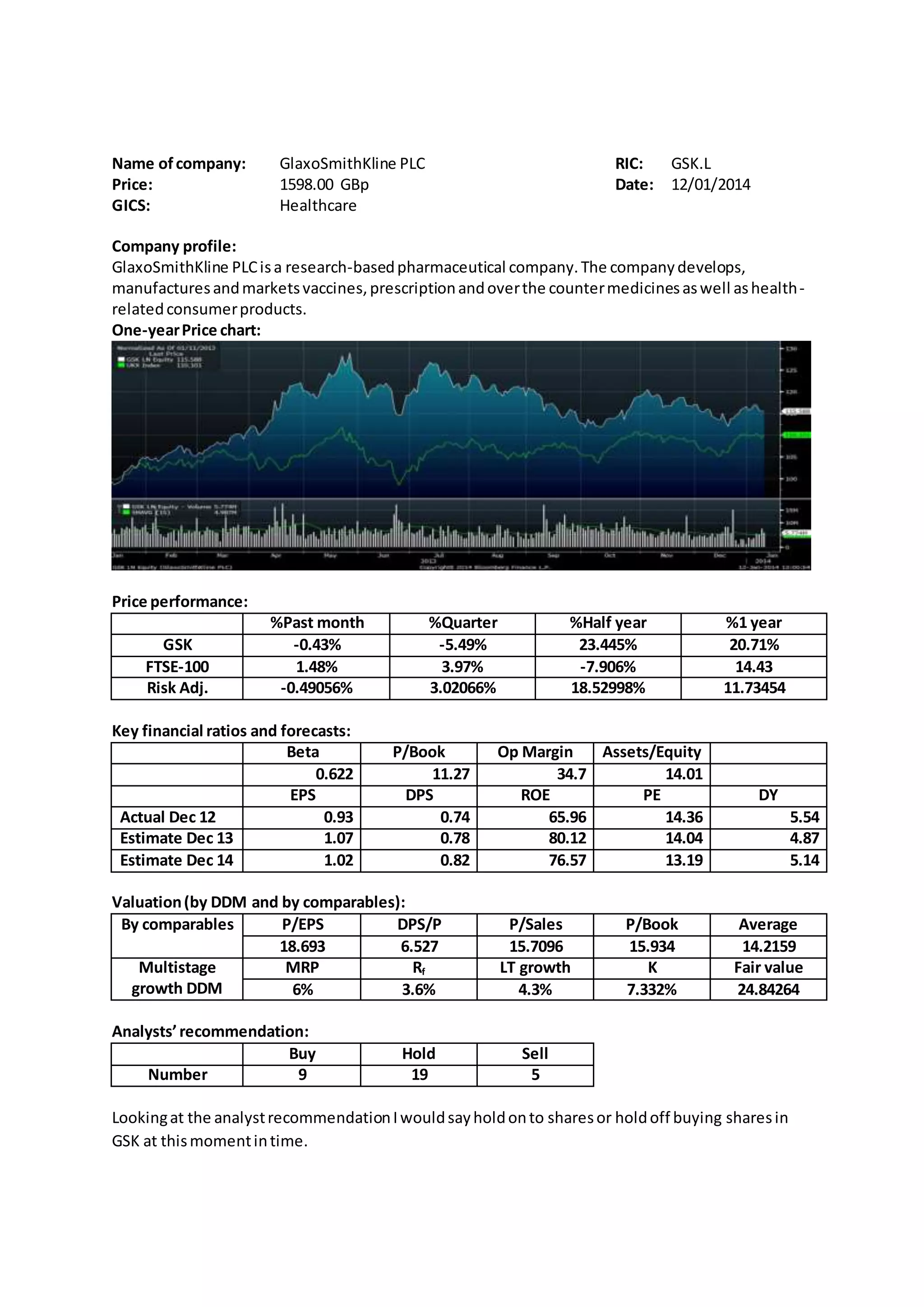

GlaxoSmithKline plc is a global healthcare company that develops, manufactures, and markets pharmaceuticals and consumer healthcare products. The document provides an overview of GSK, including its business operations, financial performance over time, analyst recommendations and valuations using different methods. The discounted dividend model valuation of £24.84 per share is considered the most appropriate given the growth rates used are lower than the cost of capital rate and closest to the current market price.

![Ireland’s ISEQ Index increased 1.5 percent to

the highestlevelsince September2008.

Oct 7 2013

11:36:10

Market Specific

London Cash Buyers Send Banks North to

RiskierLoans:Mortgages

The risky loans that helped cause the U.K.’s

real-estate crash are making a comeback as

cash buyers from abroad limit lending

opportunities in London and banks instead

venture intothe weakestmarkets.

David Cameron’s government this week

introduces mortgage guarantees designed to

allow people to buy a home costing as much as

600,000 pounds

This article explains the

contribution to the market

price dropping. It is because

banks were continuing to

give out risky mortgages in

weak markets because of

the announcement from the

government. This has

especially affected the

Northregion.

Jul 02, 2013

03:14:52 AM

[NYT]

Firm Specific

GlaxoSmithKline IsInvestigatedinChina

The British pharmaceutical giant

GlaxoSmithKline said on Monday that the

authorities here were investigating whether

senior managers working for the company in

Chinawere involvedin"economiccrimes."

This could harm the

companies brand image as

well as turn out to be a

costly lawsuit if found guilty

of bribery. This could have a

dramaticon the share price.

Valuation:

Multi-stage DDM

Firstyou mustworkout whatK equals-

K= Rf + B (E(Rm)-Rf)

K= 3.6 +0.622*6= 7.332% or 0.07332

Analyst Forecast

V0=

074

1+0.07332

+

0.78

(1+0.07332)2

+

0.82

(1+0.07332)3

+

0.82(1+0.07369)

(0.07332−0.07369) 𝑥(1+0.07332)^3 =204.8904

Economic Model Forecast V0=

0.74

1+0.07332

+

0.78

(1+0.07332)2

+

0.82

(1+0.07332)3

+

0.82(1+0.043)

(0.07332−0.043) 𝑥(1+0.07332)^3 = 24.84264

DDM ROE Forecast

V0=

0.74

1+0.07332

+

0.78

(1+0.07332)2

+

0.82

(1+0.07332)3

+

0.82(1+0.16901)

(0.07332−0.16901) 𝑥(1+0.07332)^3 = -6.07204

The Vo that I woulduse isthe EconomicModel forecastthisisbecause mygrowthrate was higher

than myK for the ROE forecastand analystforecast.Iincludedthe raw betawhencalculatingthe

DDM. The smallestvariationtothe marketprice wasthe EconomicModel forecast,whichcame out

the closest.The othershada muchlarger variationone beingaminusfigure,the other wasmuch

higher.Thisisbecause the growthrateswere muchgreaterthan K and because of thisyoushouldn’t

use theirDDM.

You alsoneedtodiscuss howyou arrive at the estimate of LT growthrate of dividends(e.g.,from

analysts’forecast,ROE*bor macro-economicbasedmodel).If there islarge deviationbetweenV0](https://image.slidesharecdn.com/gsk-160309044624/85/Gsk-3-320.jpg)