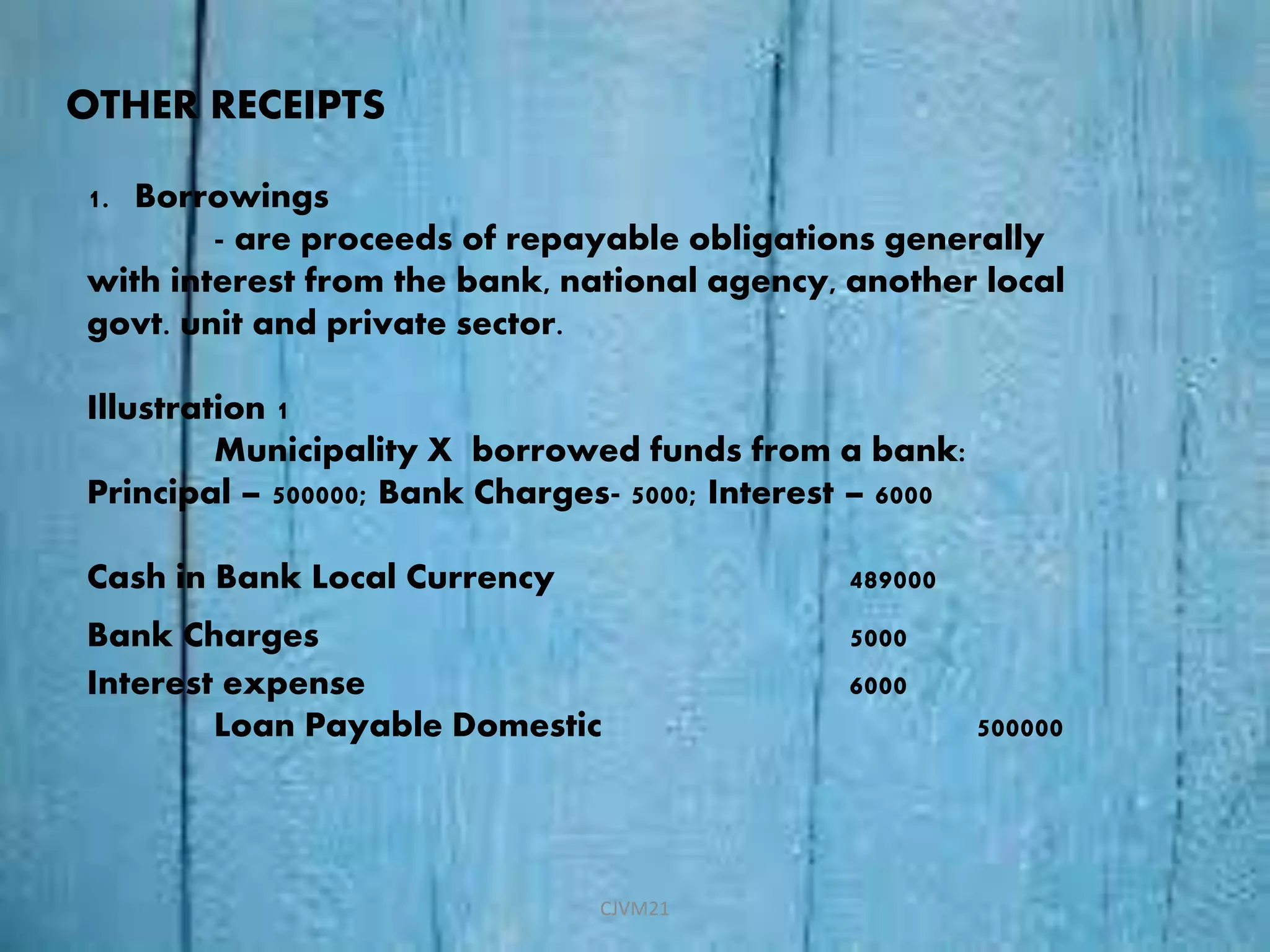

This document outlines accounting policies and procedures for local government units in the Philippines. It discusses the basic features of accrual accounting and the one fund concept used. It also describes the various books, journals, ledgers and financial statements required, as well as the budgeting and accounting processes for revenues, expenditures, assets, liabilities and financial reporting. Adjusting entries, closing entries and trial balances are discussed to ensure revenues and expenses are recorded properly.