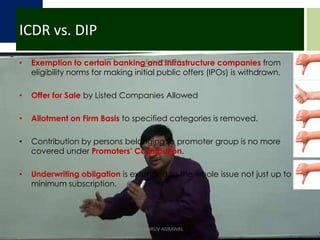

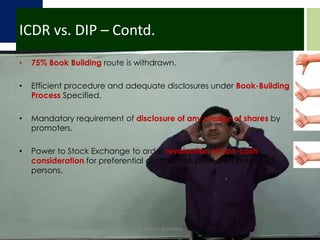

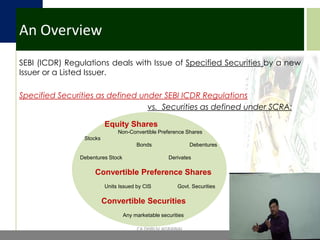

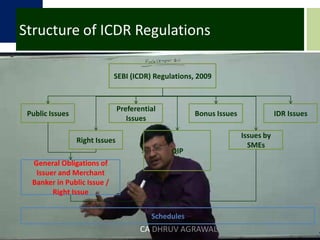

The document discusses the SEBI (ICDR) Regulations 2009 and recent amendments relating to issue management. It provides an overview of the key aspects regulated by the ICDR regulations including specified securities, structure of regulations, issues not regulated, and eligibility requirements for public issues. Recent amendments are highlighted including changes to preferential issues, QIP, book building process and minimum listing requirements. Key considerations for different types of public issues such as pricing, allocation and lock-ins are also summarized.

![What ICDR does not RegulatePublic Issue of Debt Securities(Regulated by SEBI (Issue and Listing of Debt Securities) Regulations 2008)Issue of ADRs / GDRs(Regulated by RBI FCCBs and Ordinary Shares [Through Depository Receipt Mechanism] Scheme, 1993 )Issue of FCCBs(Regulated by RBI FCCBs and Ordinary Shares [Through Depository Receipt Mechanism] Scheme, 1993 Issue of shares pursuant to ESOPs(Regulated by SEBI (Employee Stock Option Plan and Employee Stock Purchase Scheme) Guidelines, 1999)CA DHRUV AGRAWAL](https://image.slidesharecdn.com/recentamendementsinicdrnirc22052010-12823120802274-phpapp02-110622115915-phpapp02/85/SEBI-ICDR-GUIDELINES-4-320.jpg)