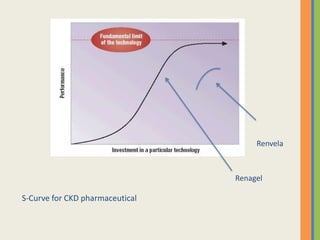

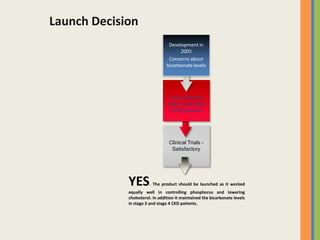

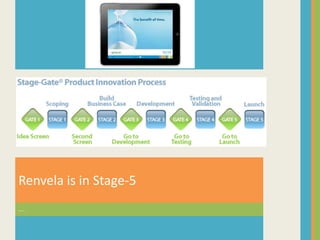

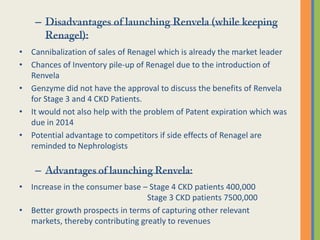

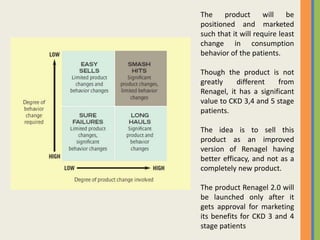

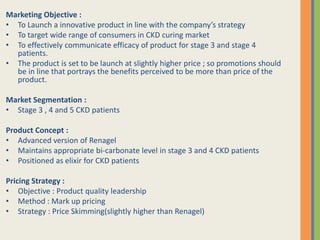

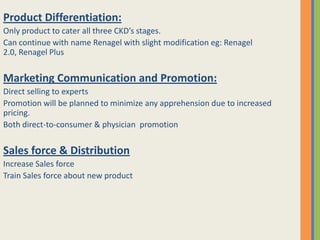

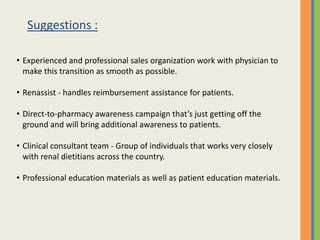

The document discusses Genzyme's decision about whether to launch the new drug Renvela. [1] Renagel is currently the market leader for treating phosphorus levels in patients with chronic kidney disease (CKD), with 50% market share. [2] Renvela was shown to control phosphorus levels equally well as Renagel and also maintain appropriate bicarbonate levels in patients with stage 3 and 4 CKD. [3] However, launching Renvela risks cannibalizing Renagel sales and causing inventory issues, as Renvela was not yet approved to discuss its benefits for earlier CKD stages.