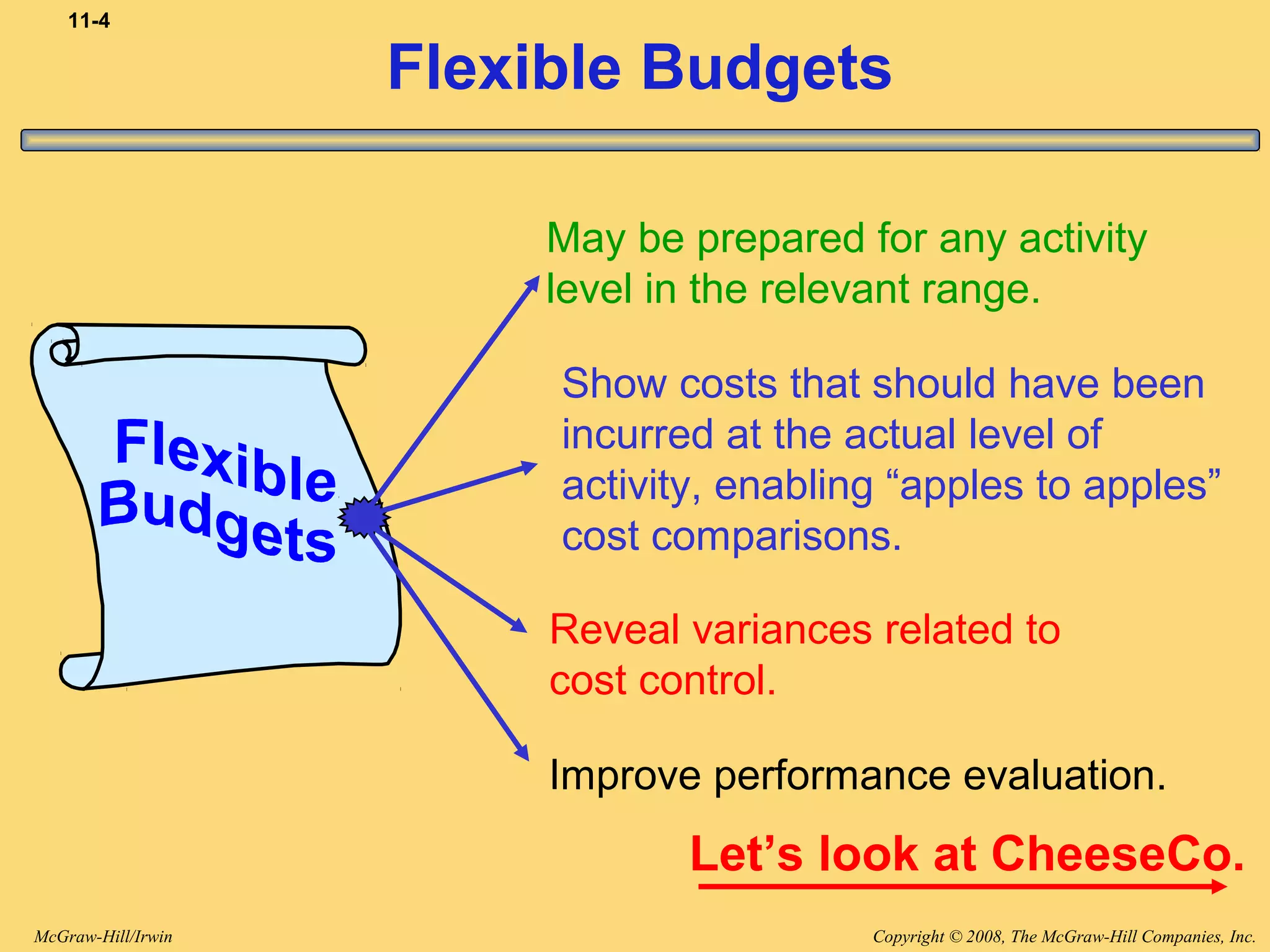

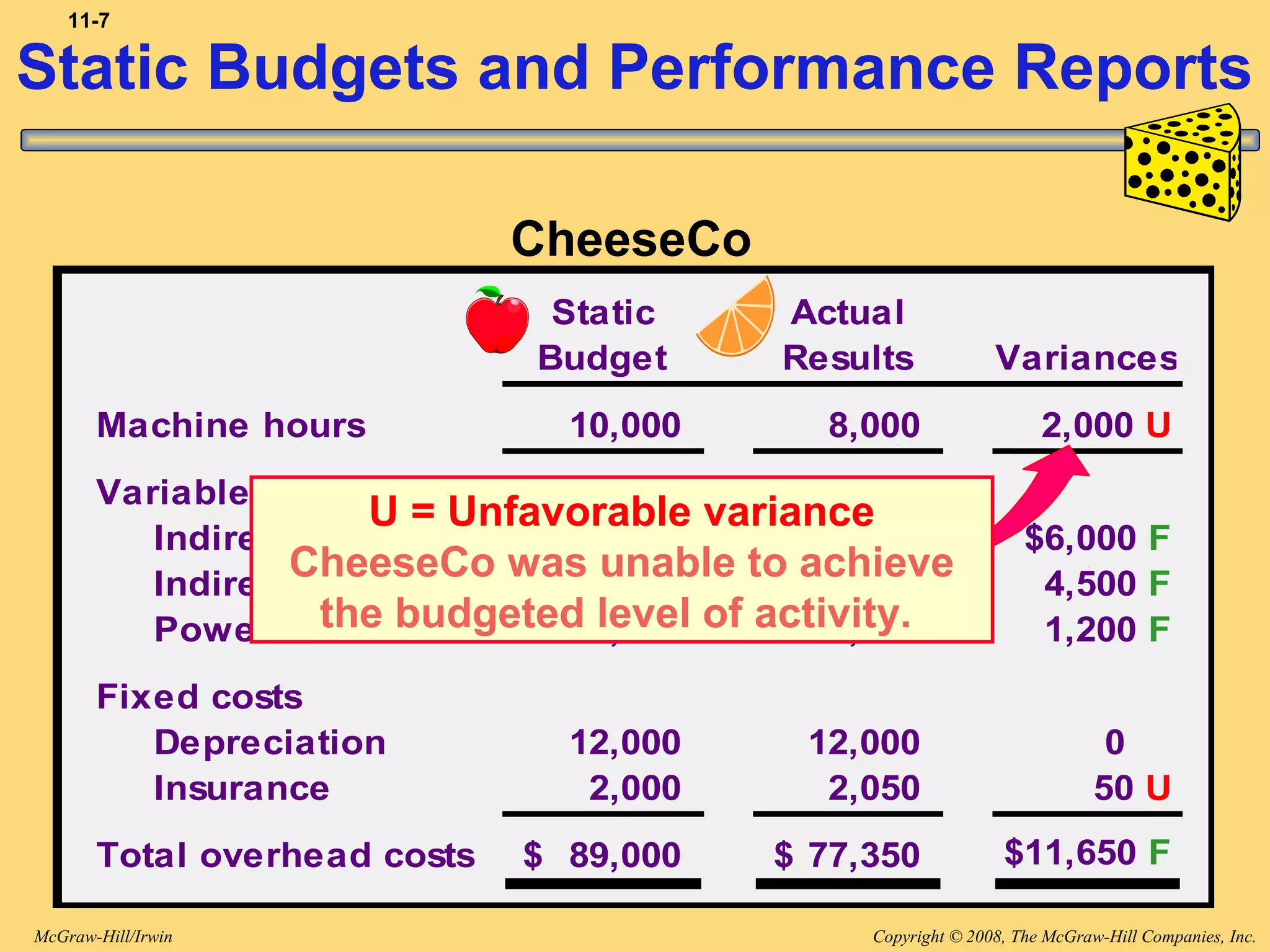

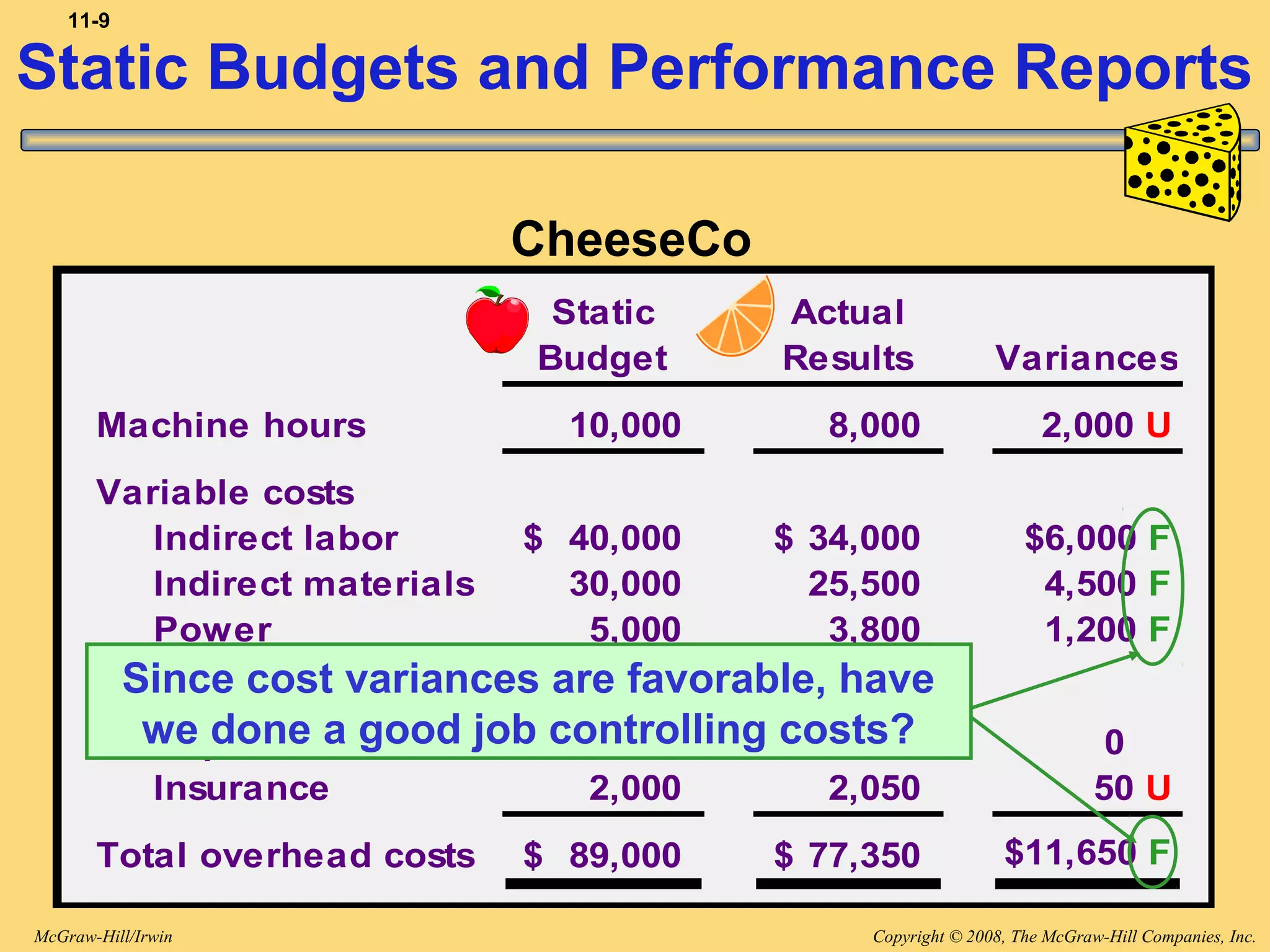

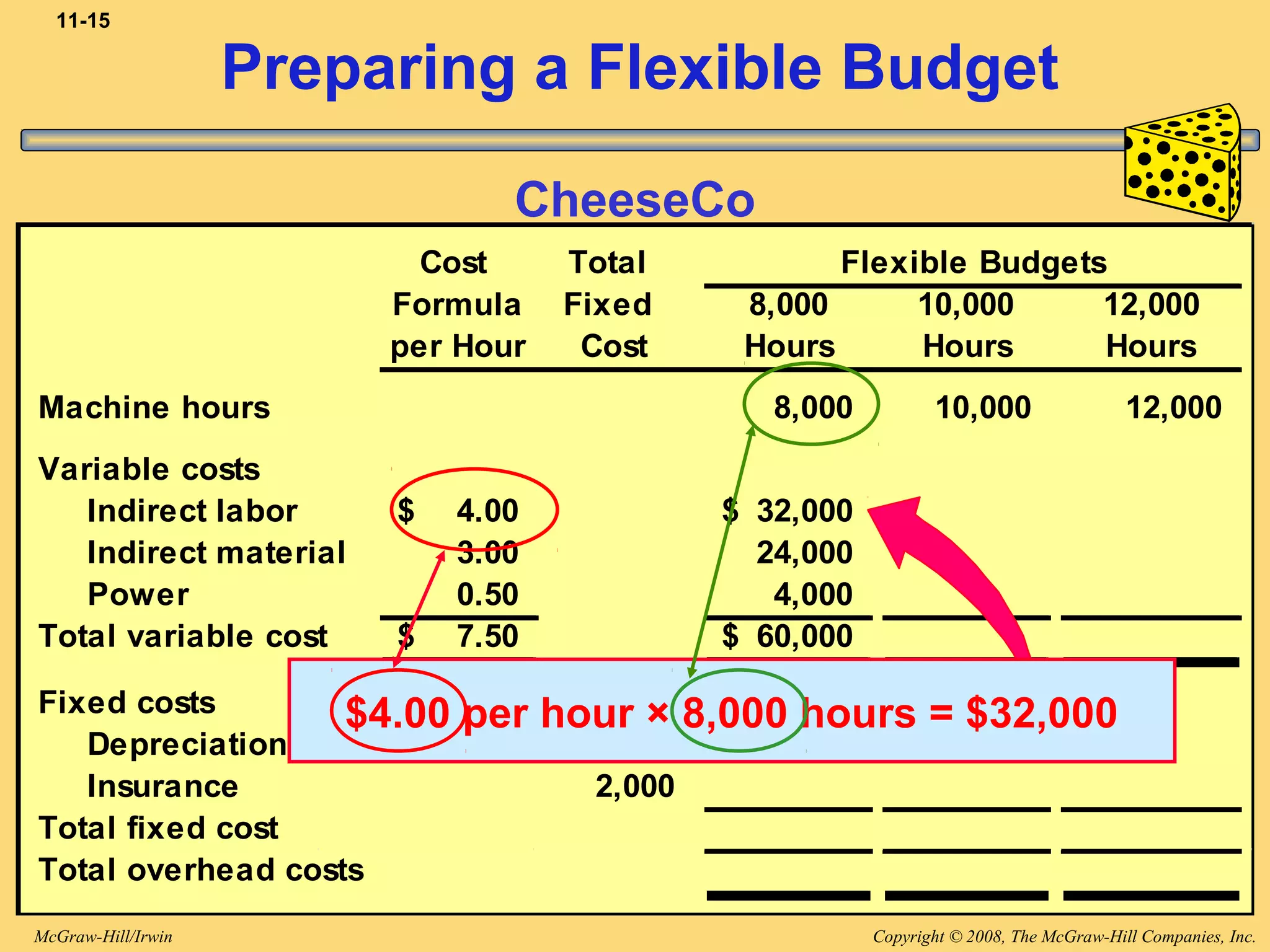

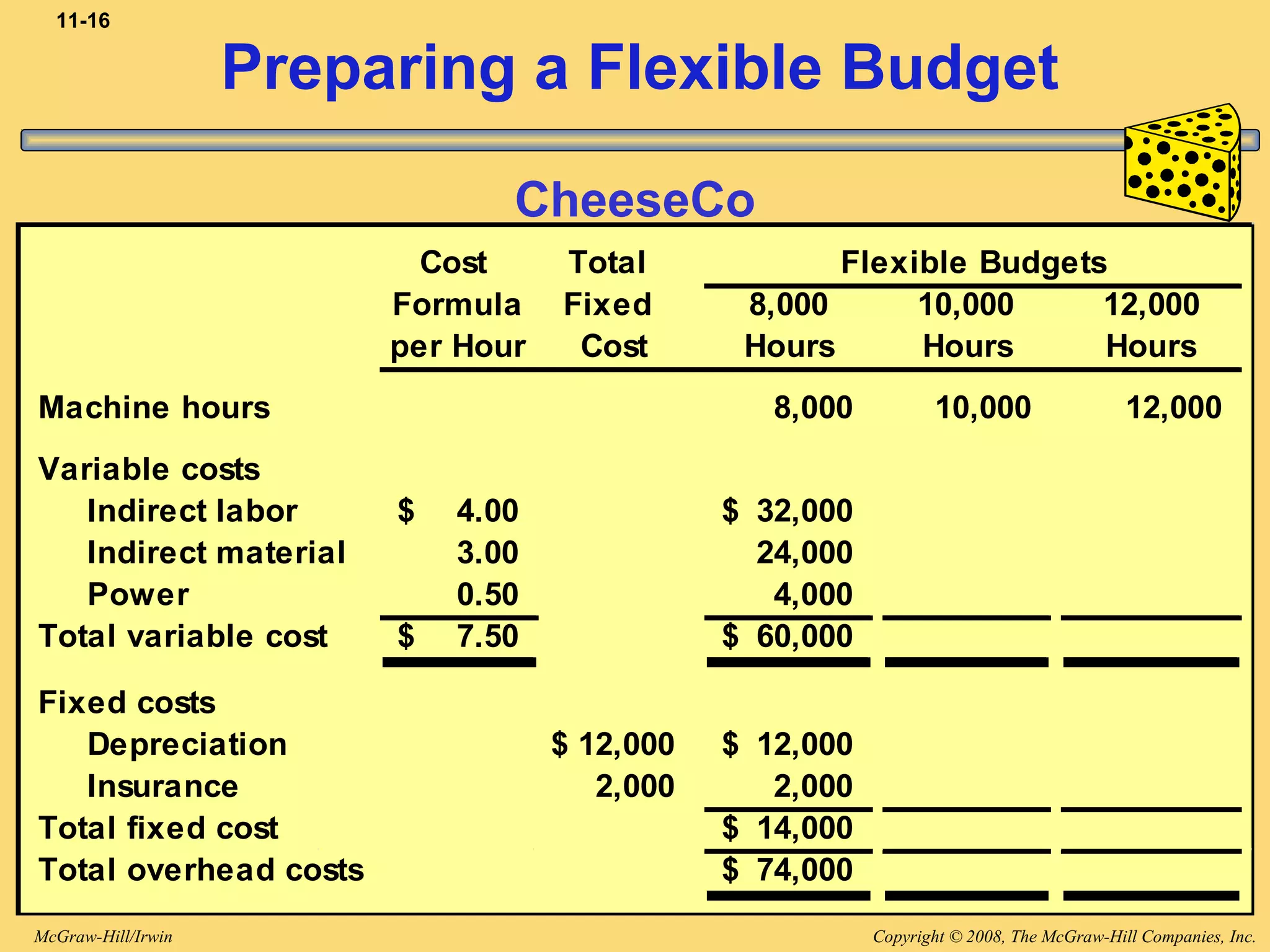

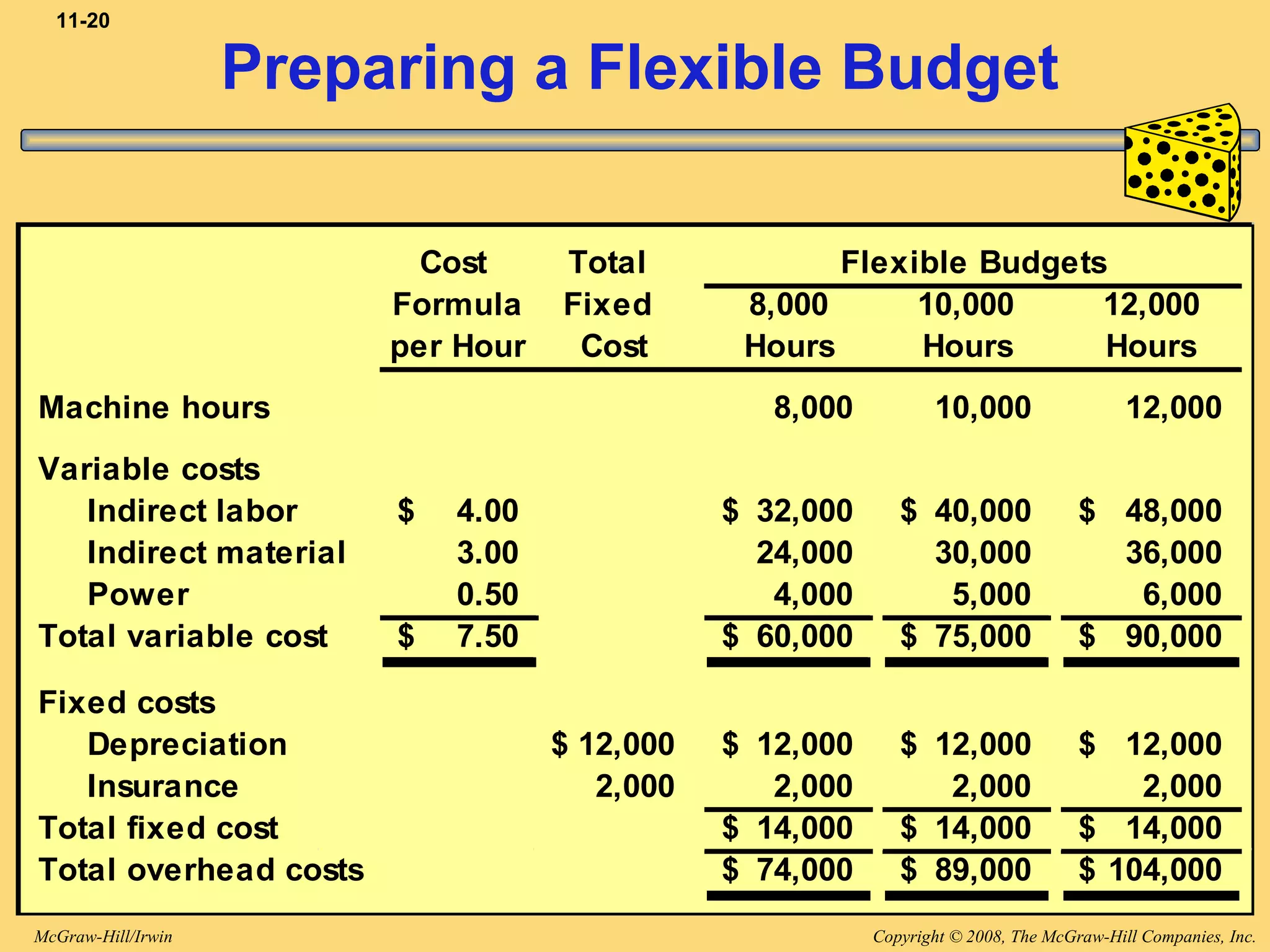

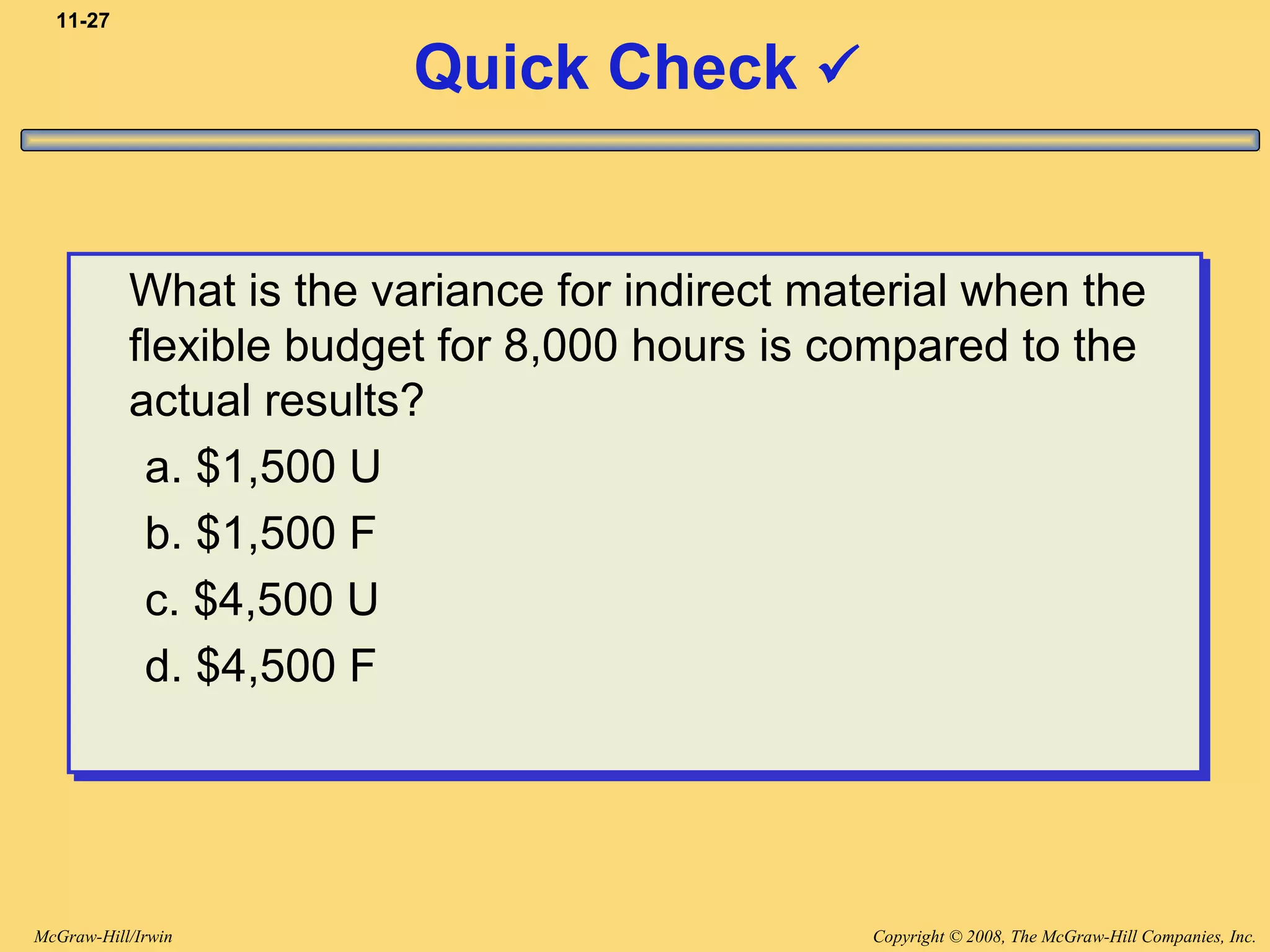

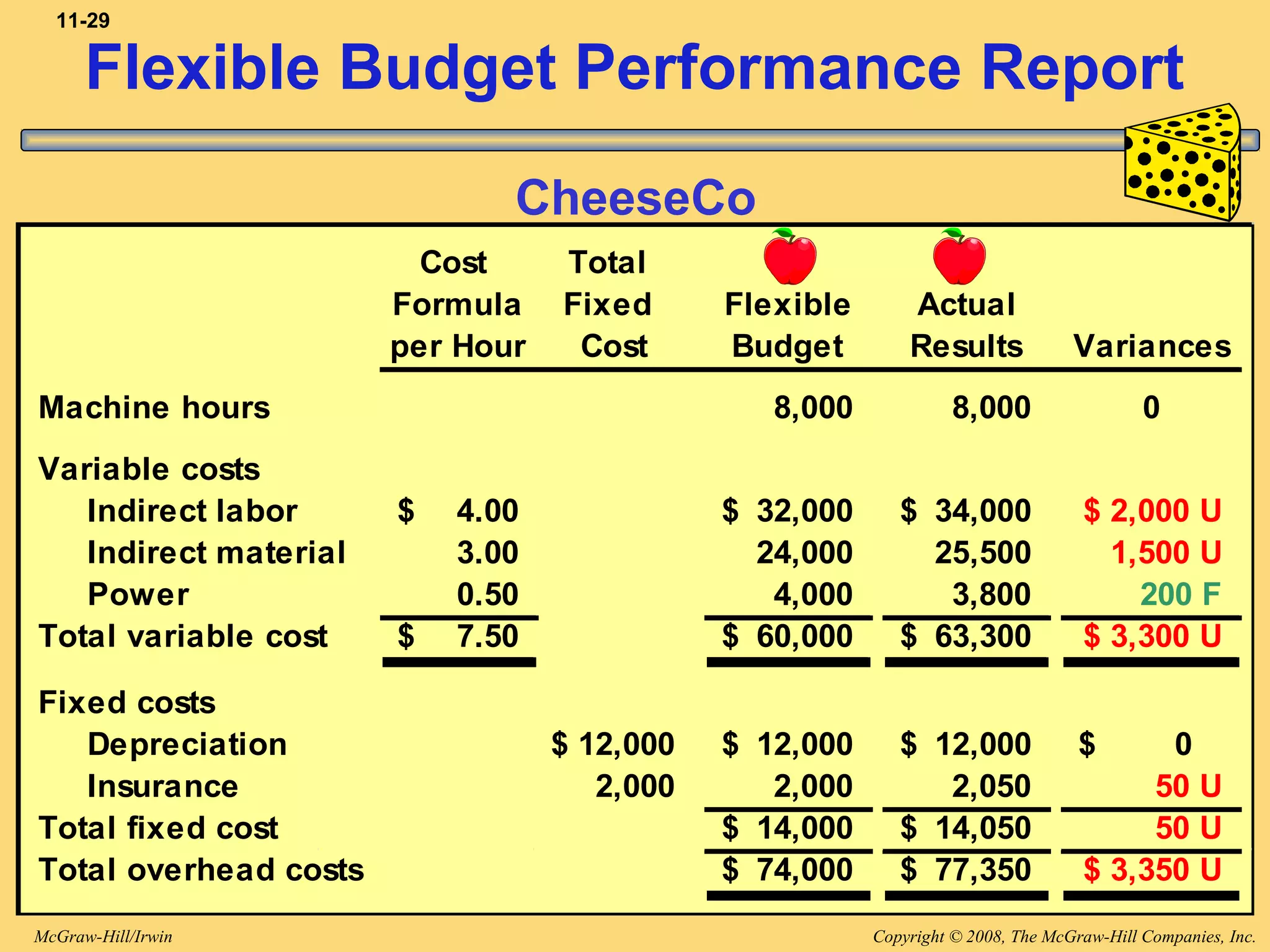

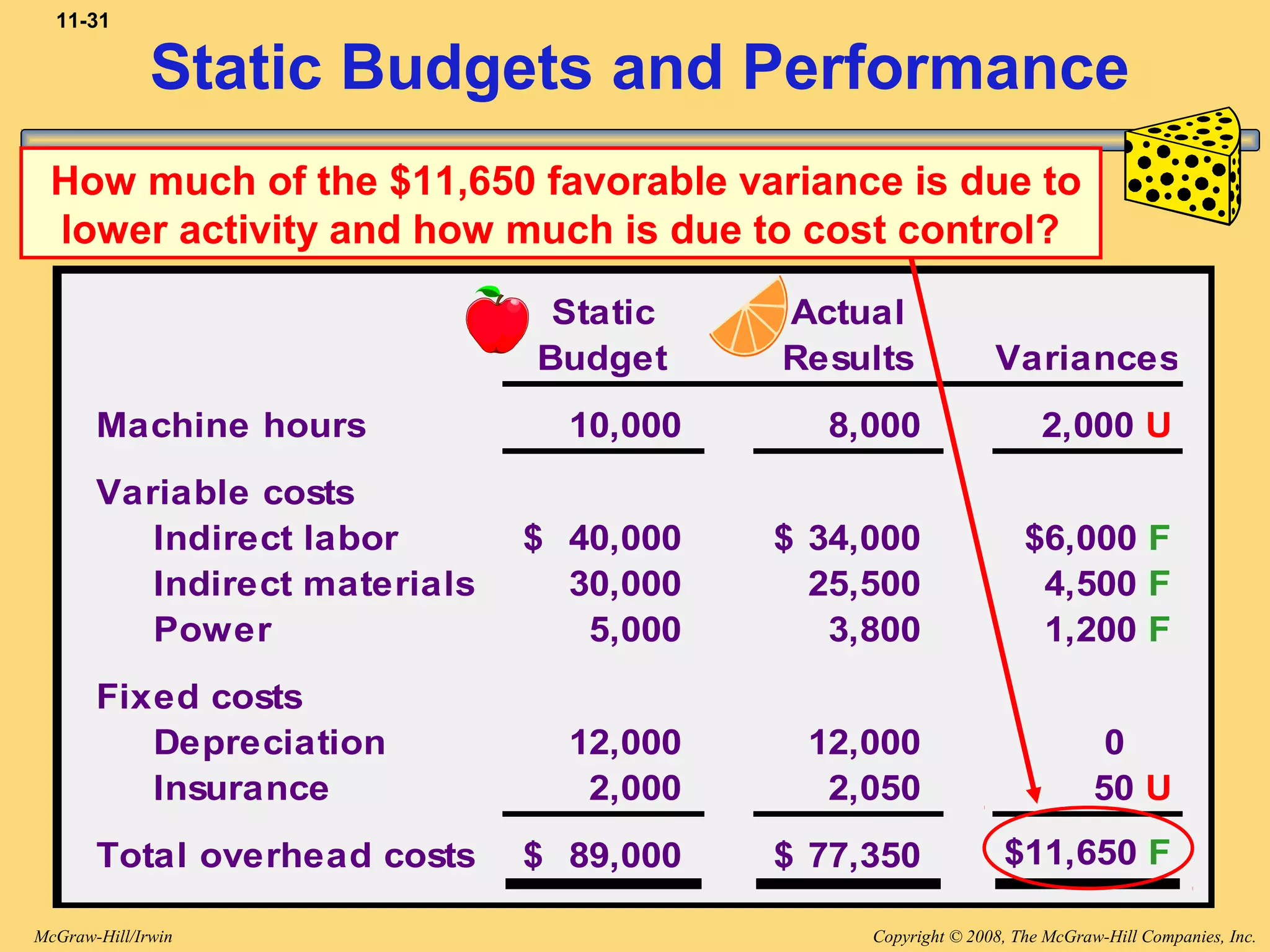

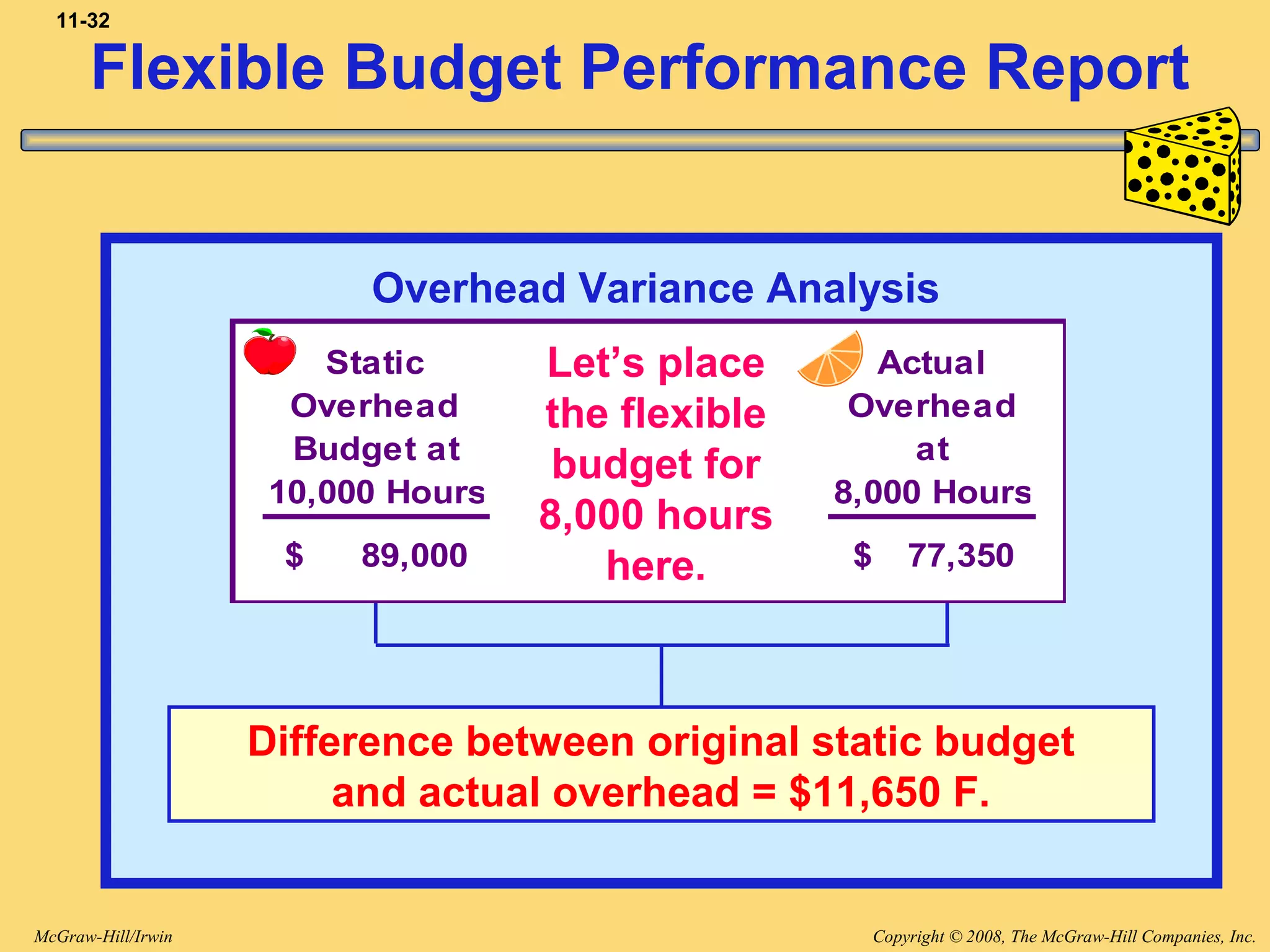

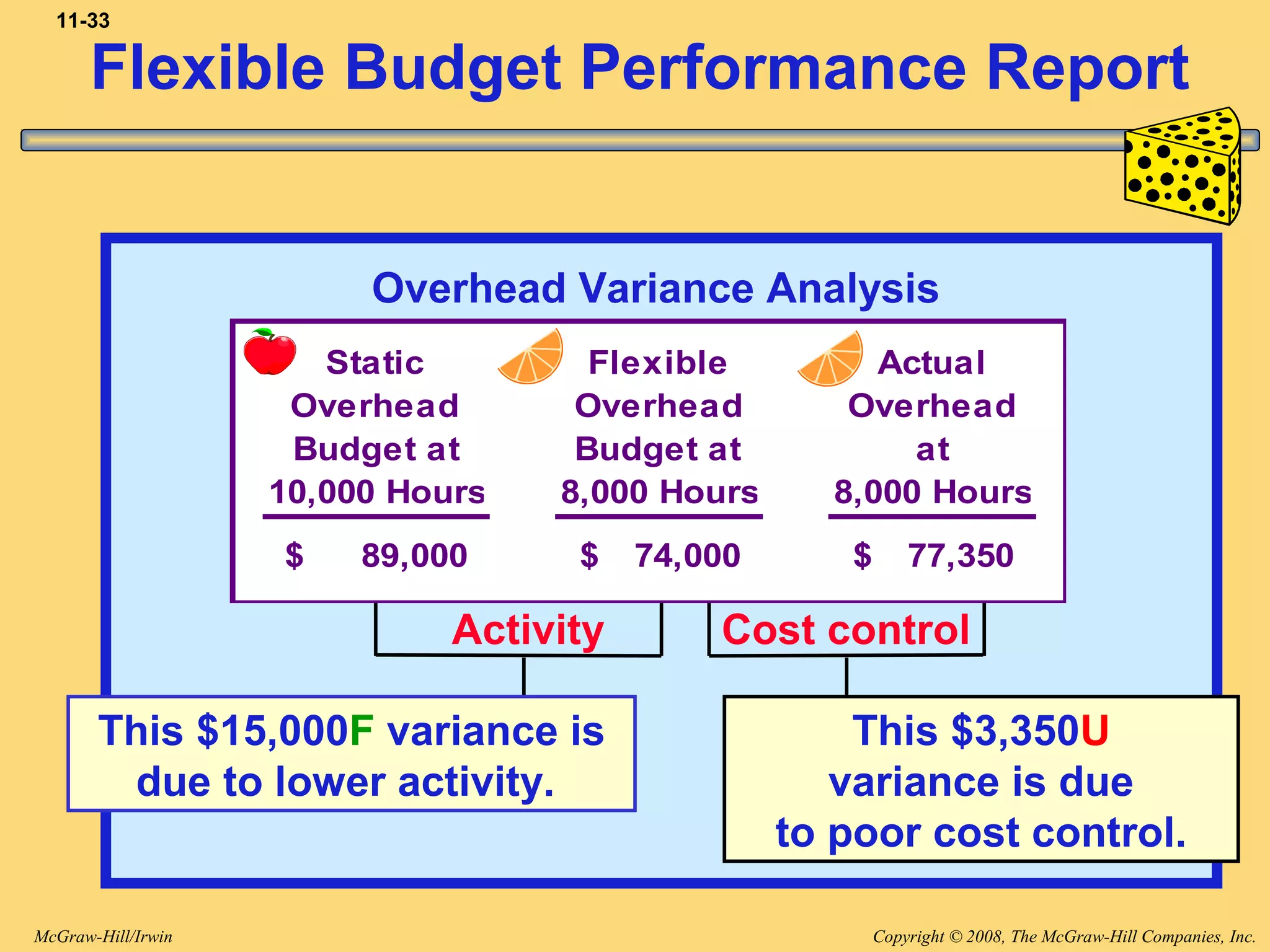

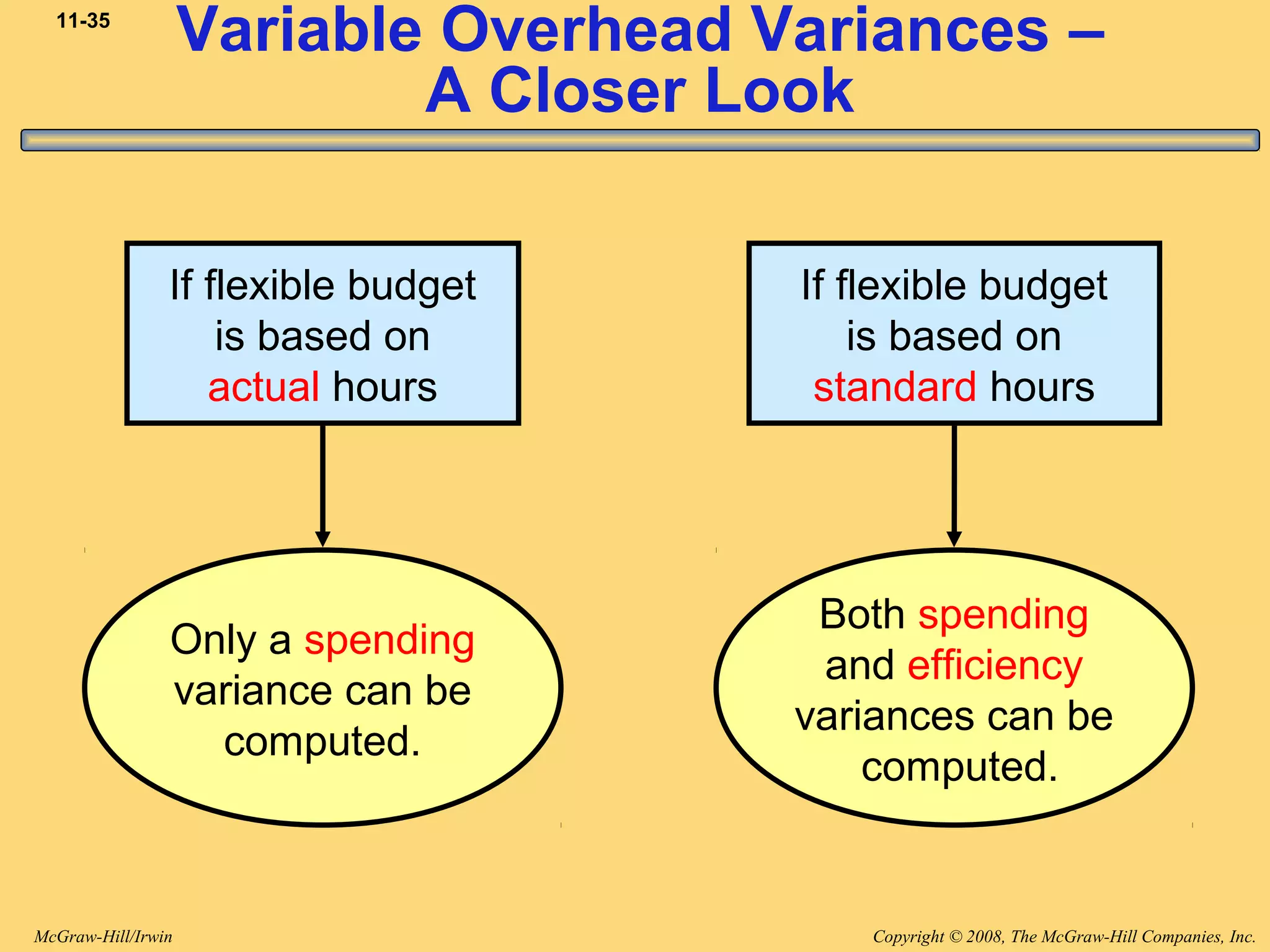

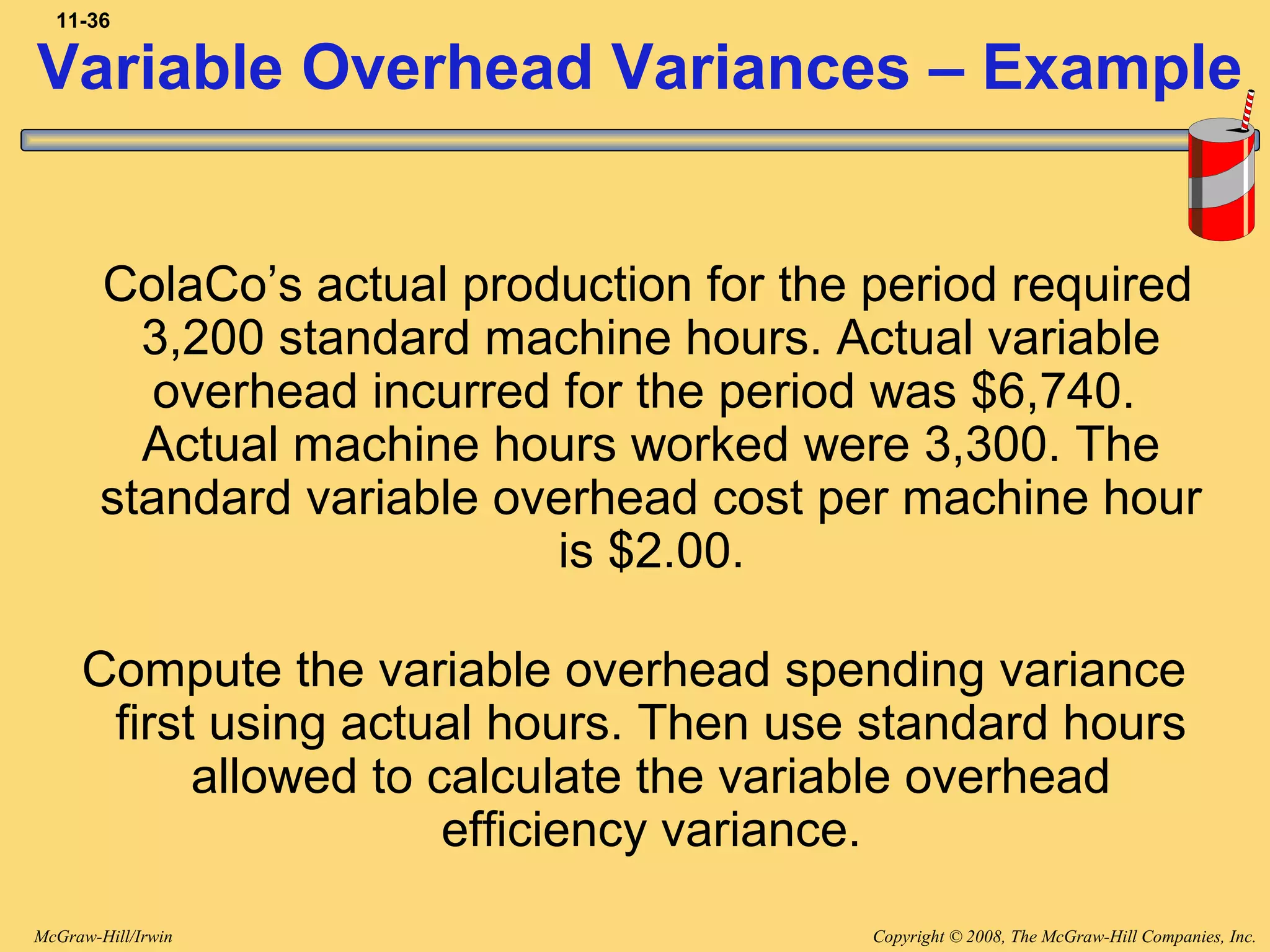

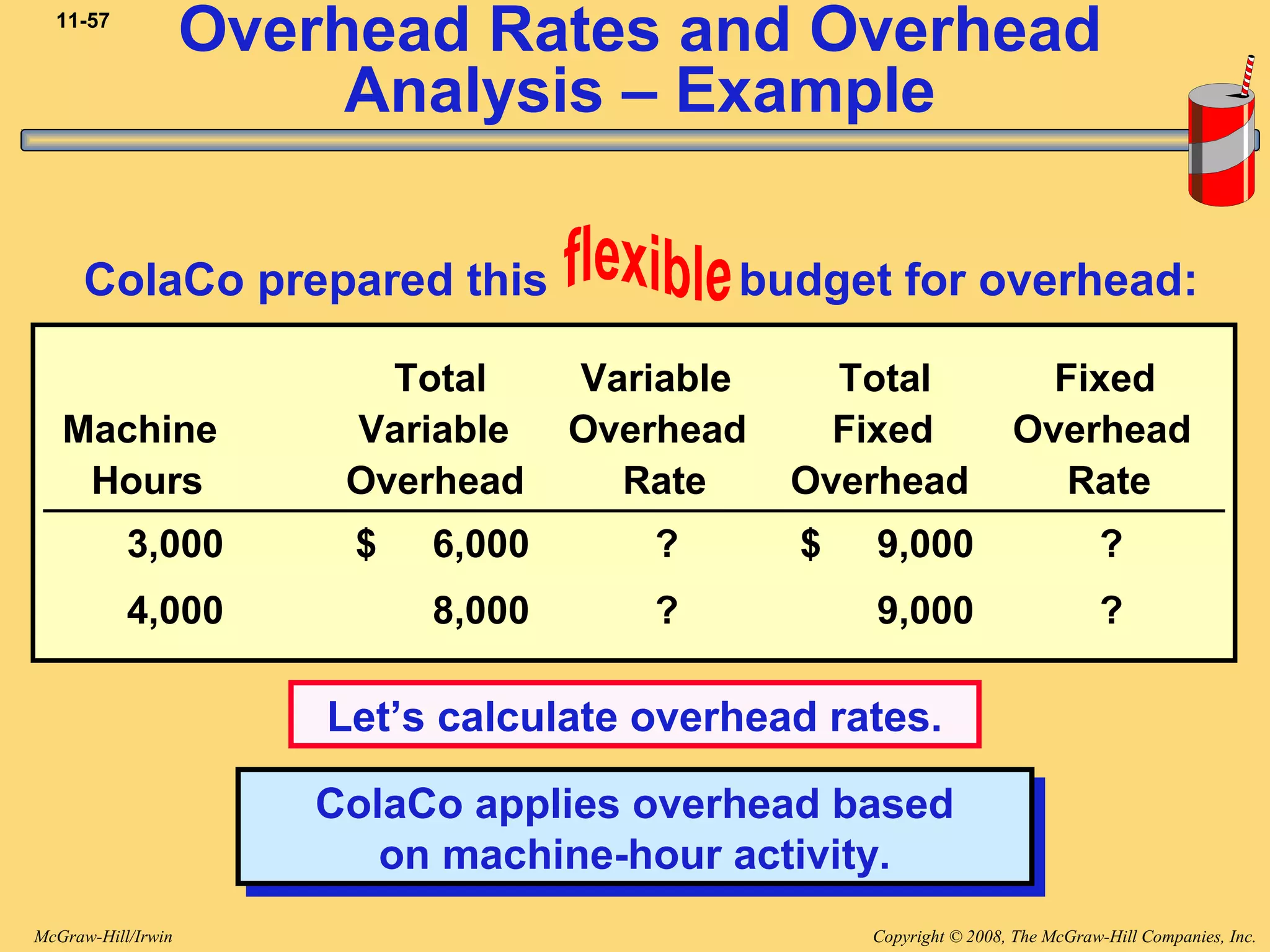

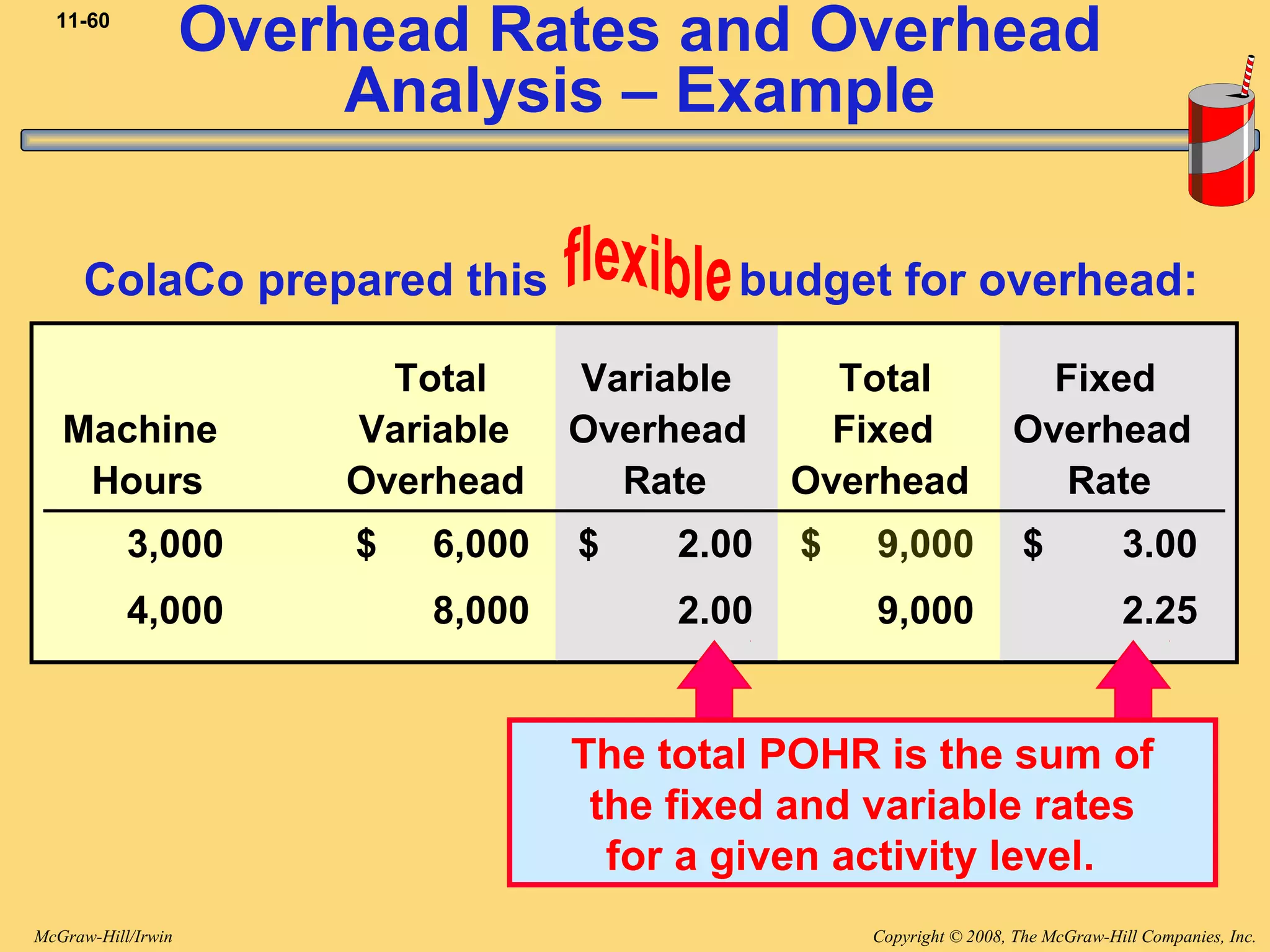

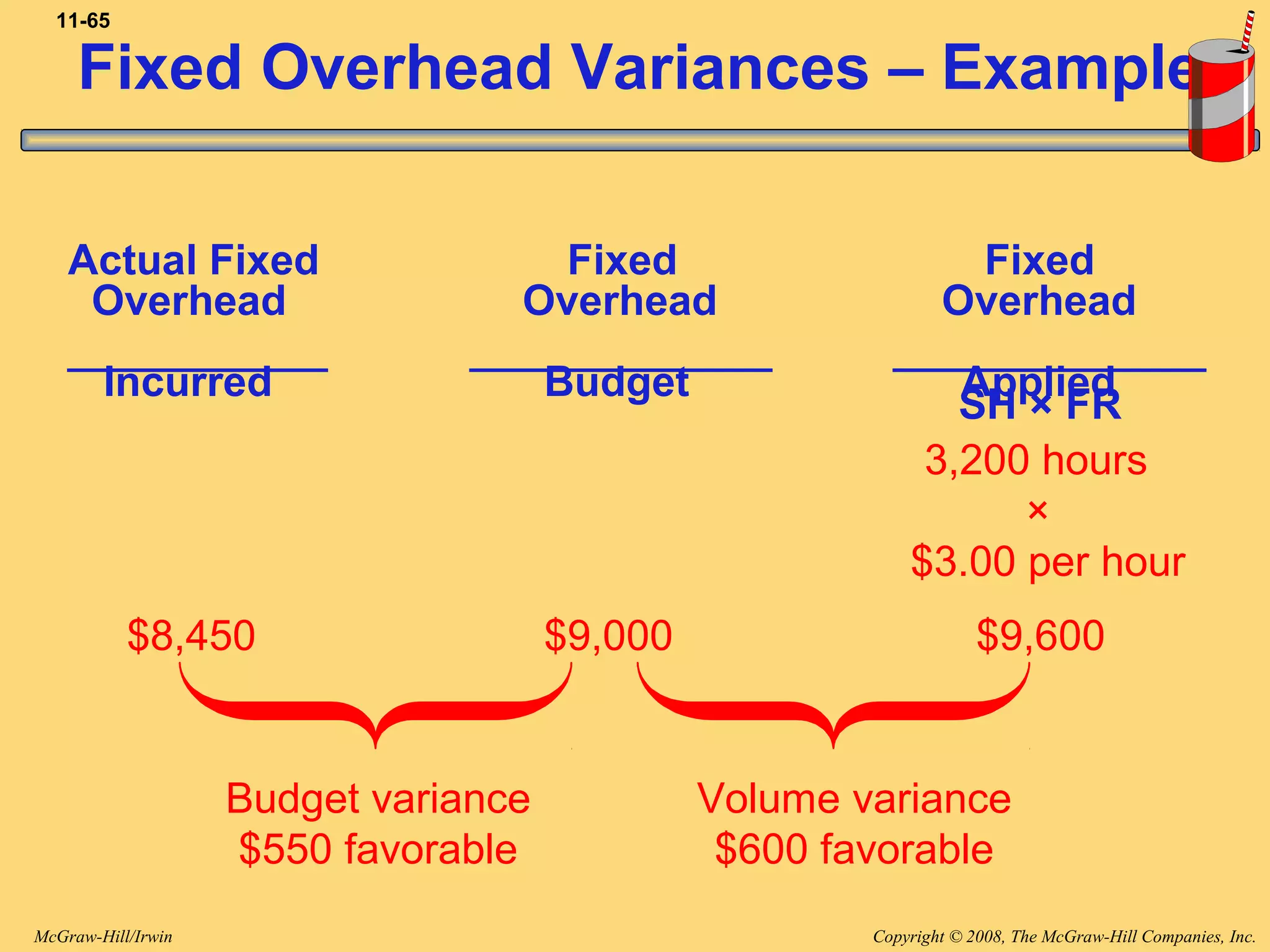

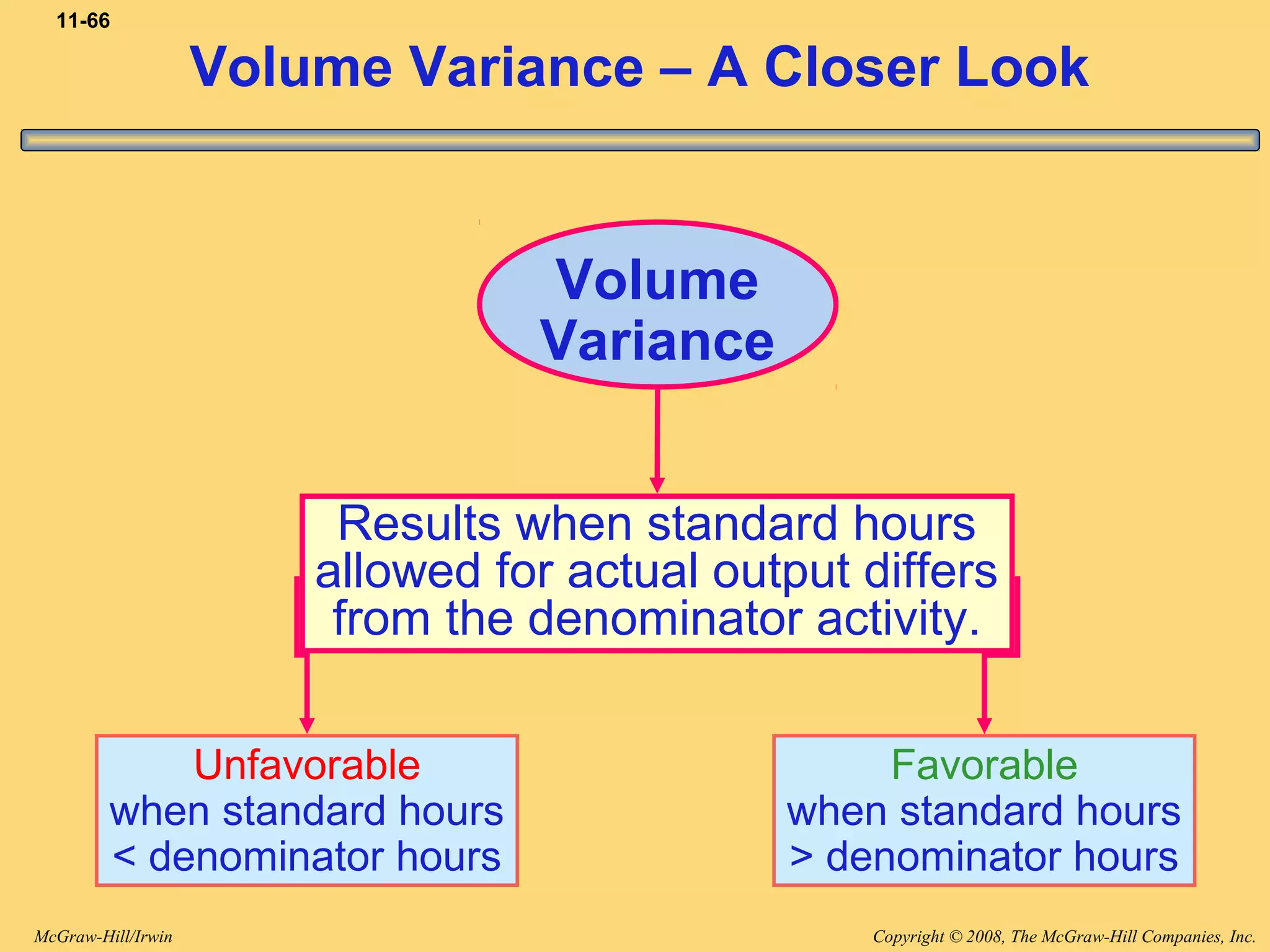

This document discusses flexible budgets and overhead analysis. It begins by explaining the advantages of flexible budgets over static budgets, noting that flexible budgets allow for "apples to apples" cost comparisons by showing costs that should have been incurred at the actual activity level. The document then provides an example of preparing a flexible budget for CheeseCo, calculating variable and fixed overhead costs across different activity levels. It concludes by discussing how to prepare a performance report using a flexible budget to analyze variances between budgeted and actual costs.