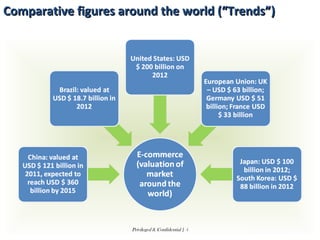

The document discusses whether there should be governance for e-commerce in India. It outlines the current regulatory framework covering IT acts, contract acts, consumer protection acts, and data privacy laws. It also reviews regulations in other countries like the European Union, South Korea, and the UK. The document concludes by proposing areas that could be covered under a new e-commerce law in India, including recognizing e-commerce as a business sector, limiting liability for third-party goods, and harmonizing laws around logistical services.