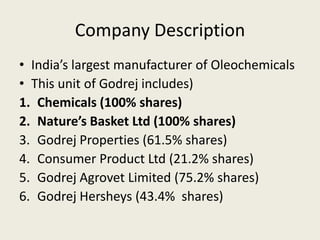

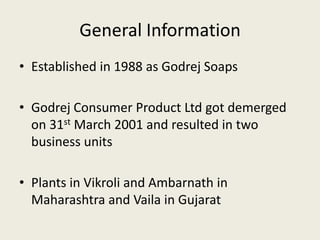

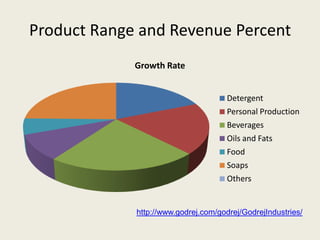

- Godrej Consumer Products Ltd is India's largest manufacturer of consumer goods such as soaps, oils, and home care products. It has a wide product range sold in India and other global markets.

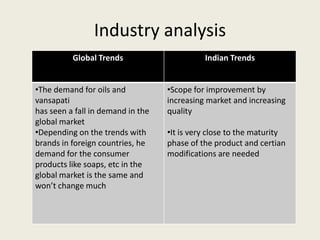

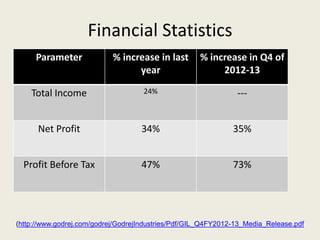

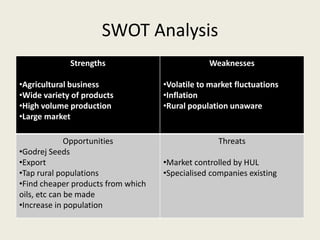

- The company has seen strong financial growth in recent years with increases in total income, net profit, and profit before tax. However, the global demand for oils and fats has declined while demand for soaps and personal care products has remained steady.

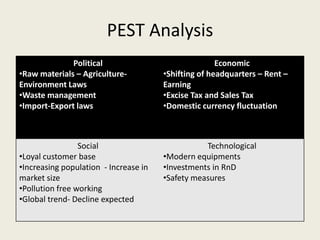

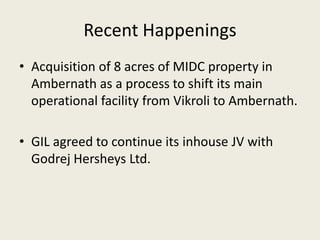

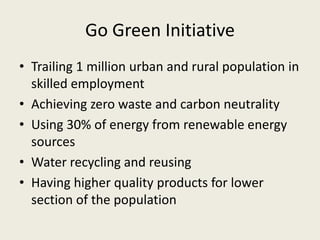

- Godrej operates multiple business units and has pursued acquisitions and joint ventures to expand its portfolio and geographic reach. It faces competition from other major Indian consumer goods companies but maintains its market position through green initiatives and investments in research and development.