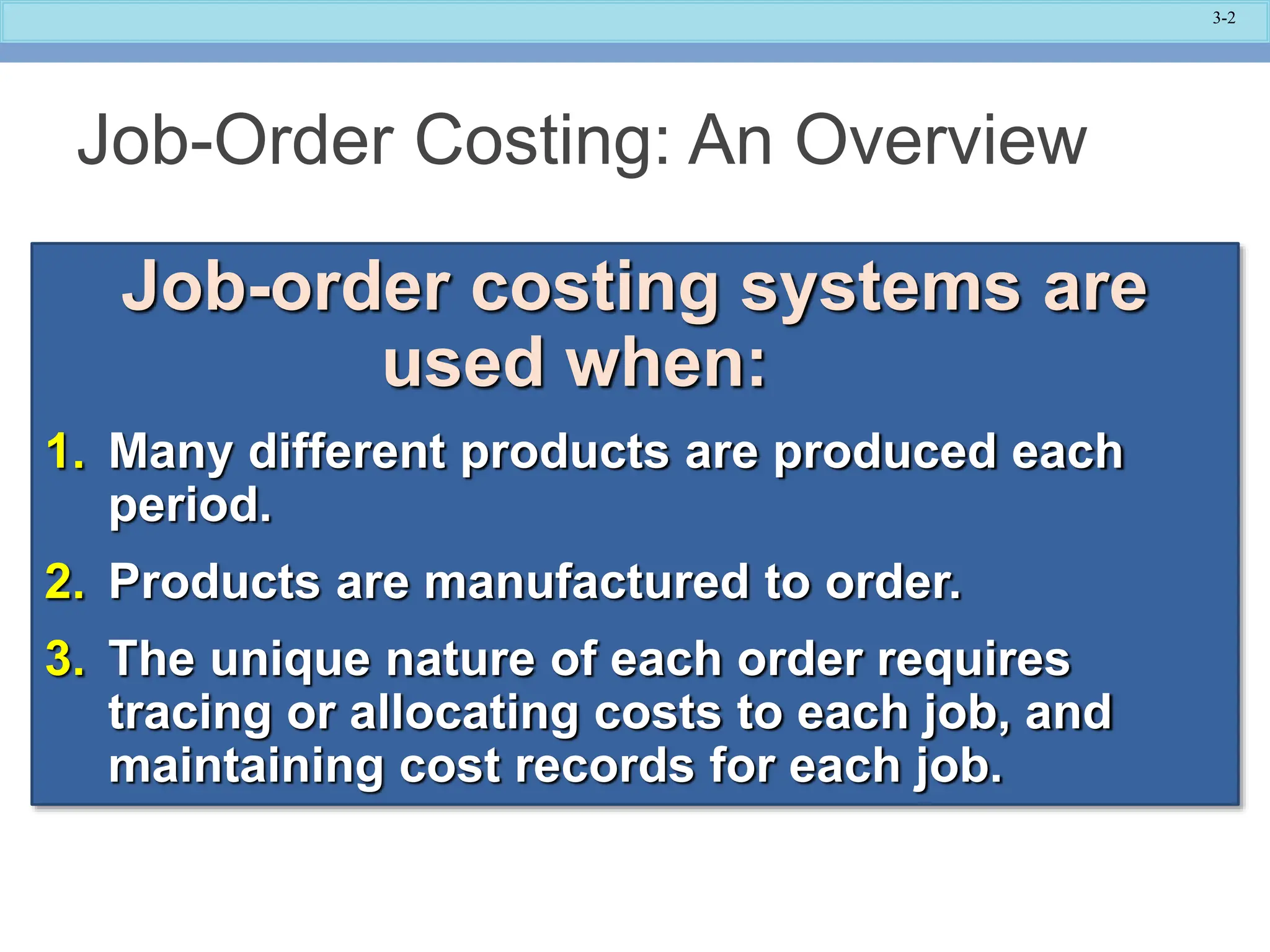

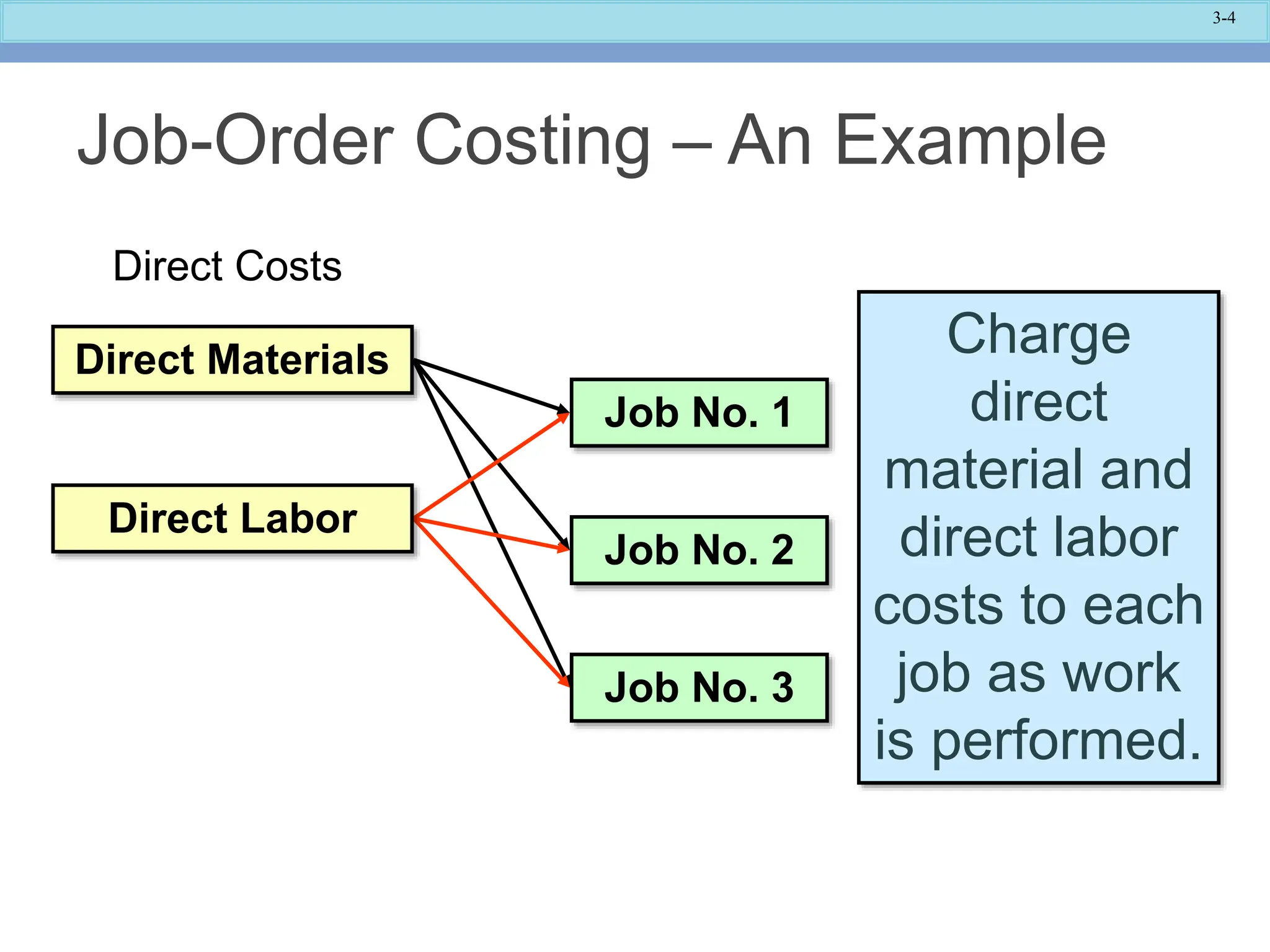

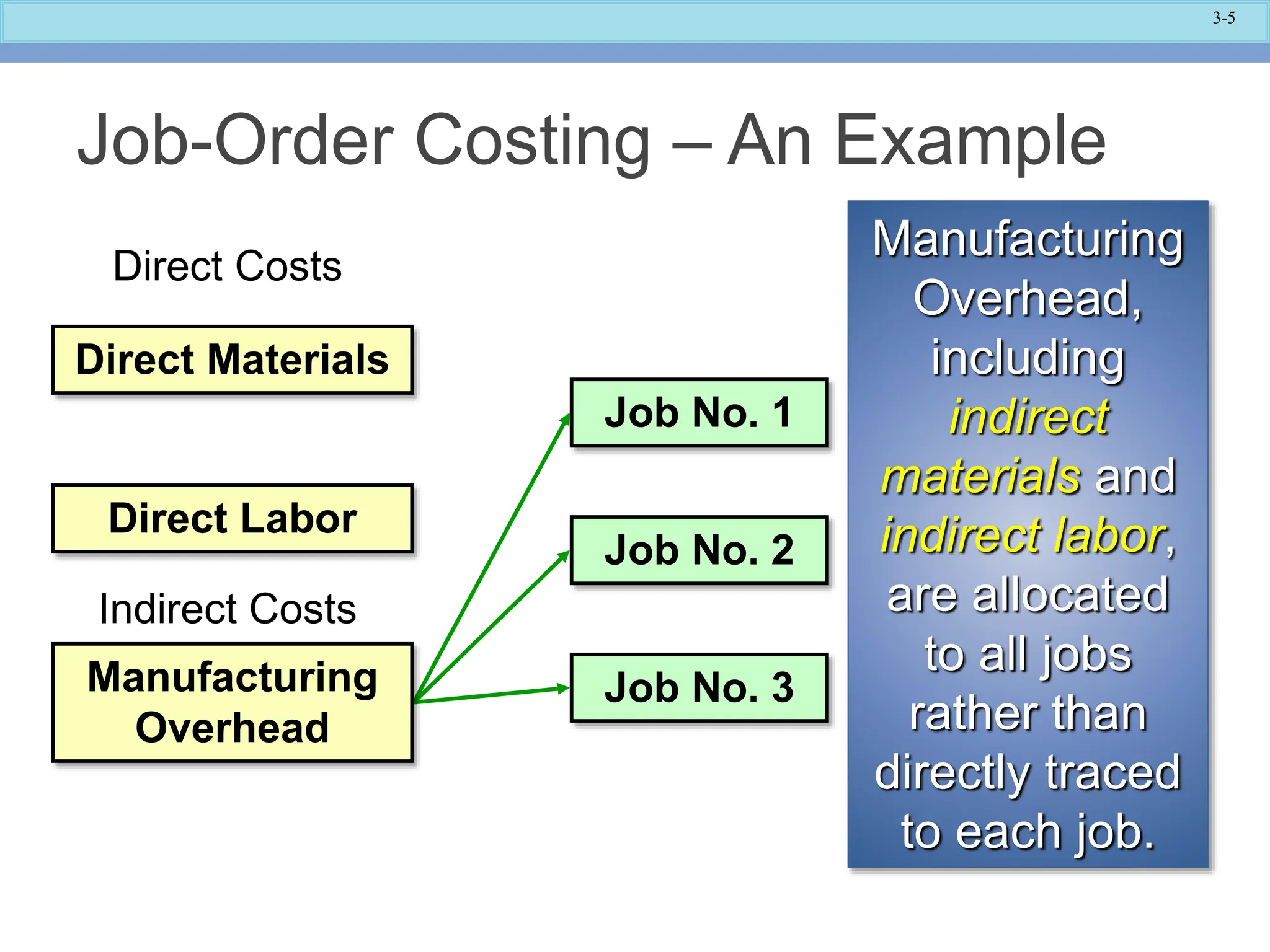

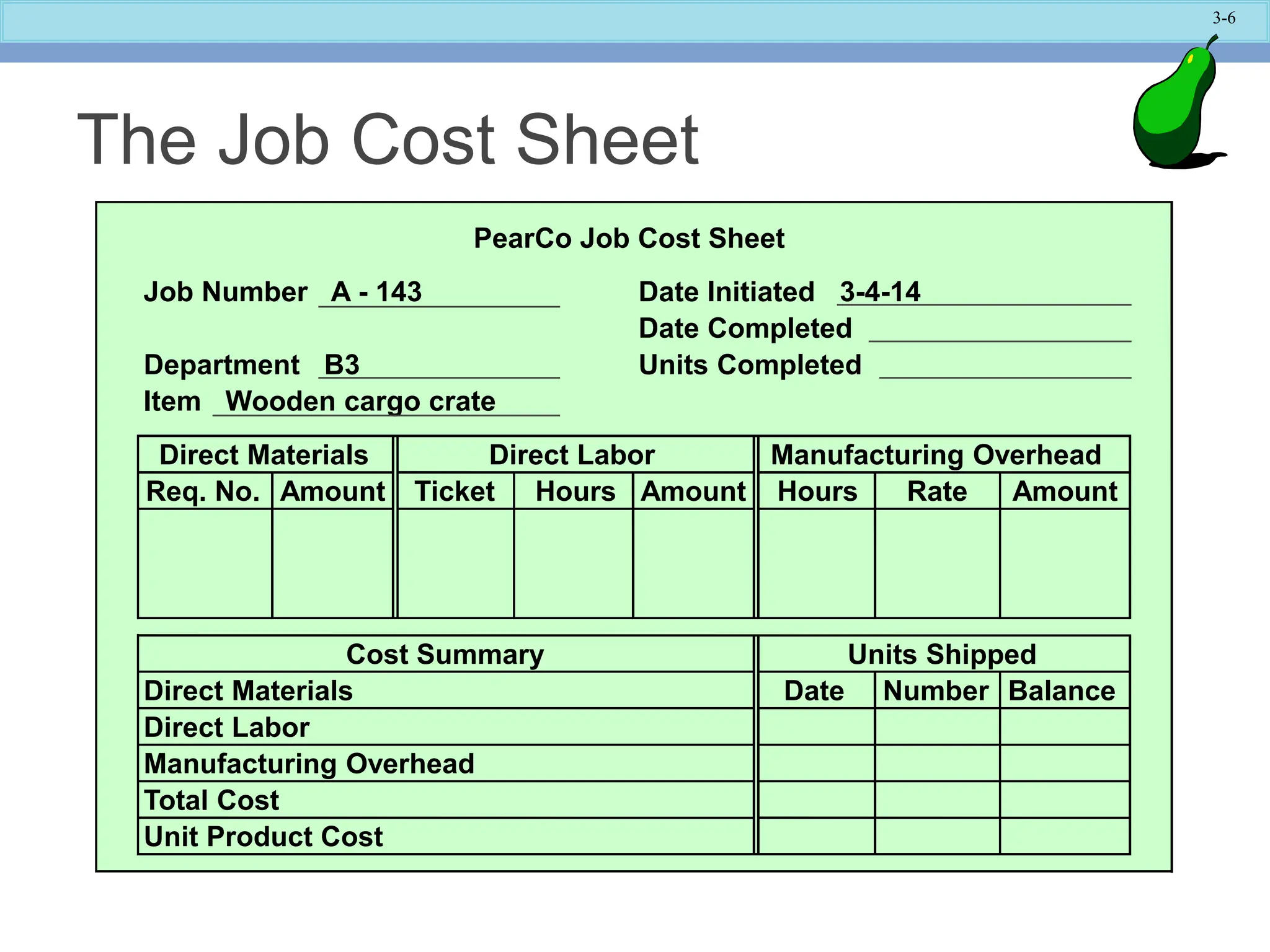

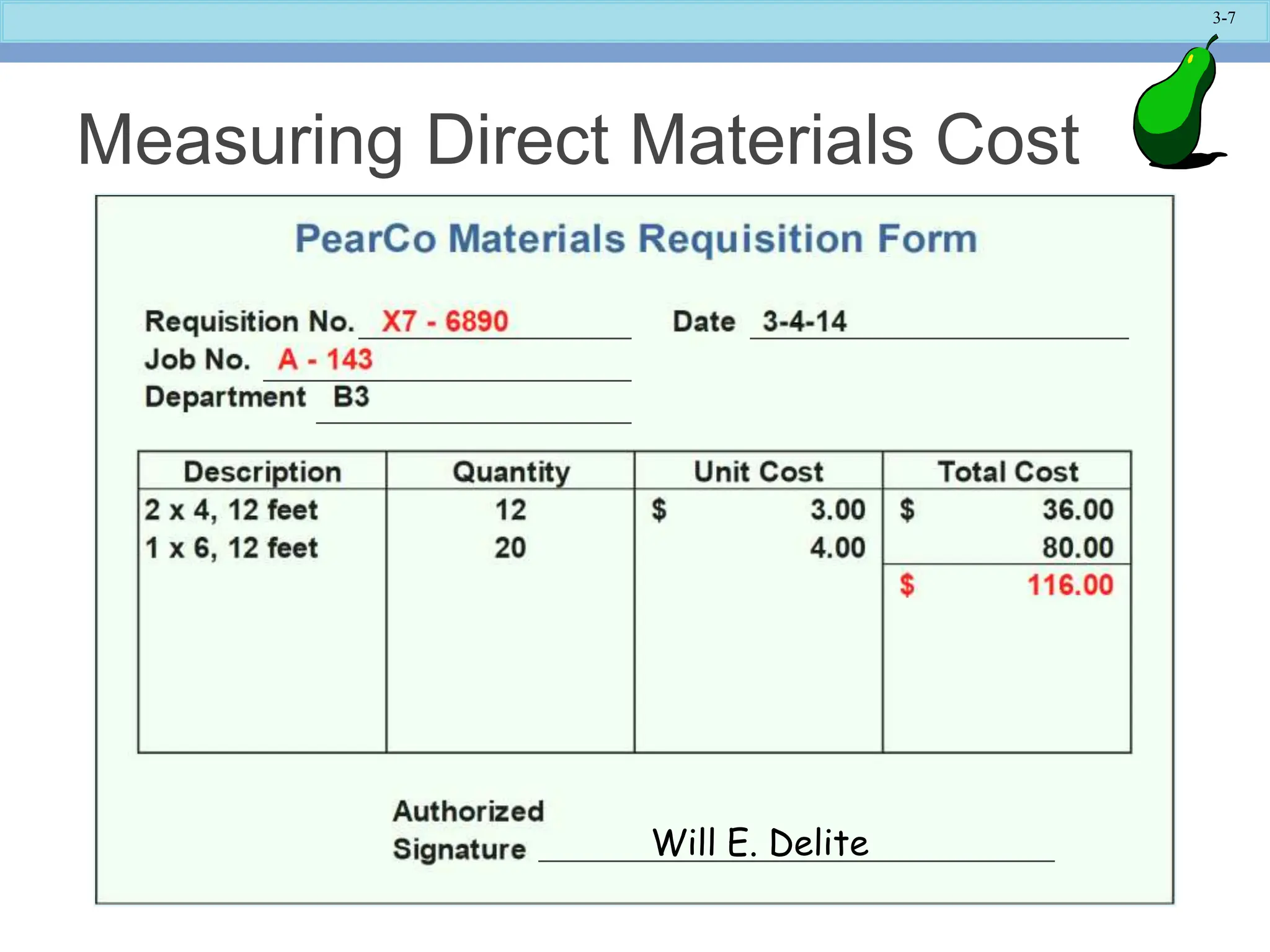

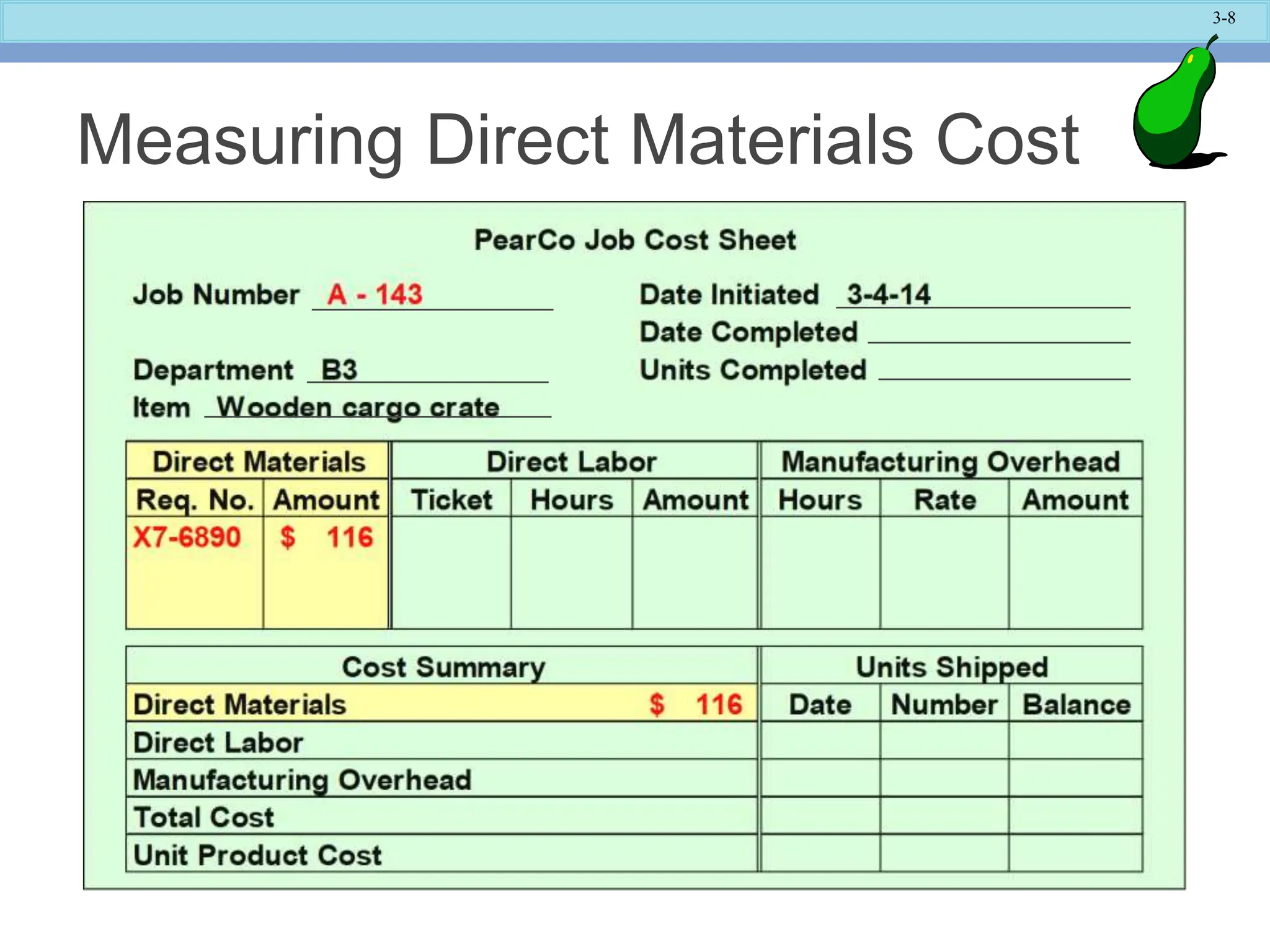

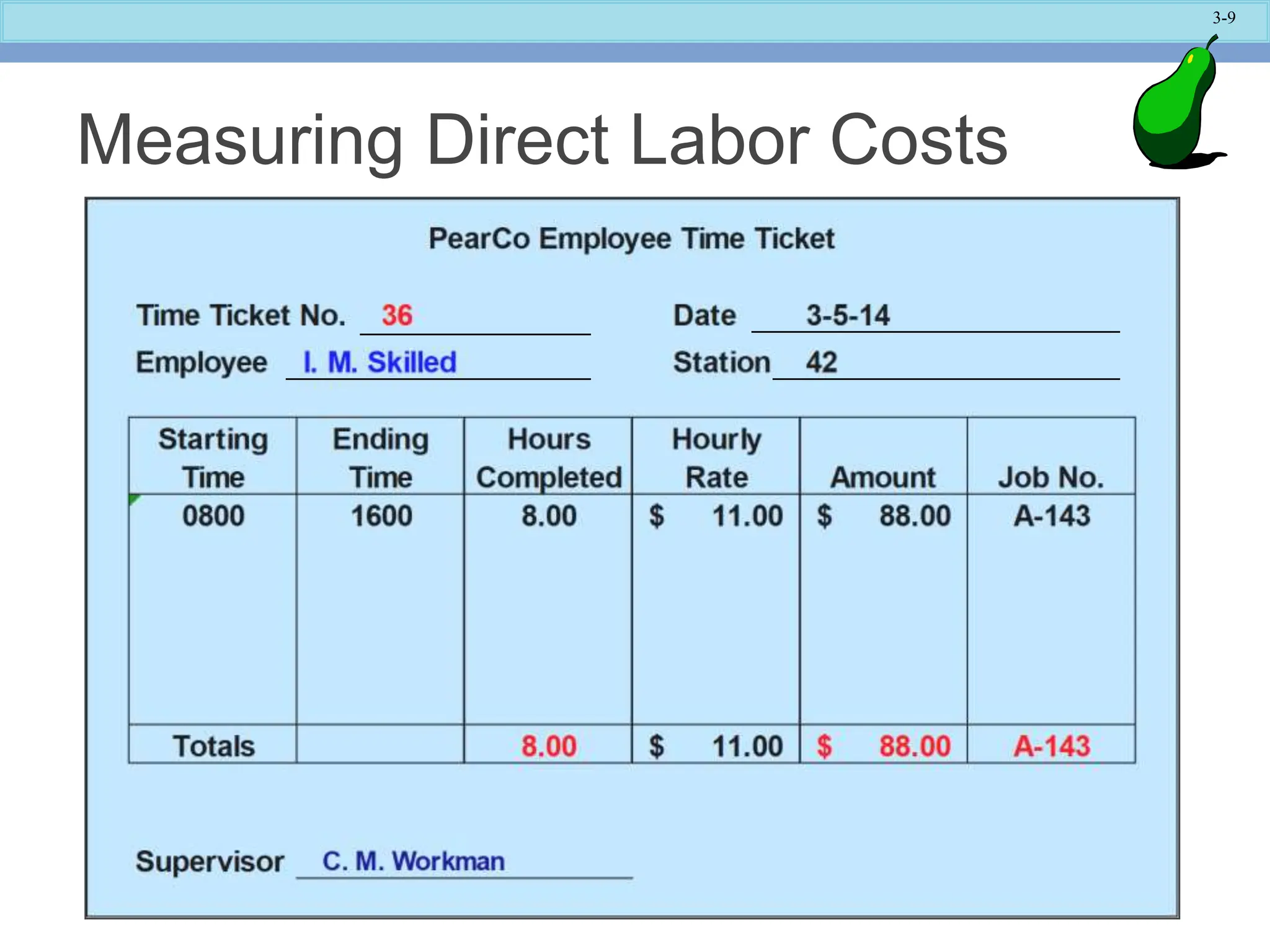

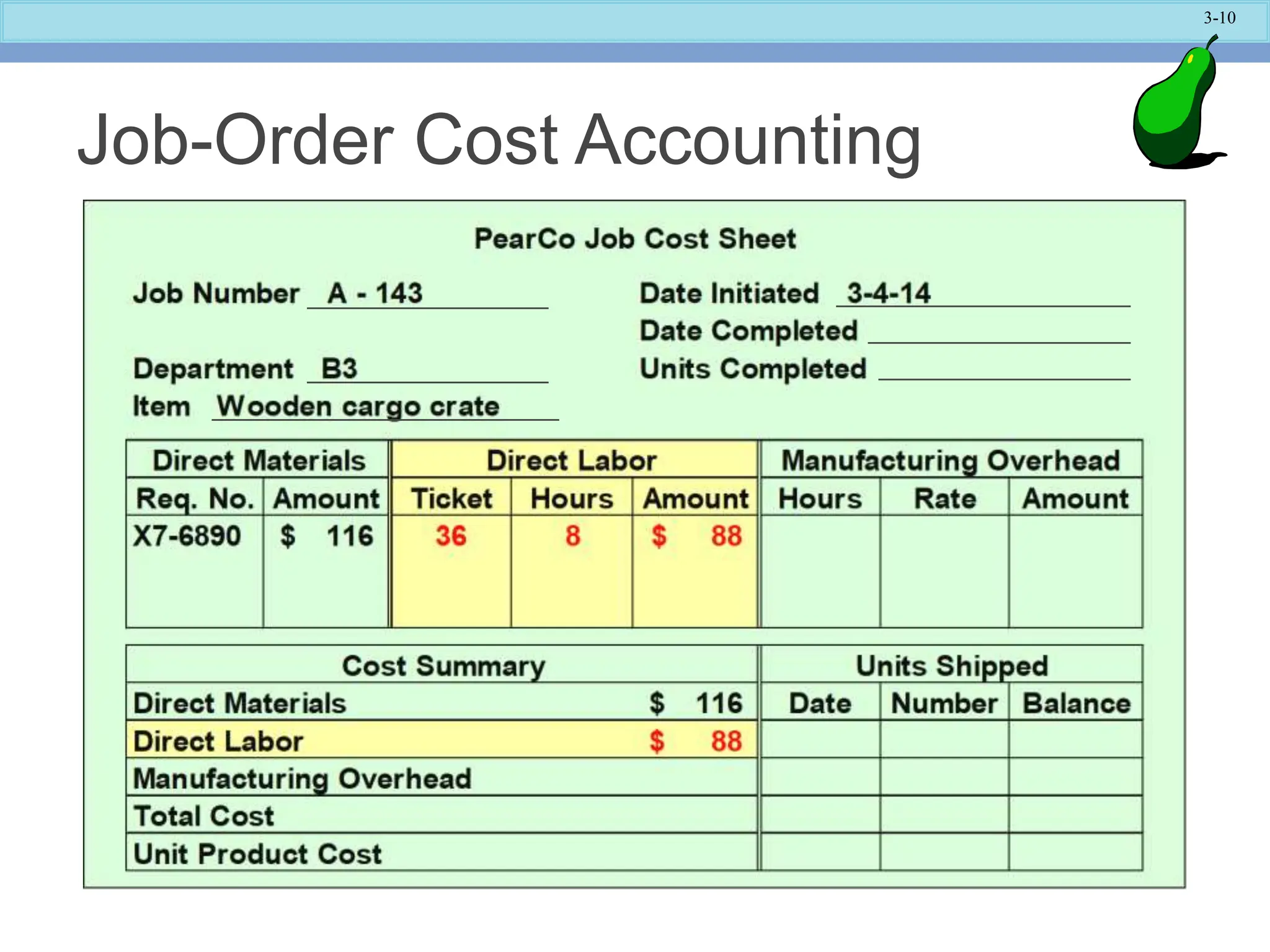

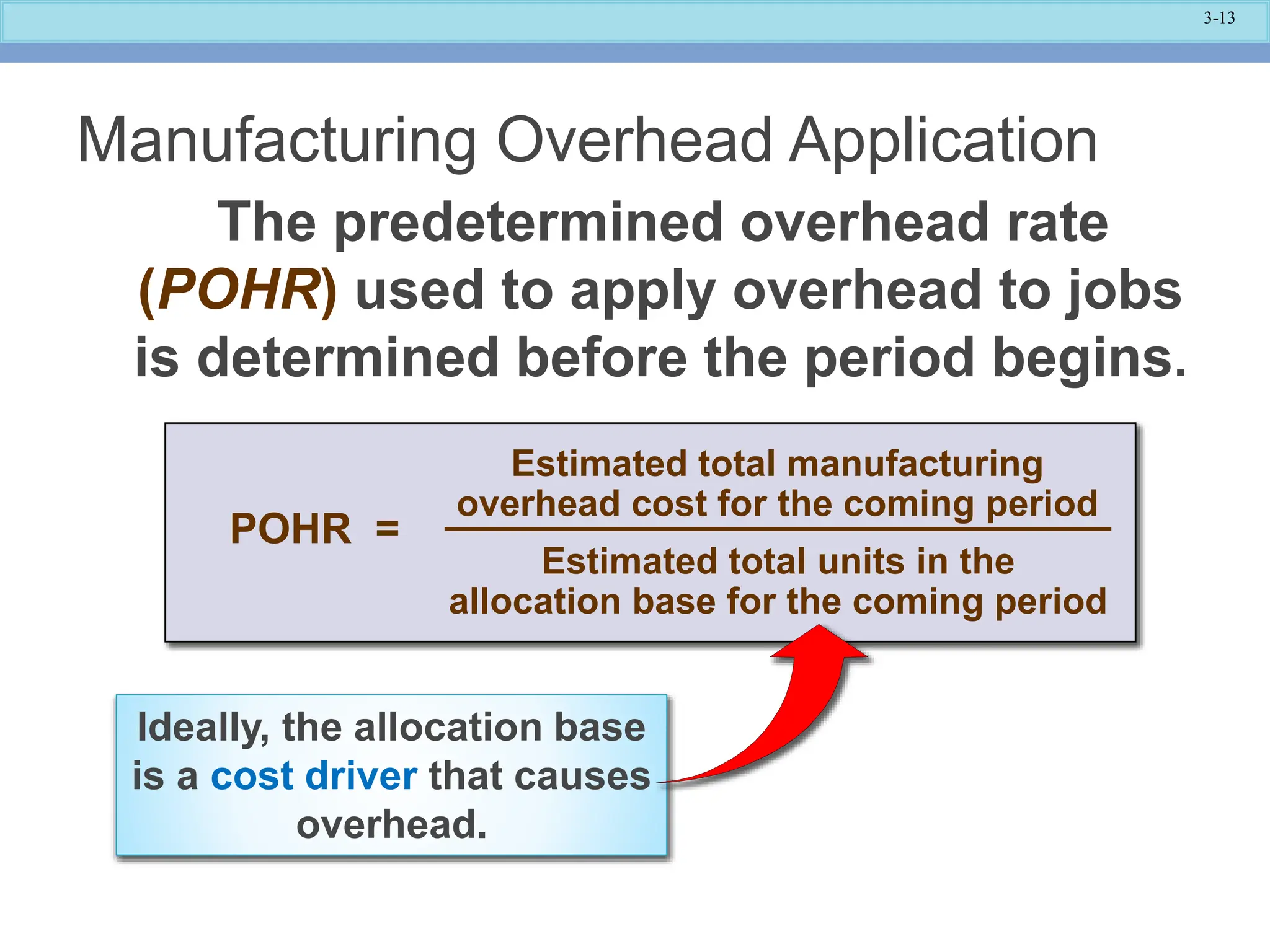

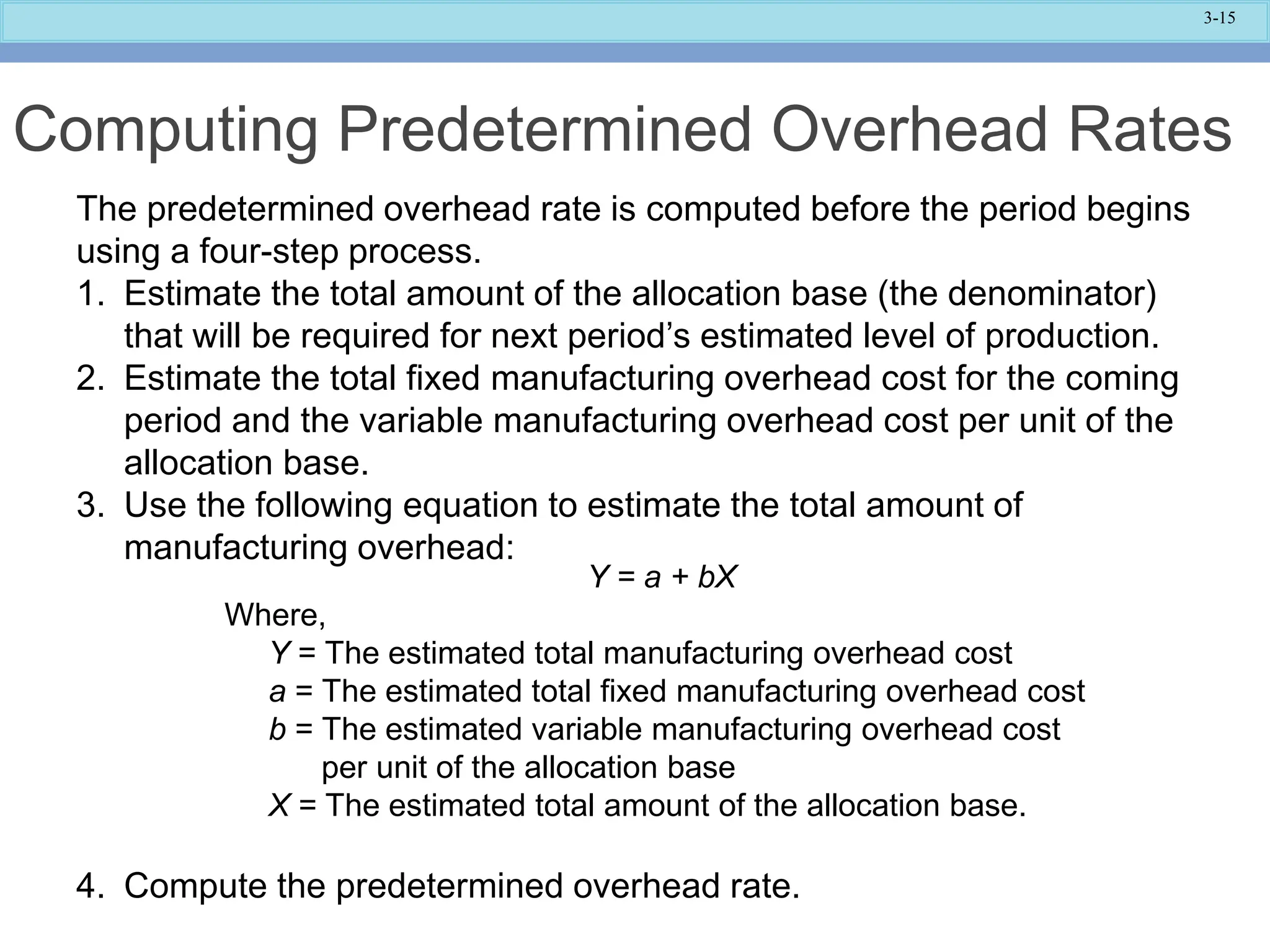

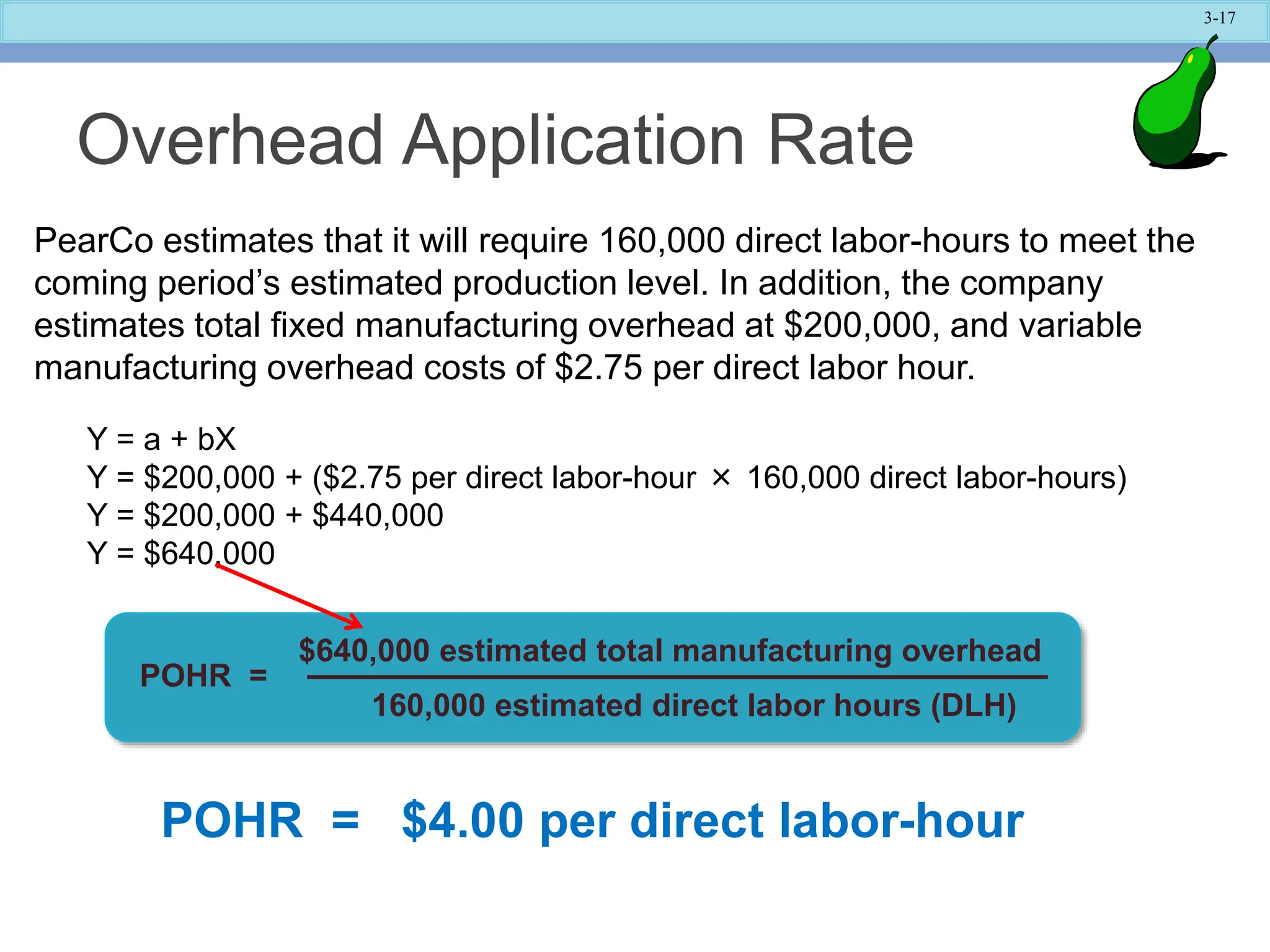

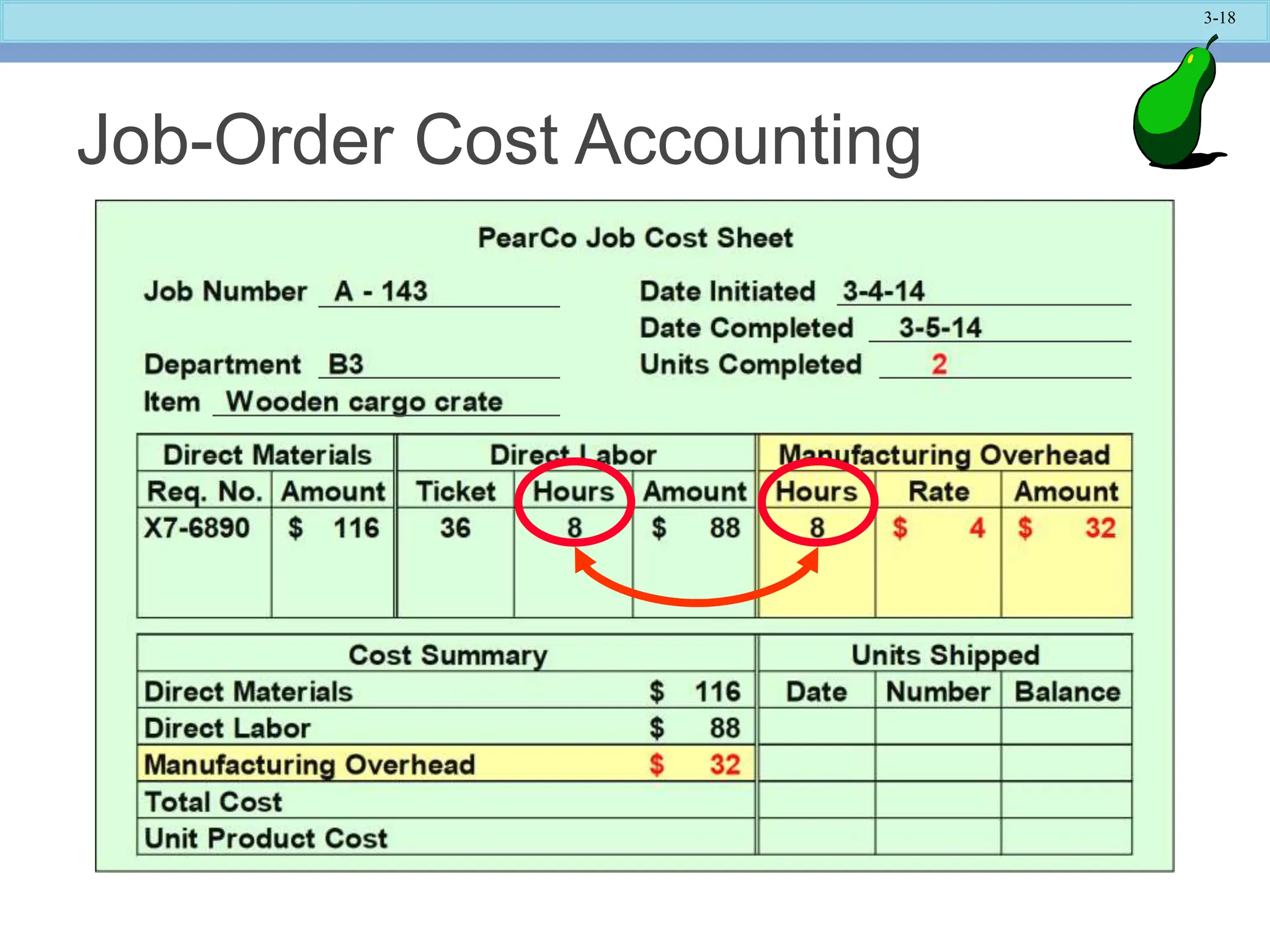

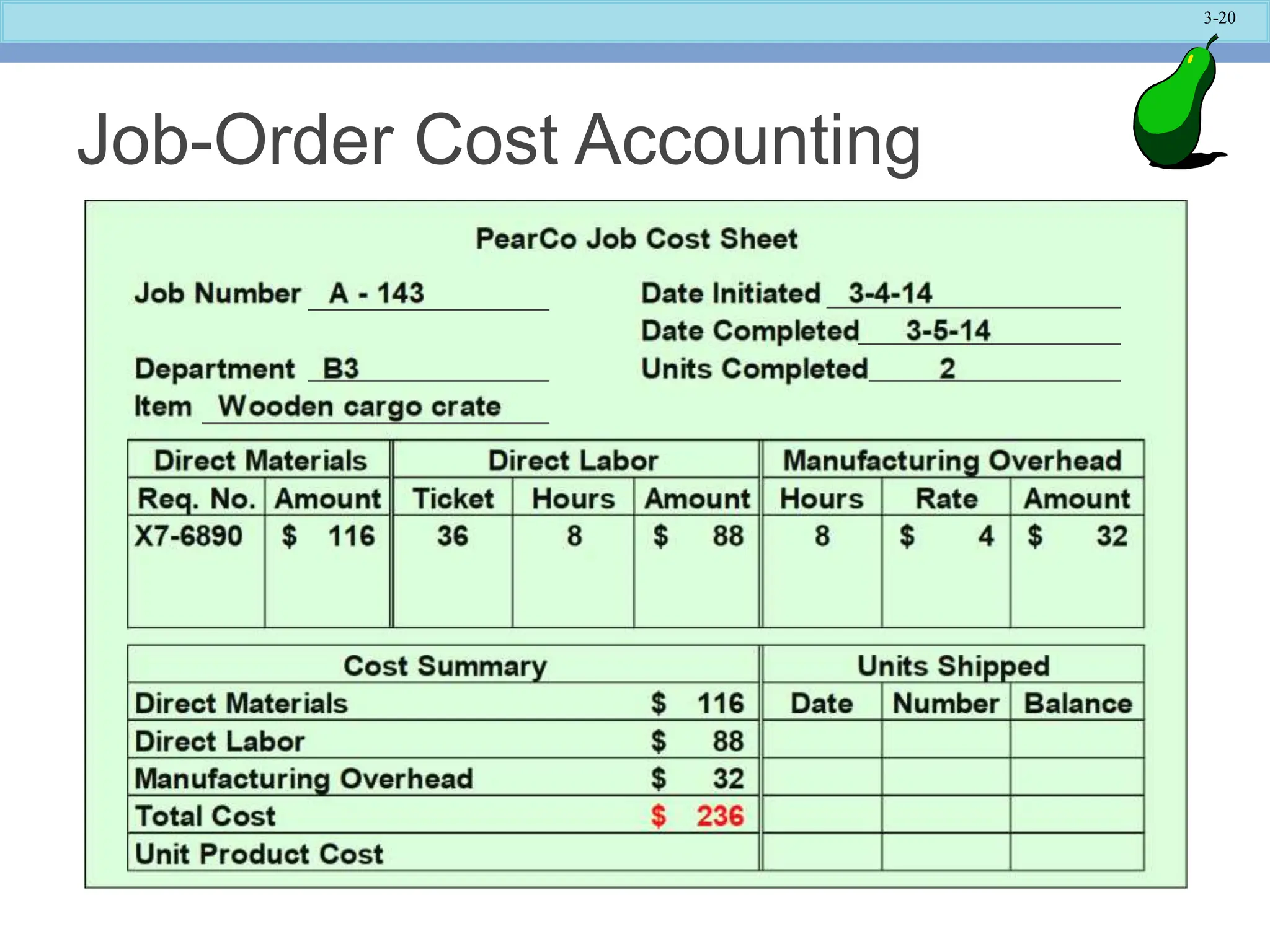

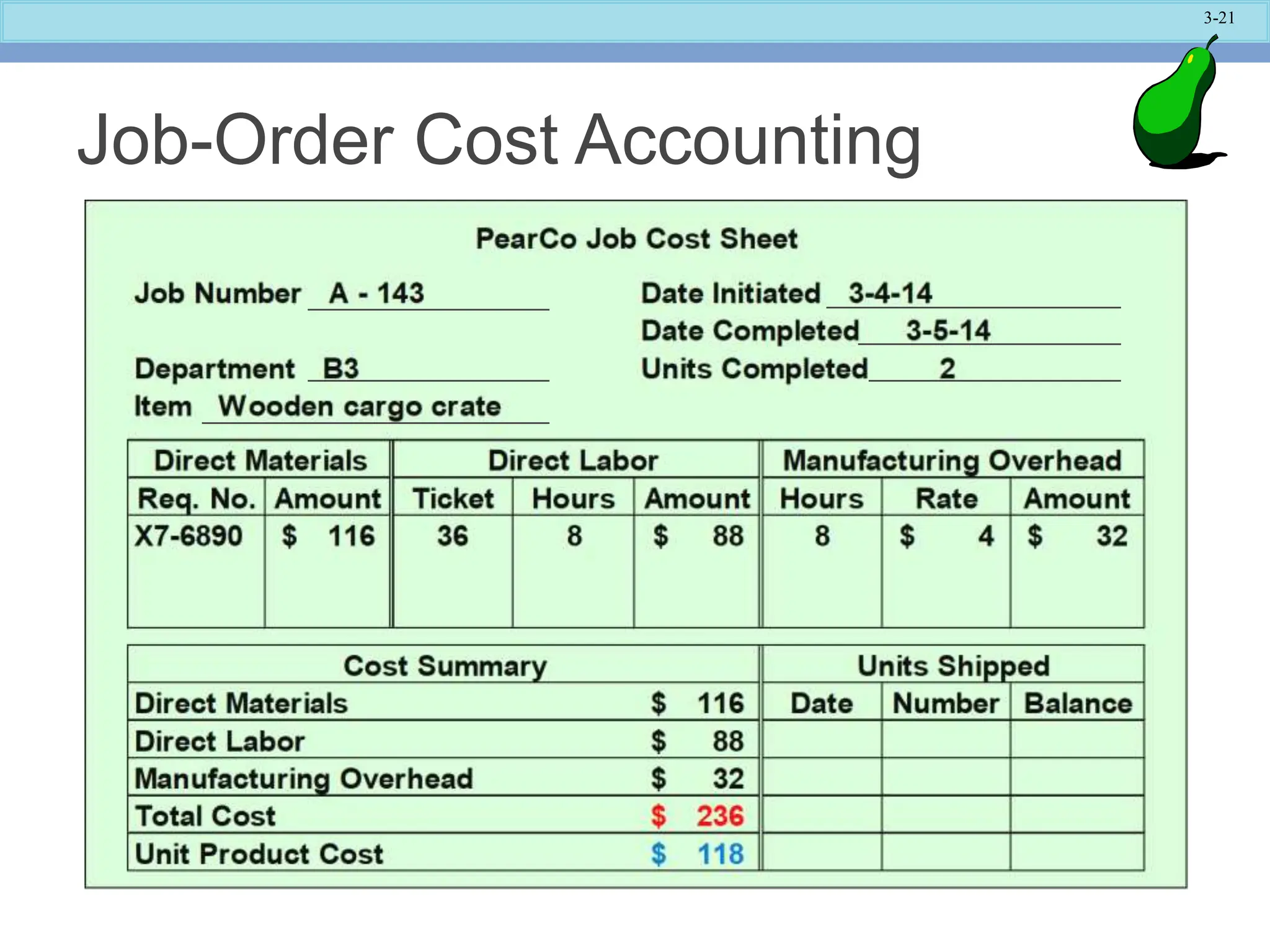

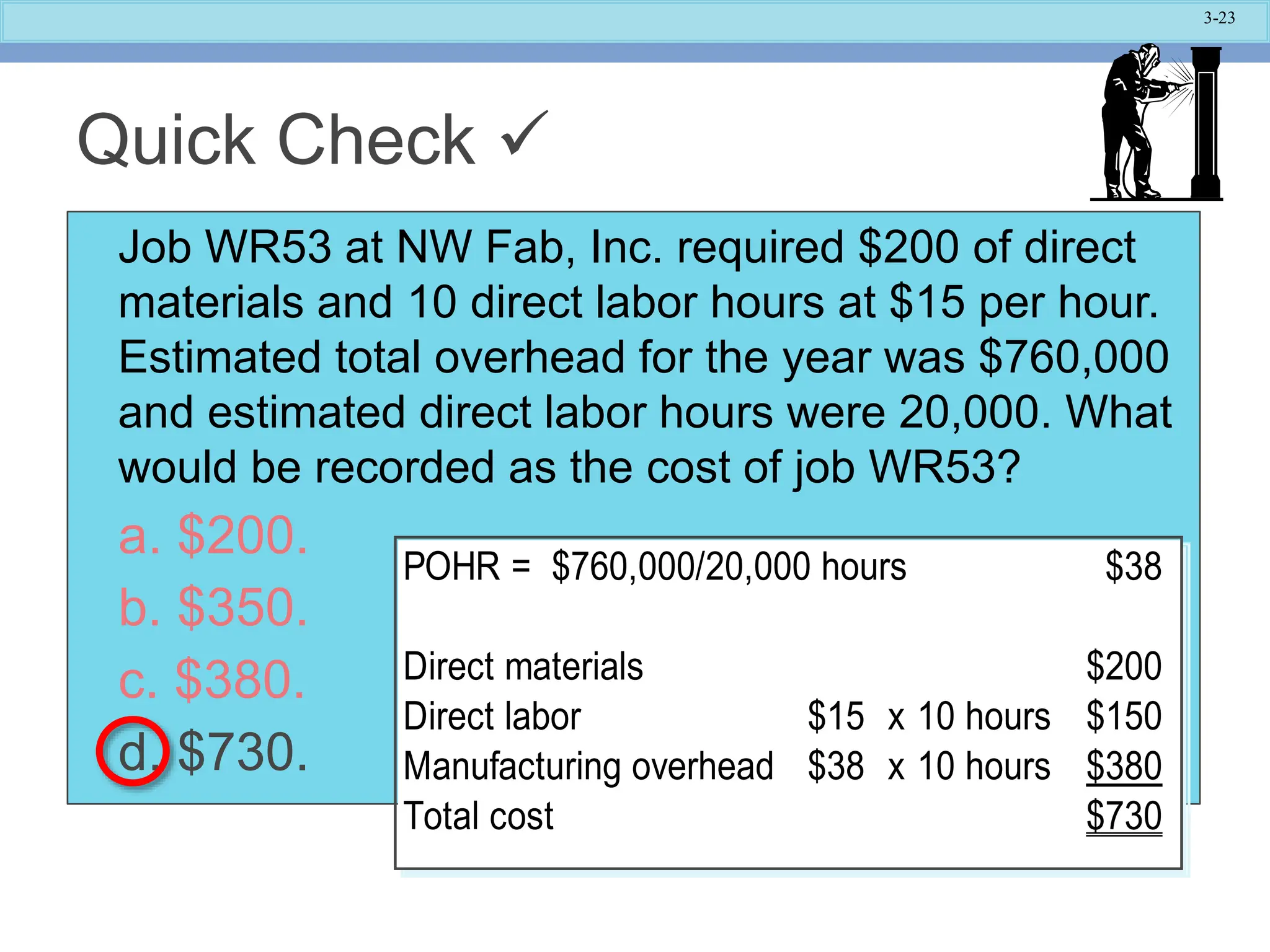

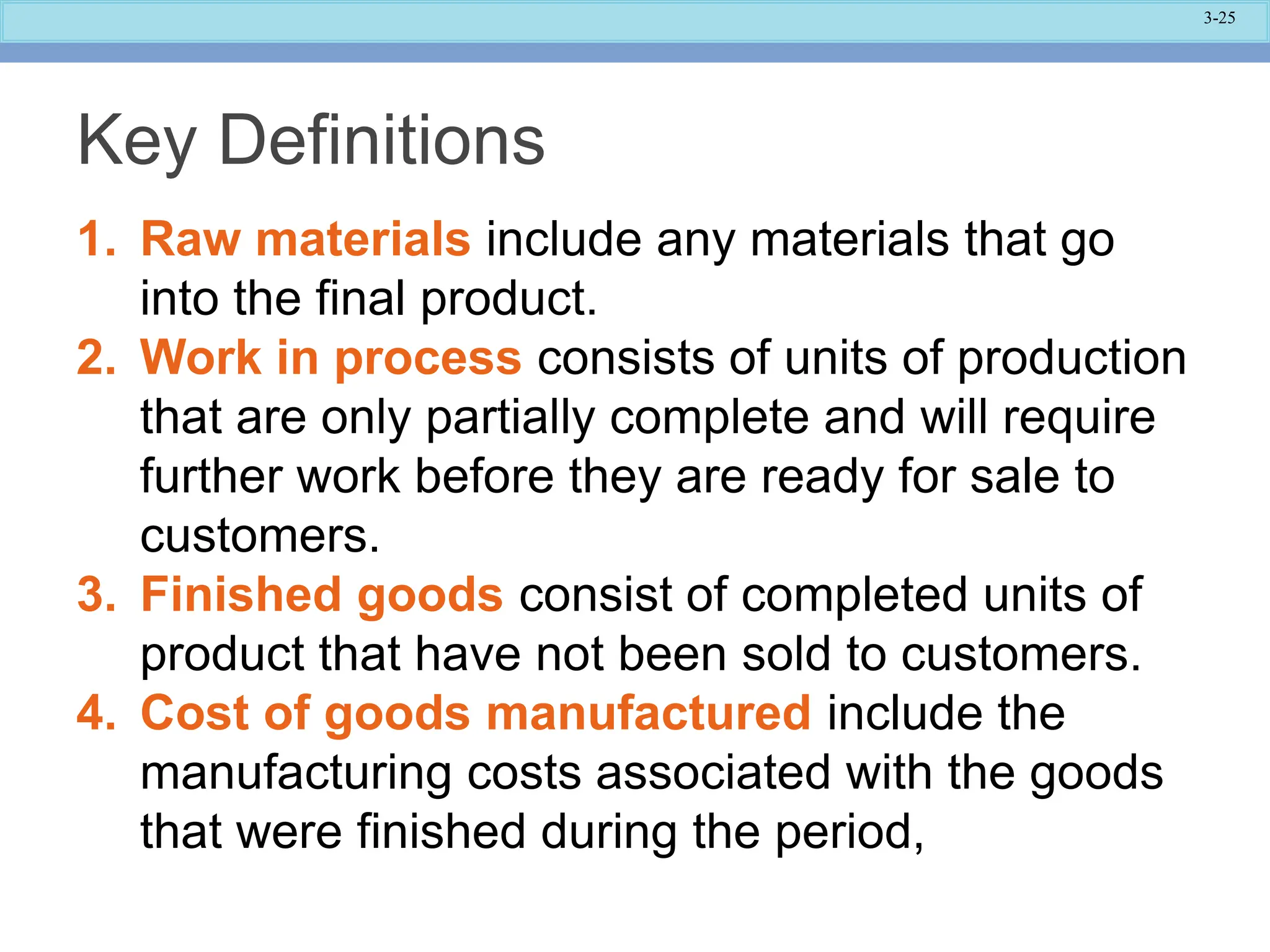

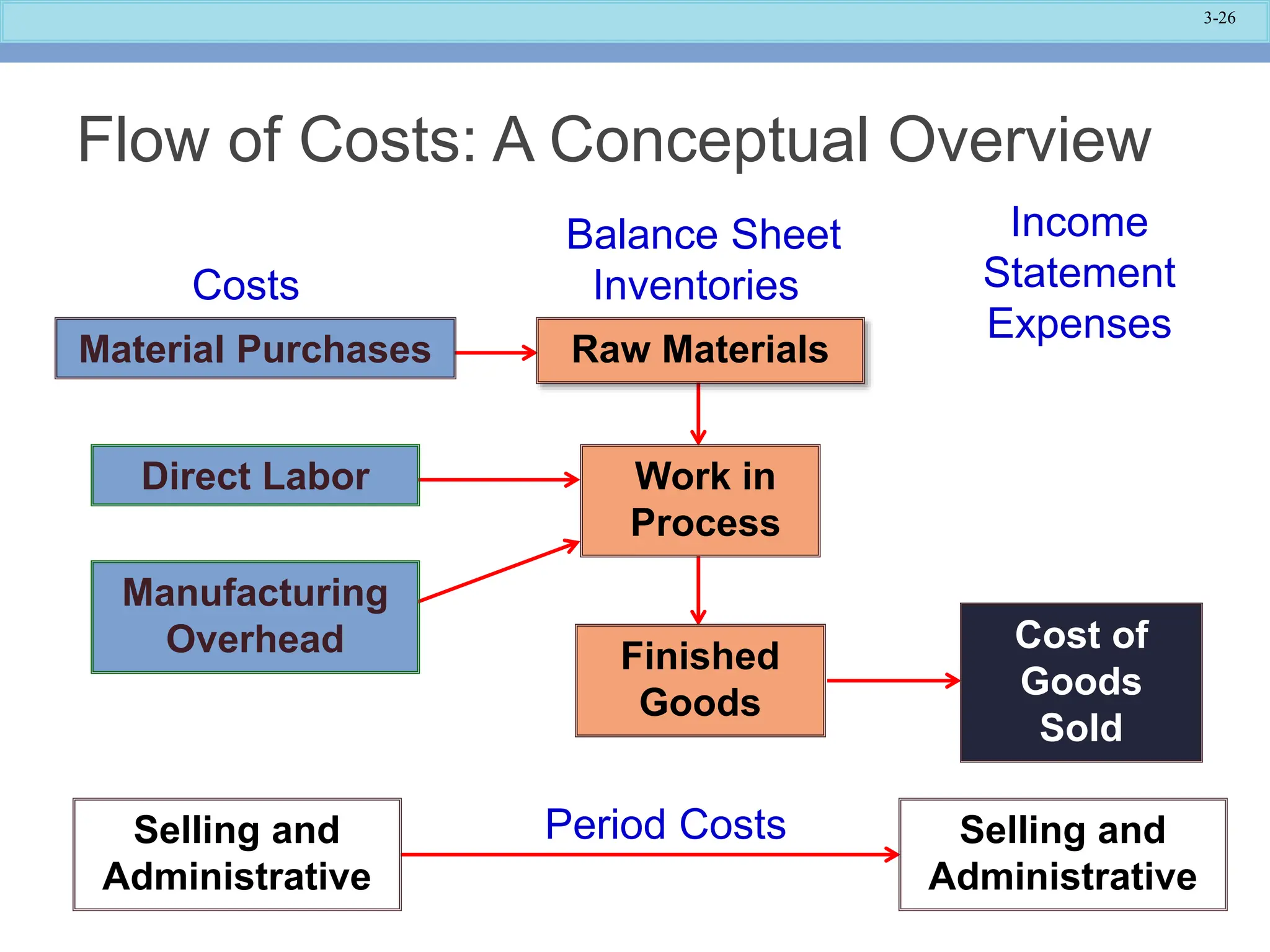

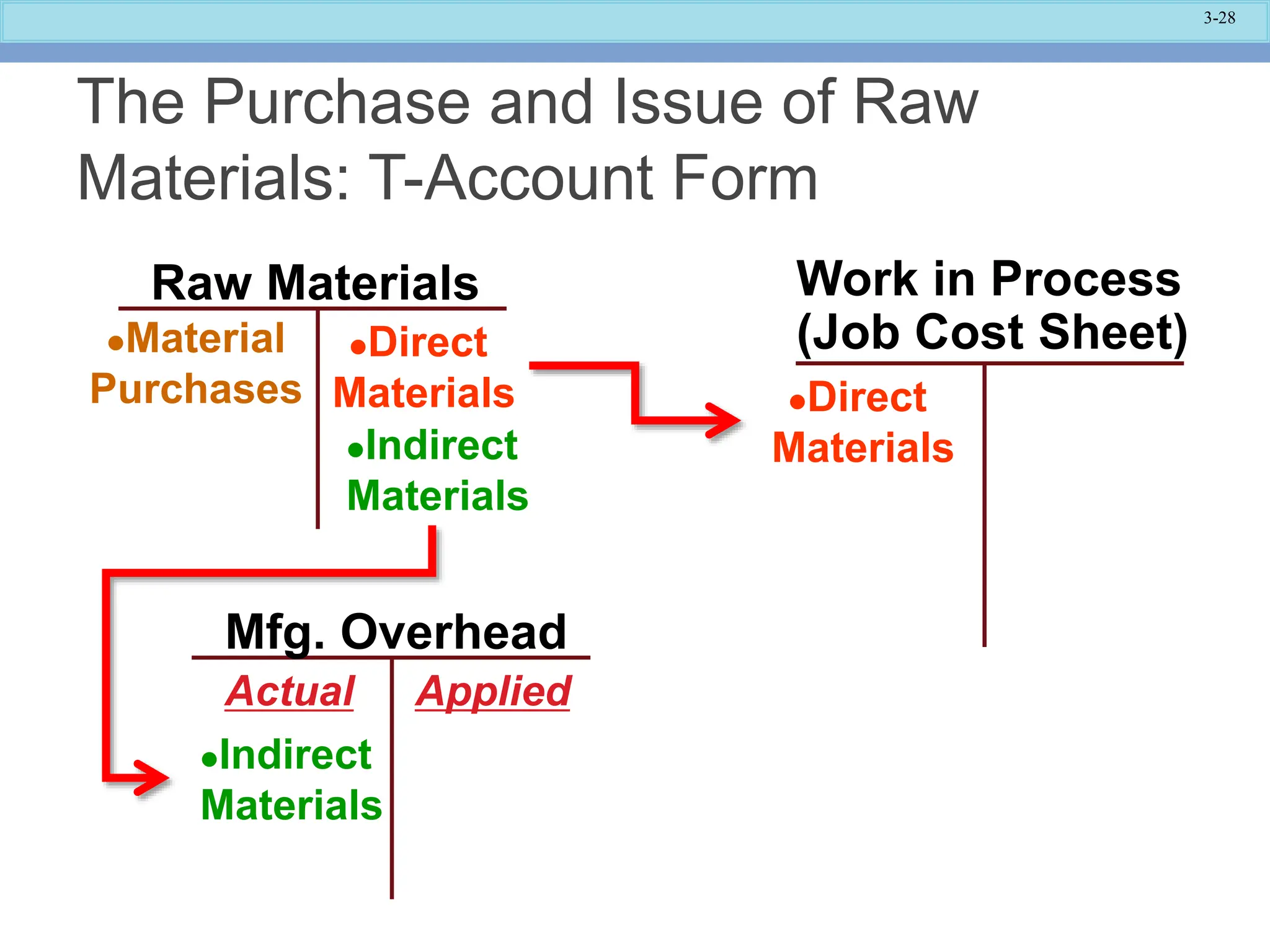

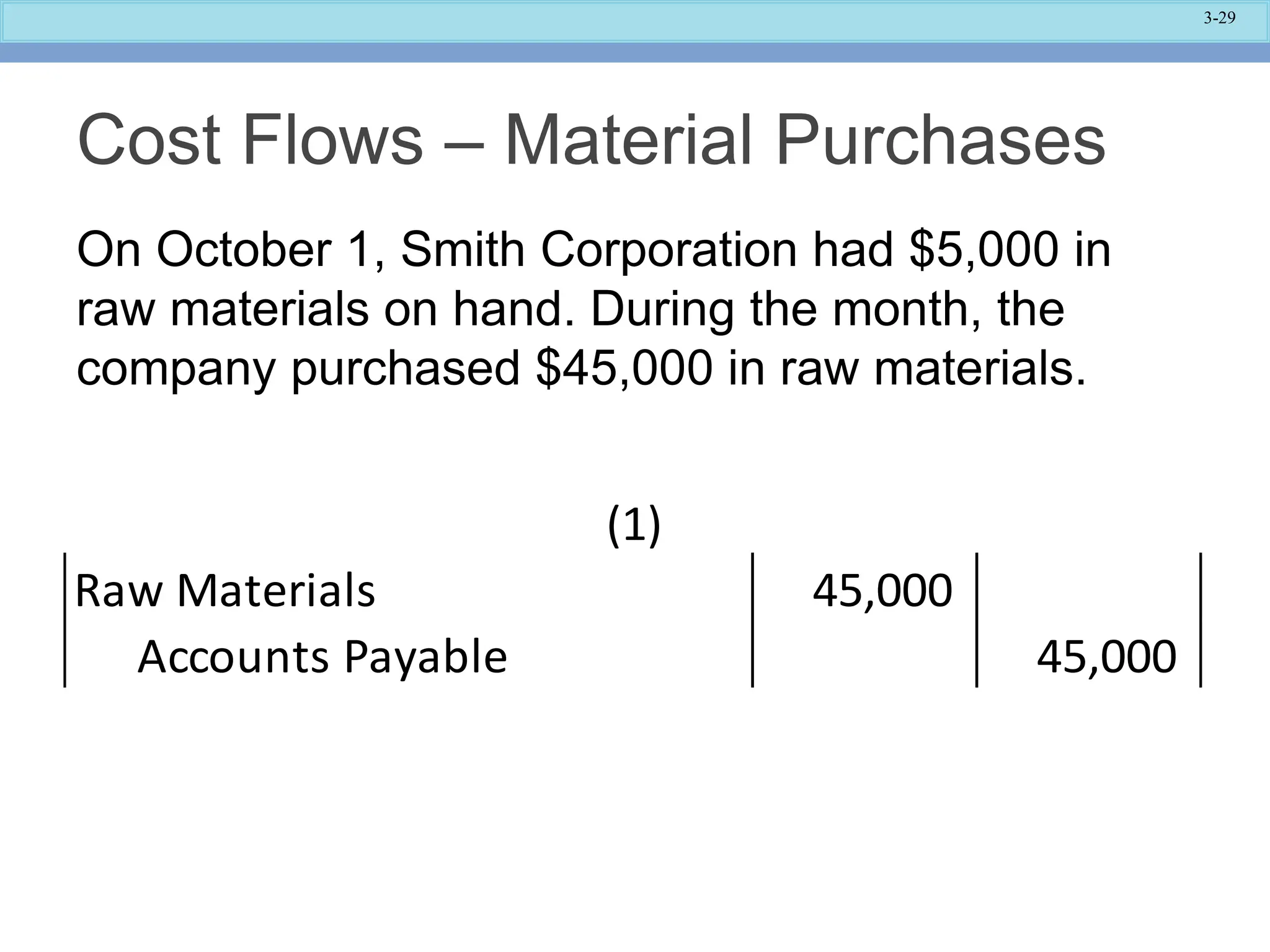

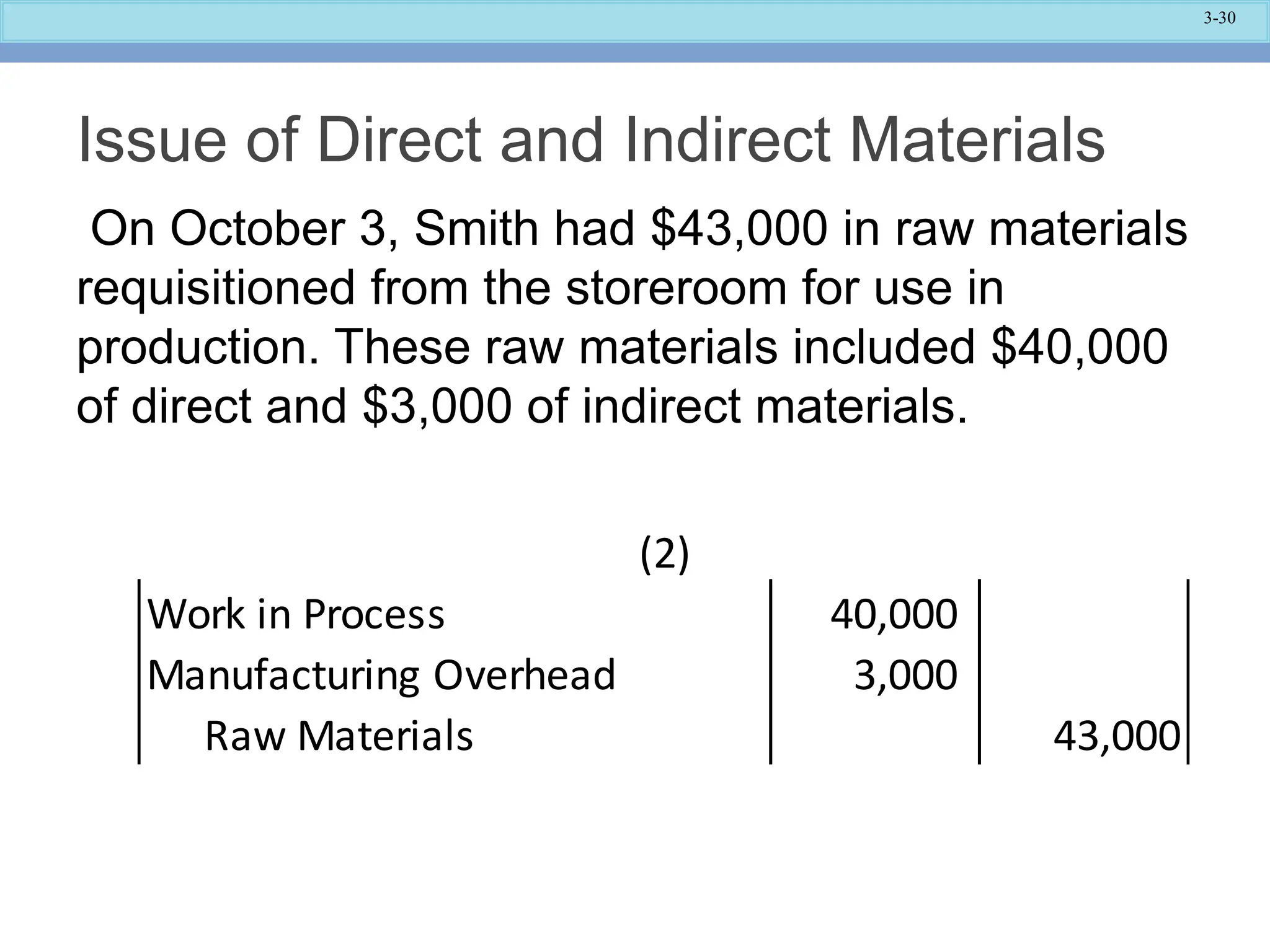

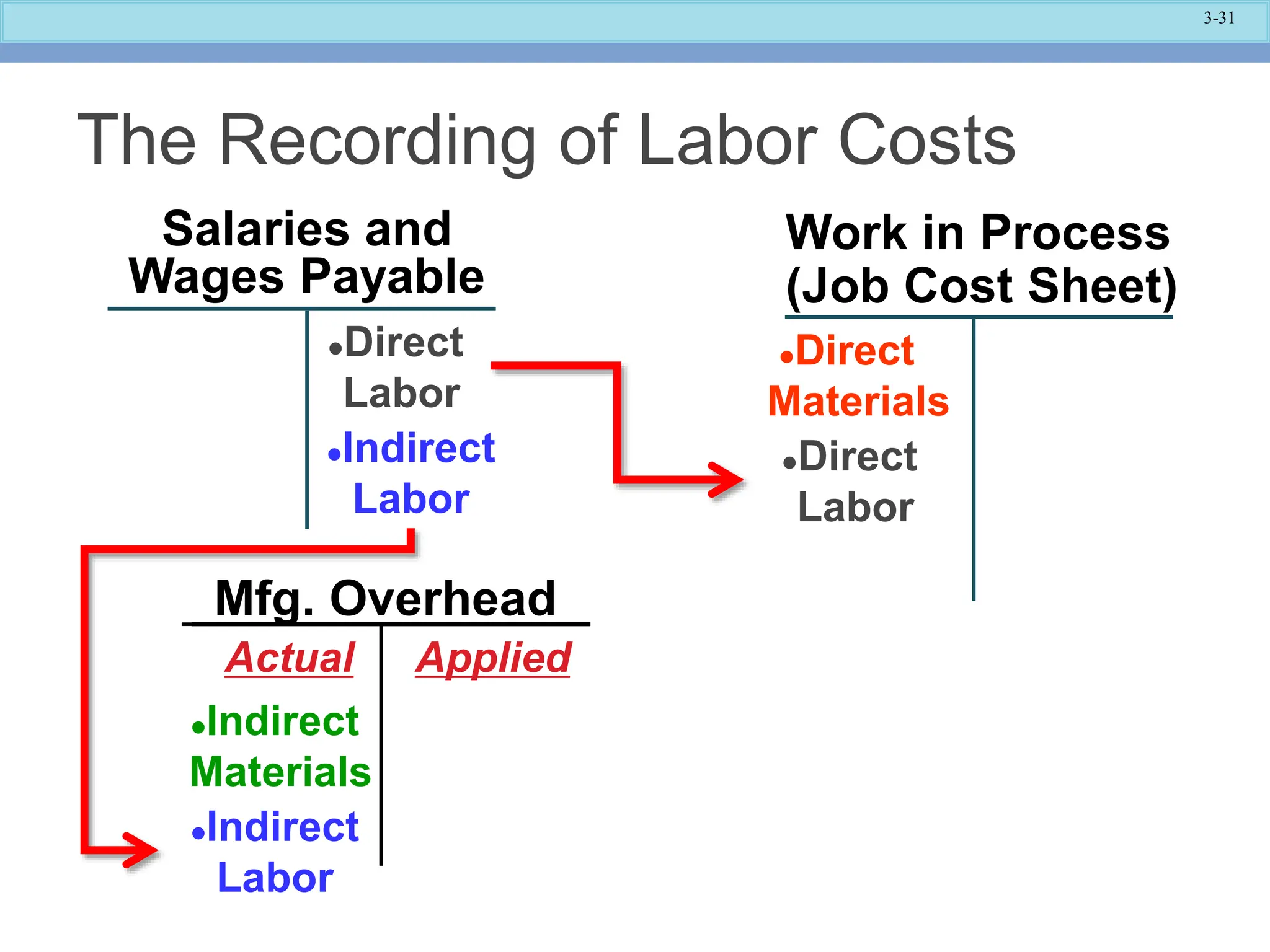

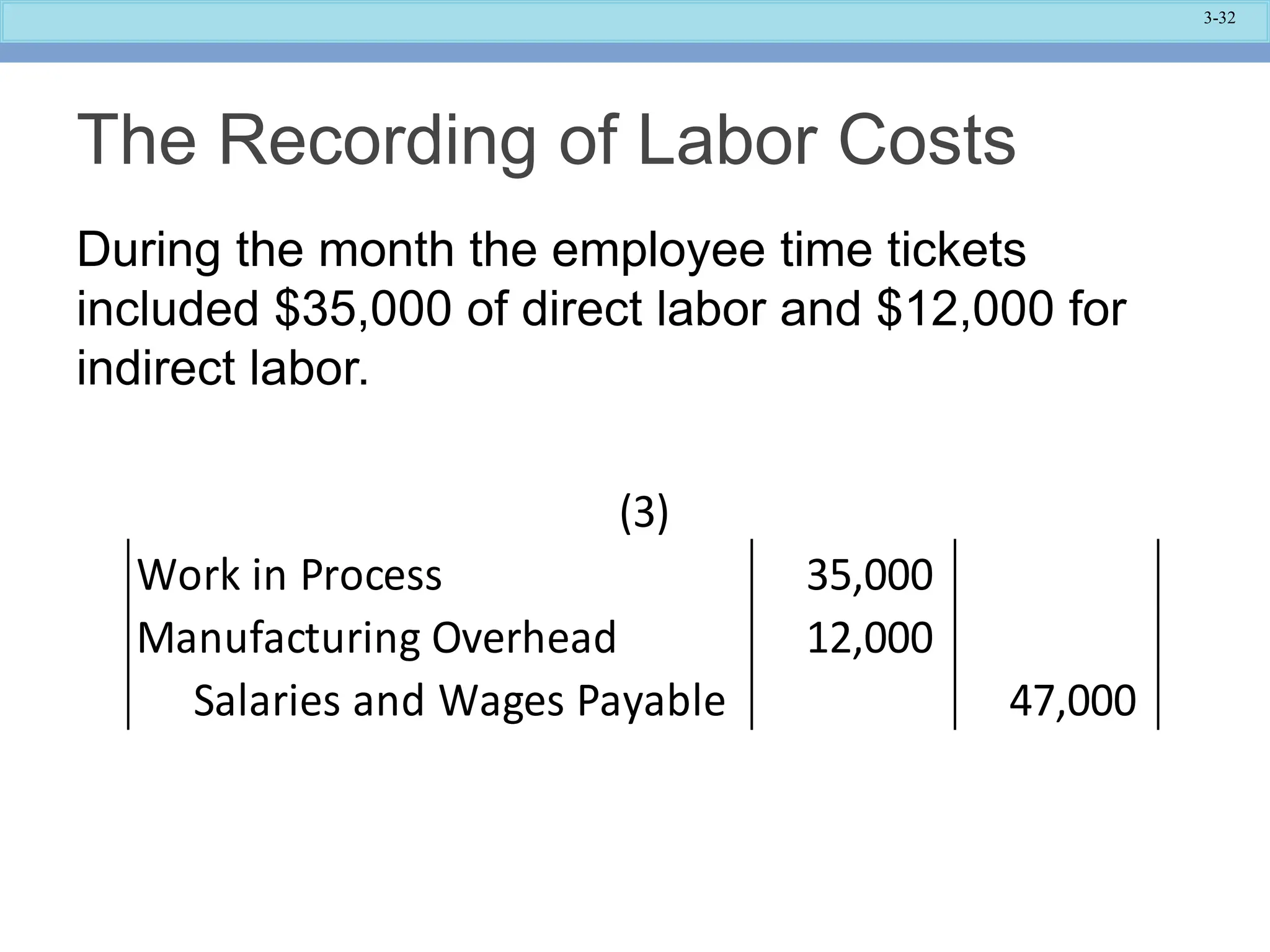

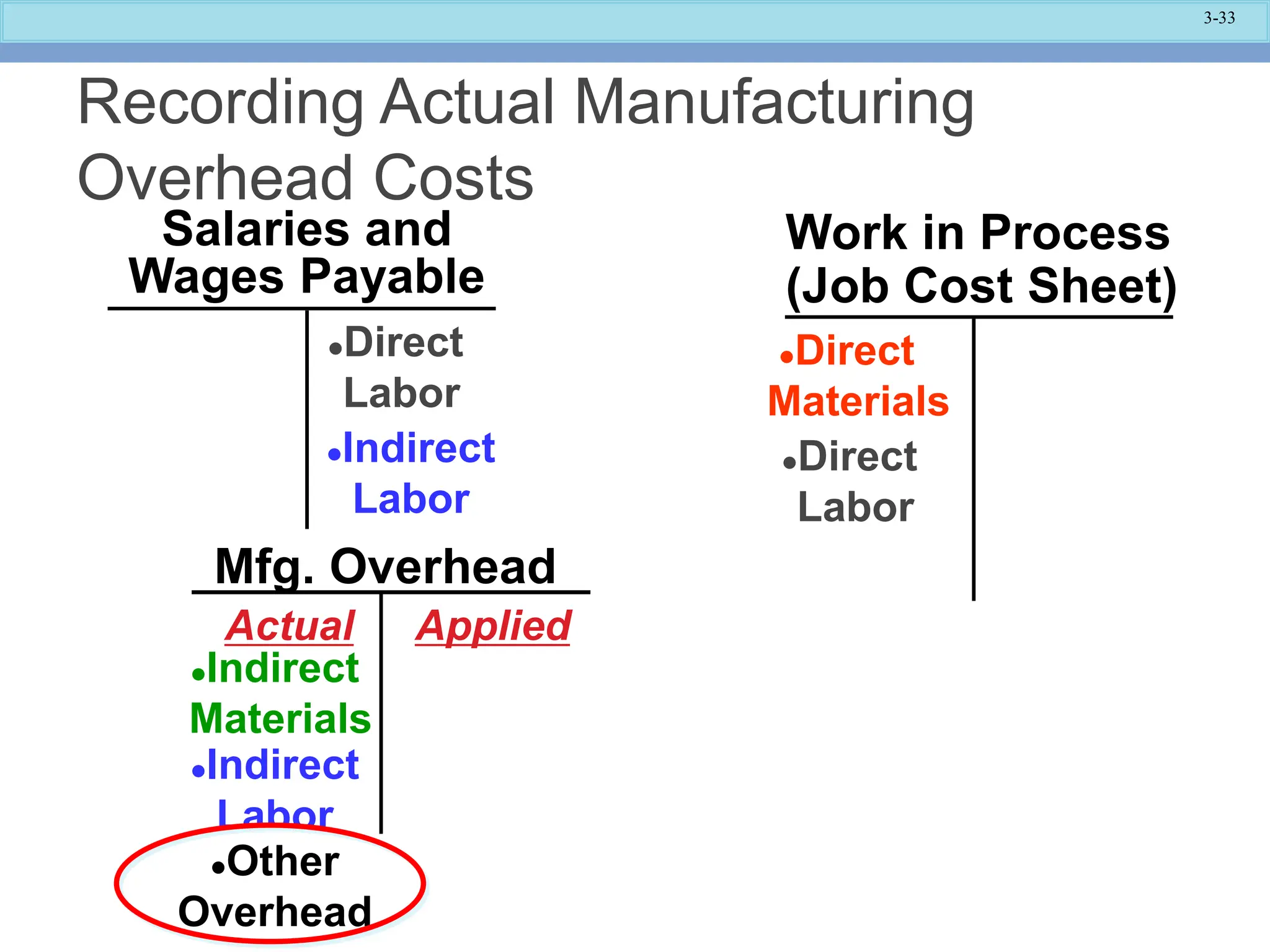

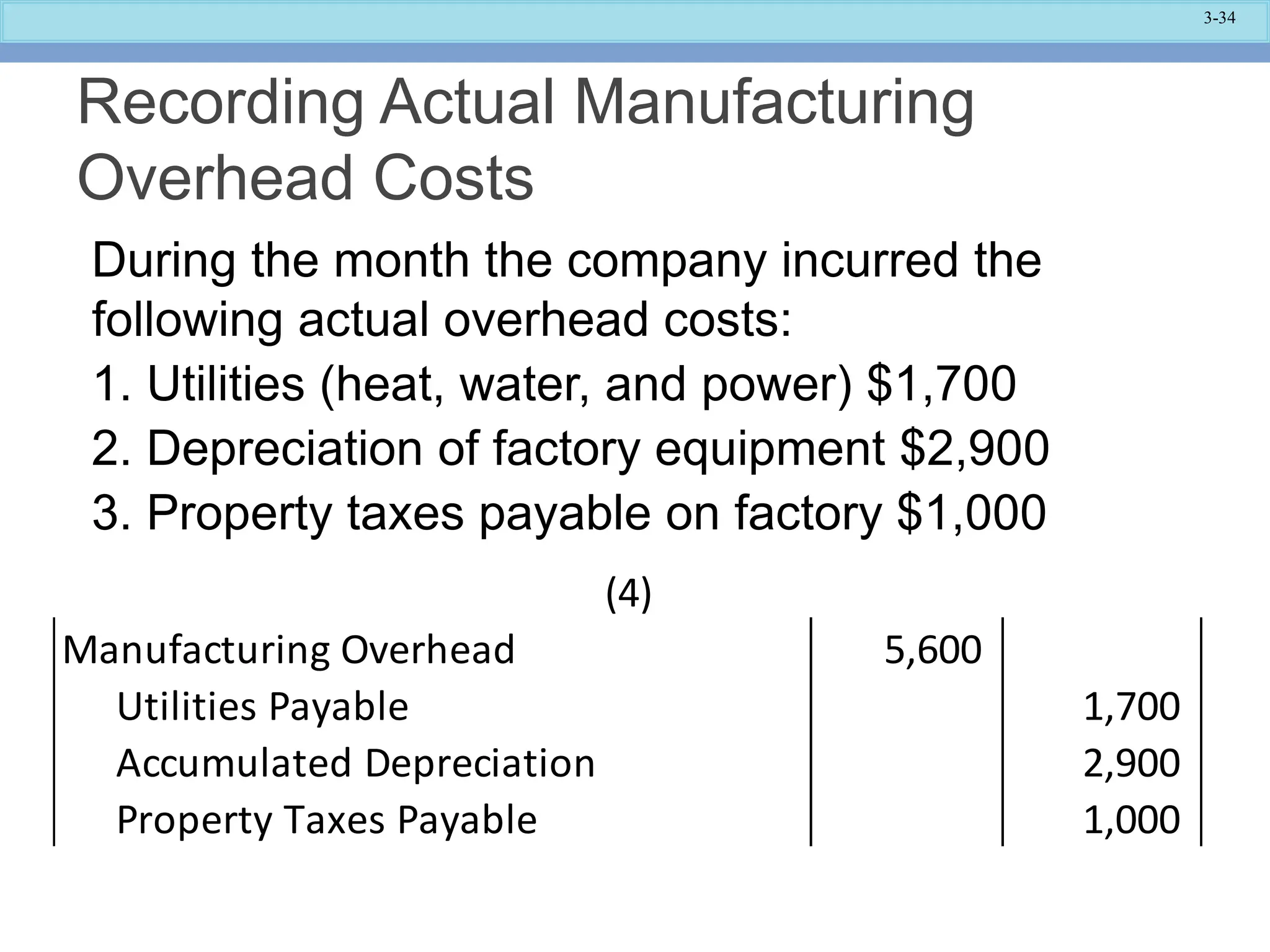

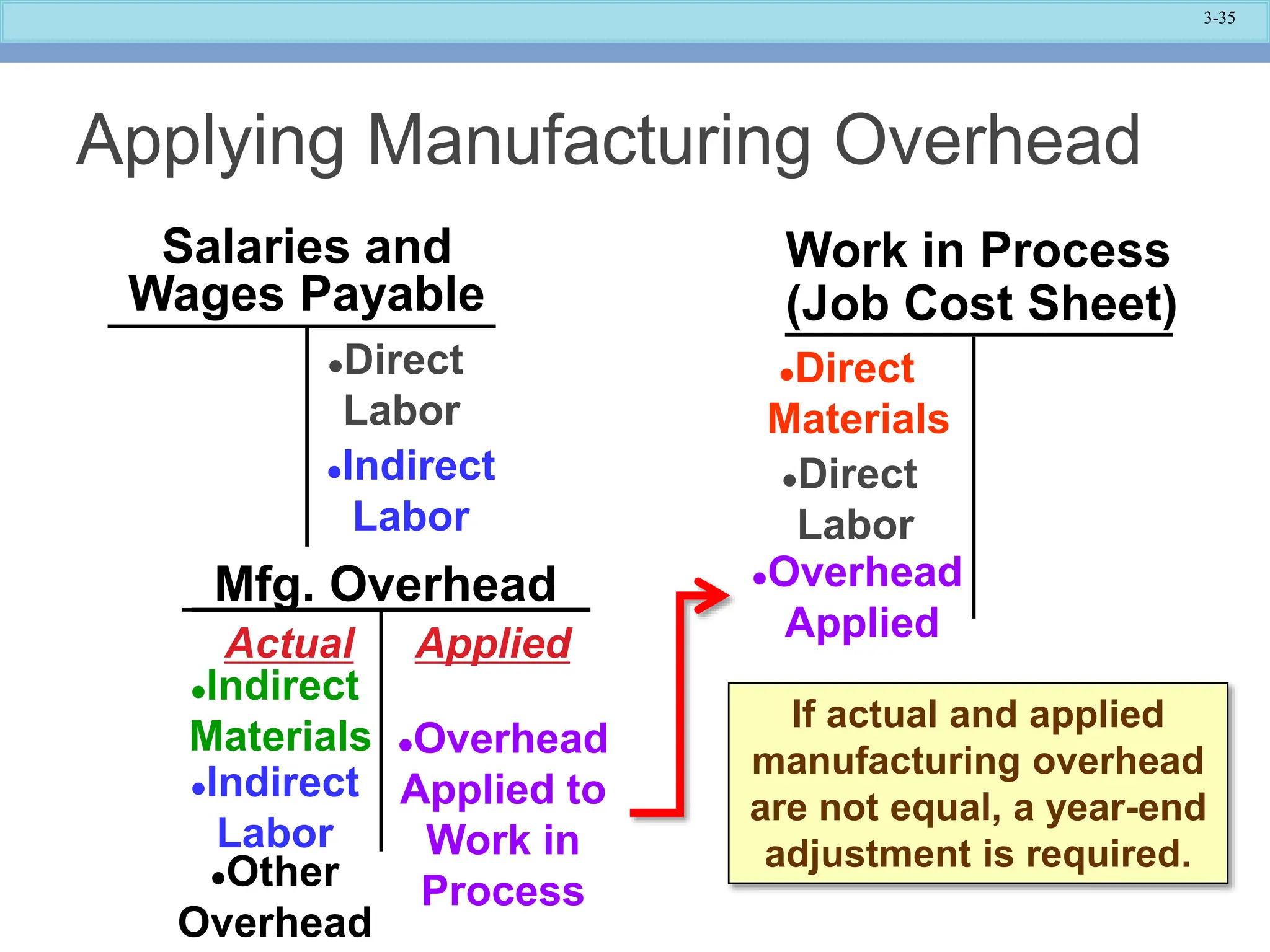

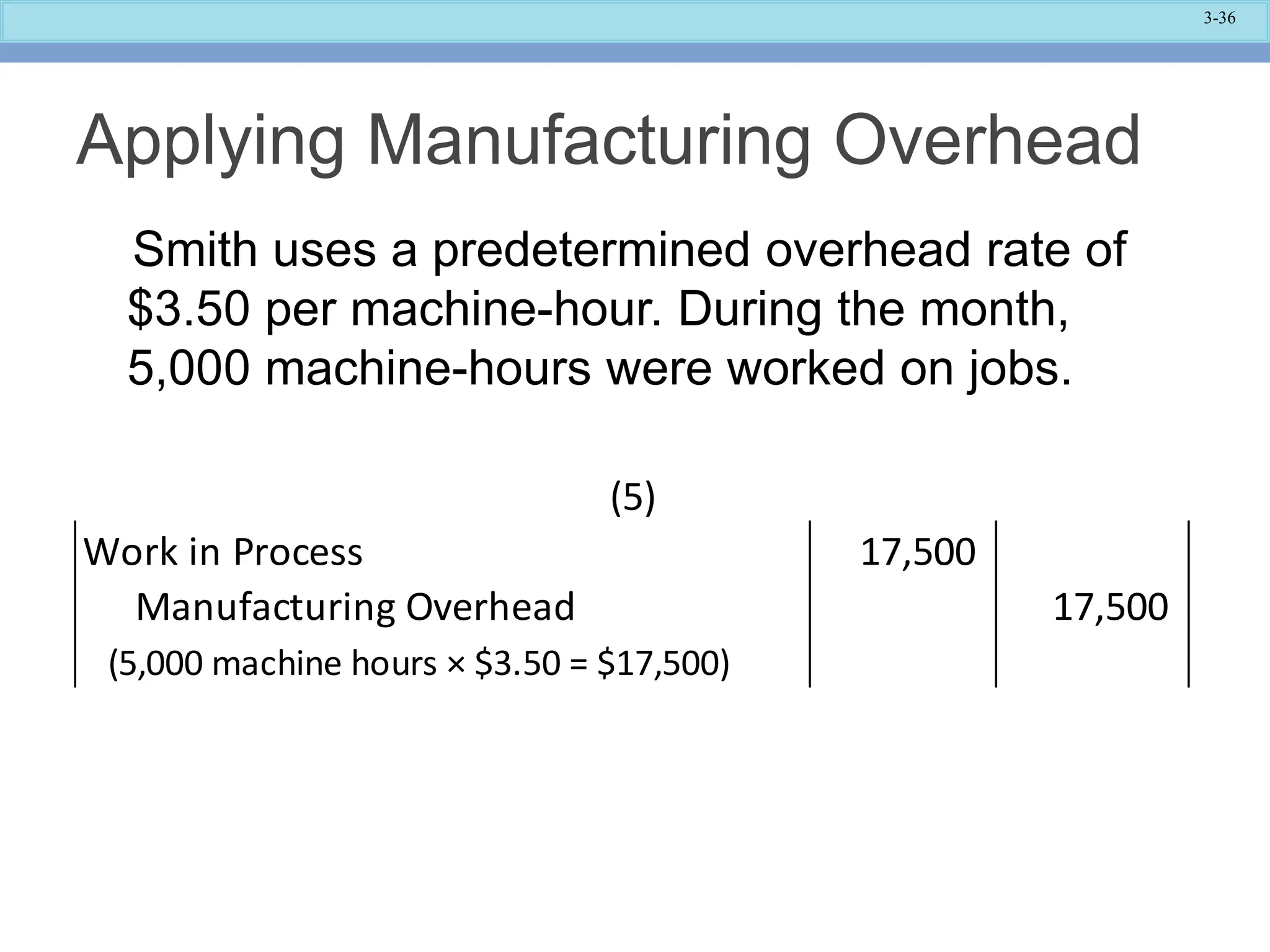

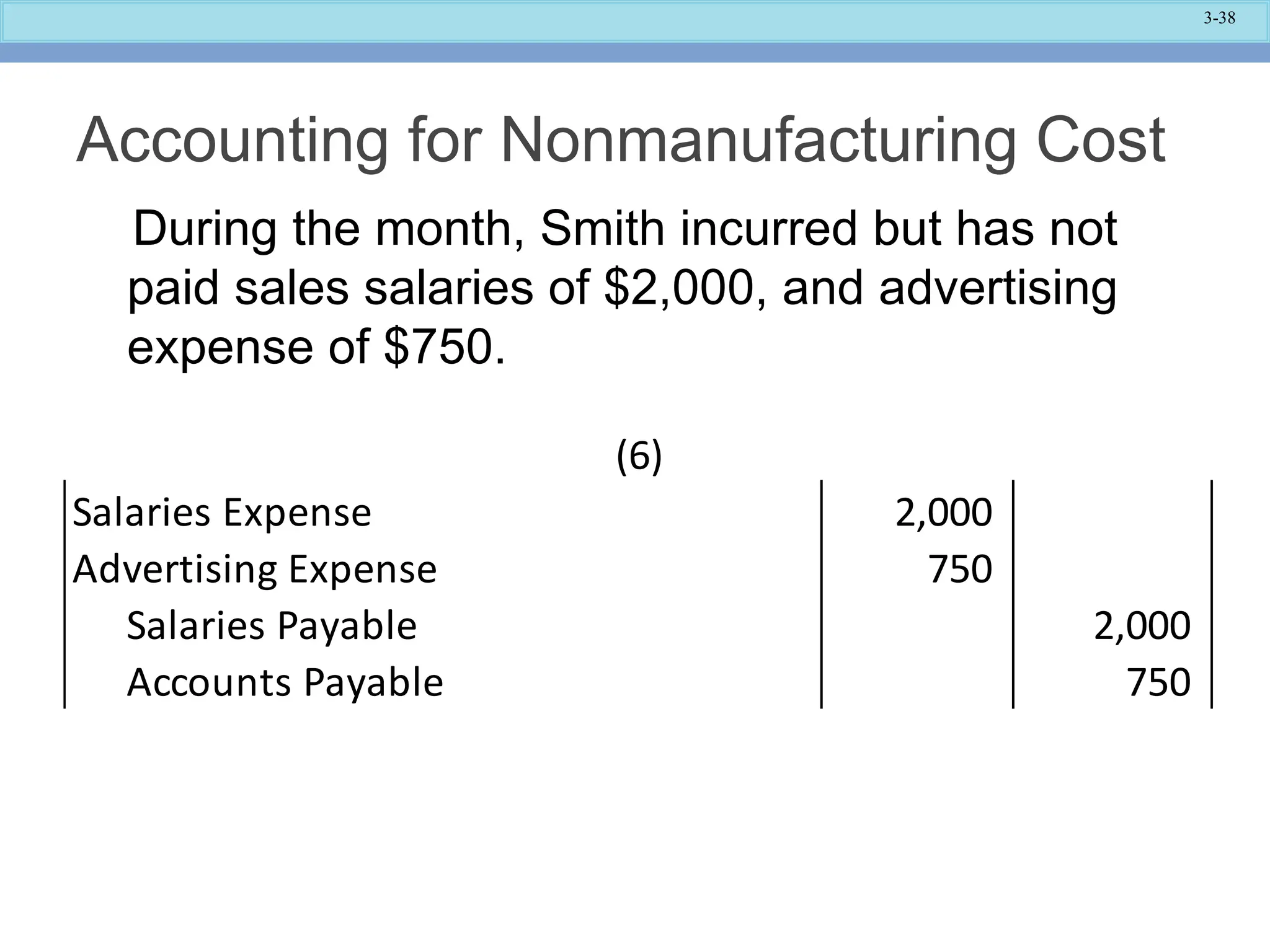

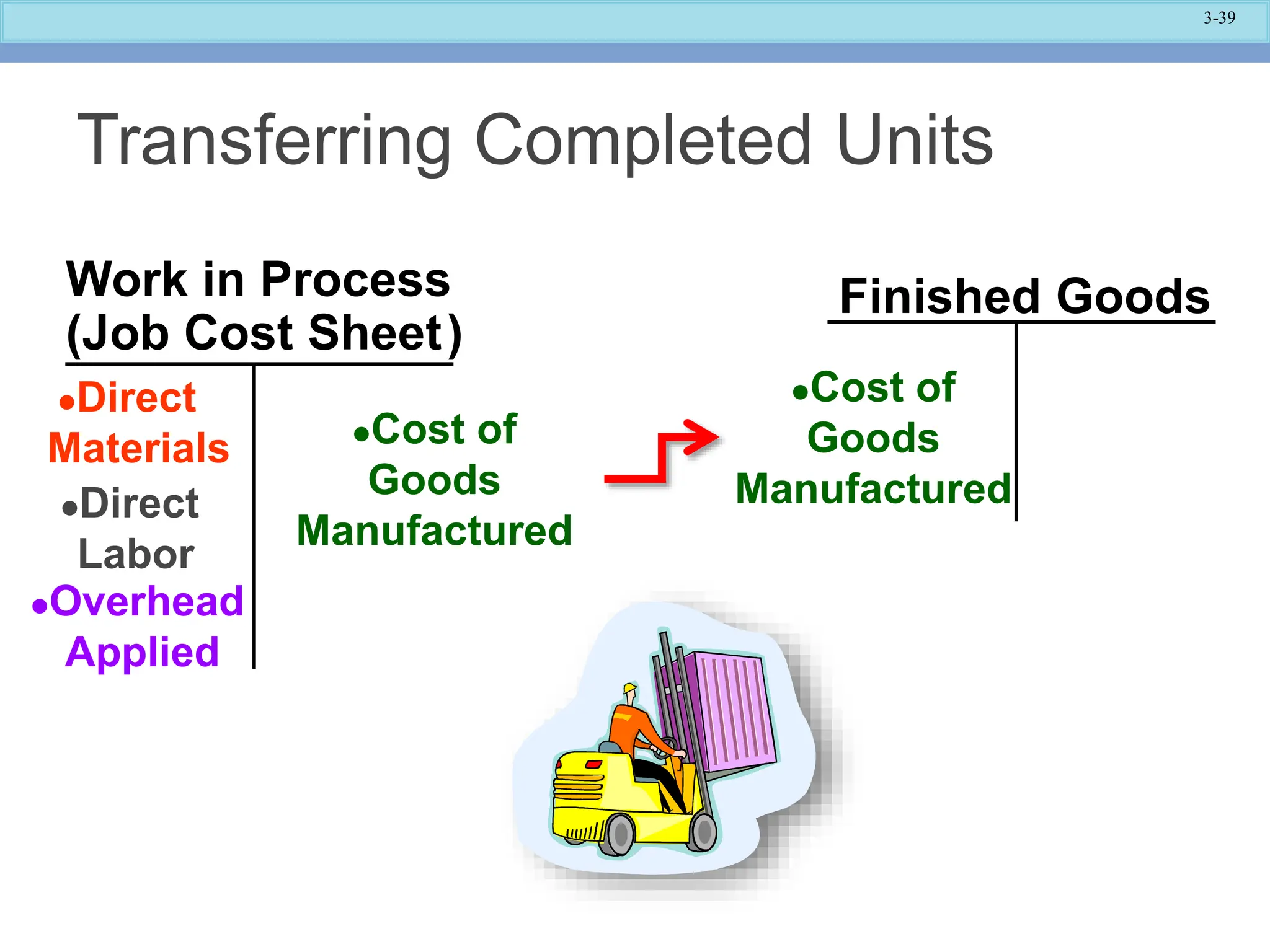

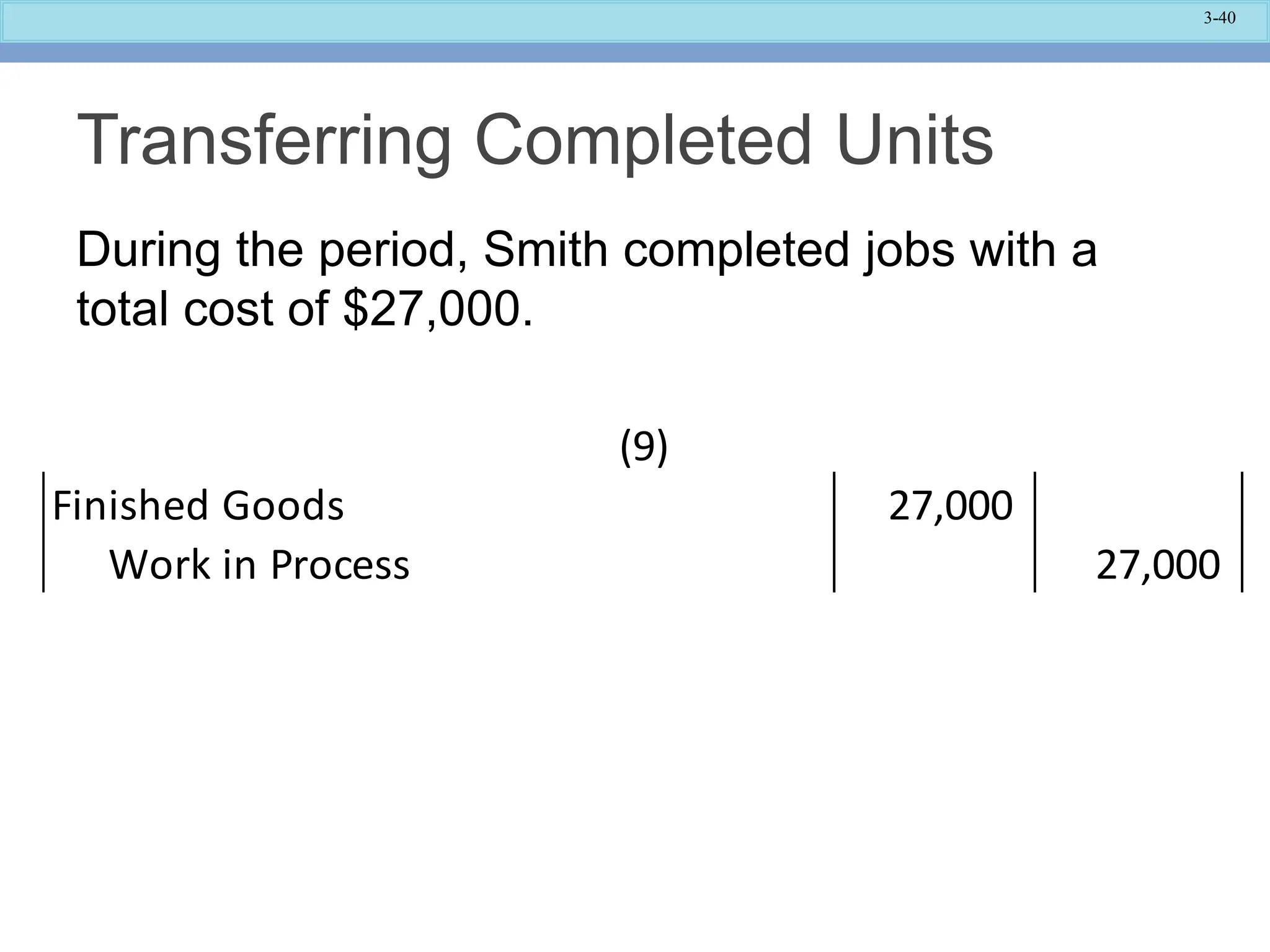

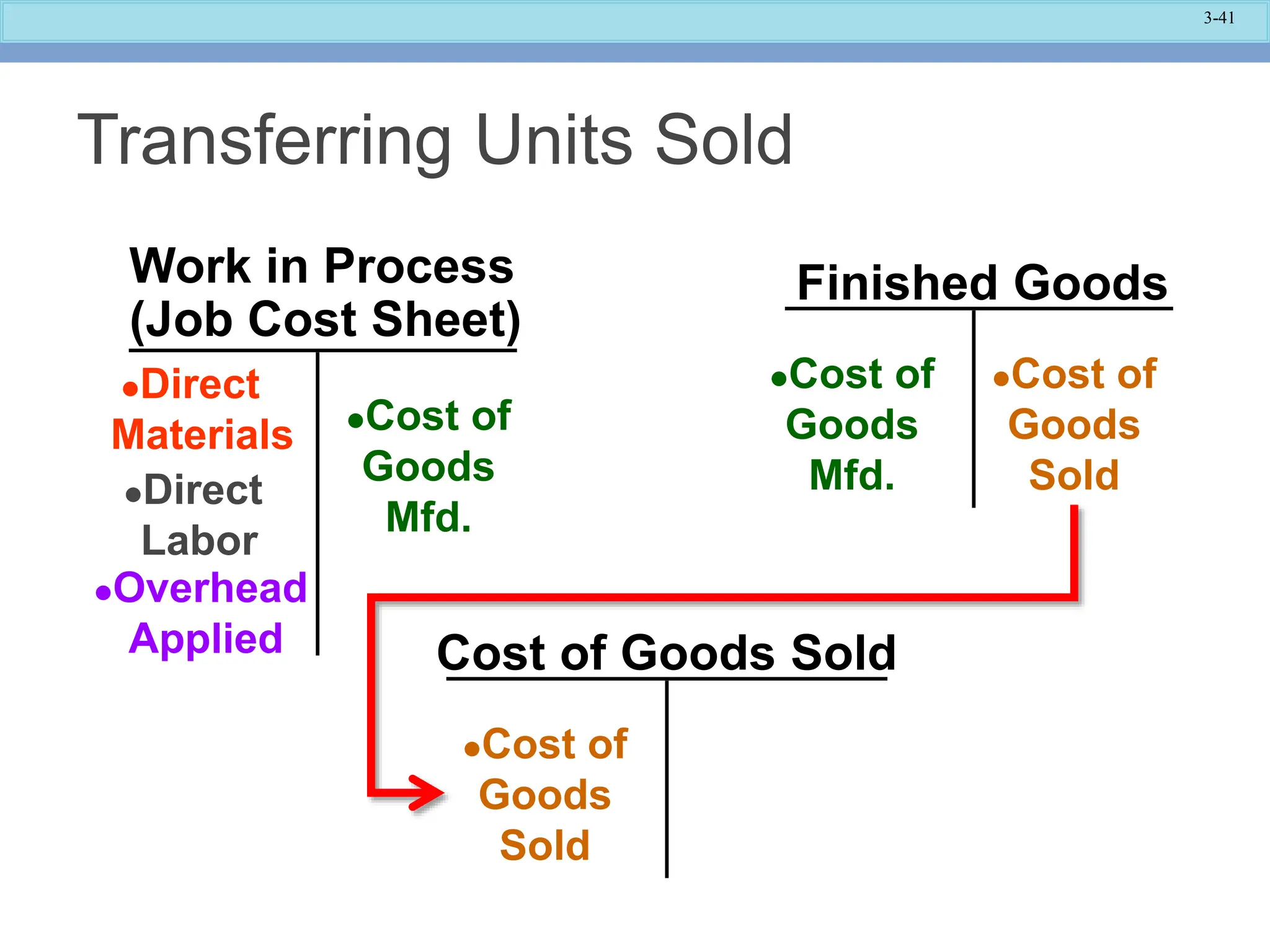

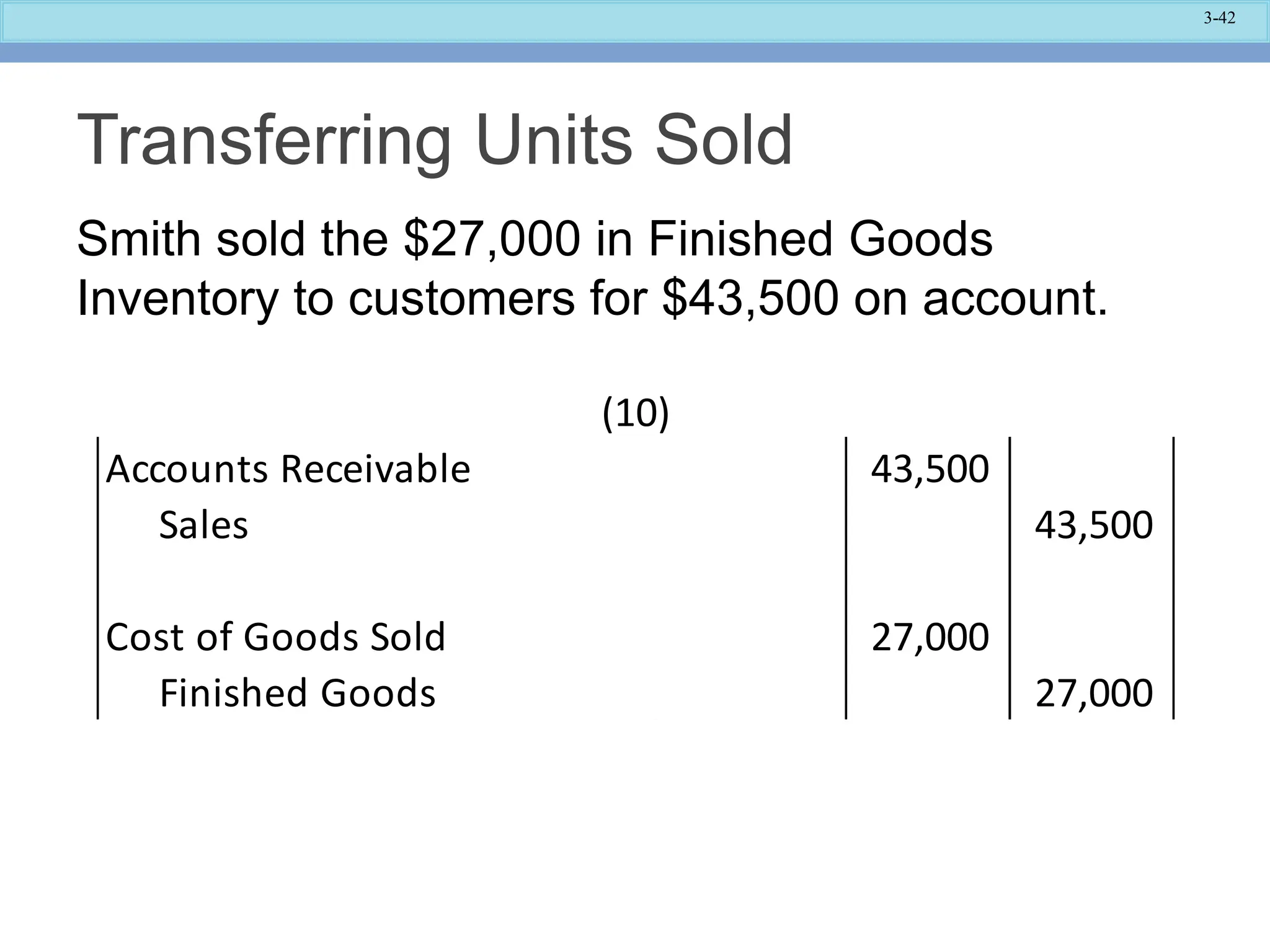

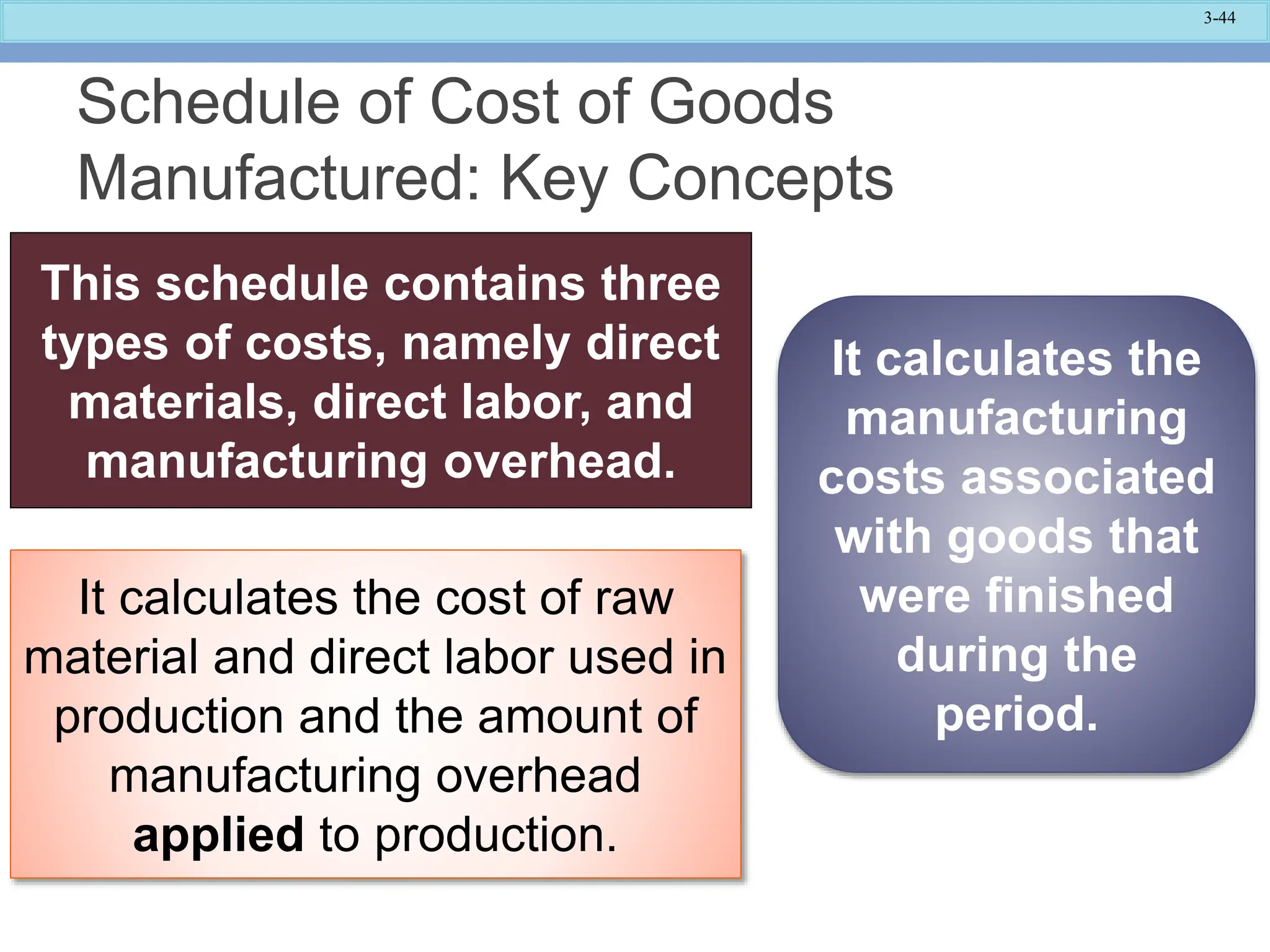

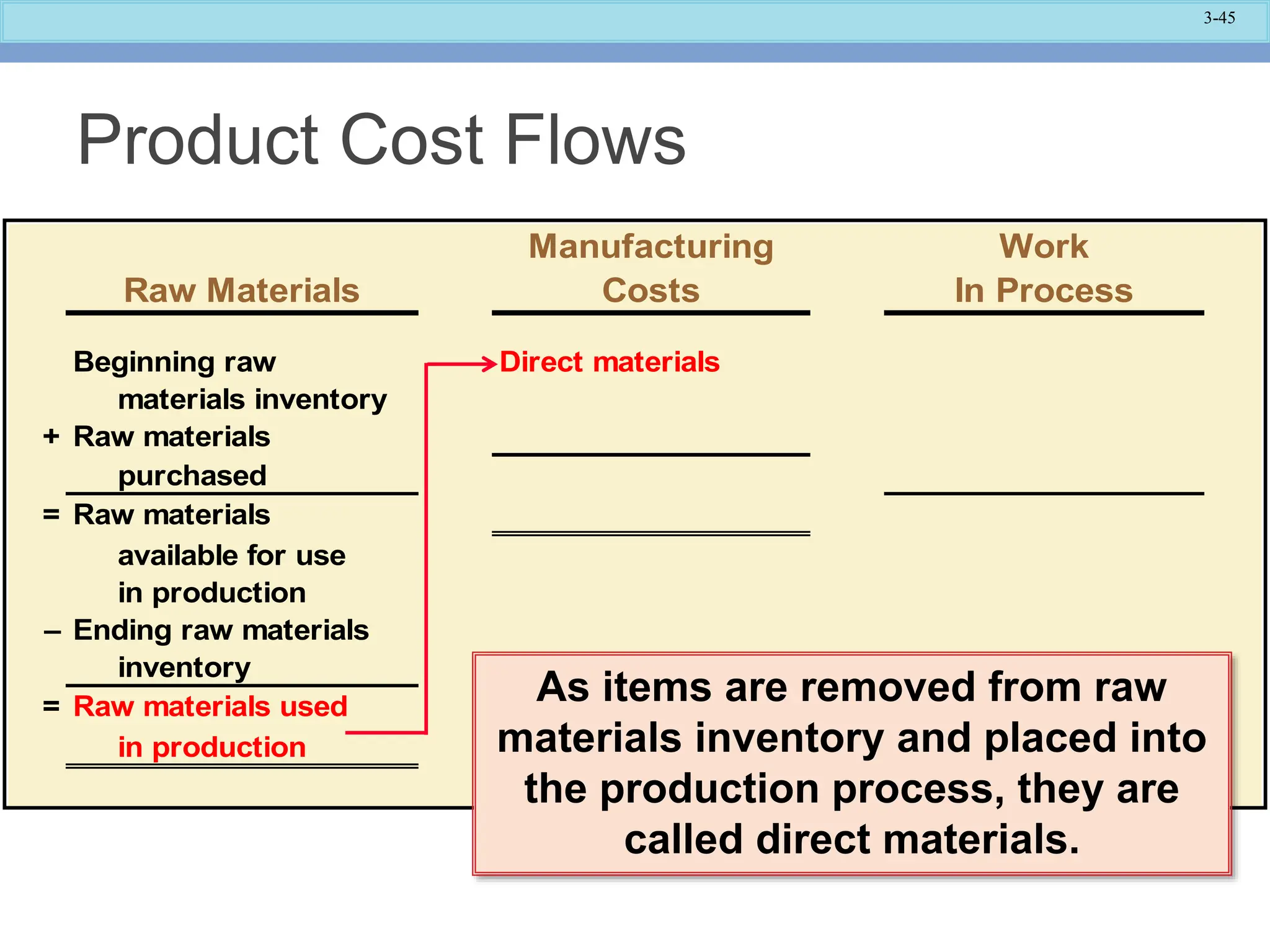

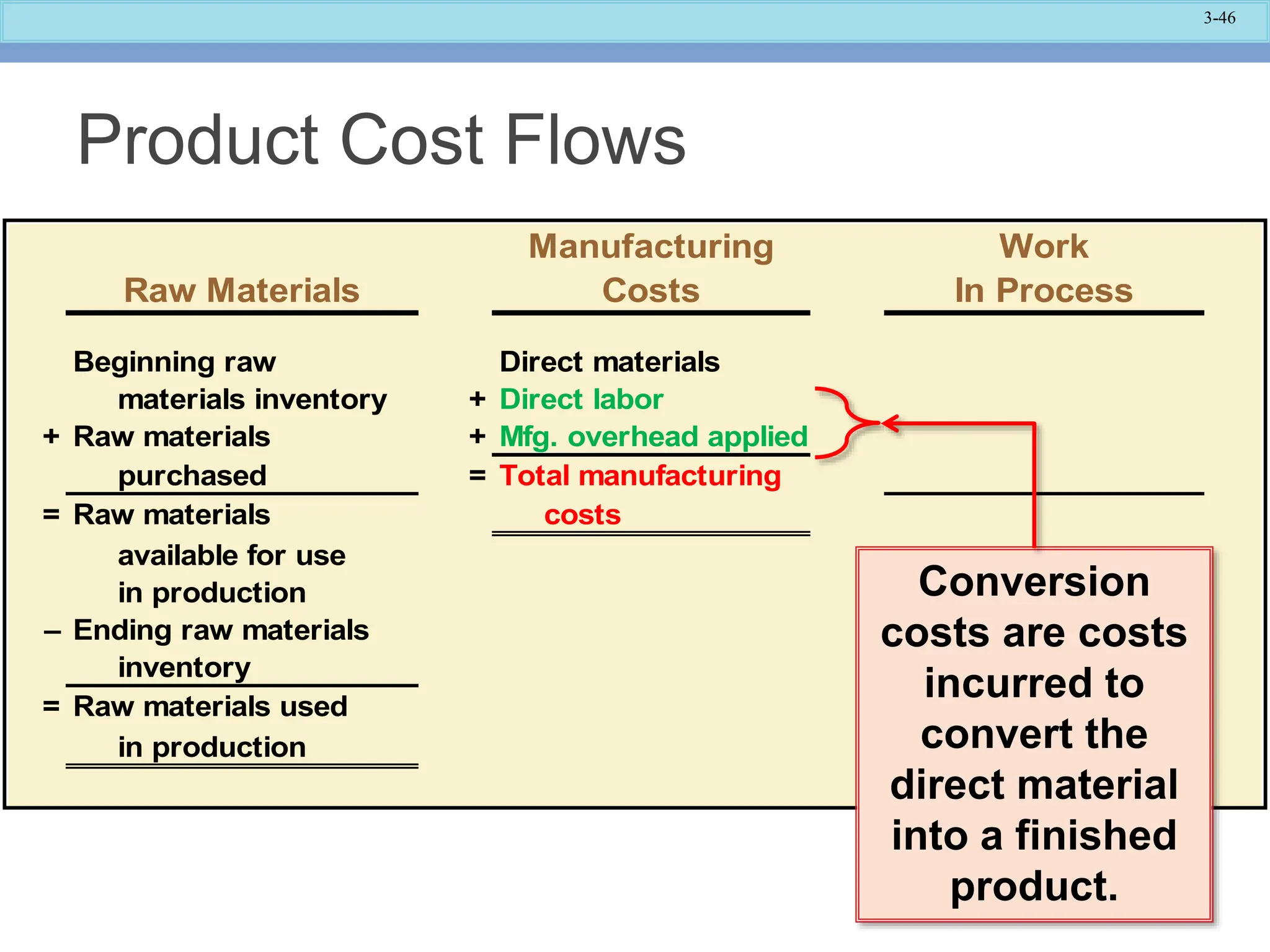

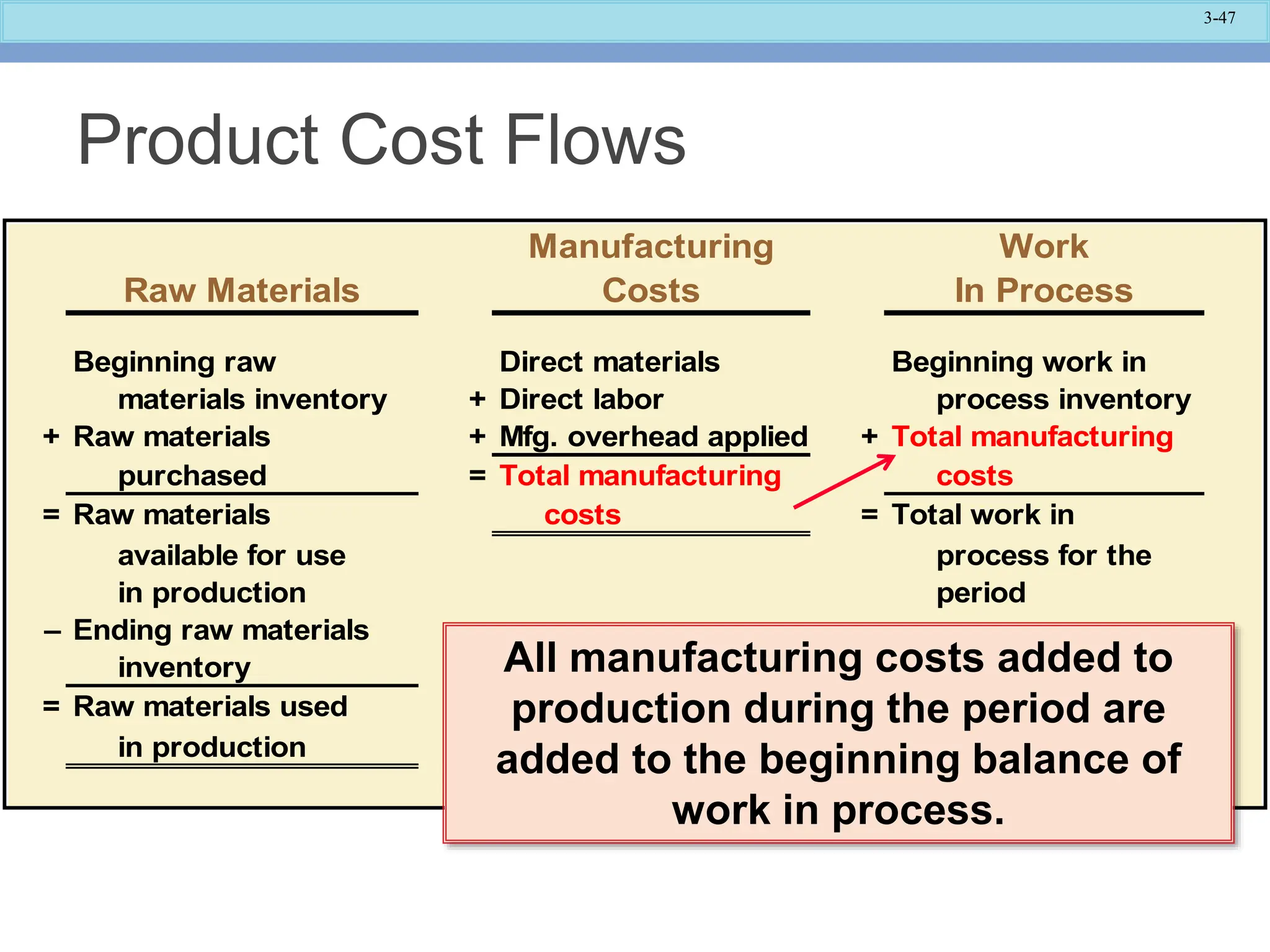

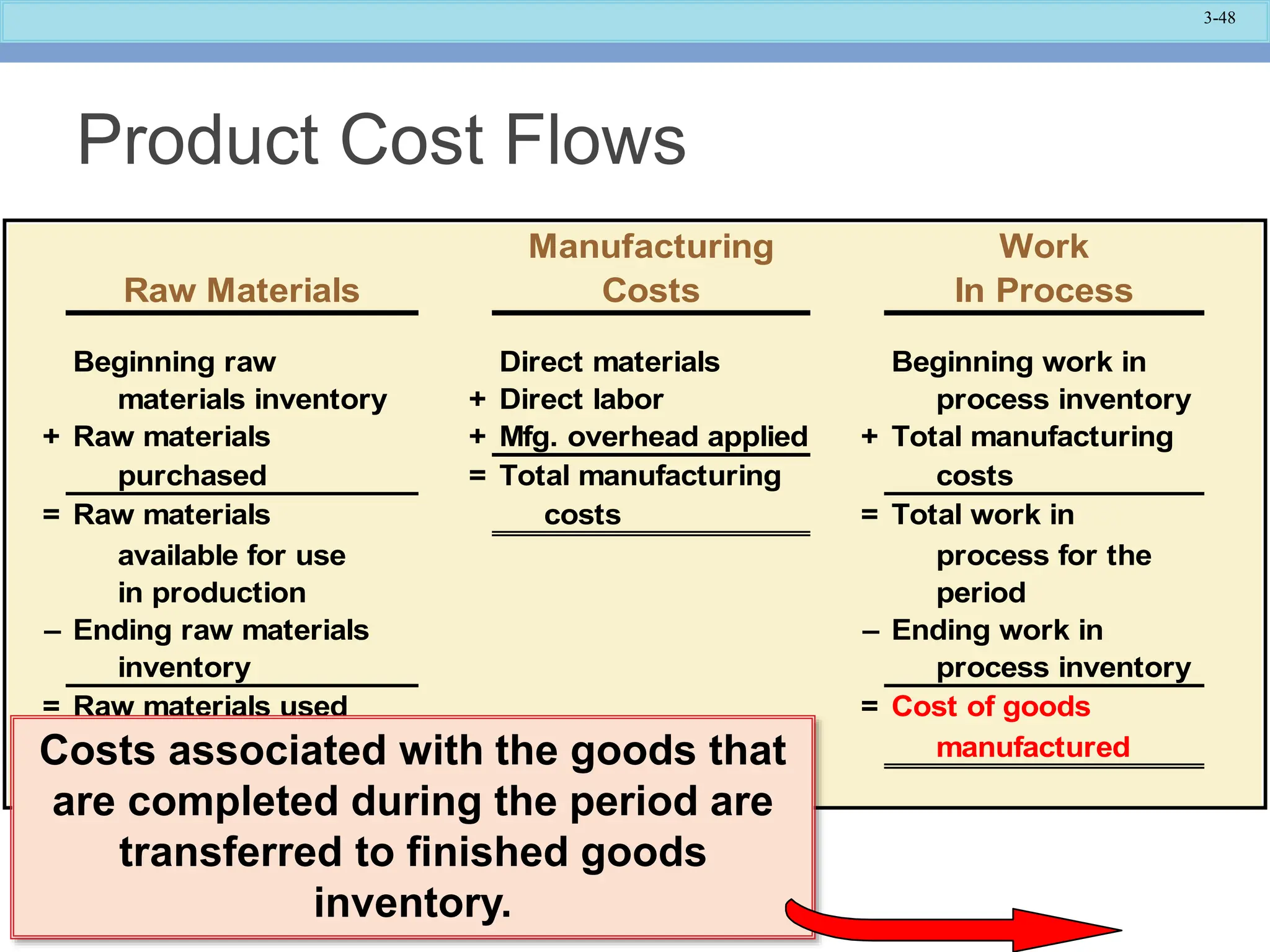

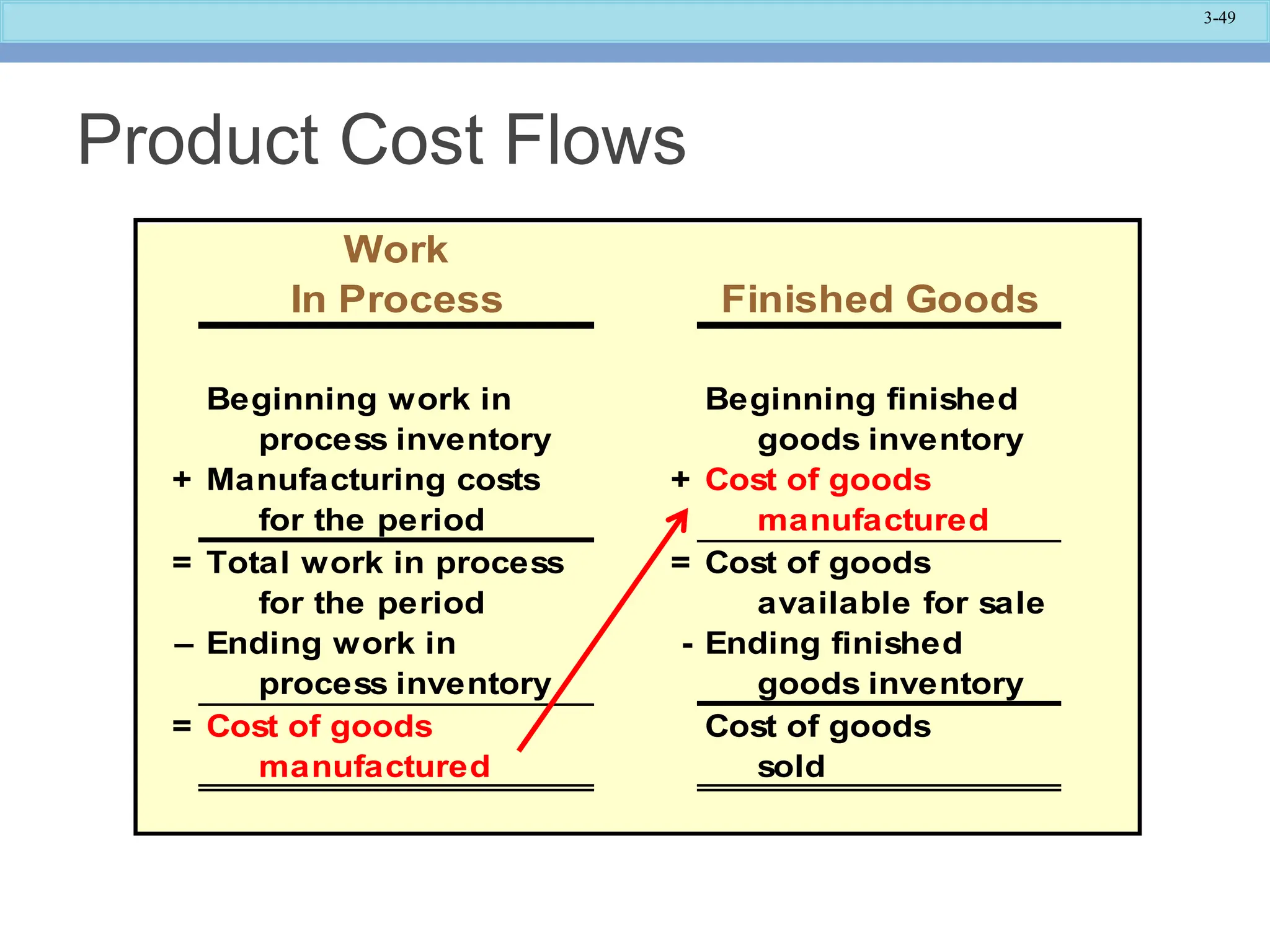

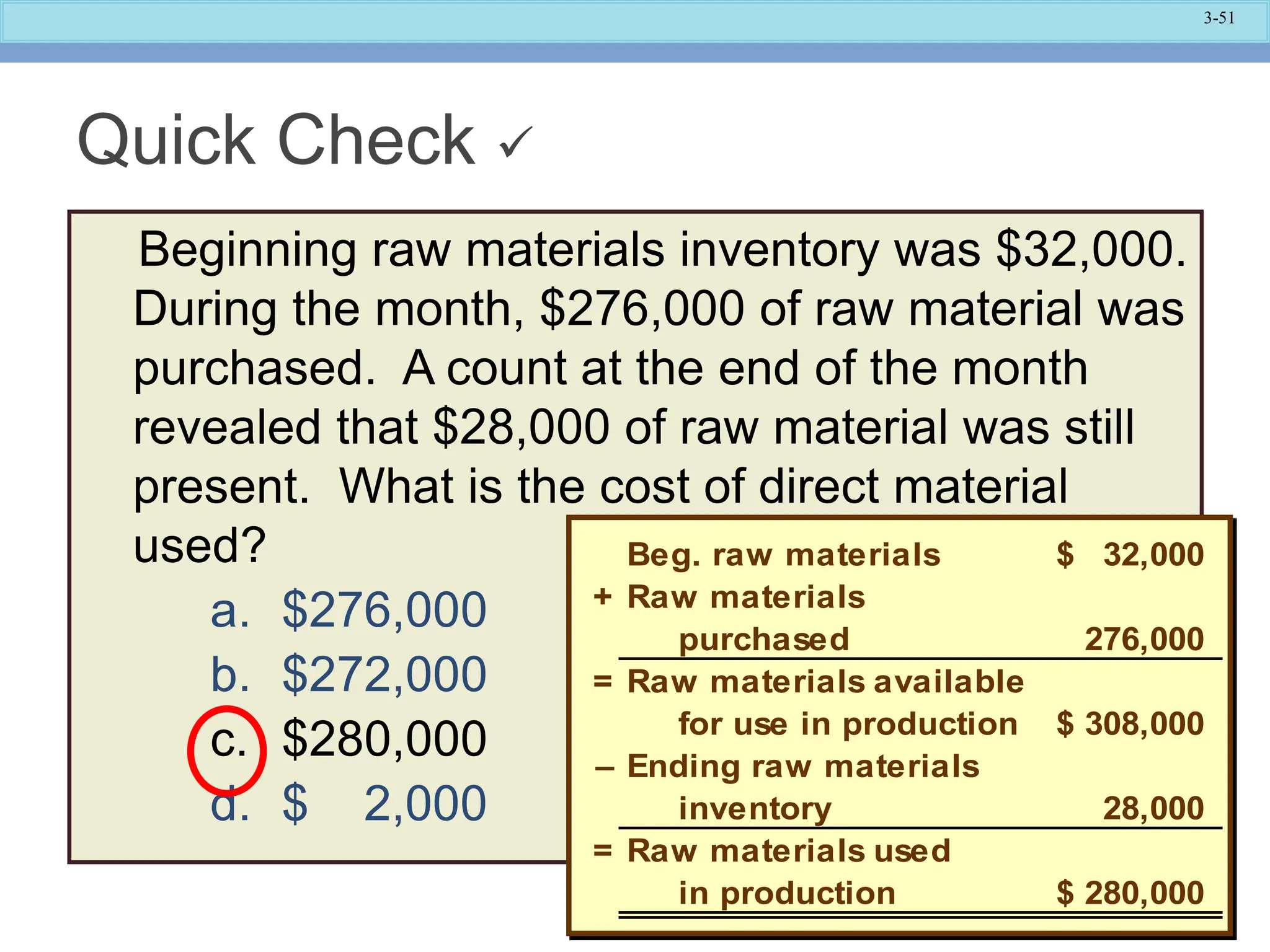

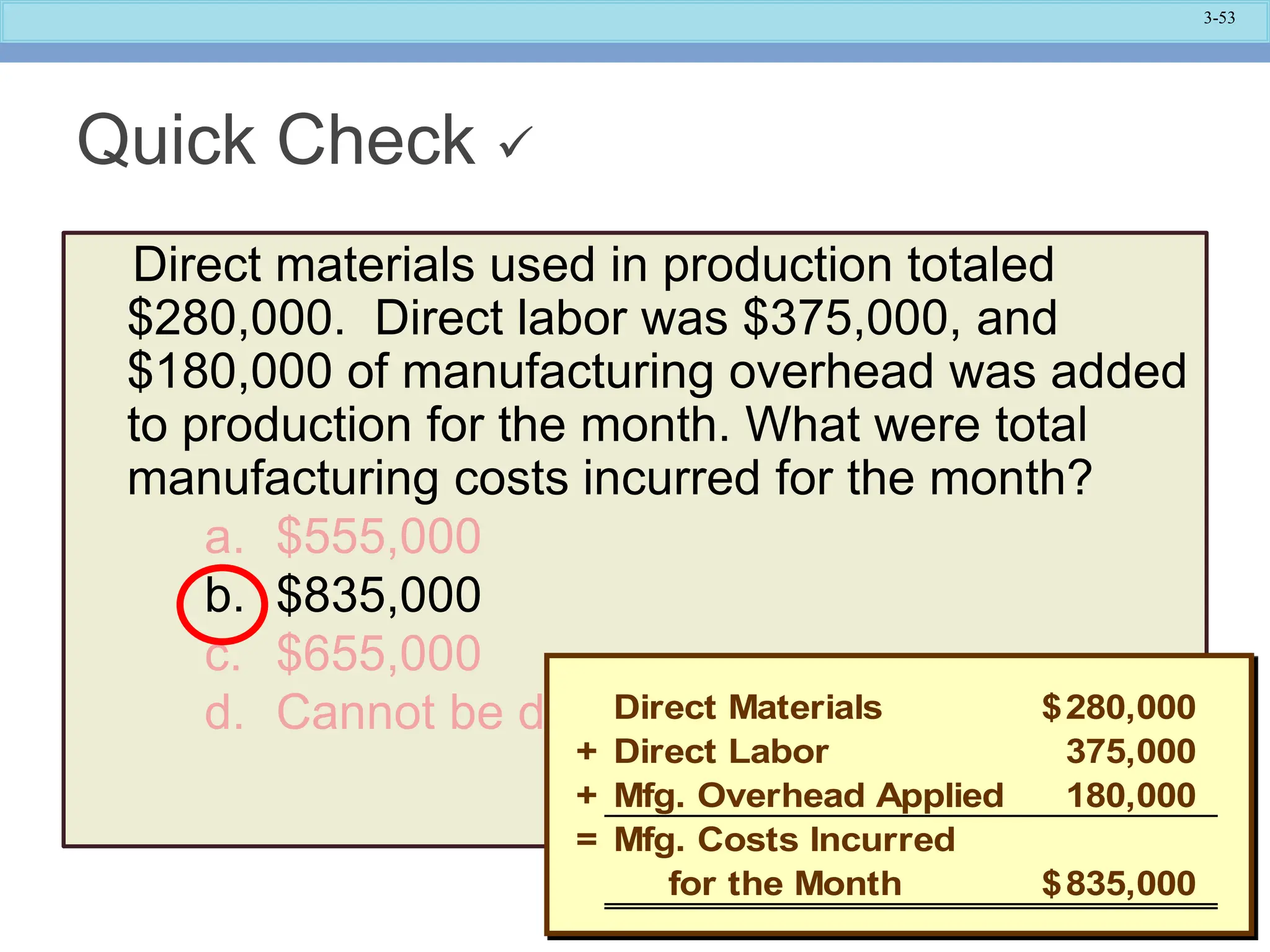

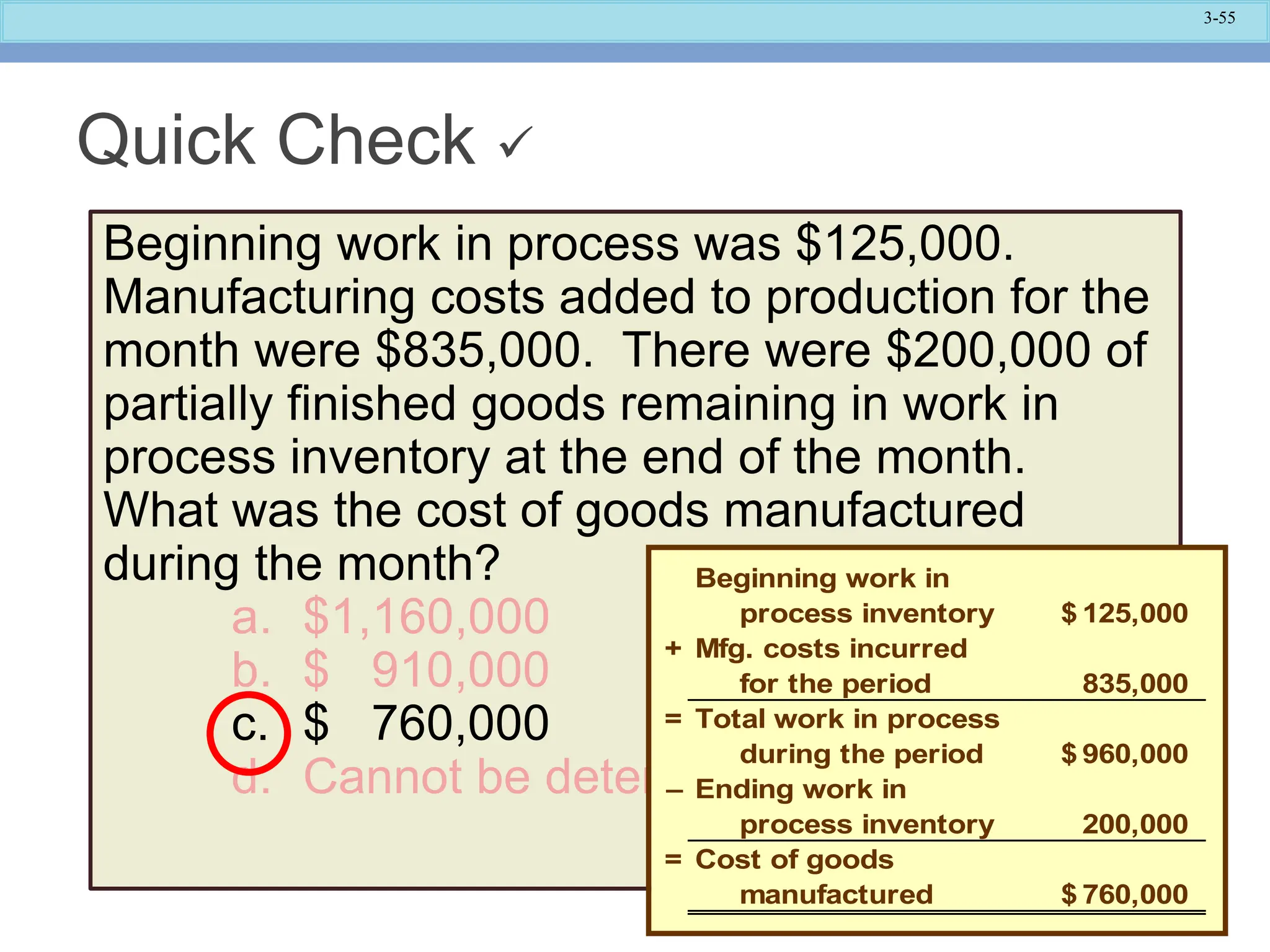

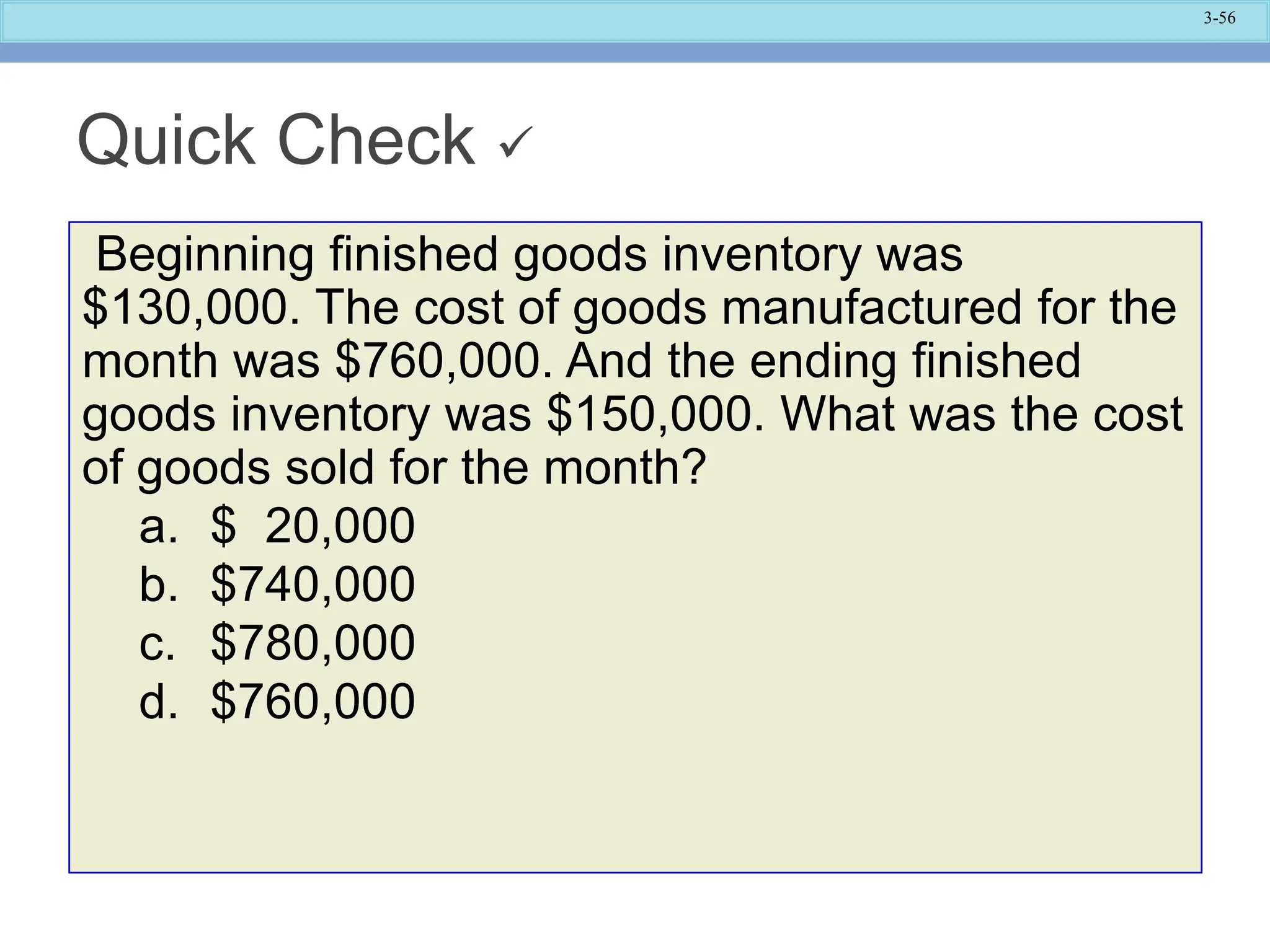

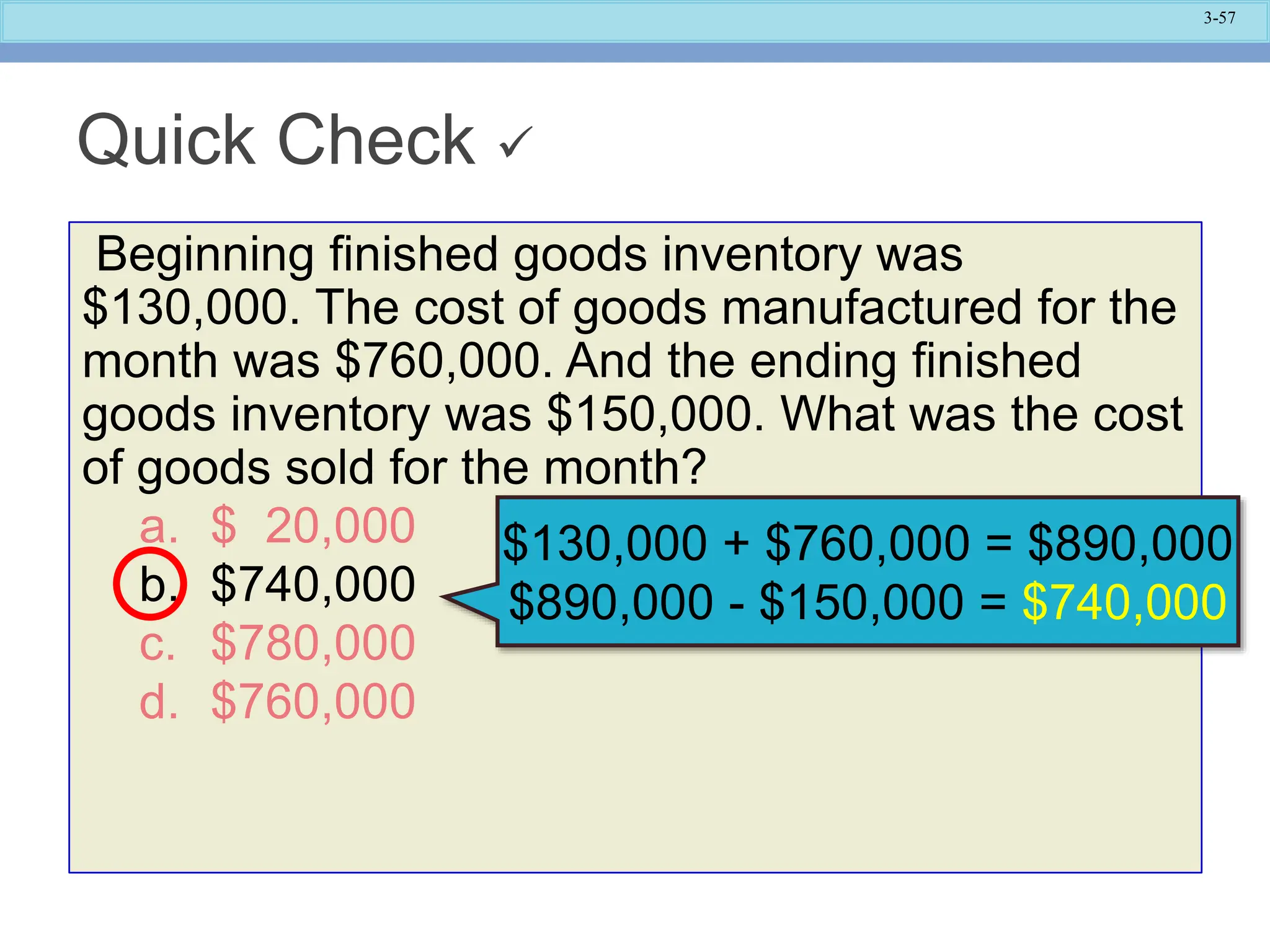

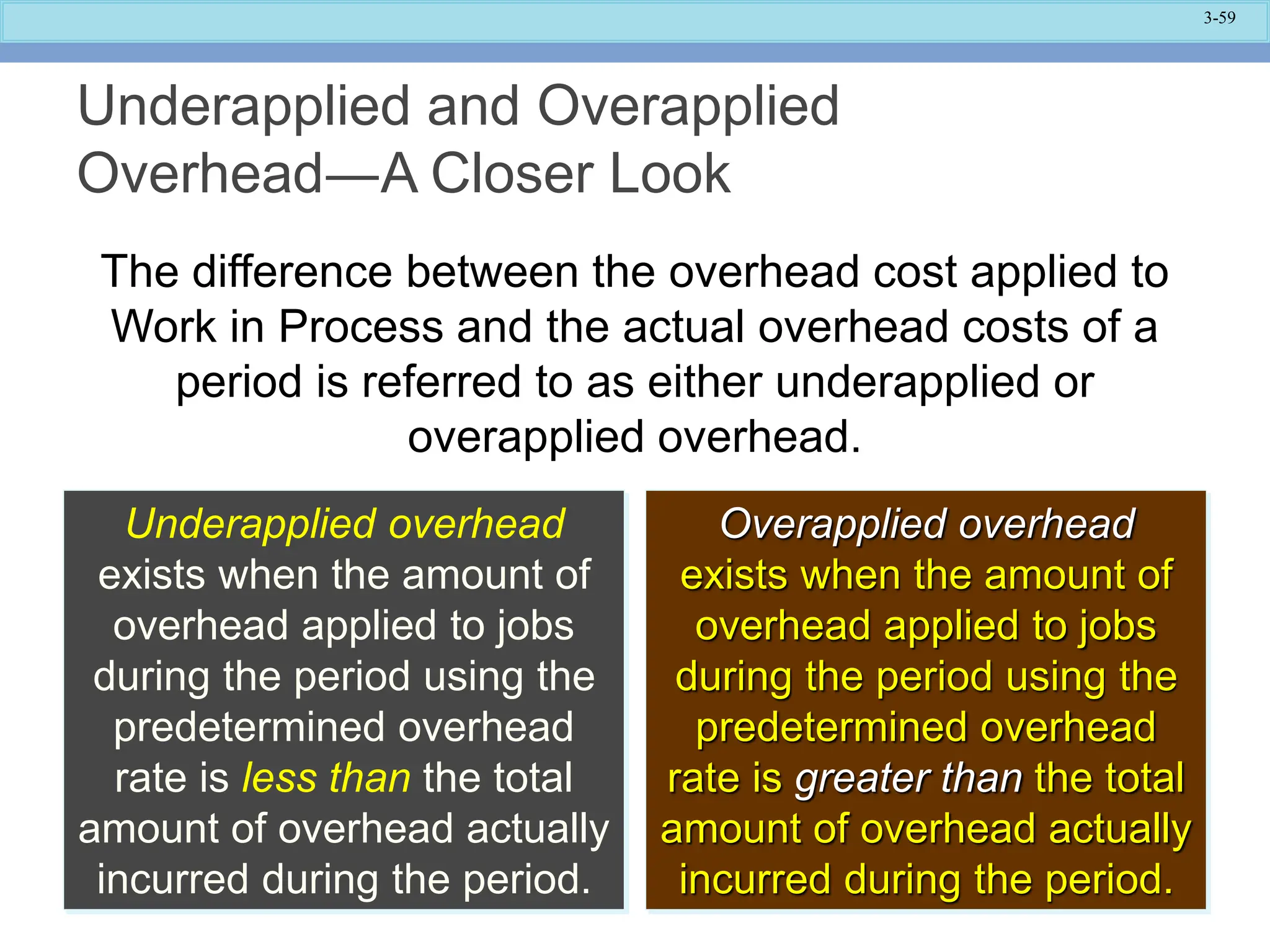

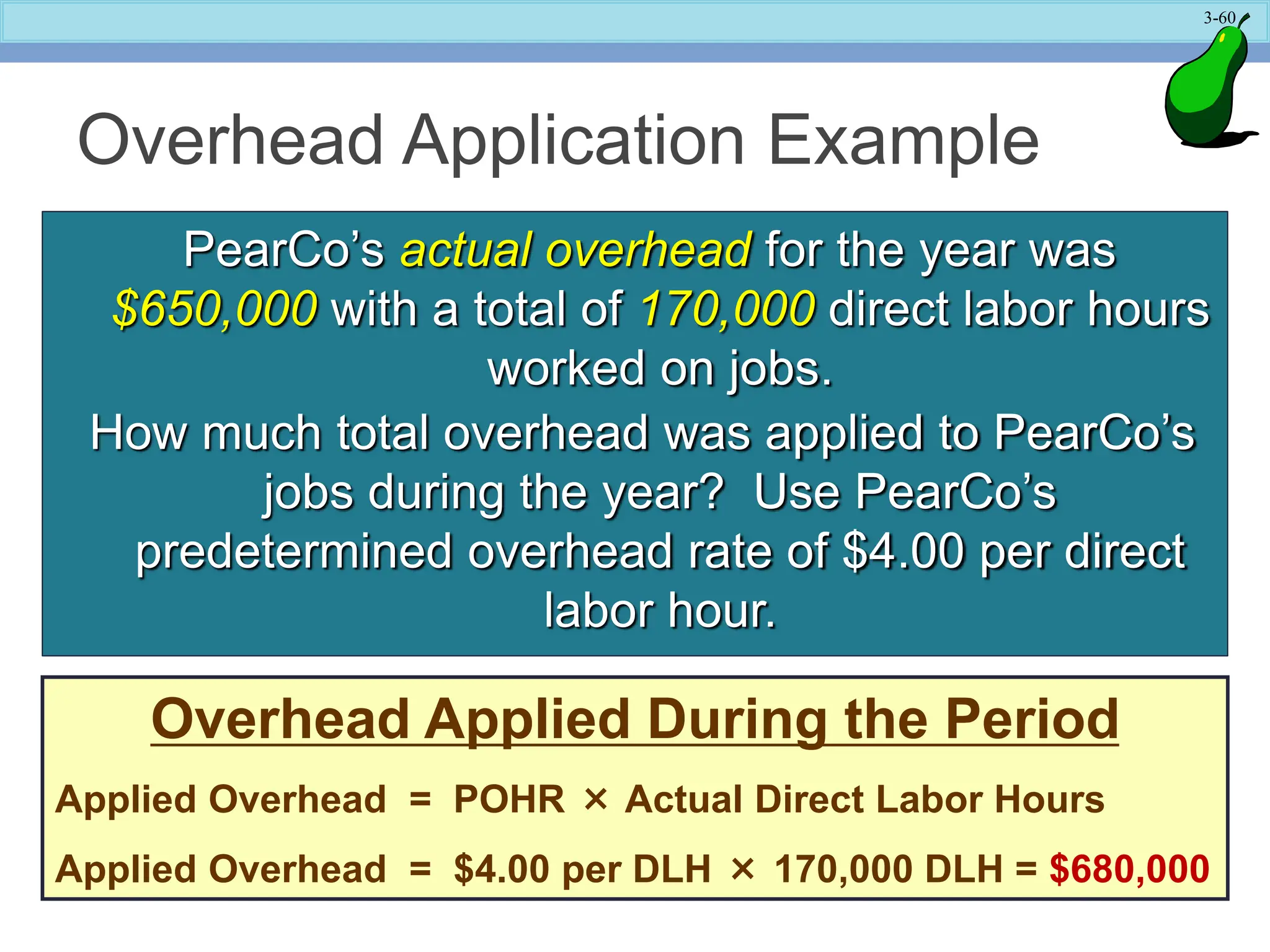

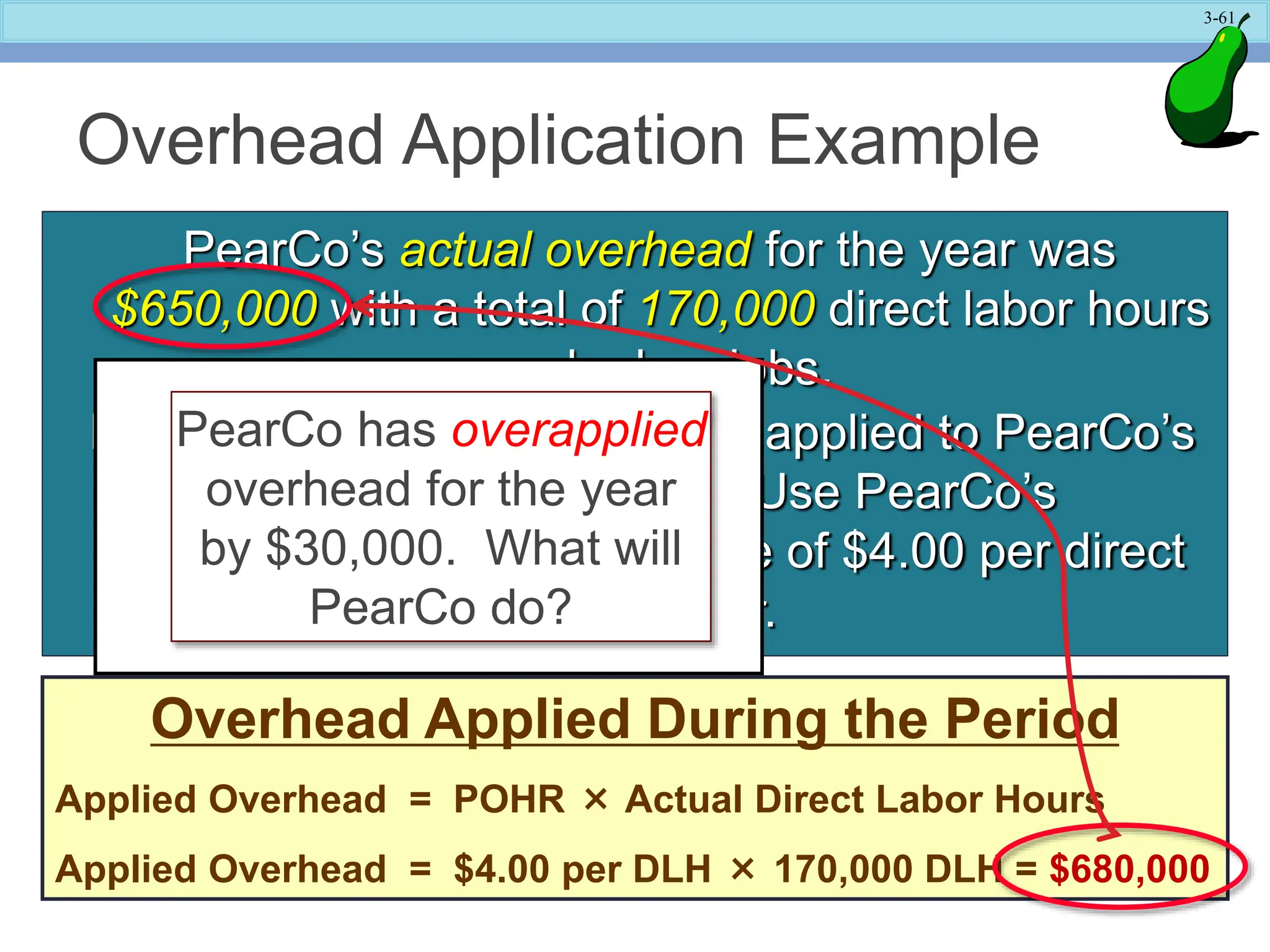

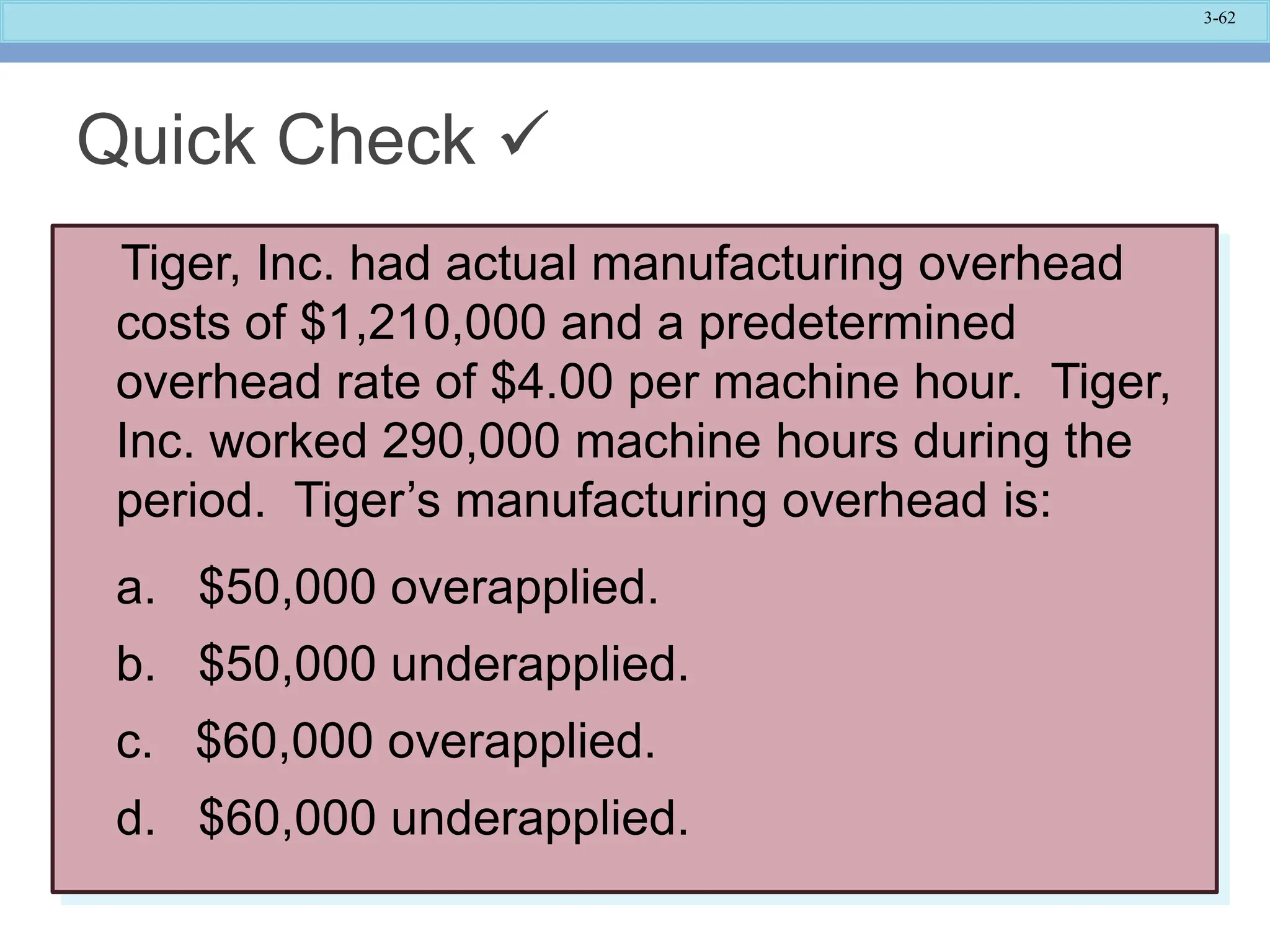

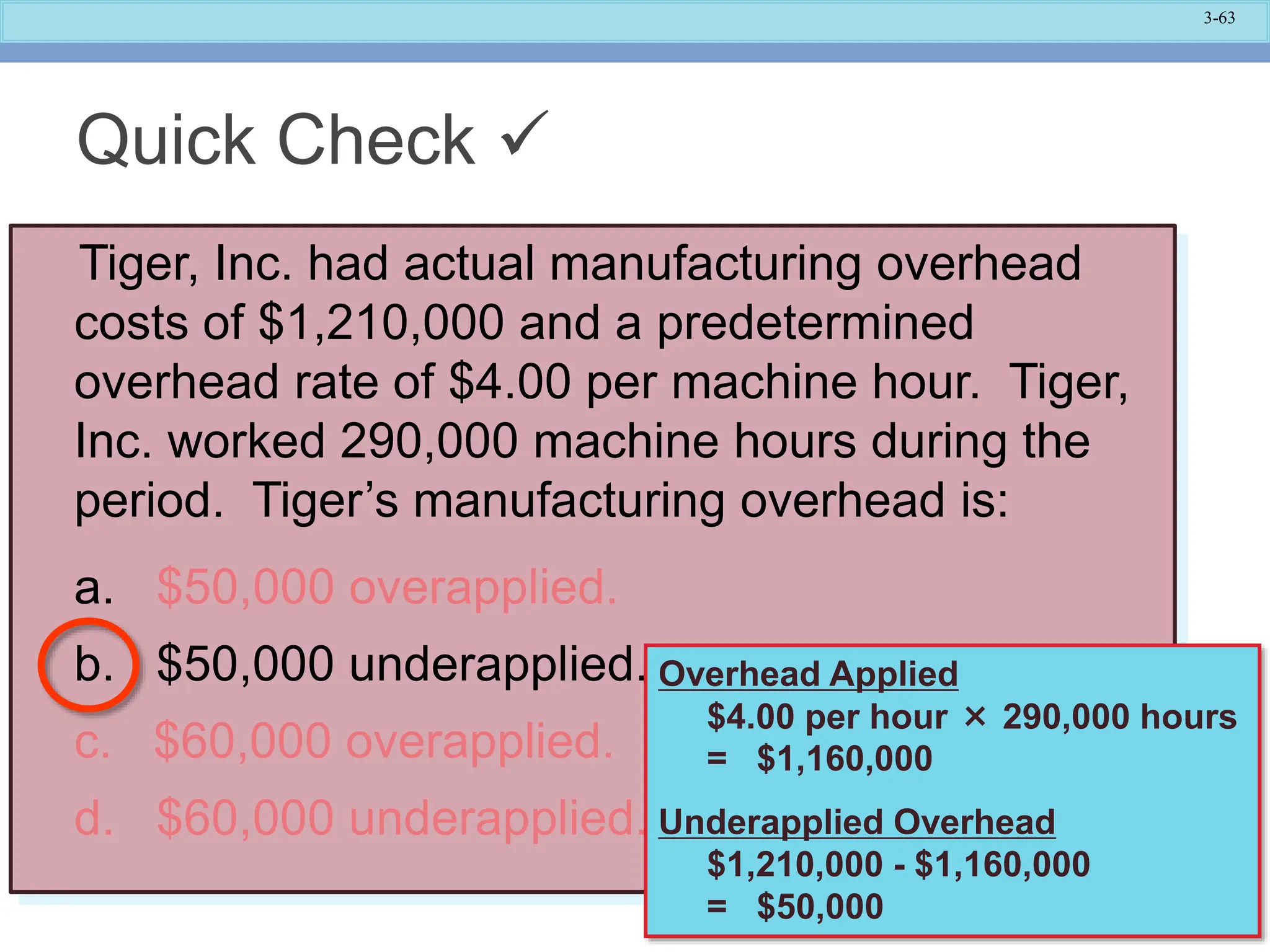

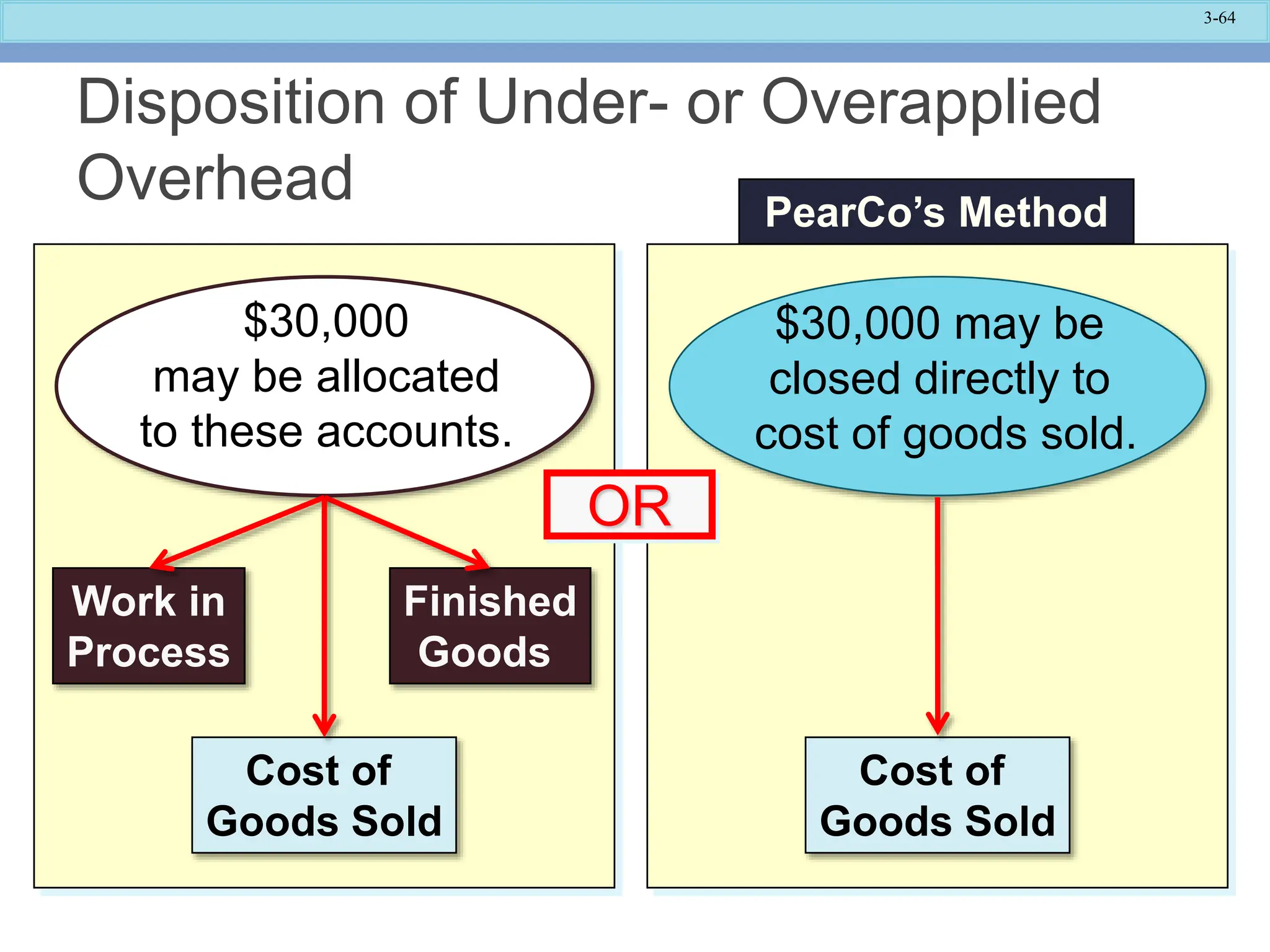

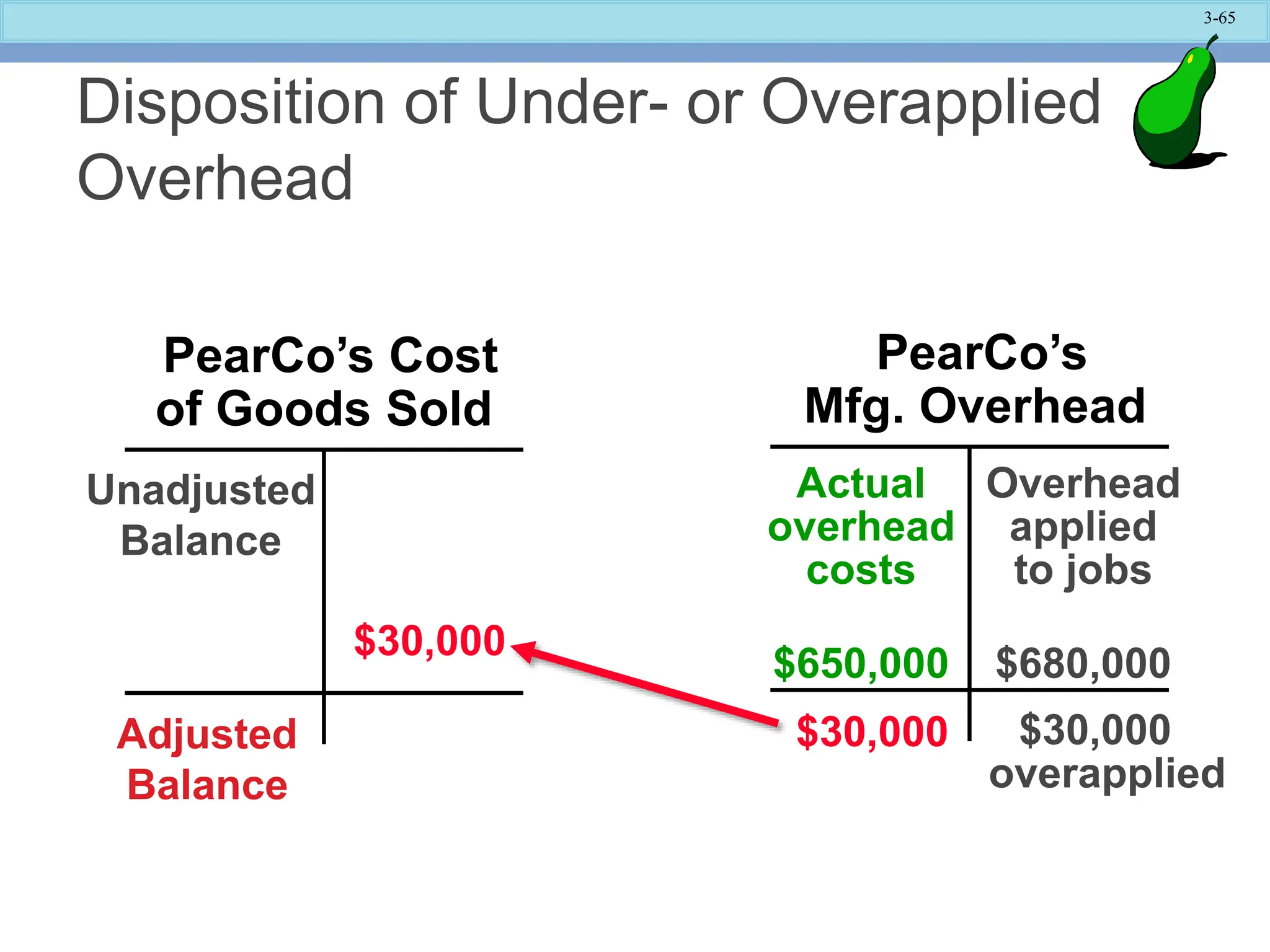

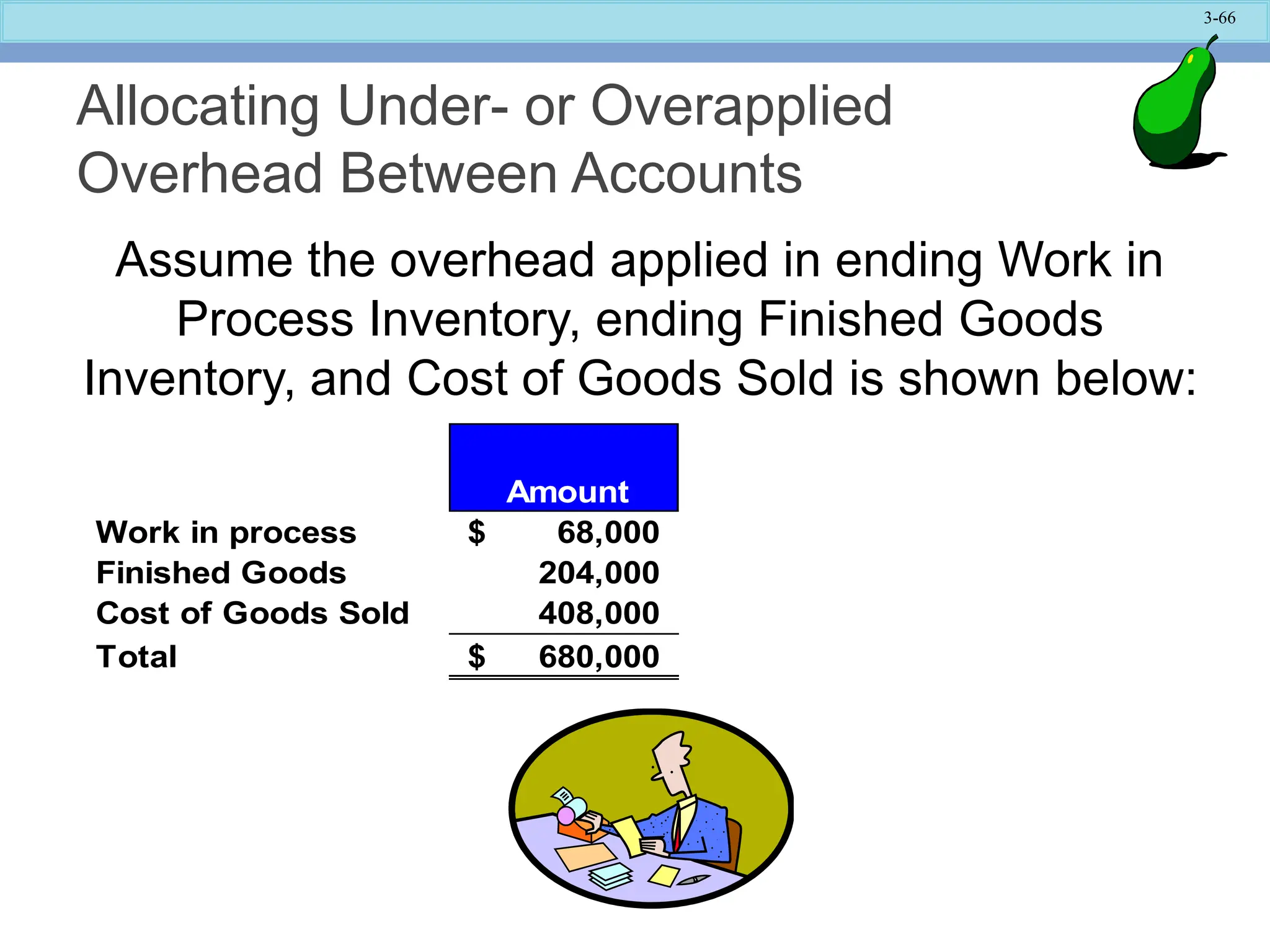

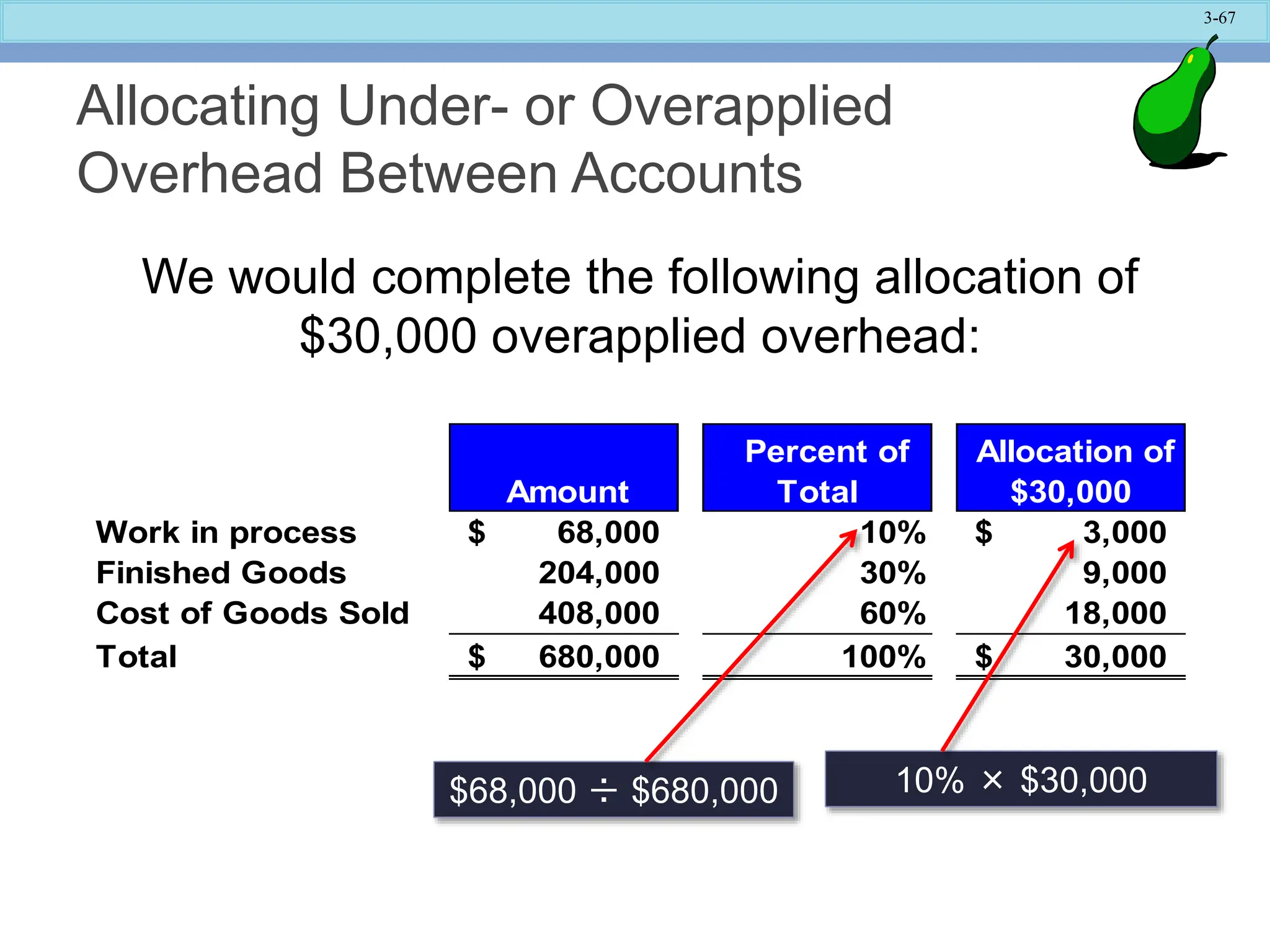

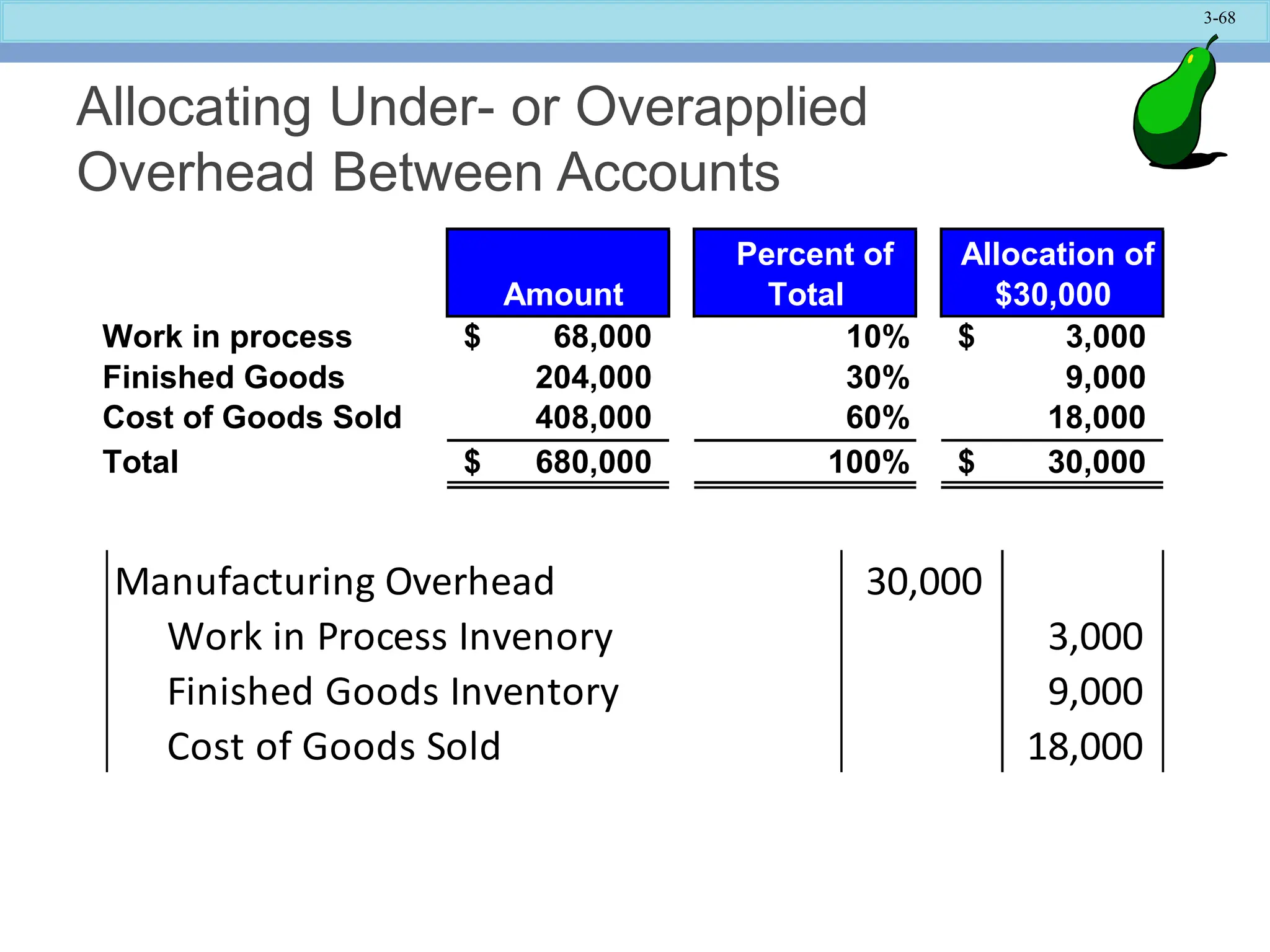

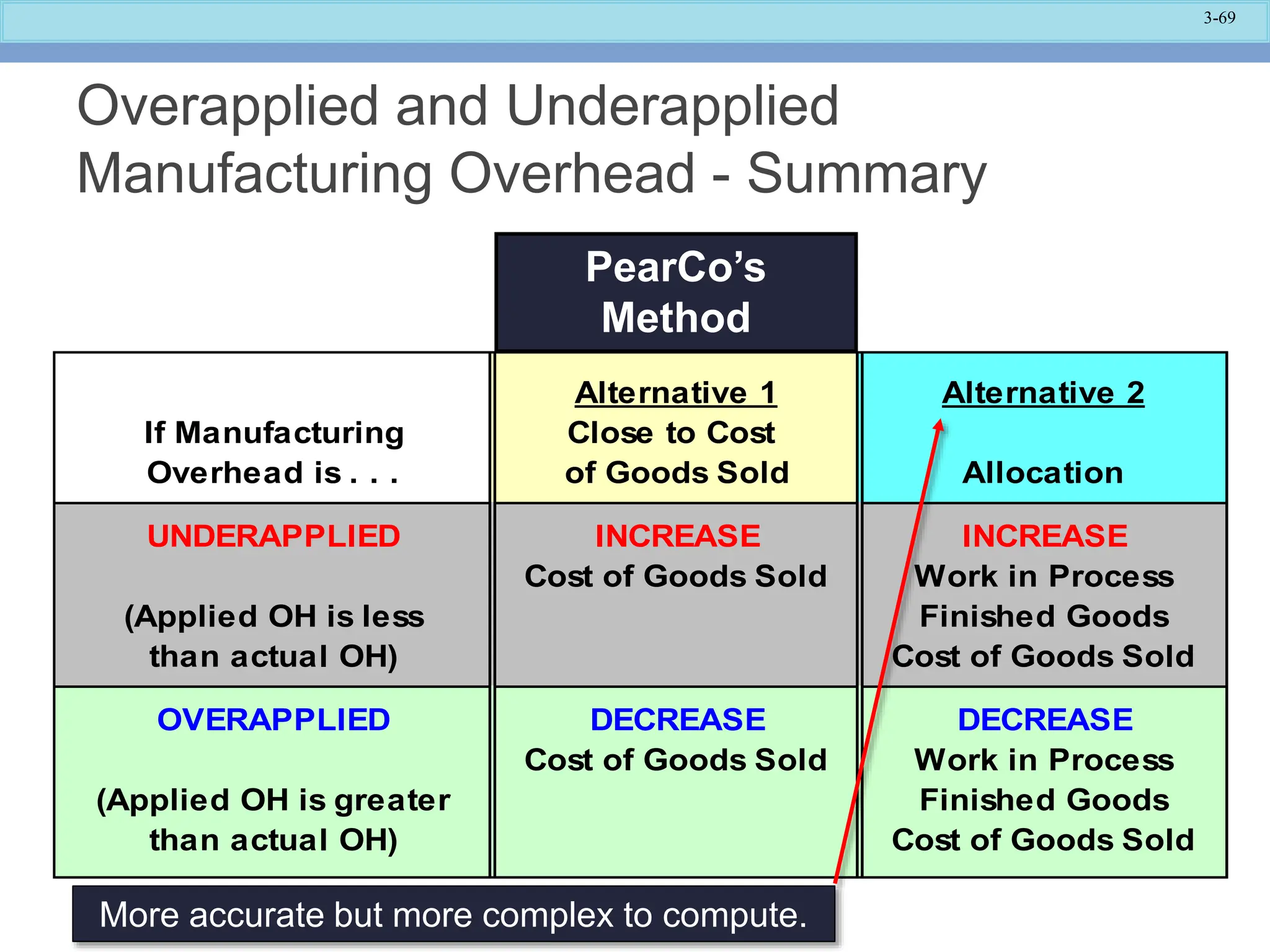

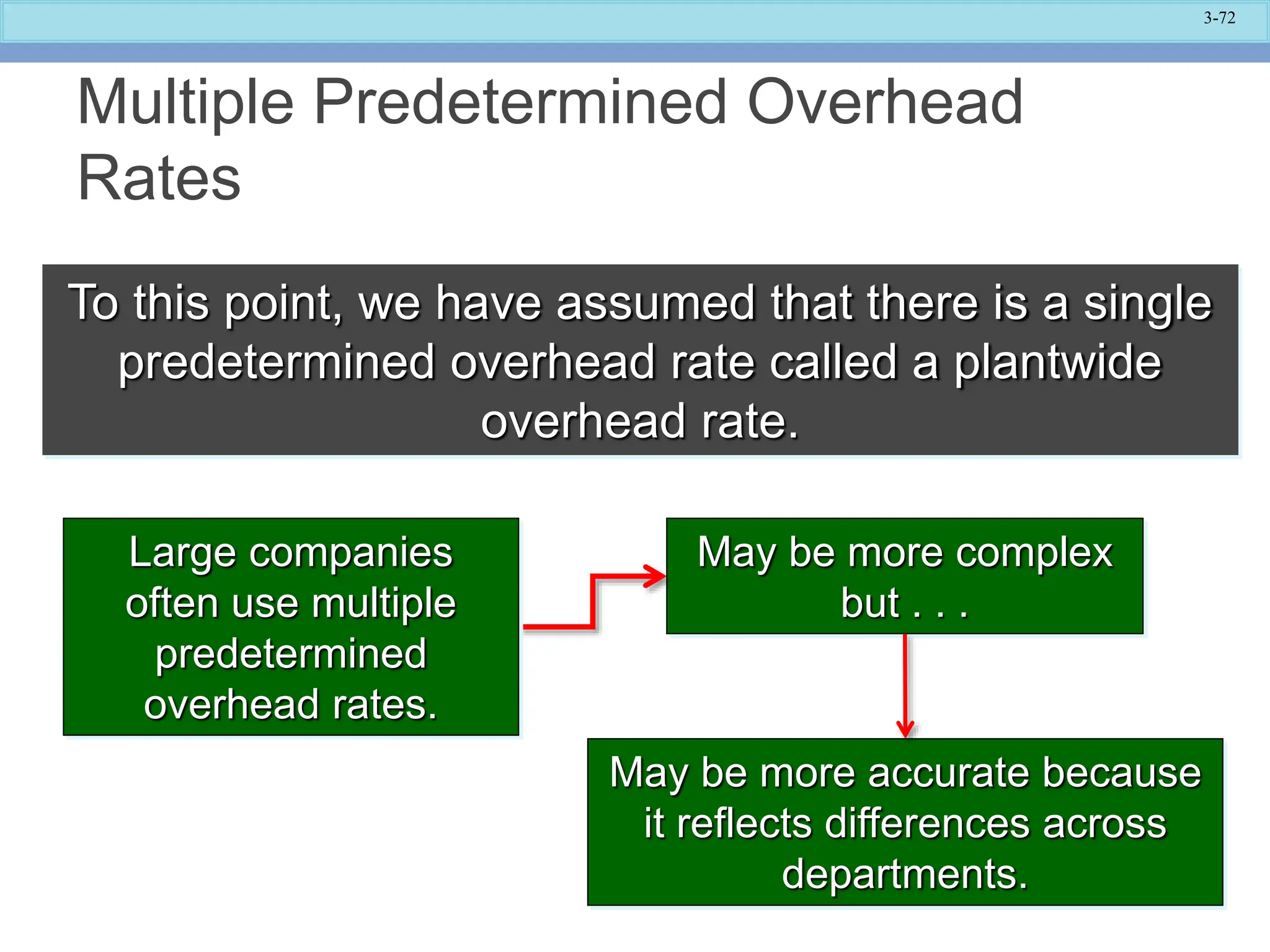

The document outlines job-order costing systems used for manufacturing unique products, emphasizing the allocation of direct material, direct labor, and manufacturing overhead costs to specific jobs. It includes explanations of predetermined overhead rates and their calculation, as well as examples of applications in various industries. Additionally, it covers the flow of costs within job-order costing and provides learning objectives for accounting these costs.