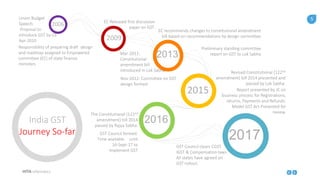

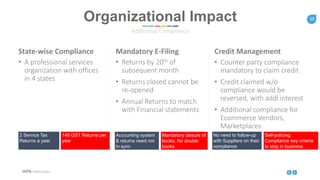

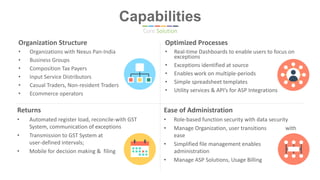

The document provides a detailed overview of the Goods and Services Tax (GST) system in India, emphasizing its importance as the largest tax reform in decades, requiring transactional compliance and collaboration between businesses. It outlines the timeline and legislative developments in the implementation of GST, the technological infrastructure required for compliance, and the roles of various stakeholders. Confidentiality is stressed throughout, with restrictions on reproduction and dissemination of the information contained within.