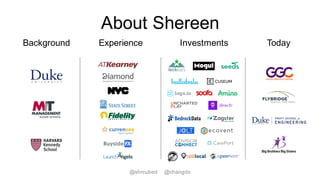

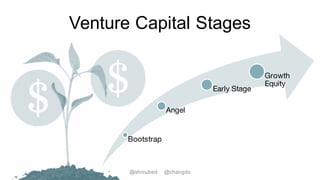

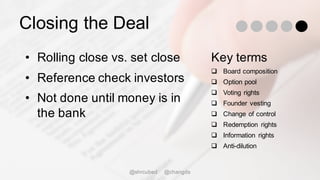

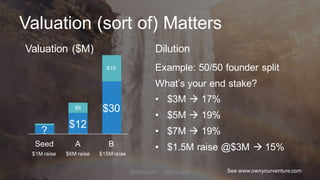

The document provides an overview of a MassChallenge 2016 bootcamp on fundraising basics presented by Shereen Shermak and David Chang. The bootcamp covers topics such as sources of capital, venture capital dynamics, stages of fundraising, preparing to raise a round, targeting investors, socializing an idea, closing a deal, and negotiating valuation. Attendees are encouraged to ask questions.