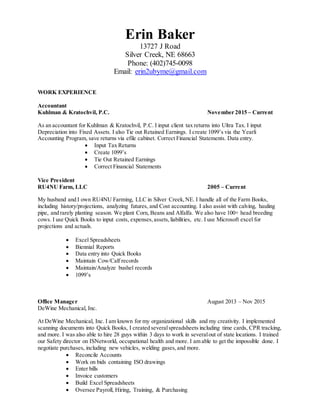

The document provides a professional profile and resume for Erin Baker. It outlines her education including a Master's degree in Accounting and various certificates. It also details over 10 years of work experience in accounting, administration, and management roles for companies like Kuhlman & Kratochvil P.C., DeWine Mechanical Inc., Dell Business Solutions, and as the City Clerk/Treasurer for the City of Osceola. The resume emphasizes her skills with accounting, Microsoft applications, data entry, and her goal-driven work ethic. Contact information and professional references are also included.