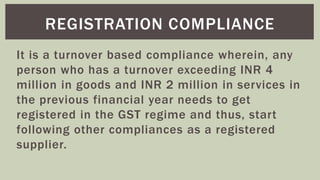

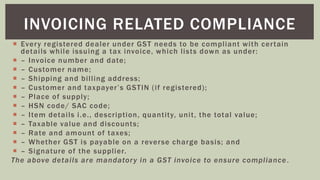

This document discusses the key compliance requirements for taxpayers under India's Goods and Services Tax (GST) regime, including registration requirements, invoicing rules, return filing obligations, and other requirements like obtaining e-way bills for transportation of goods. It notes that the GST Act prescribes penalties for non-compliance in areas like registration, returns filing, and invoice maintenance. Taxpayers must meet turnover thresholds to be registered and comply with rules for invoice content and filing periodic returns. Strict penalties are in place under the Act to ensure enforcement of the various compliance areas.