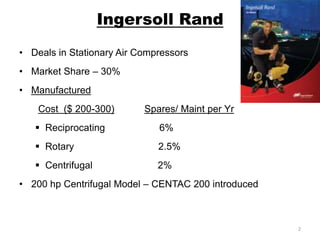

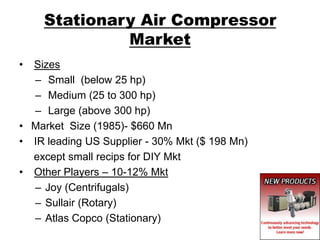

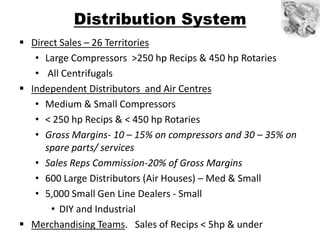

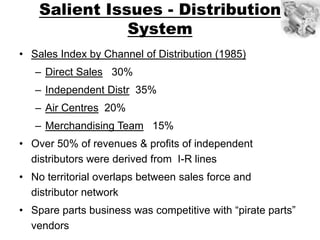

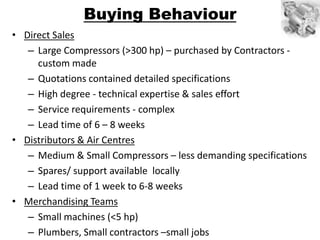

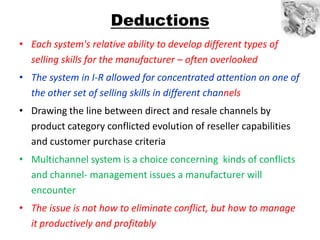

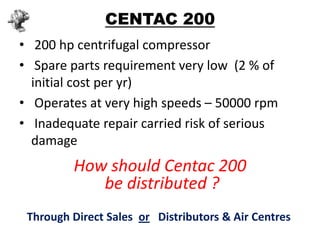

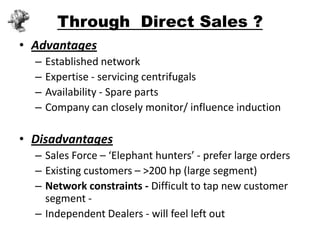

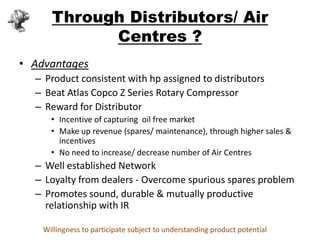

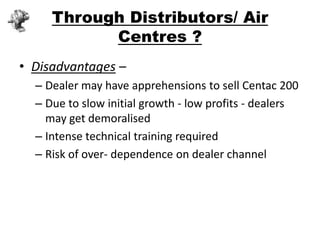

Ingersoll Rand deals in stationary air compressors and has a 30% market share in the US, with their product lines including reciprocating, rotary, and centrifugal compressors. They are looking to introduce a new 200hp centrifugal compressor model called CENTAC 200 and are considering whether to distribute it through their direct sales force or existing independent distributor network. The document analyzes the advantages and disadvantages of both distribution options and concludes that involving the distributors is the best approach if Ingersoll Rand provides them proper training and is willing to take over distribution if they fail to achieve results.