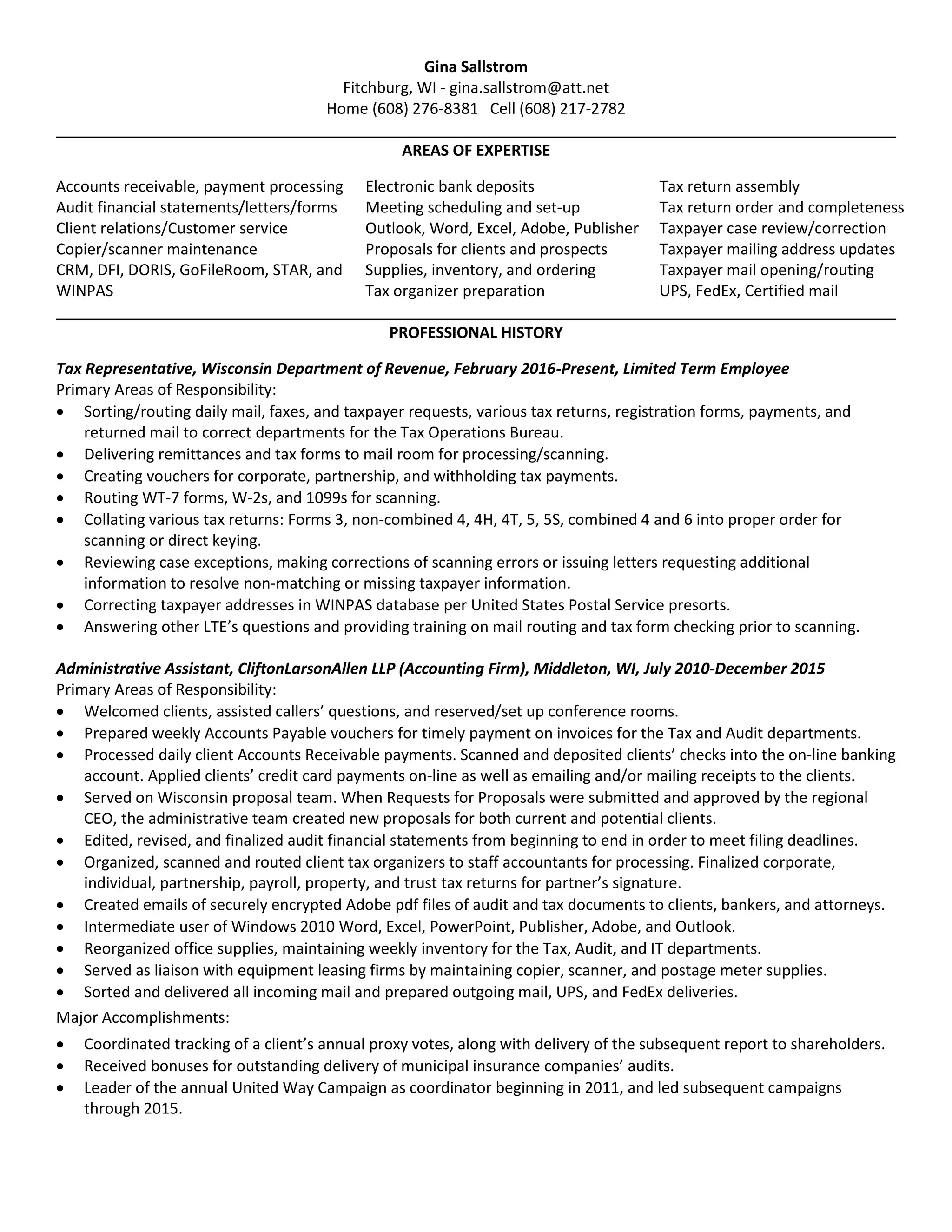

Gina Sallstrom has over 15 years of experience in administrative and accounting roles. She currently works as a Tax Representative for the Wisconsin Department of Revenue where she sorts mail, routes tax forms for processing, and corrects taxpayer information. Previously, she held administrative positions at two accounting firms where she performed tasks like accounts receivable processing, proposal preparation, and financial statement editing to meet deadlines. She also has experience maintaining office supplies and coordinating equipment. Sallstrom's resume demonstrates strong skills in organization, customer service, and using Microsoft Office programs.