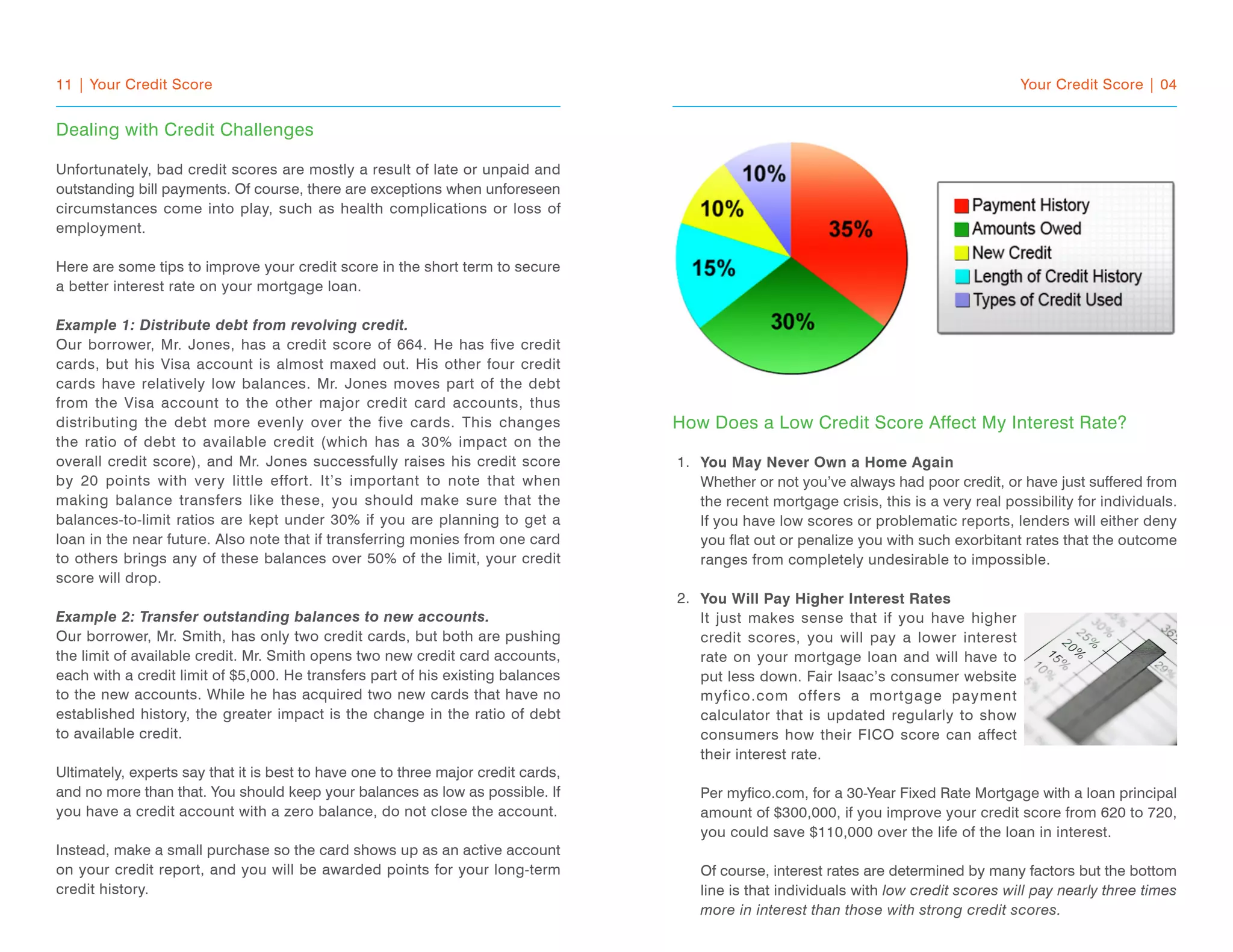

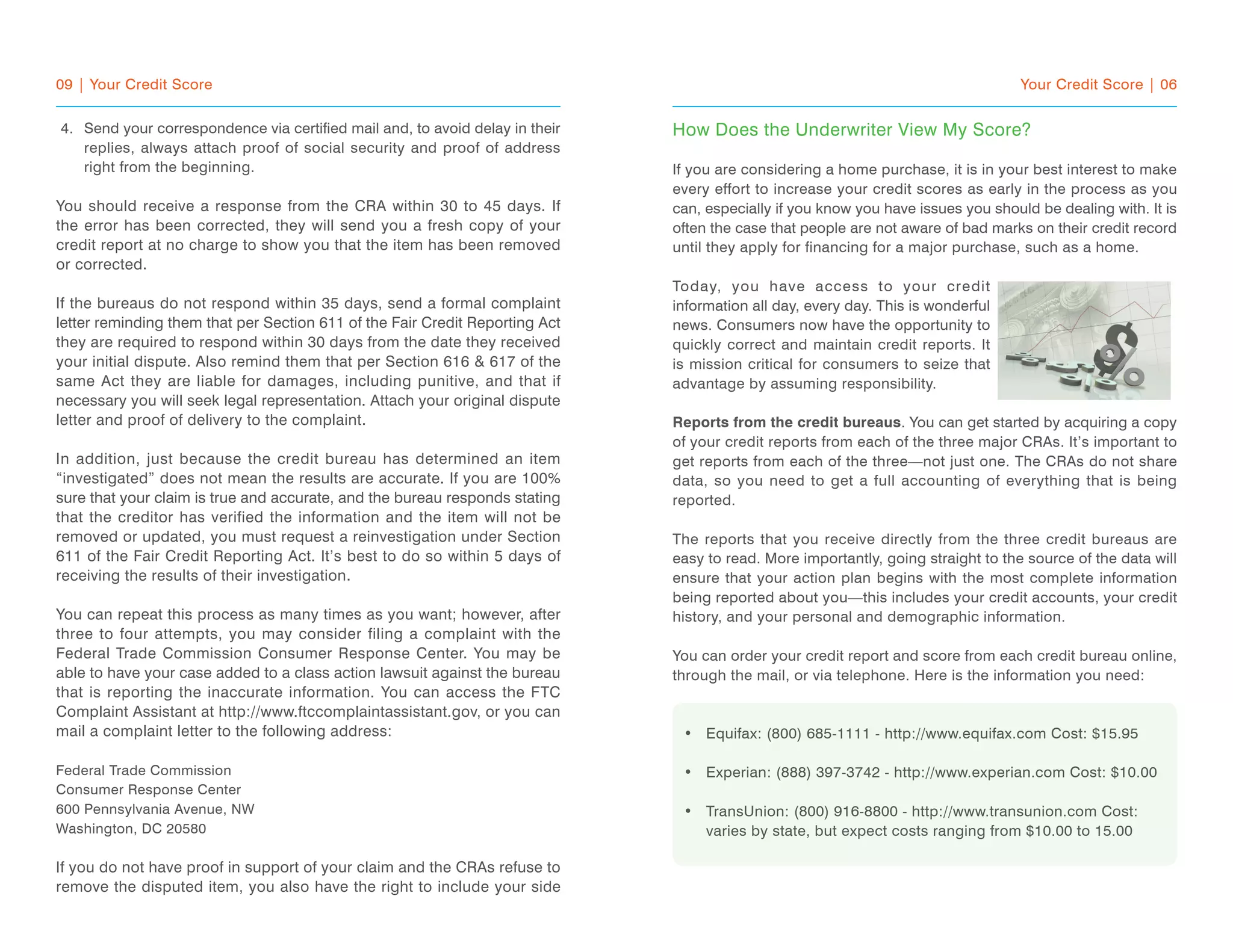

This document provides an overview of credit scoring and its importance. It discusses the five factors that determine a credit score, including payment history, credit utilization, credit history length, credit mix, and number of inquiries. A low credit score can significantly increase interest rates on loans like mortgages, costing borrowers thousands over the life of the loan. It also outlines tips for improving credit scores, such as paying bills on time, keeping credit utilization low, and maintaining a mix of different credit types. The document emphasizes the importance of not making changes to credit reports or applying for new credit during the loan application process.