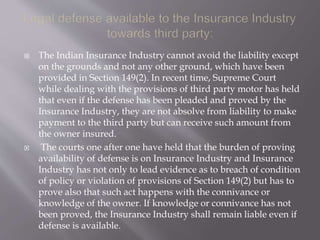

- Third party insurance is mandatory under the Motor Vehicles Act and provides coverage for legal liabilities towards third parties for bodily injury, death or property damage caused by the vehicle. It does not cover damages to the insured vehicle.

- The policy covers the insured's liability towards anyone other than the policyholder or insurer (known as third parties), including passengers, pedestrians or other vehicle owners. Claims are paid as per the Motor Vehicles Act even if defenses are proved by the insurer.

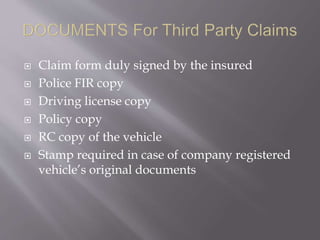

- To claim, one needs documents like the claim form, police report, driving license, insurance policy and vehicle registration. Court precedents have established the scope and liabilities under a third party policy.

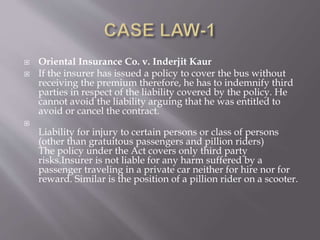

![ K. Gopal Krishnan v. Sankara Narayanan[8]

In this case Madras High Court observed that a

scooter-owner is not bound to take out a third party

risk policy to cover the claim of the pillion rider that is

carried gratuitously. If he is injured , the insurance

company would not be liable unless policy covering

such risk is obtained by the scooter-owner. A private

carrier registered as such with R.T.O. and also in

insurance policy , cannot be used for carrying any

passenger or goods for hire or reward. However if it is

so used and the employees of a party hiring the private

vehicle belonging to the insured are injured in an

accident the insurance company will not be liable.](https://image.slidesharecdn.com/insurancelaw-200410070551/85/third-party-Insurance-15-320.jpg)

![ S.Sudhakaran v. A.K.Francis,[10]

There was an agreement for sale of a vehicle.

The owner did not comply with the statutory

provisions regarding transfer of a vehicle.He,

however ,allowed the vehicle to be used by the

transferee .The owner had retained the

insurance policy with him.

Held— The insurance company was not liable

to indemnify the owner.](https://image.slidesharecdn.com/insurancelaw-200410070551/85/third-party-Insurance-16-320.jpg)