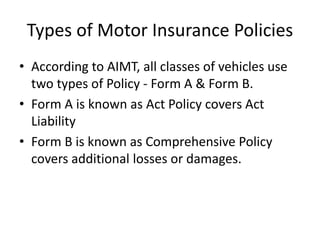

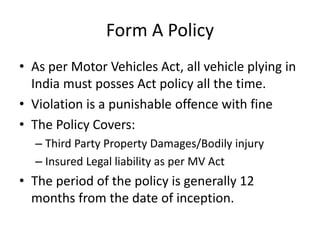

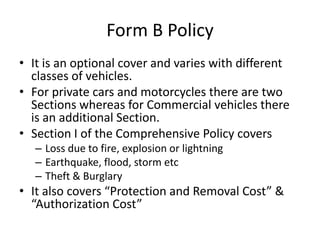

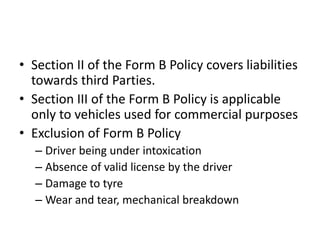

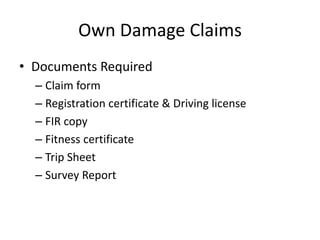

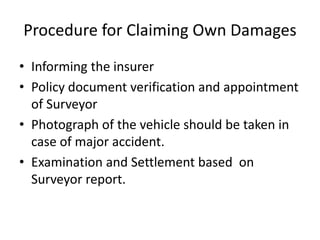

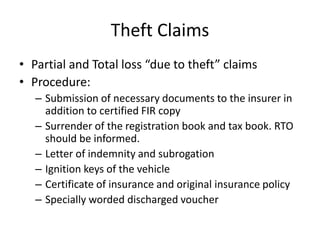

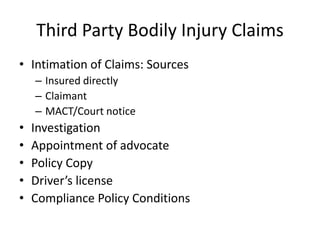

Motor insurance originated in the UK in 1864 and later expanded in India through legislation. There are two main types of motor insurance policies - Form A covers mandatory third party liability, while Form B additionally covers own damage claims such as accidents and theft. Key factors that determine premium rates include the driver's class, vehicle use and value, and claims history. The document outlines the claim procedures and required documents for own damage, theft, and third party bodily injury claims, such as a police report, vehicle registration, and surveyor's assessment.