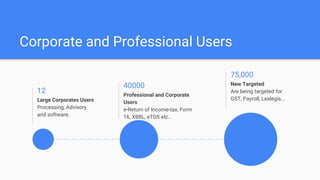

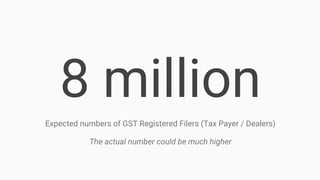

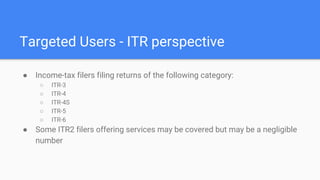

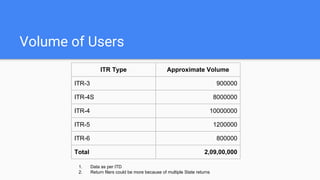

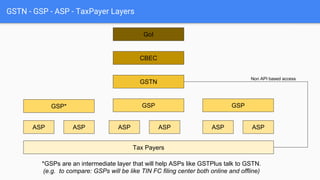

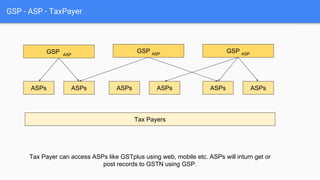

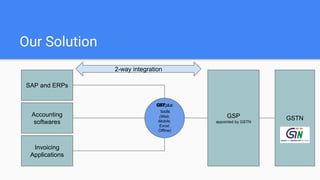

This document provides information about GSTplus.com and their plans for providing services related to the Goods and Services Tax (GST) in India. It summarizes their experience building tax filing solutions, estimates that 10 million taxpayers will need to file GST returns, and outlines their proposed multi-layered solution involving GSTN, GSPs, and ASPs like GSTplus to enable taxpayers to file returns through various tools.