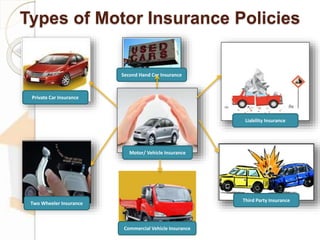

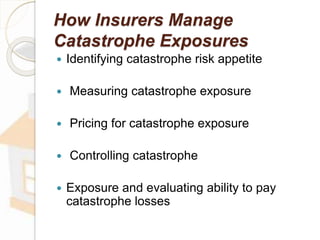

This document provides an overview of auto insurance. It begins by discussing the origins of motor vehicles and motor insurance in the UK in the 1890s. It then defines motor insurance as protection against unforeseen risks that can cover liability damages and unexpected repairs. The document outlines the main types of auto insurance policies like private car insurance, two-wheeler insurance, and commercial vehicle insurance. It provides details on coverage and benefits of policies, as well as what is not covered. It also discusses the importance of insurance and managing risks of catastrophic losses.