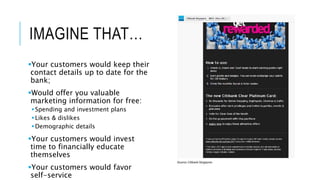

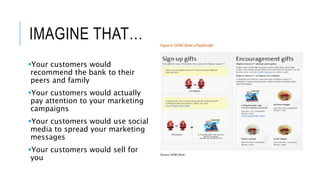

The document discusses the concept of gamification in banking, emphasizing its potential to enhance customer engagement and alter behaviors by leveraging people's natural affinity for play. It cites various examples of banks and brands successfully implementing gamification strategies to achieve business objectives. The document also outlines a six-step process for successfully gamifying services, aligning gameplay with customers' needs and objectives.