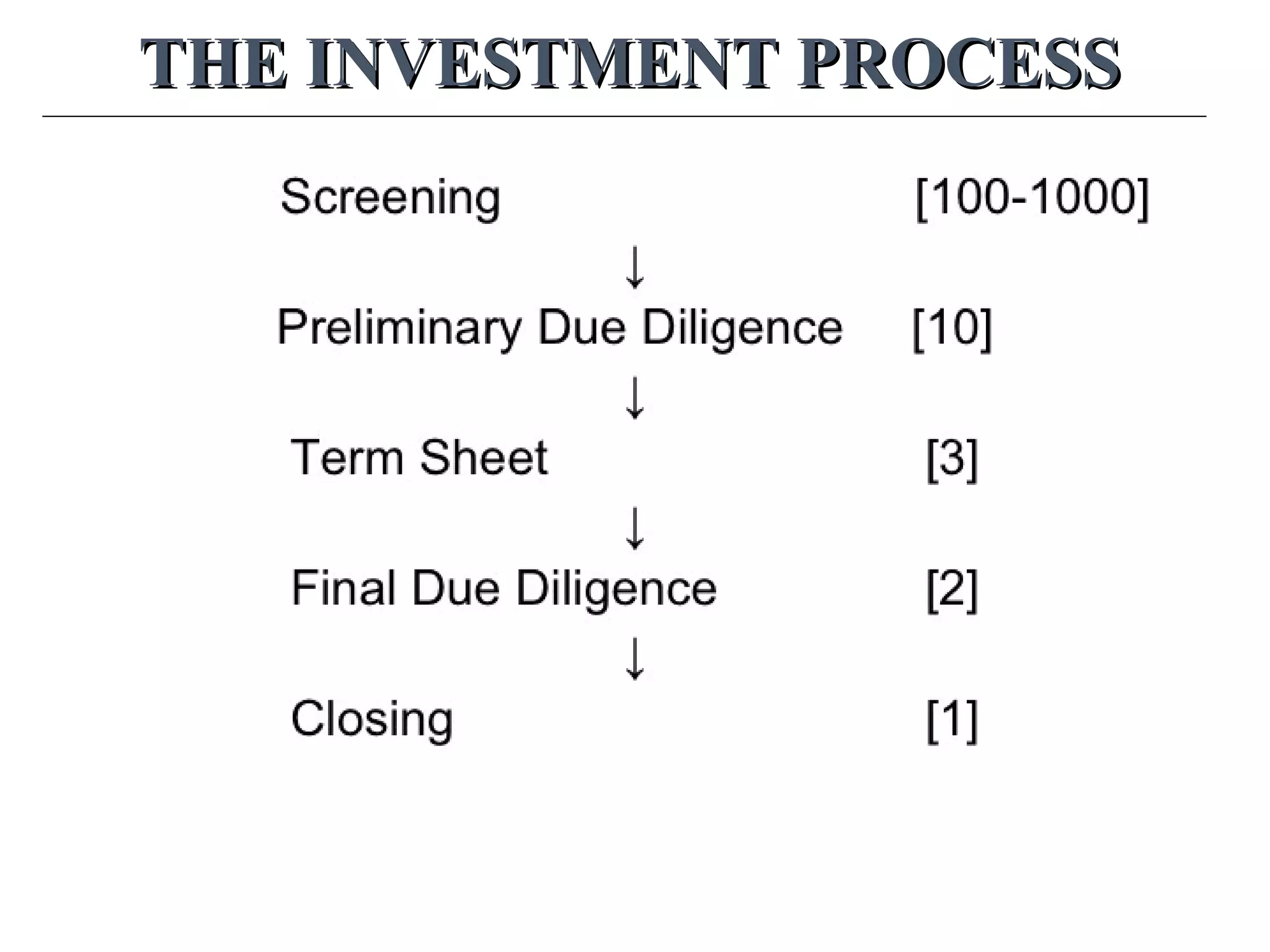

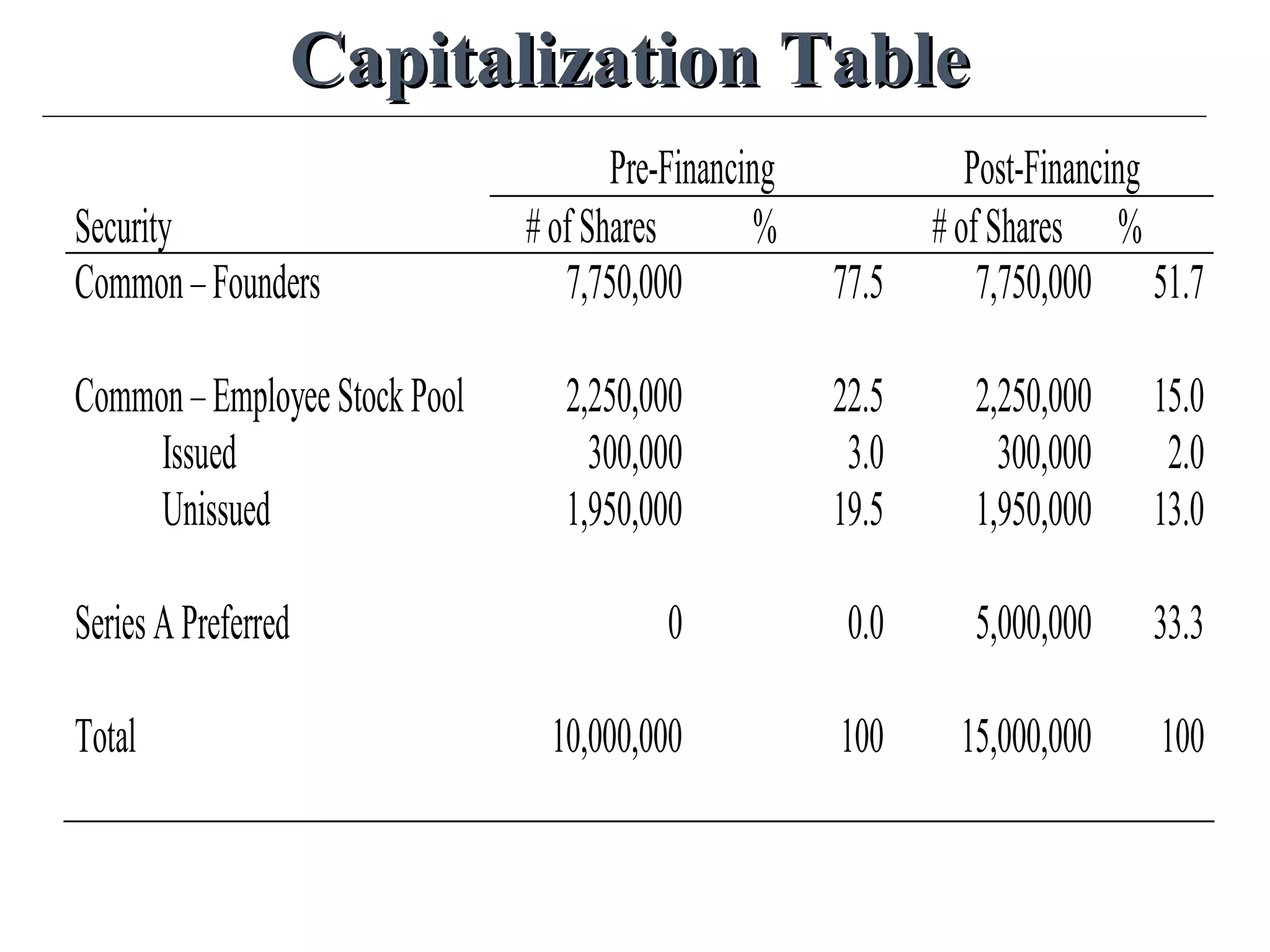

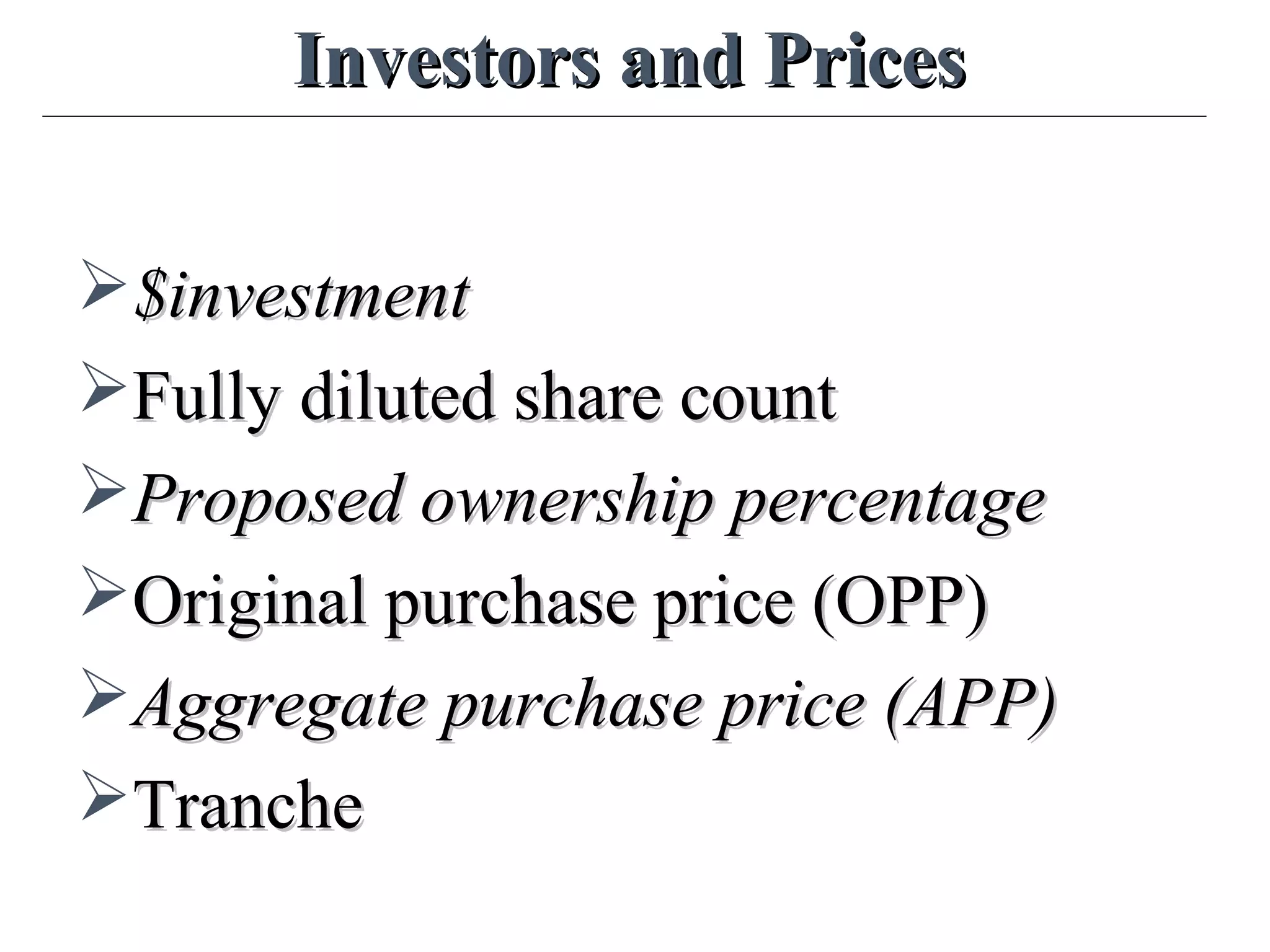

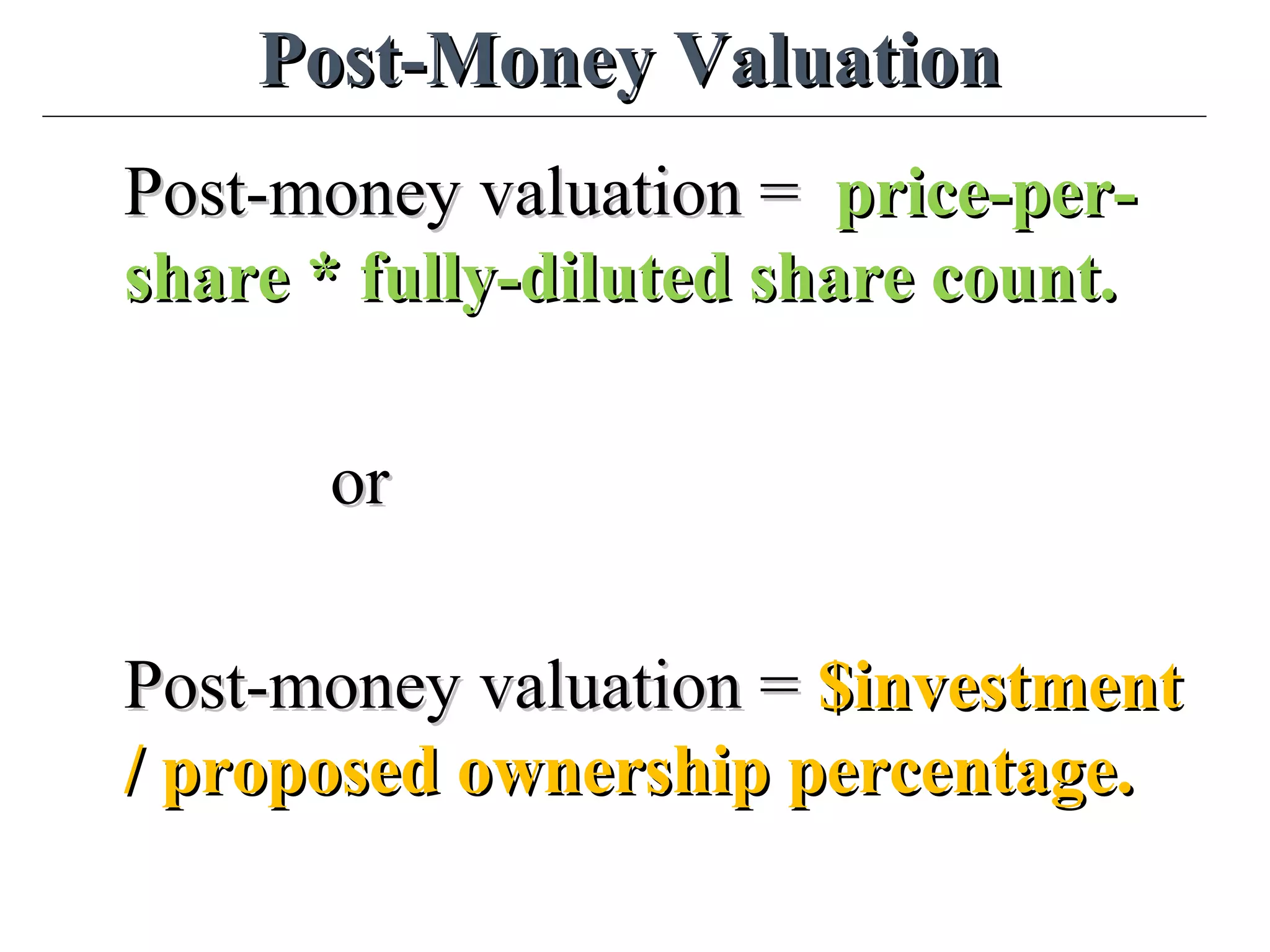

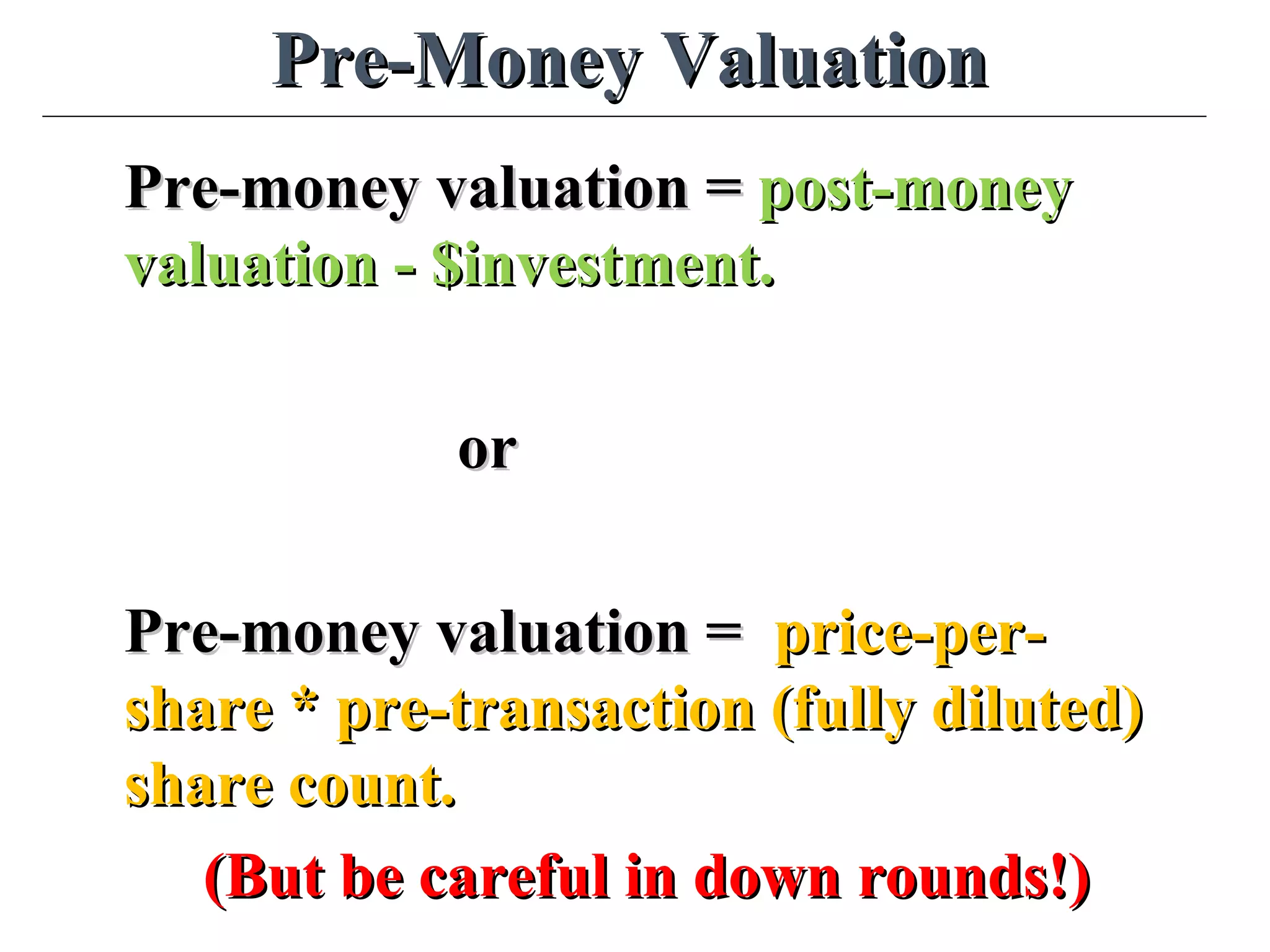

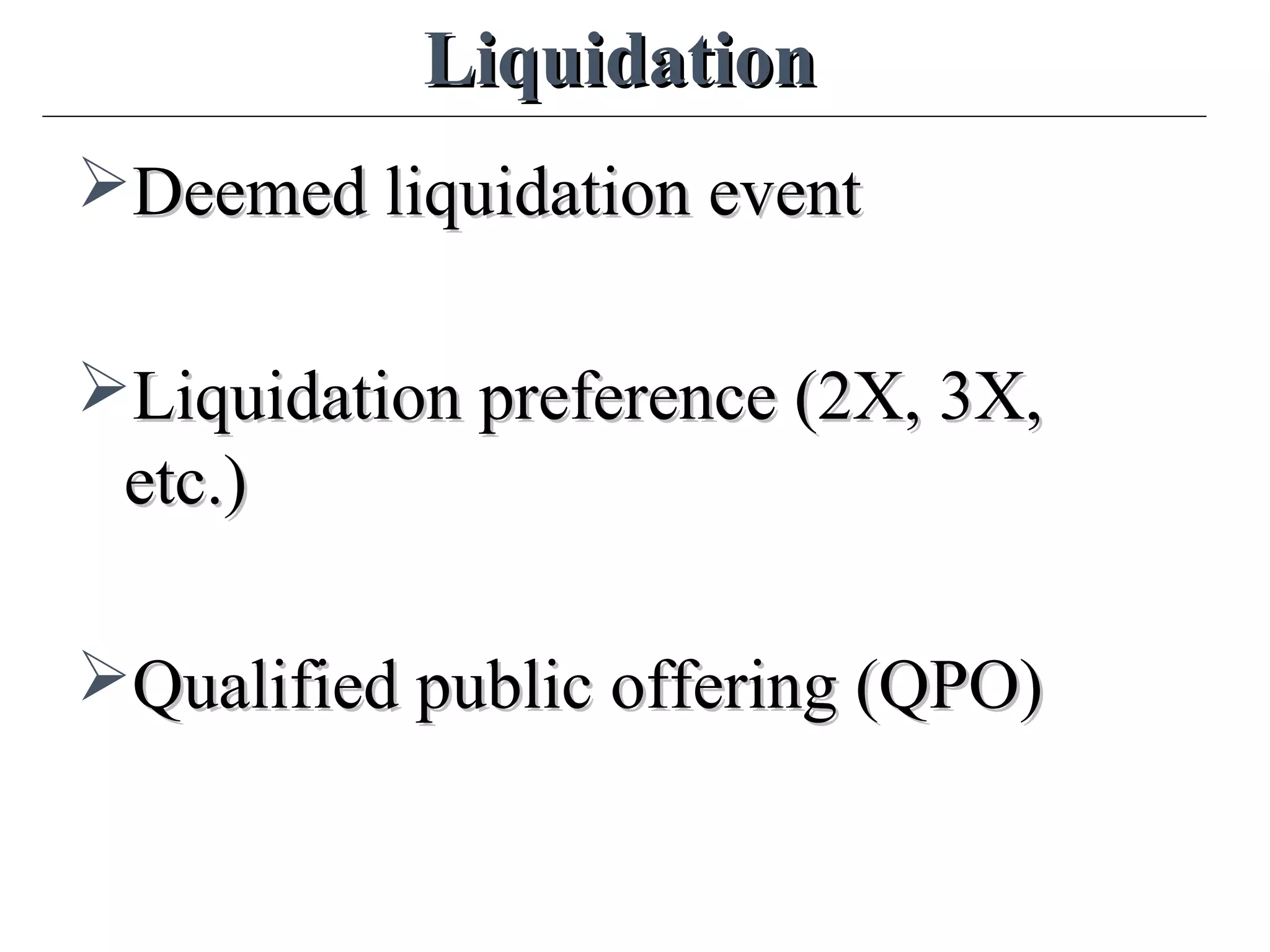

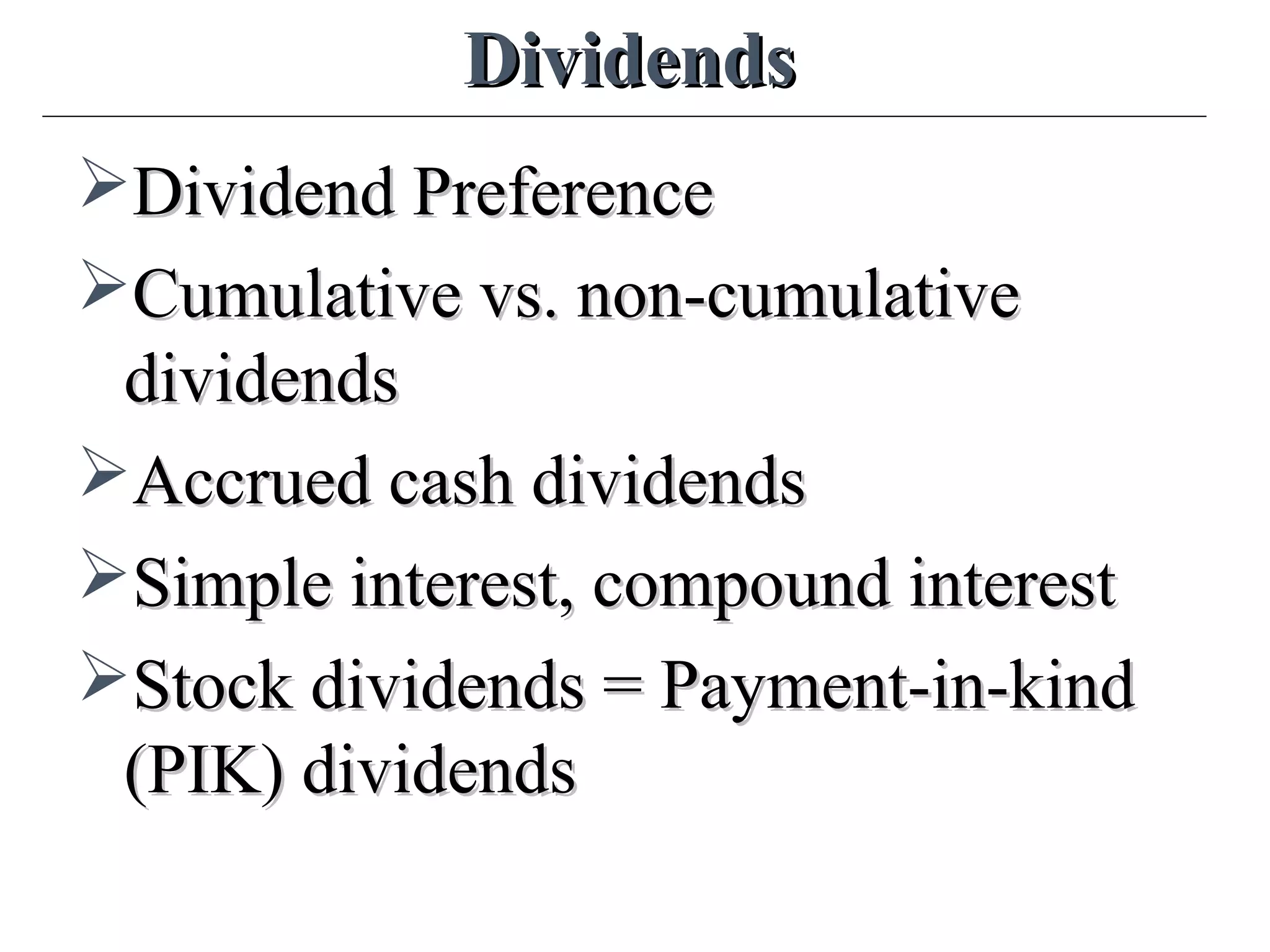

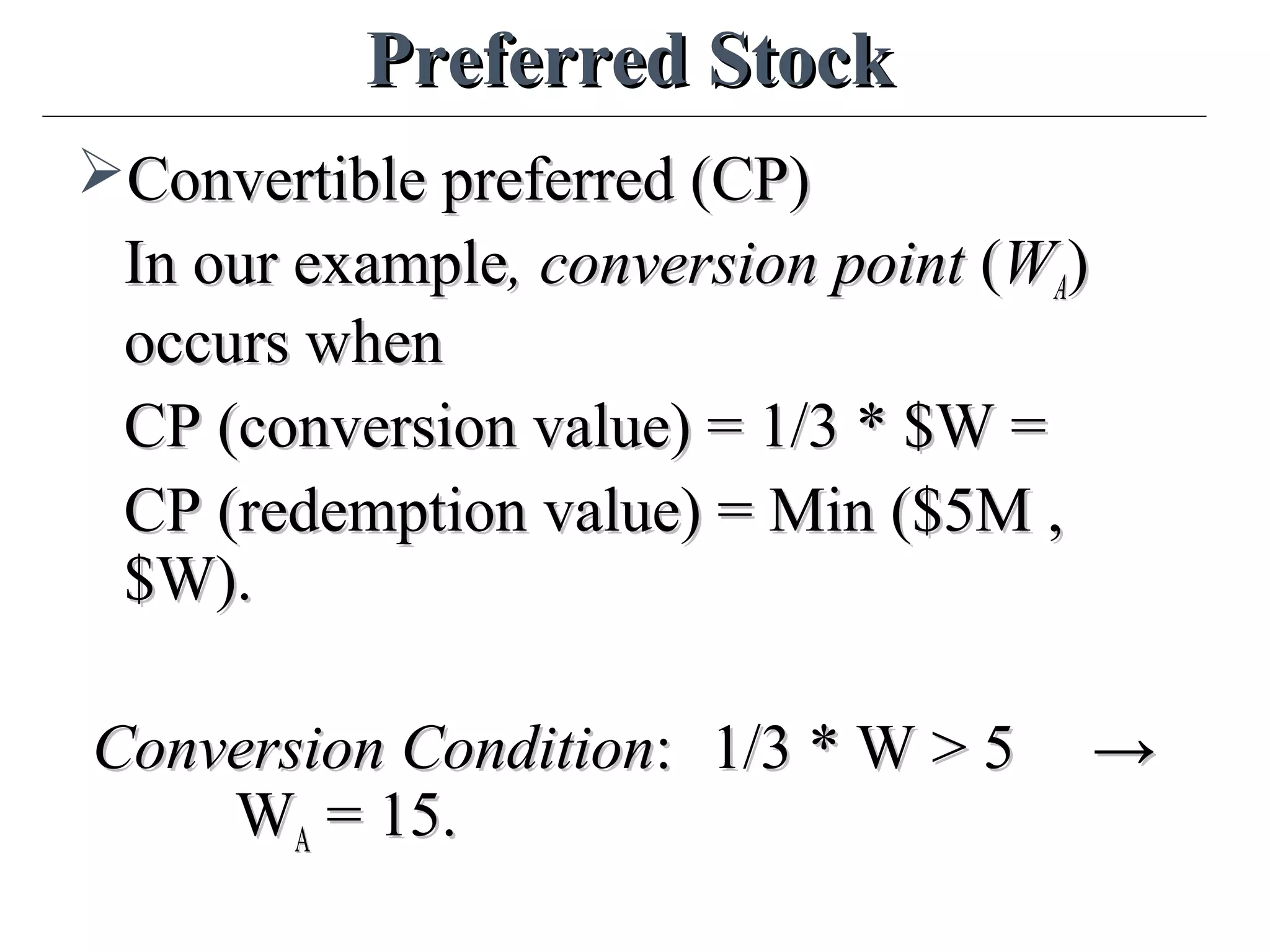

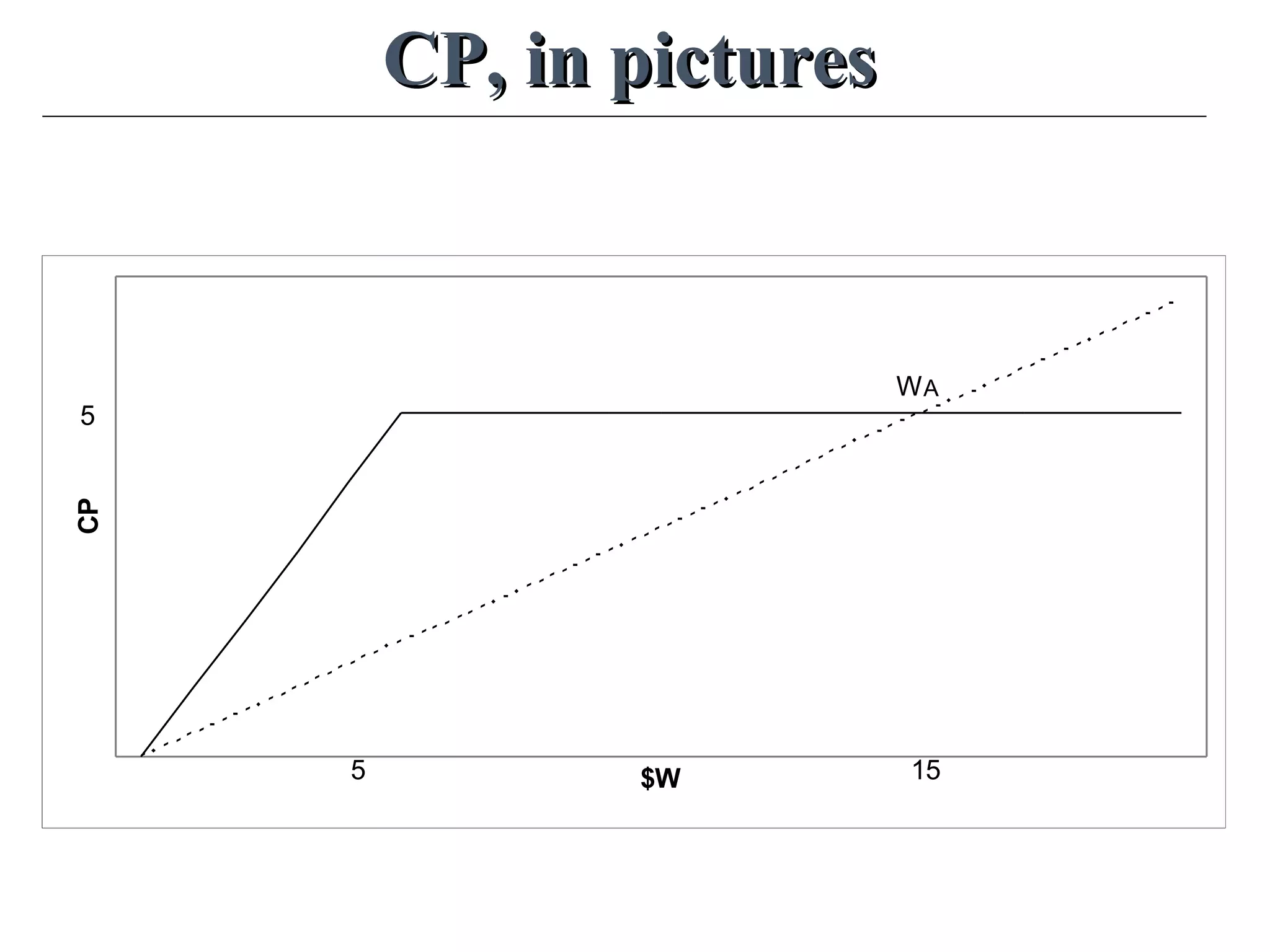

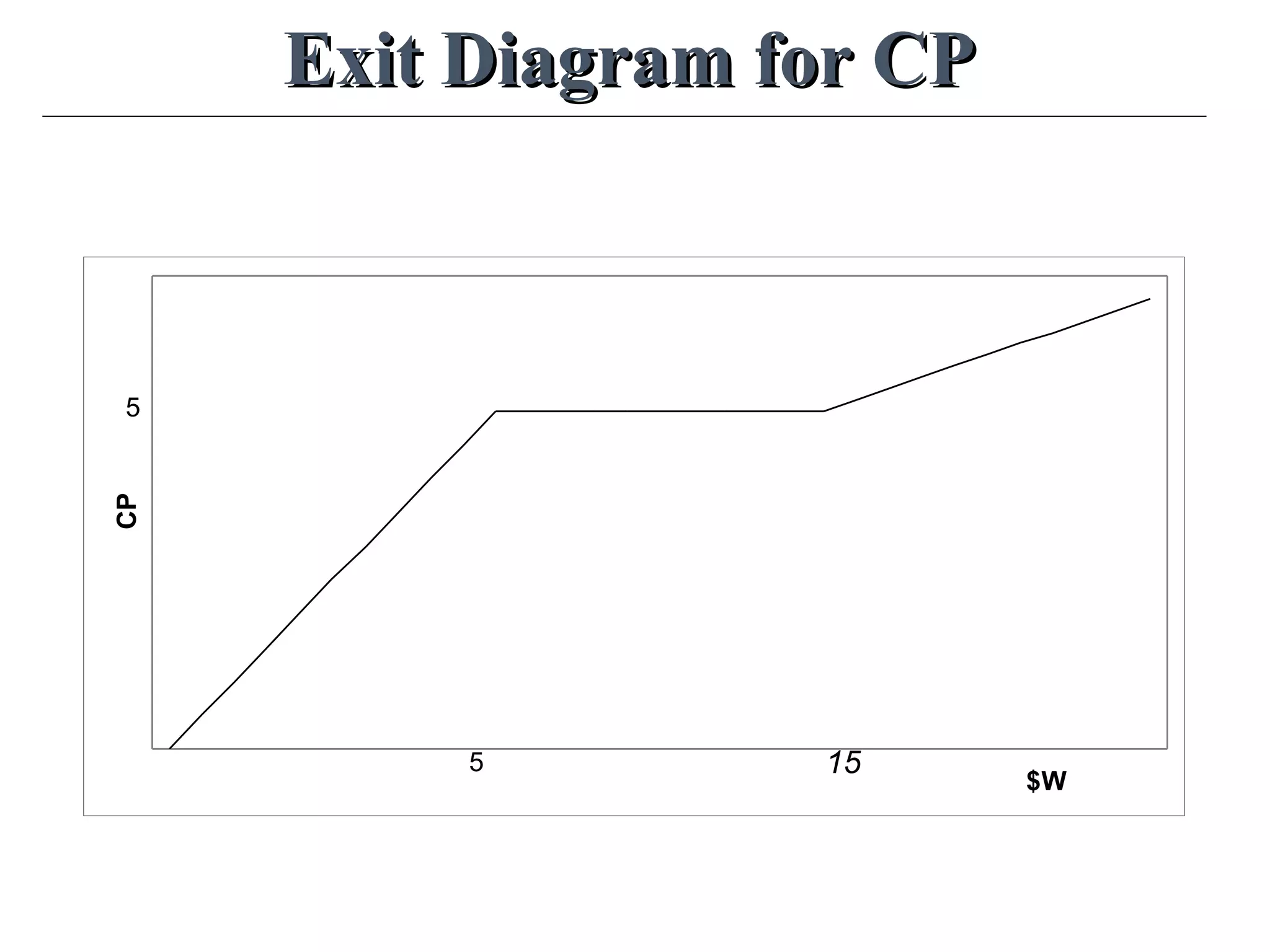

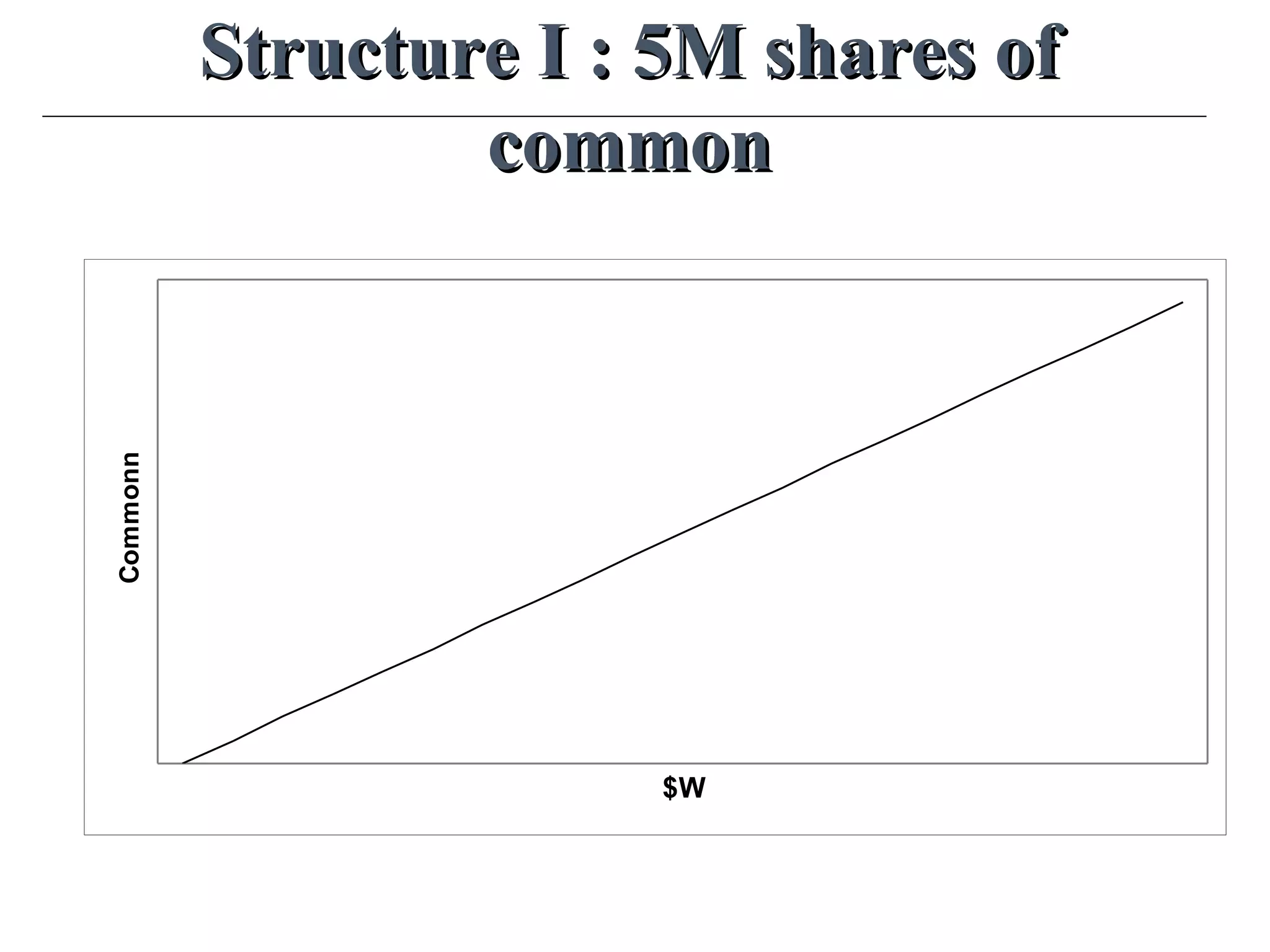

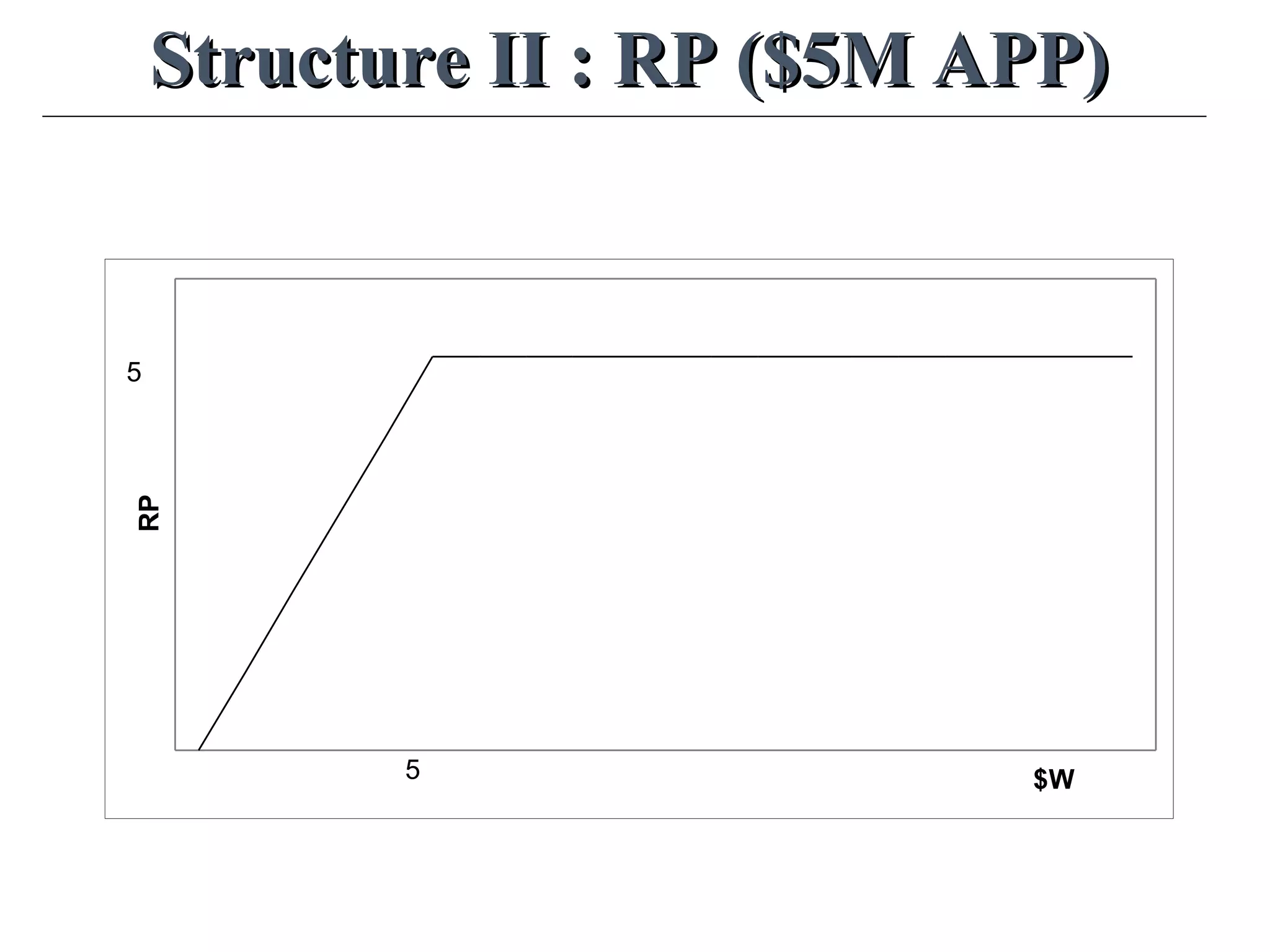

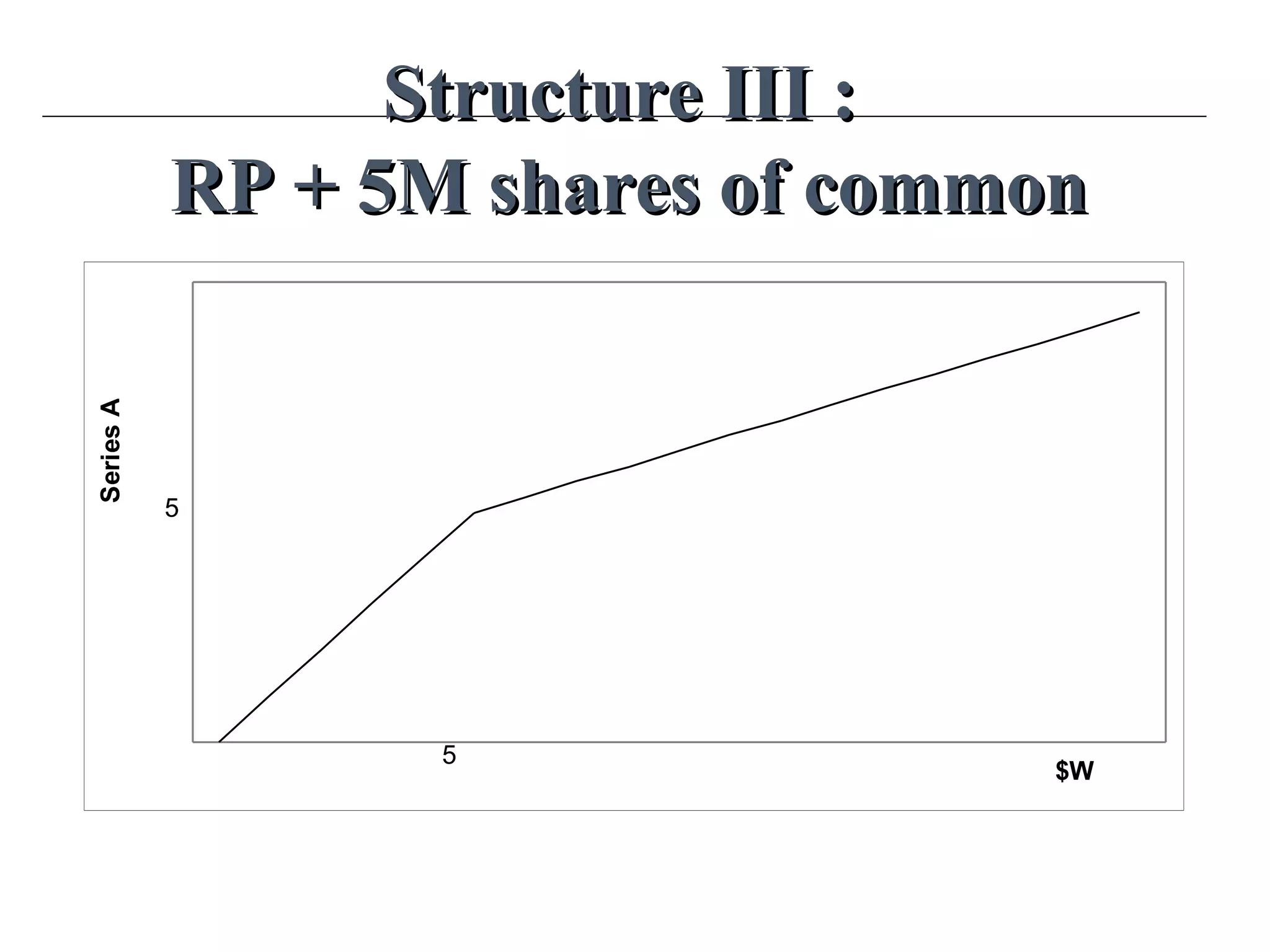

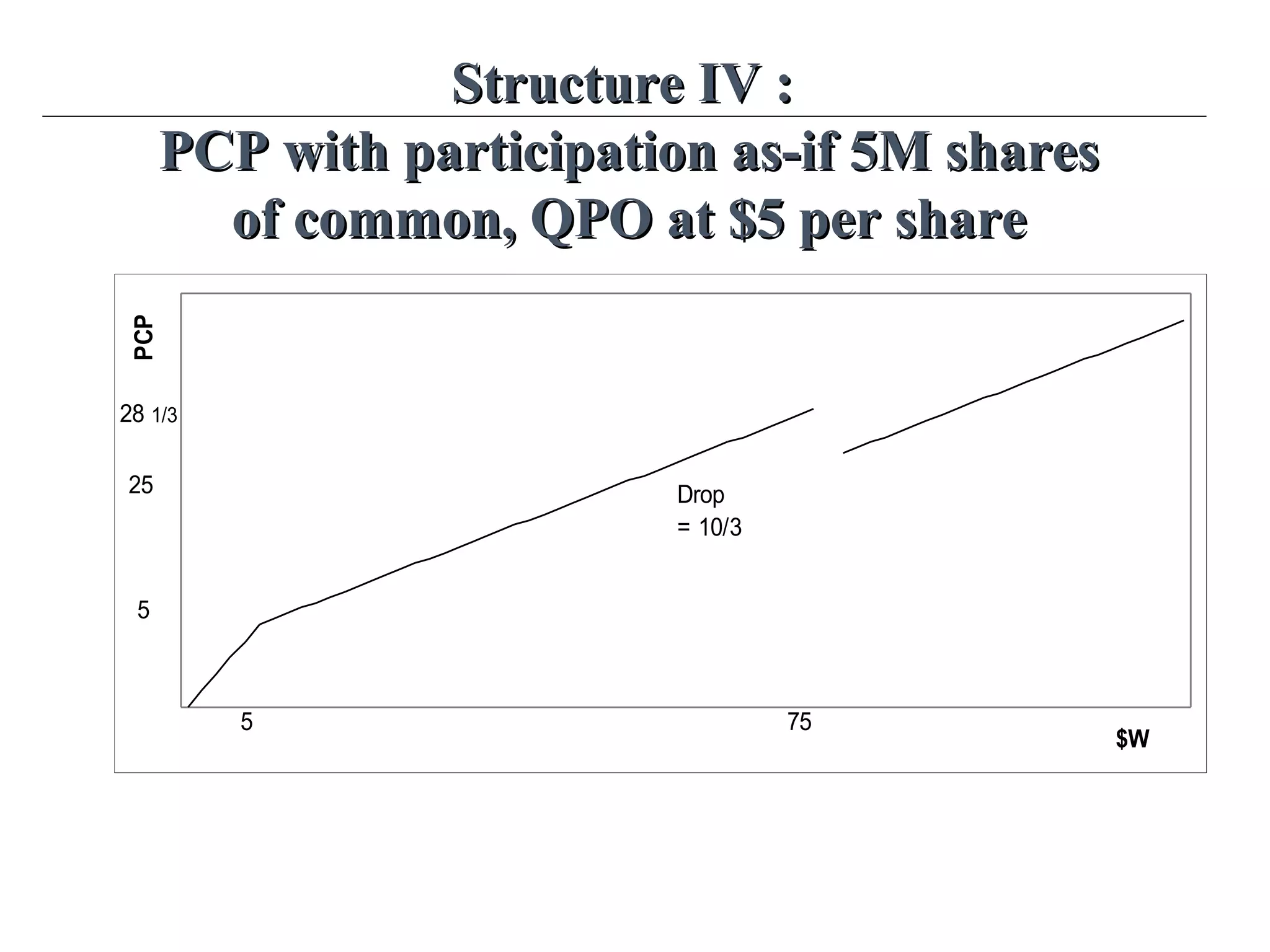

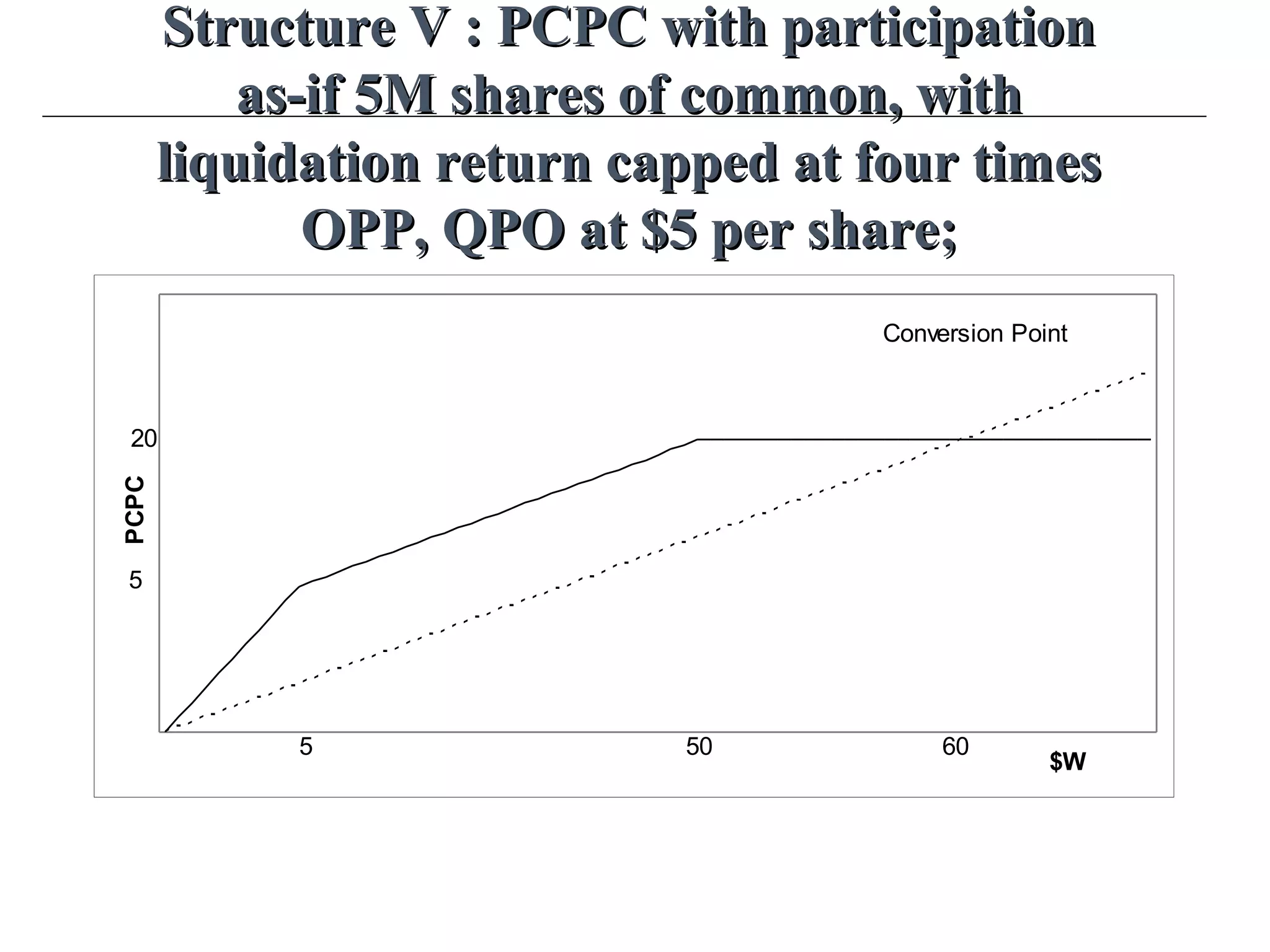

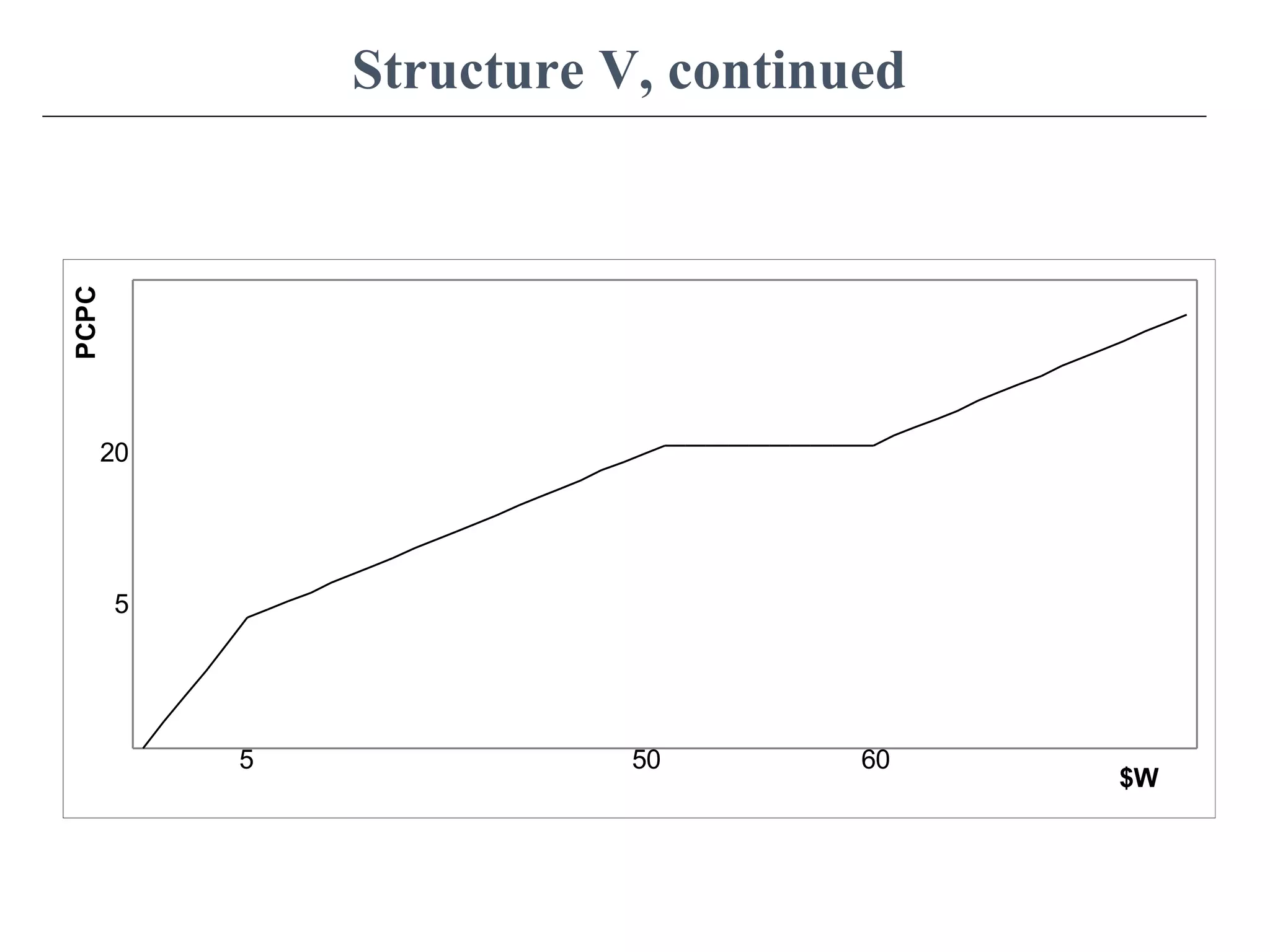

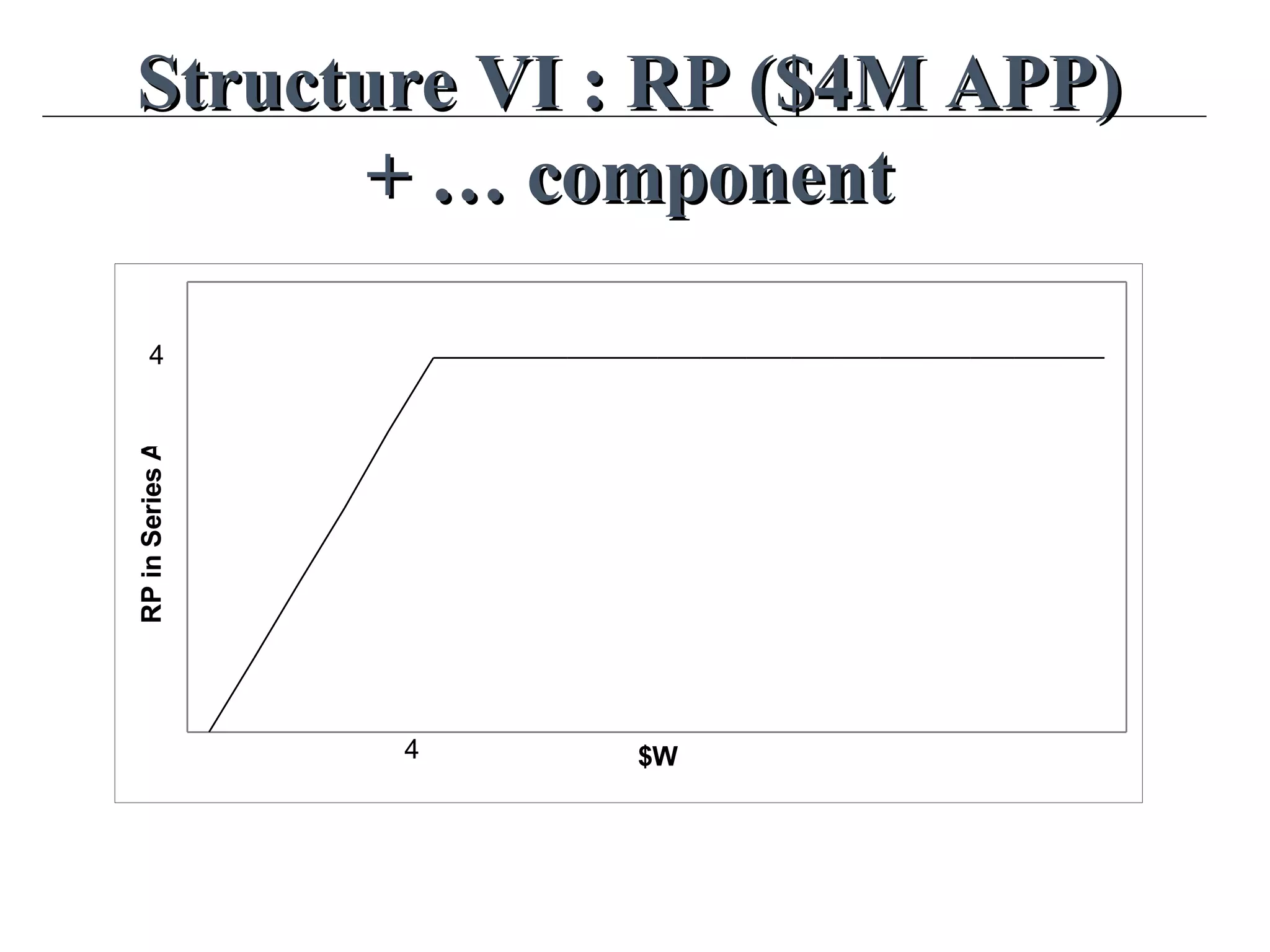

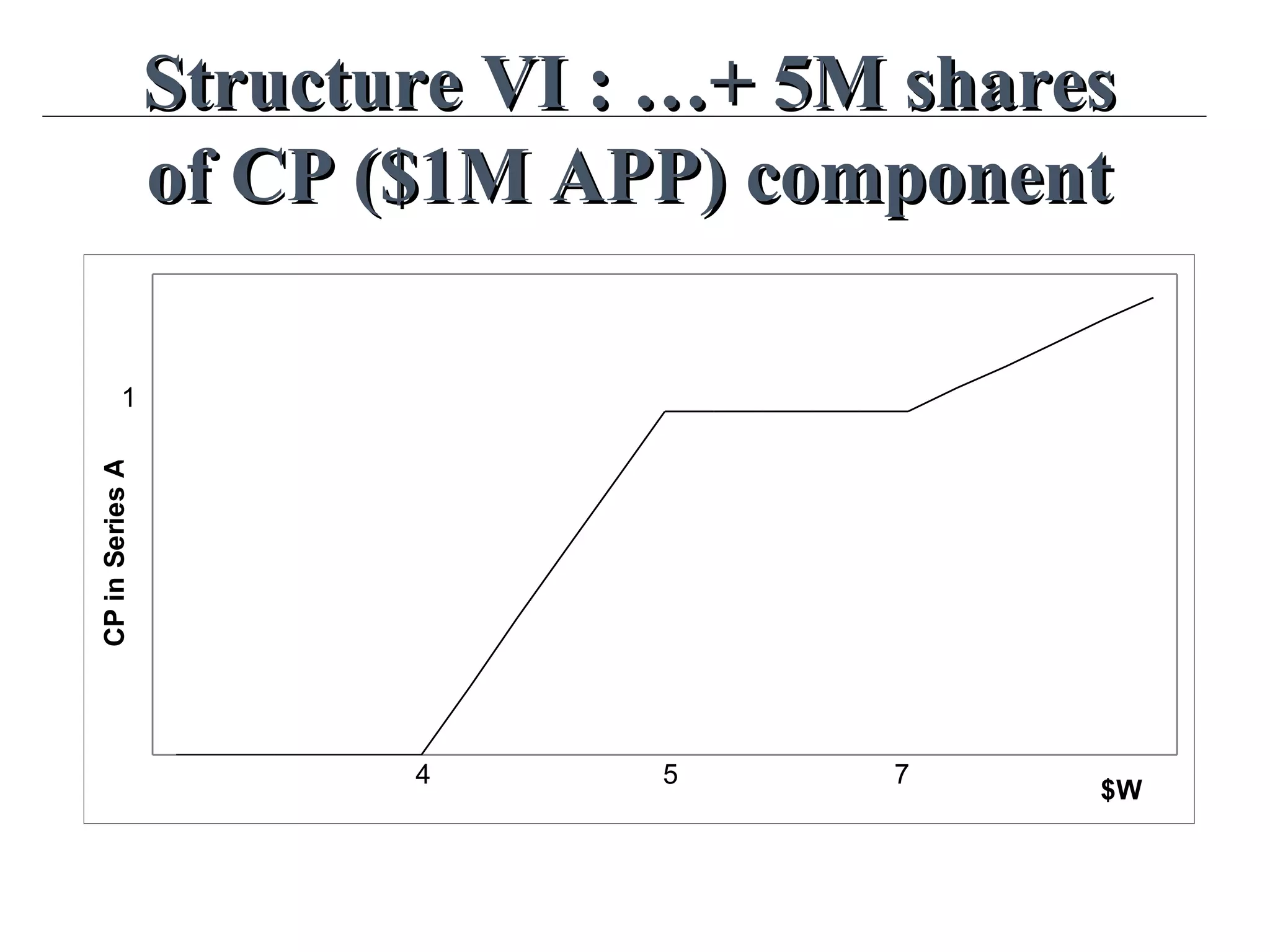

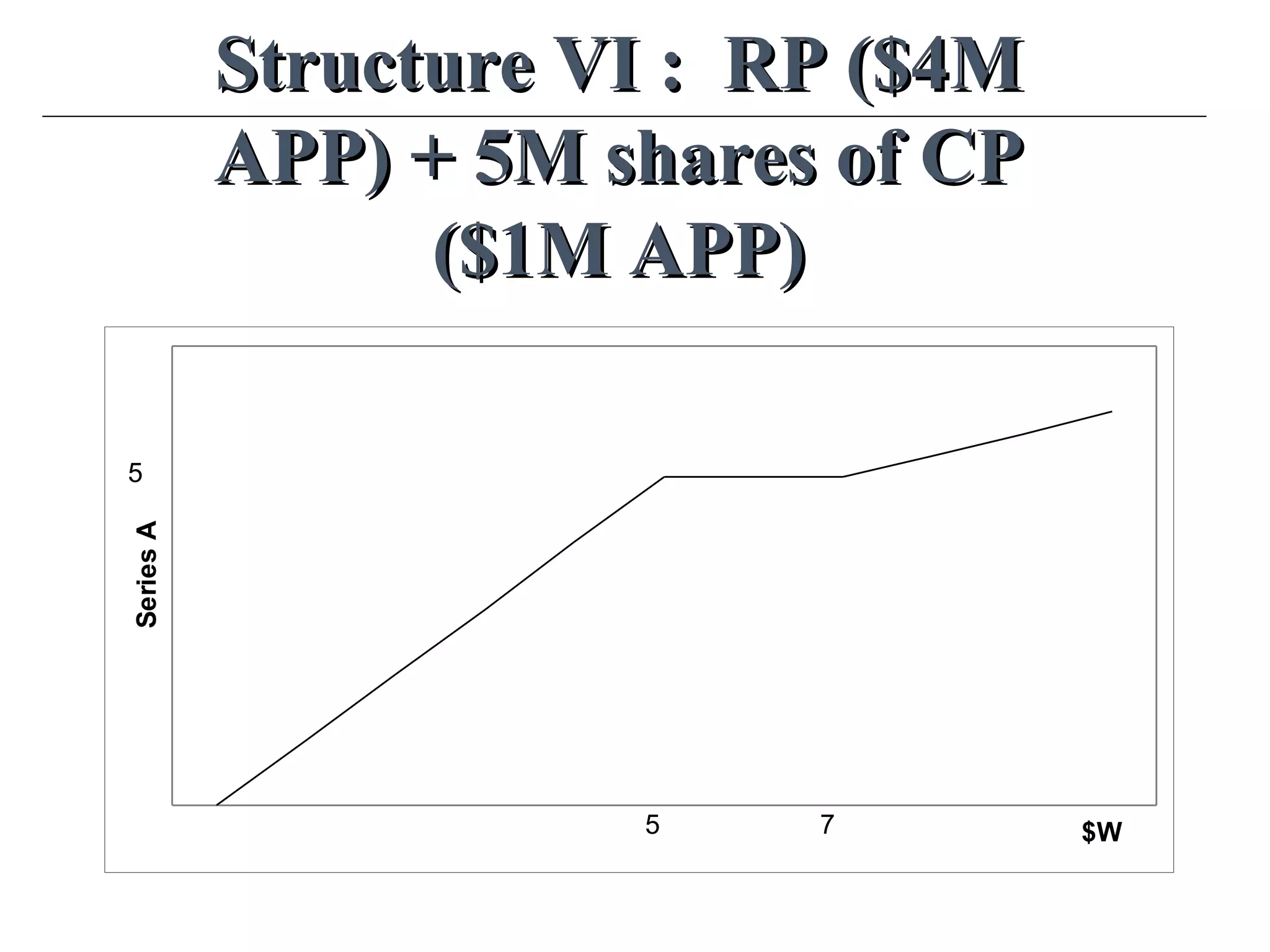

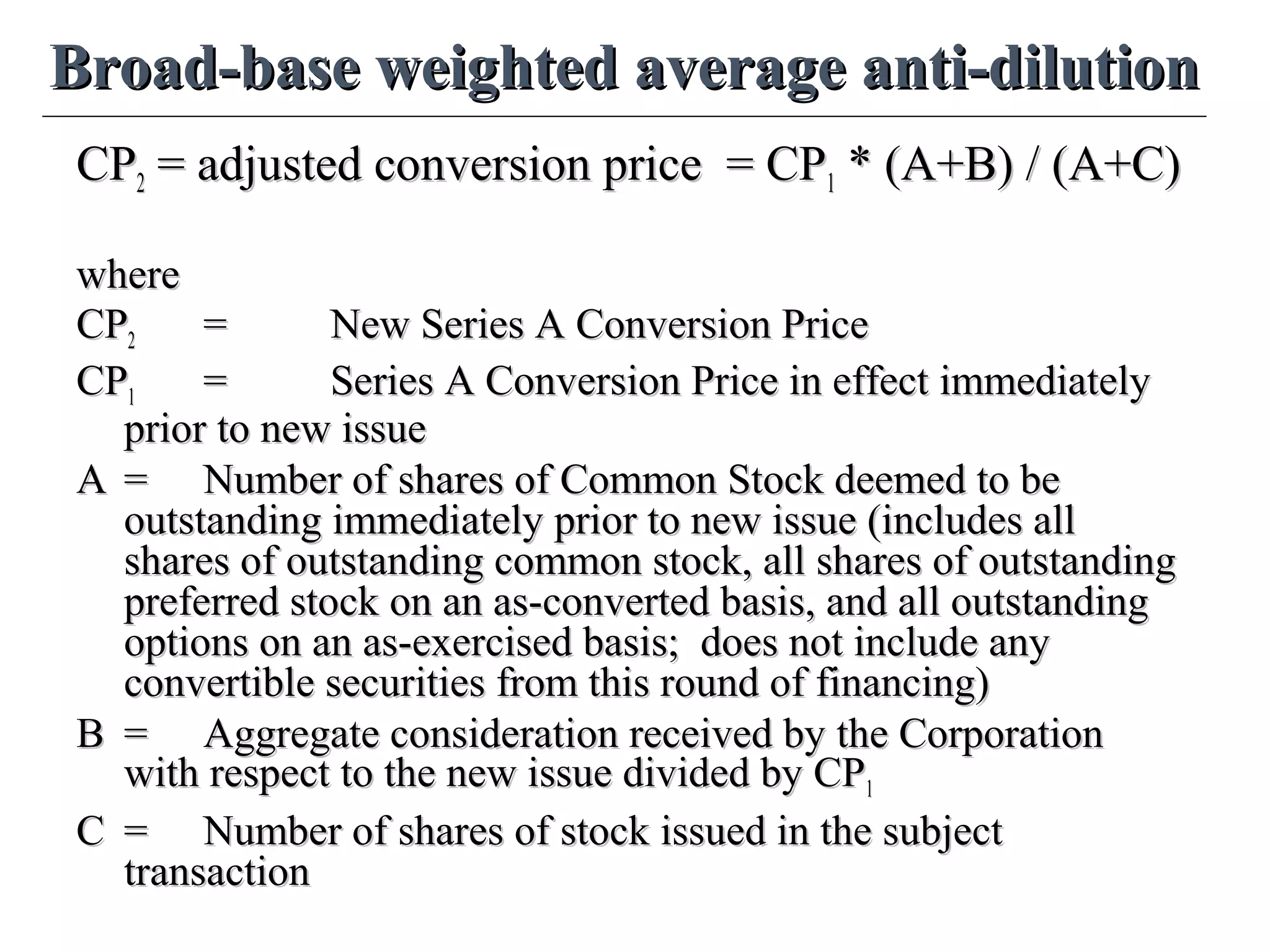

The document discusses venture capital financing and preferred stock structures. It begins by analyzing the VC investment process and typical terms in a term sheet. It then discusses different types of preferred stock, including convertible preferred stock, redeemable preferred stock, and participating convertible preferred stock. Various preferred stock structures are presented and compared, including how they handle liquidation events and anti-dilution protection. An example is provided to illustrate how anti-dilution terms would apply in a down round financing.