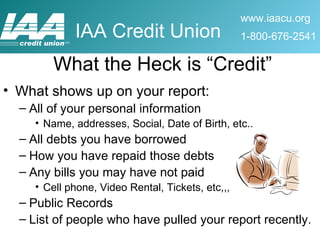

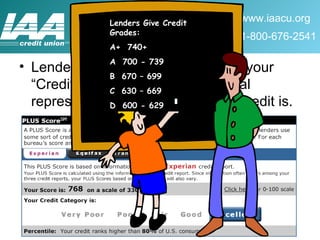

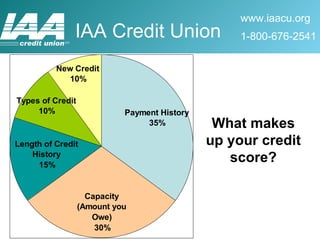

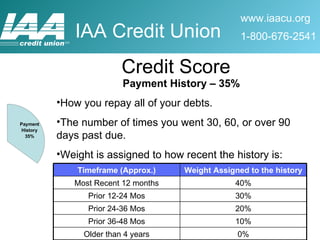

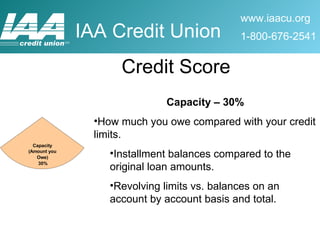

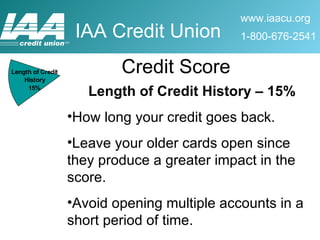

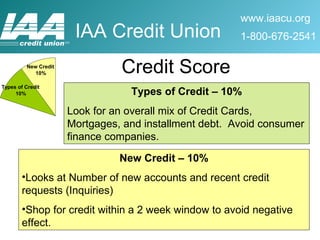

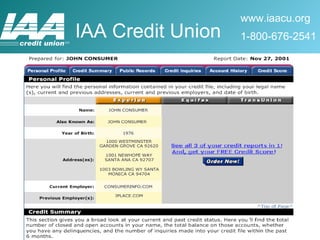

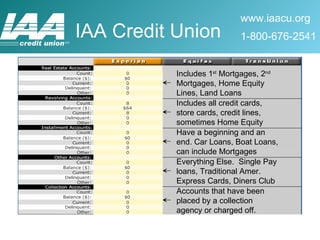

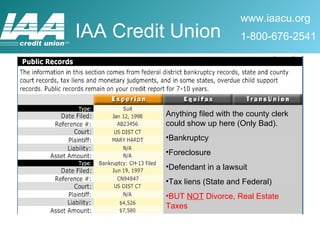

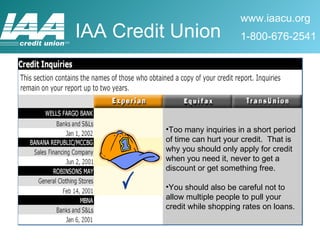

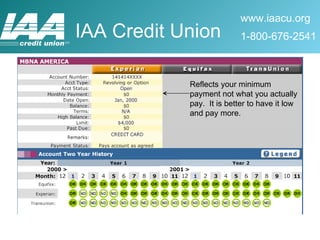

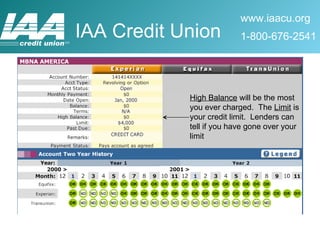

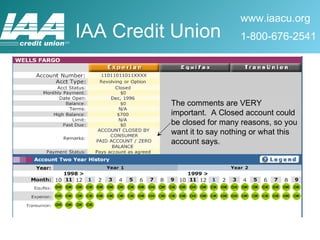

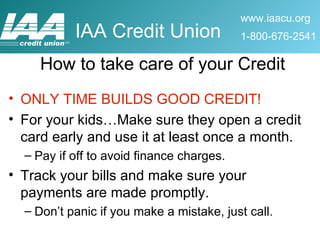

This document explains the significance of credit reports, detailing their contents, the role of credit scores, and the factors that affect them. It emphasizes the importance of managing one's credit history and offers guidance on maintaining a good credit score, such as making timely payments and minimizing unnecessary credit inquiries. Additionally, it advises readers to obtain and review their credit reports annually to identify and rectify any errors.

![QUESTIONS? Nick Sosnowski V.P. of Lending 557-2541 [email_address]](https://image.slidesharecdn.com/CreditPresentationLunchLearn-123567599851-phpapp01/85/Understanding-your-Credit-38-320.jpg)