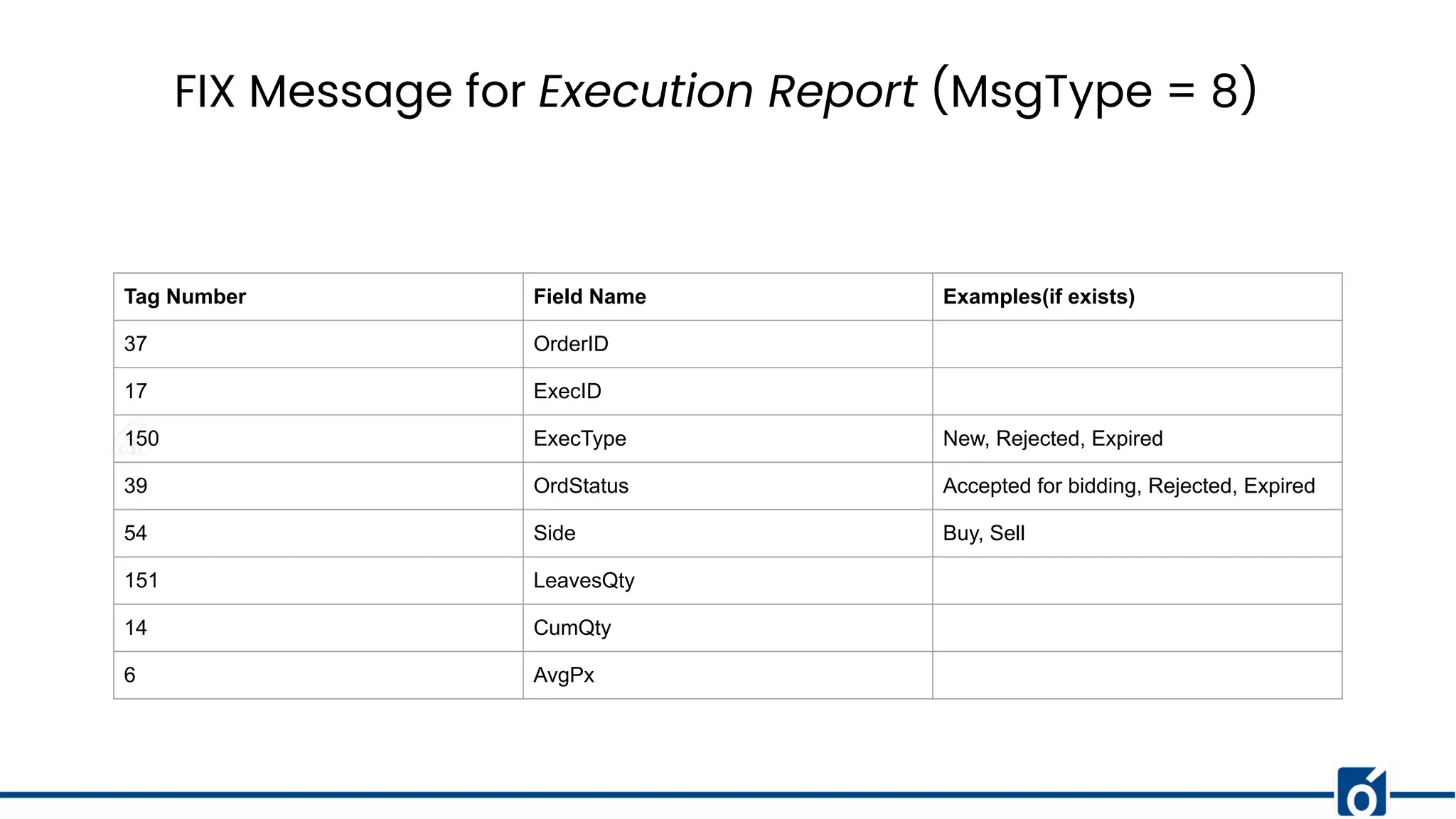

The document discusses hexagonal architecture in fintech, emphasizing its use for creating loosely coupled application components that enhance maintainability and flexibility. It details the architecture's components such as the application core, ports, and adapters, and their independence benefits, particularly in a multi-service environment. Additionally, it outlines the trading lifecycle and challenges in fintech applications, demonstrating how hexagonal architecture addresses these issues by allowing components to function both independently and in unity.