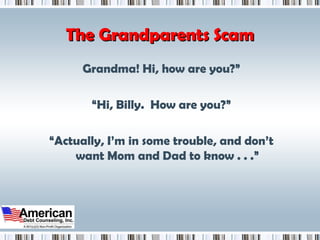

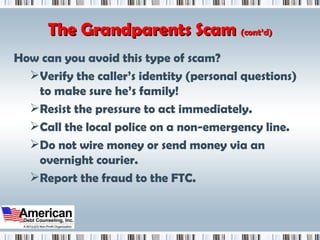

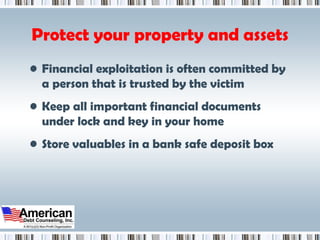

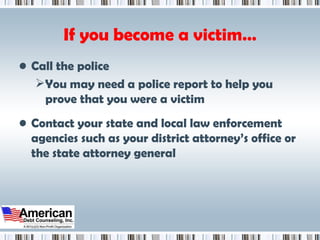

This presentation discusses consumer fraud and scams that often target seniors. It defines consumer fraud and notes that seniors account for a large percentage of fraud victims despite being a smaller portion of the population. Various common scams are described such as sweepstakes and lottery scams, charity scams, identity theft, caretaker crimes, and health and funeral fraud. Warning signs of fraud are provided and steps seniors can take to protect themselves are outlined, including verifying identities, resisting pressure to act quickly, and reporting fraud.