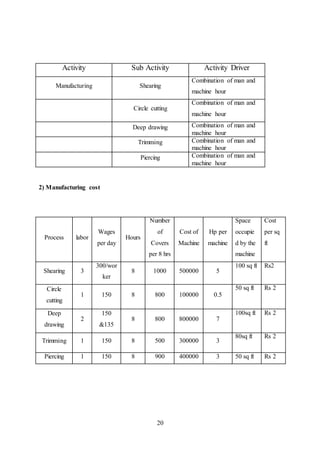

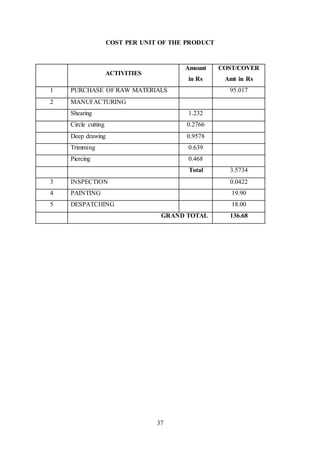

Activity based costing provides more accurate product costs than traditional costing. The document analyzes Vikash Industries' costing system and compares it to activity based costing for one of its products. It identifies the activities involved in manufacturing the product, calculates the costs of each activity, and allocates costs using appropriate drivers. Implementing activity based costing would provide Vikash Industries a better understanding of true product costs and help identify areas to reduce costs and increase efficiencies.