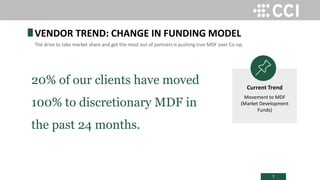

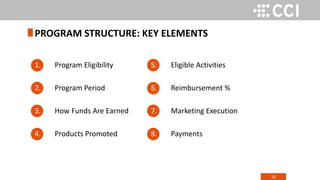

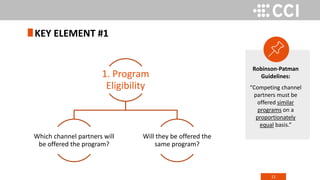

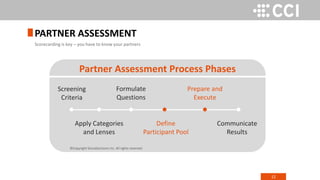

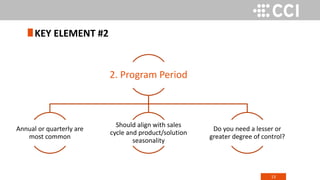

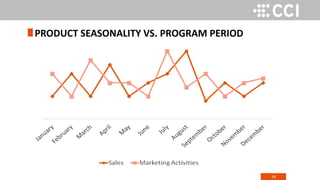

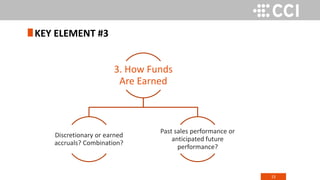

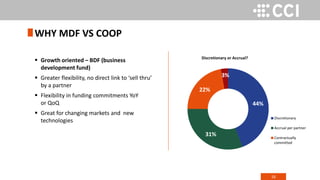

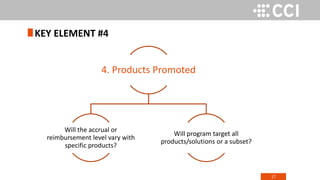

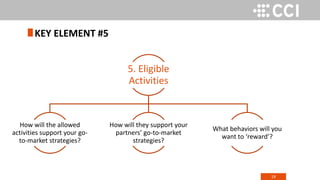

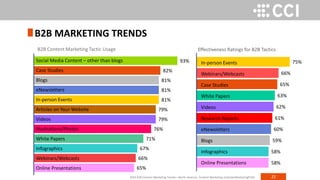

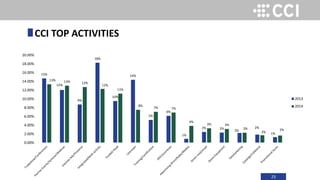

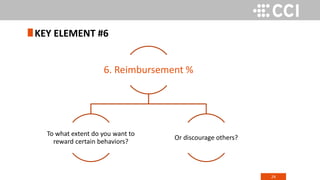

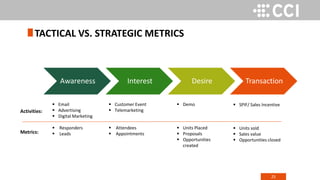

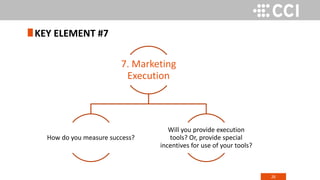

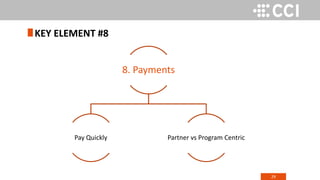

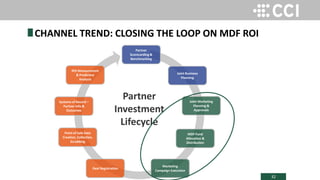

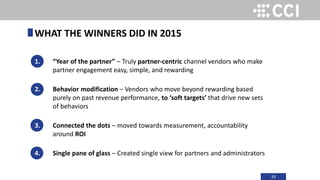

The document outlines the key trends and factors affecting marketing development funds (MDF) in 2016, emphasizing the shift to discretionary MDF models to increase partner engagement and market share. It identifies eight critical elements for optimizing MDF programs, focusing on program structure, eligibility, and measurement of success. Additionally, it discusses the evolving B2B buyer journey and the importance of adapting marketing strategies to support partners effectively.