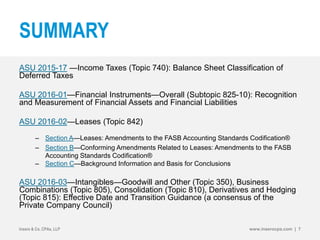

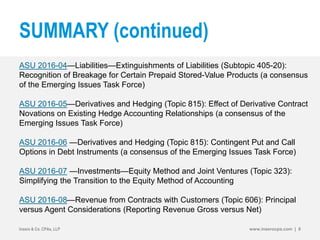

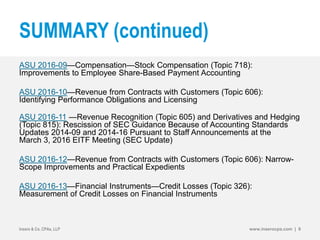

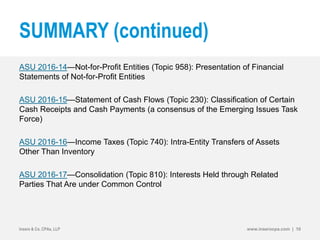

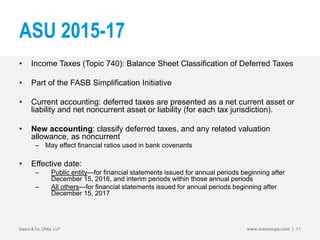

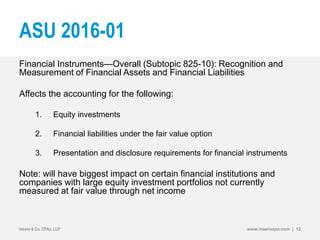

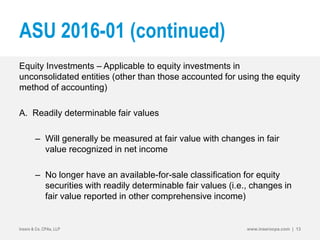

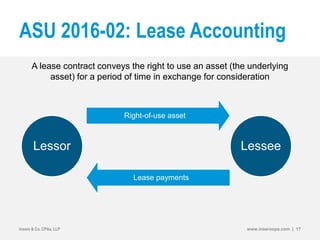

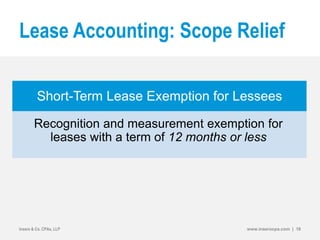

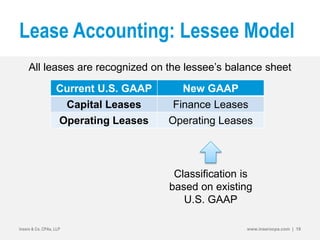

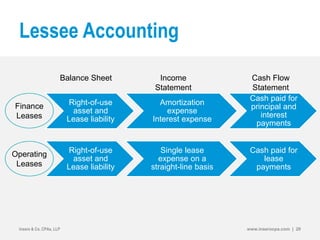

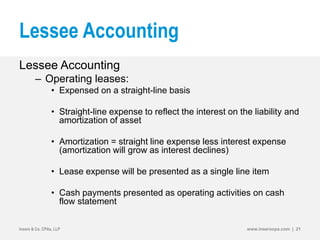

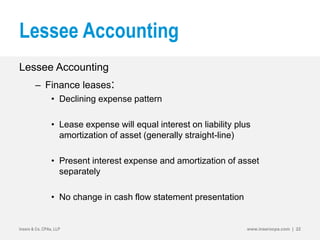

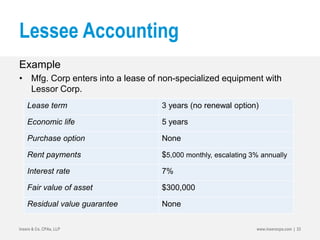

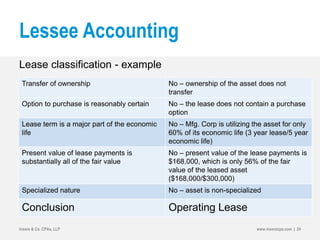

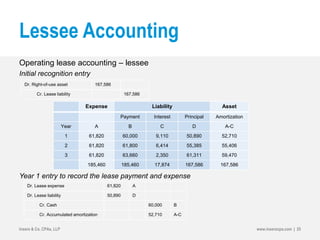

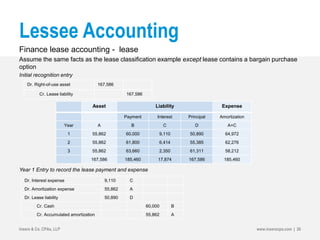

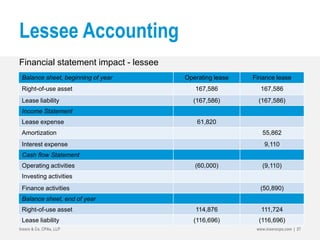

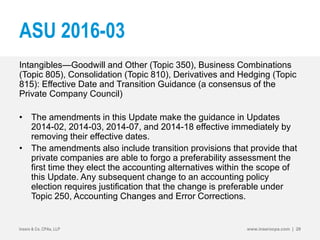

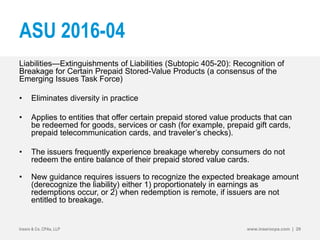

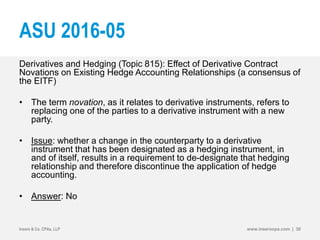

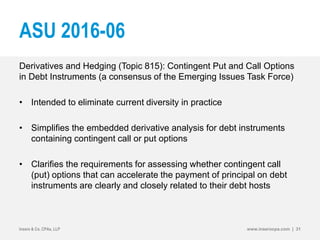

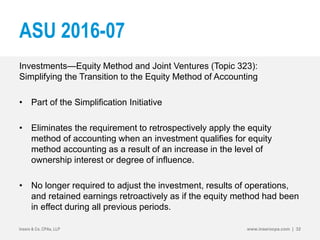

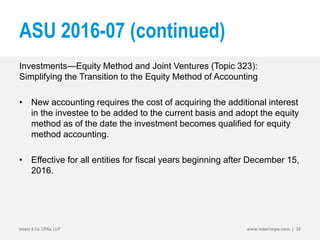

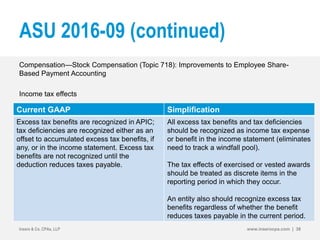

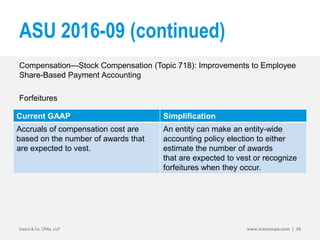

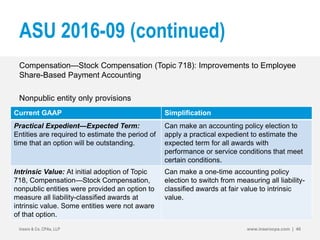

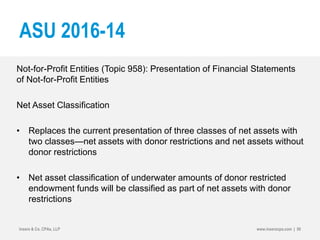

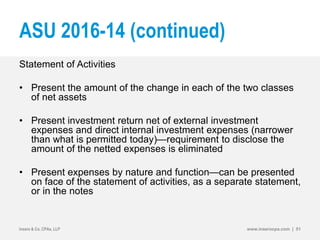

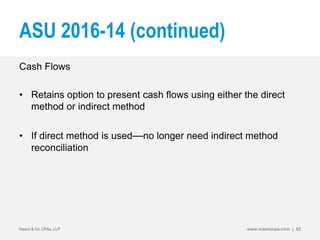

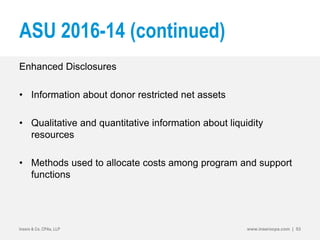

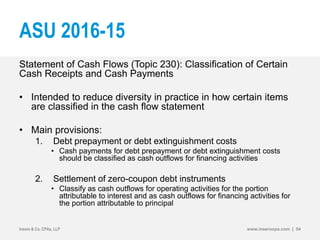

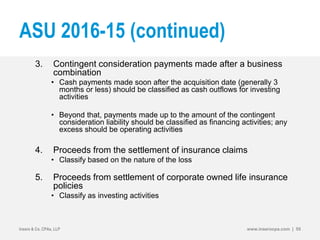

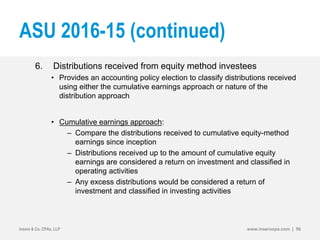

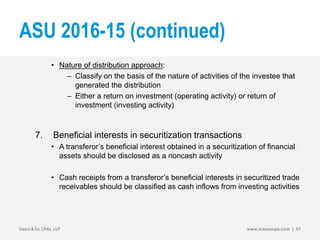

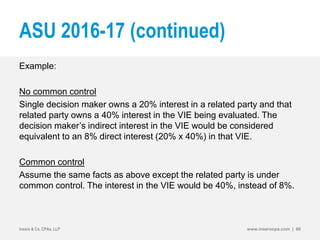

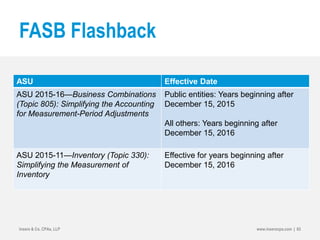

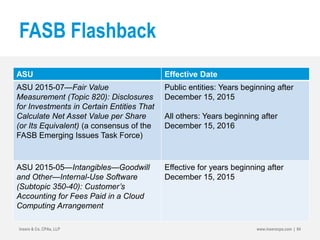

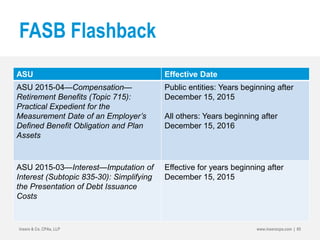

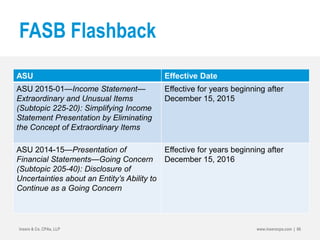

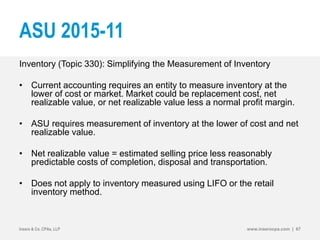

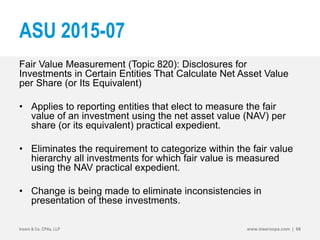

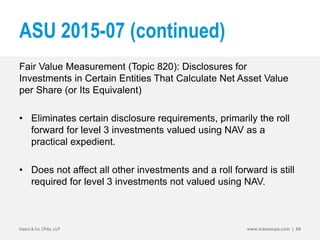

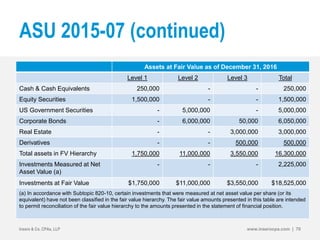

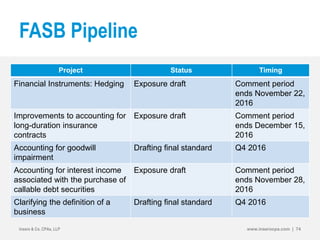

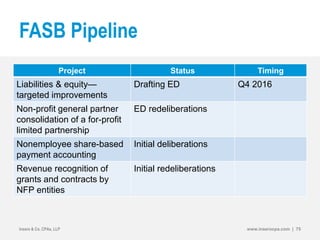

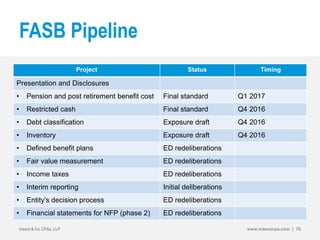

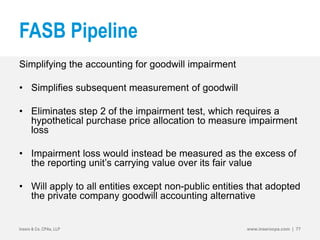

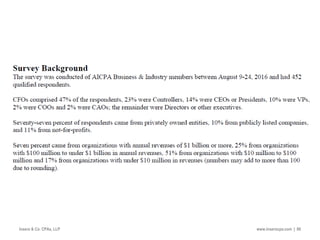

The document details various accounting standards updates (ASUs) from 2015 and 2016 that affect the classification and measurement of financial instruments, leases, liabilities, and revenue recognition. It includes the expertise of CPA partners at Insero & Co., emphasizing their roles and experiences in guiding organizations through these accounting changes. Key changes include new guidelines for deferred taxes, lease accounting, and financial instruments, with specified effective dates for implementation.