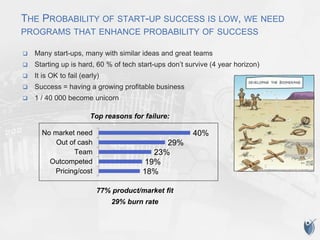

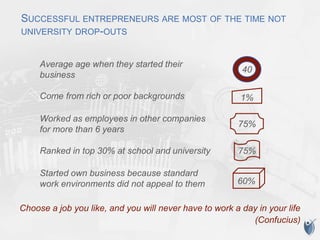

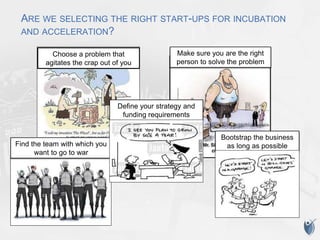

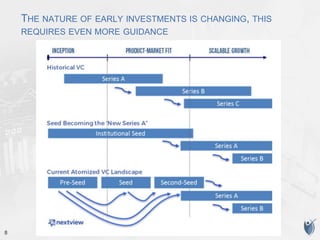

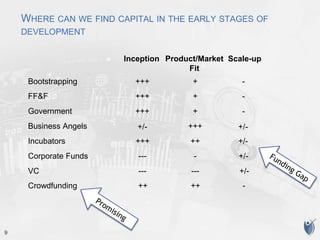

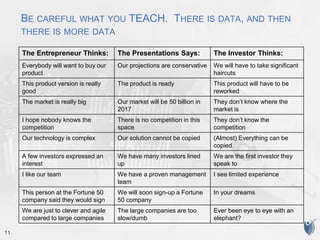

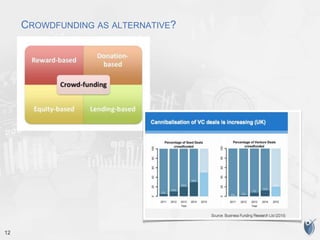

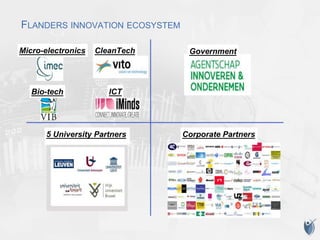

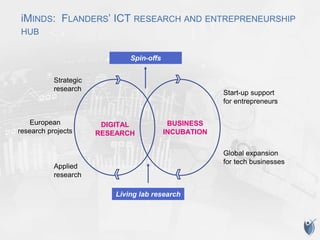

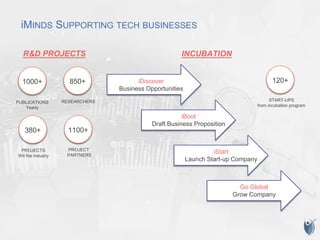

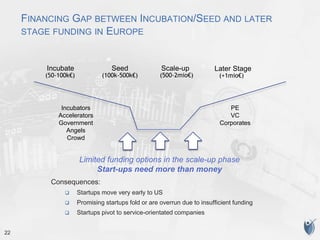

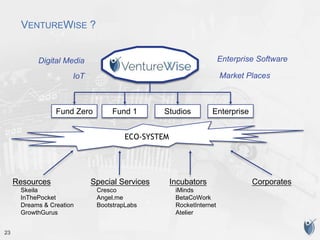

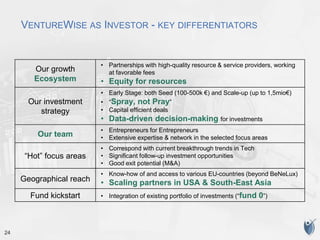

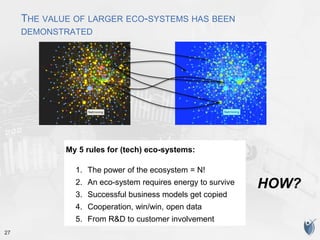

Jan Vorstermans discusses funding and ecosystems for ICT startups. He outlines his background and experience founding startups and investing. The probability of startup success is low, so programs are needed to enhance success rates. However, successful entrepreneurs are often not university dropouts but have work experience. When selecting startups for incubation and acceleration, the right problems and teams must be chosen. External investment is not always needed but provides validation and risk/reward sharing. Crowdfunding is an alternative source of early funding that is growing. iMinds supports tech businesses in Flanders through incubation, research projects, and global expansion support. VentureWise aims to fill financing gaps for startups between incubation and later funding stages through their