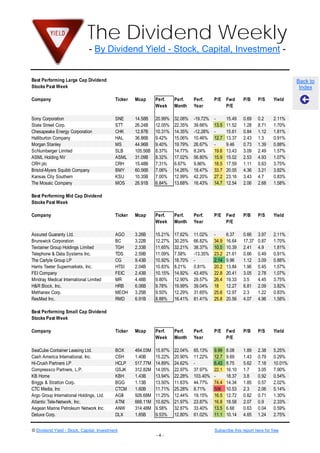

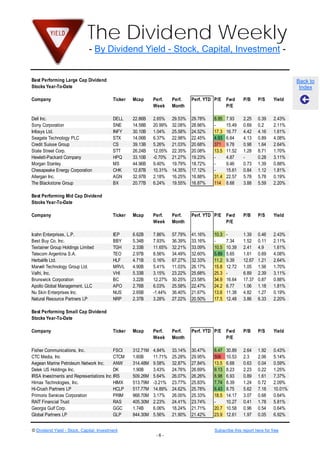

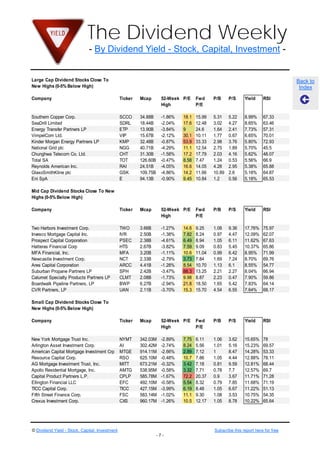

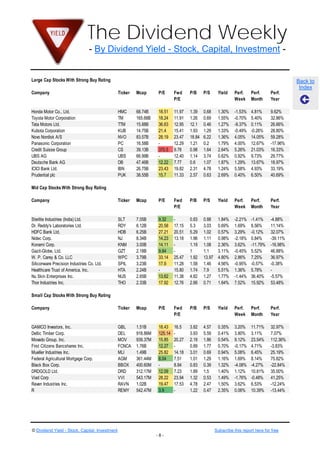

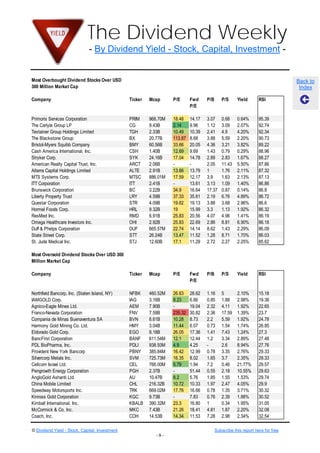

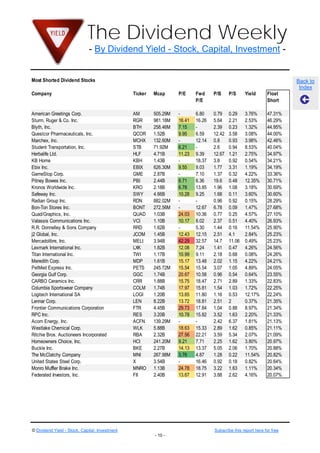

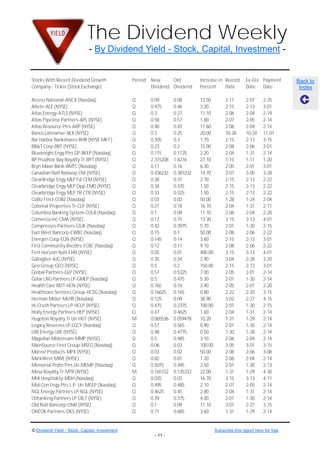

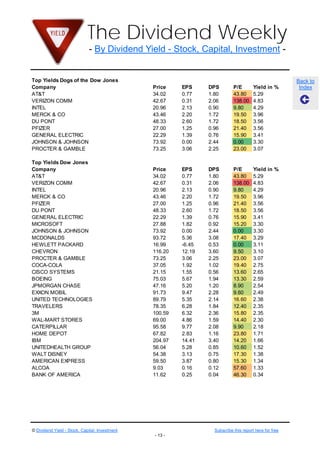

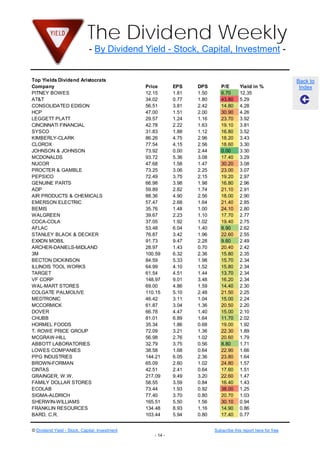

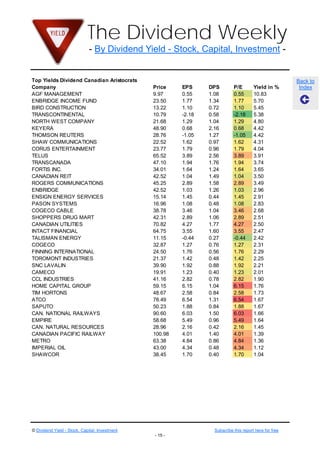

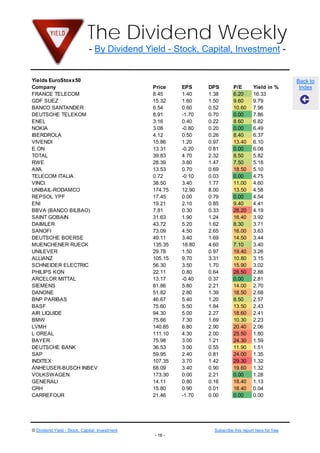

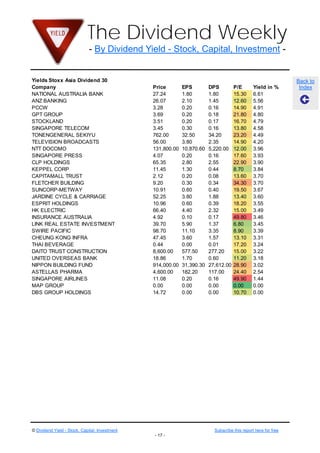

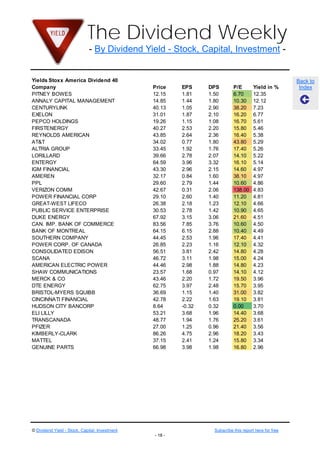

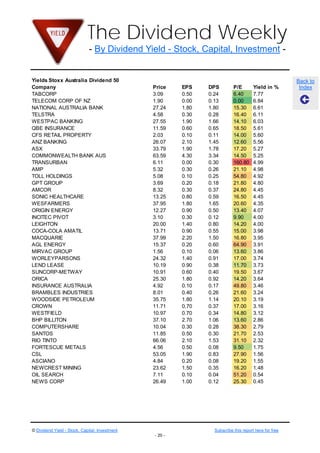

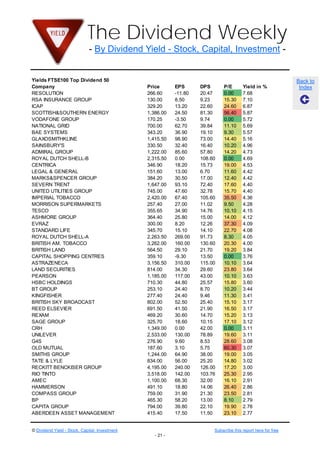

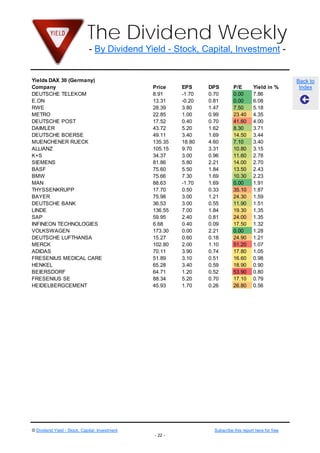

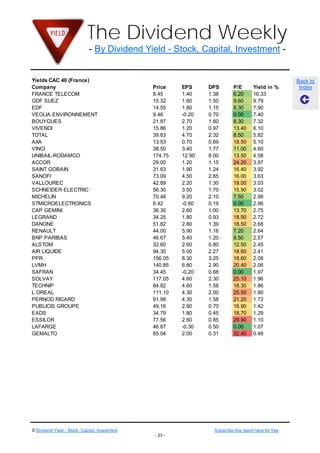

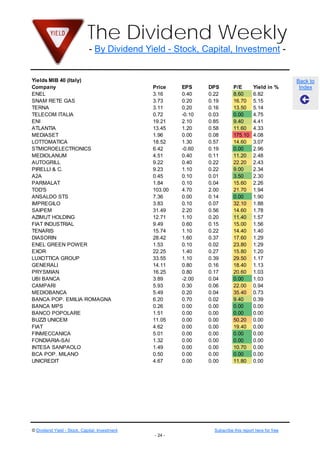

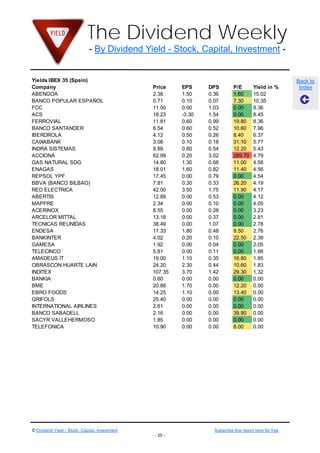

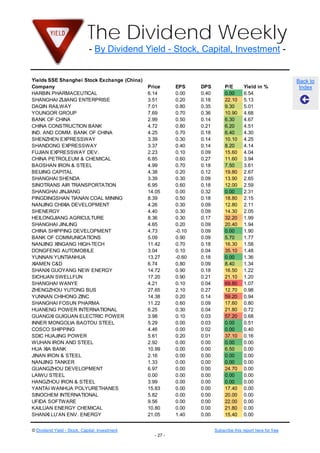

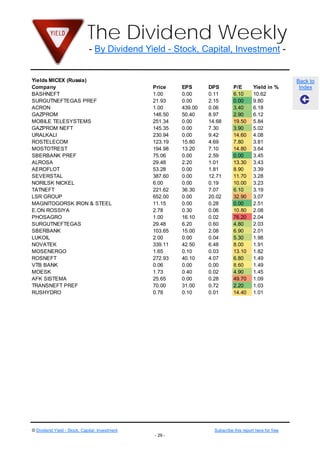

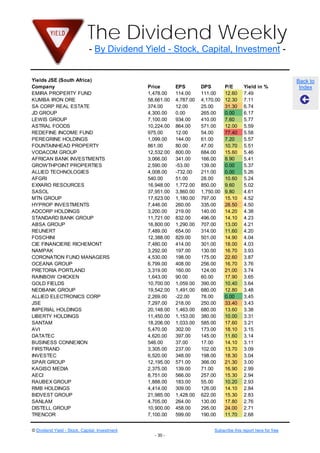

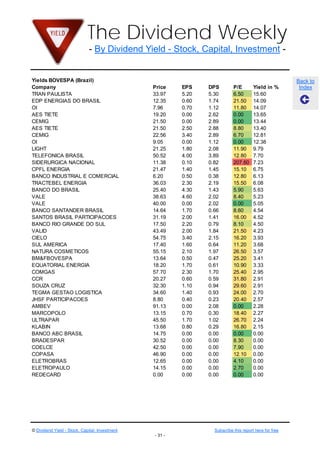

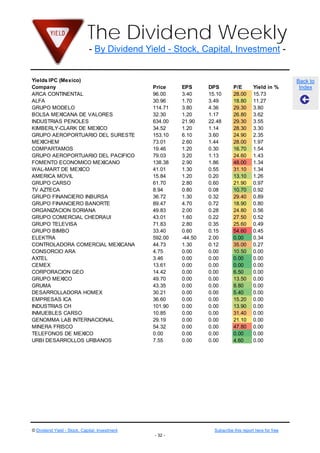

The document titled 'The Dividend Weekly' reports on various dividend yields, highlighting the best performers across large, mid, and small-cap stocks. It includes listings of stocks with the highest yields, recent recommendations, and datasets categorized by performance metrics such as P/E ratios and market capitalization. Additionally, it offers options for subscribers to receive more detailed reports on dividend stocks and strategies.