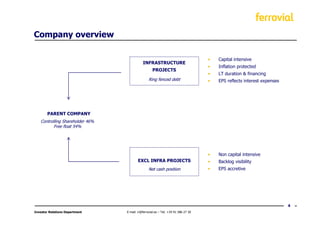

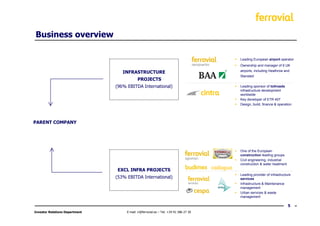

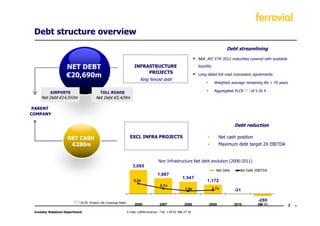

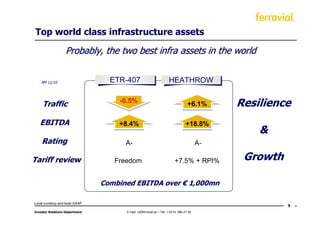

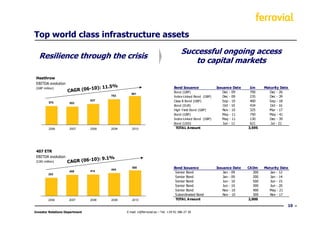

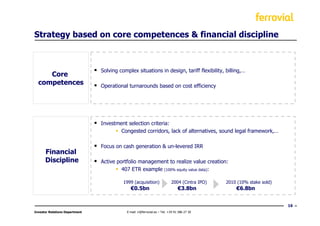

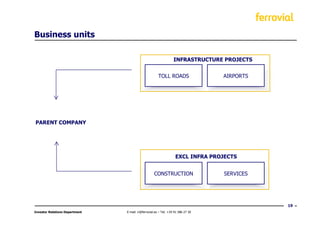

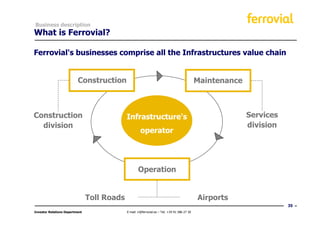

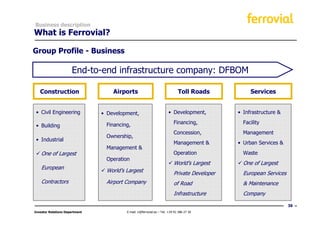

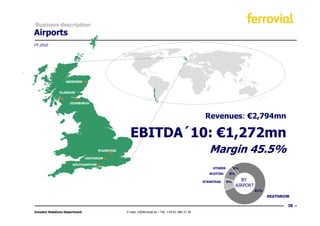

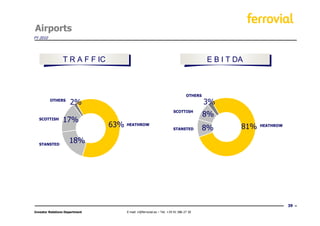

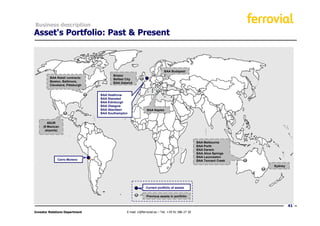

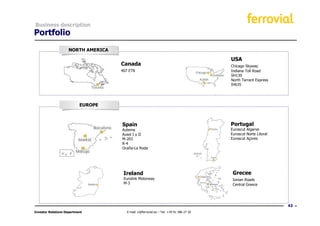

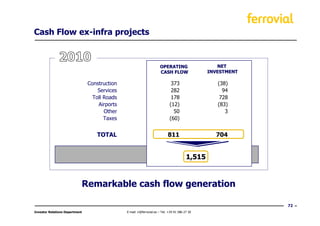

- Ferrovial has infrastructure projects and other business units. Infrastructure projects are capital intensive with long-term debt financing, while other business units are less capital intensive.

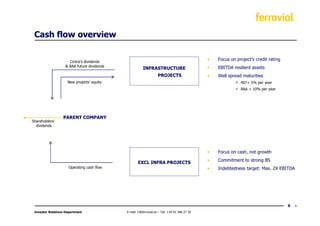

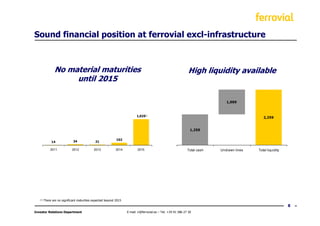

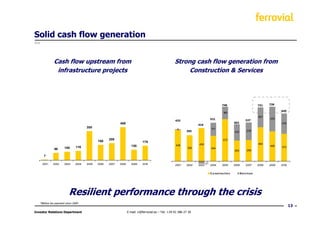

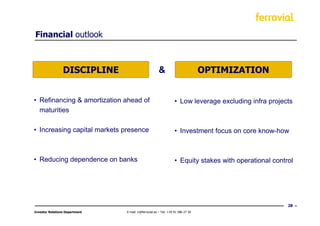

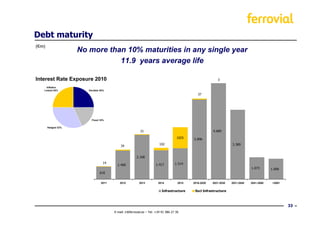

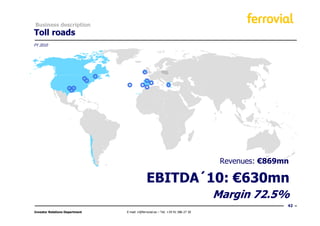

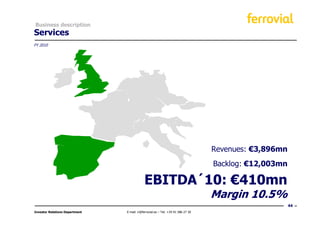

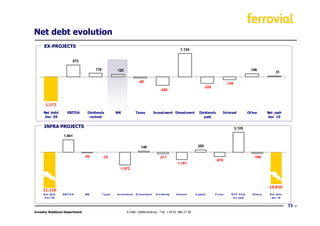

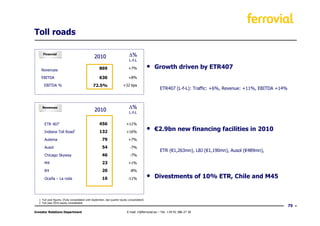

- The outlook is for resilient earnings from infrastructure assets with well-spread debt maturities, while excluding infrastructure projects the focus is on operating cash flow and a net cash position with maximum debt targets.

- Ferrovial has been reducing debt levels over time outside of its infrastructure projects.