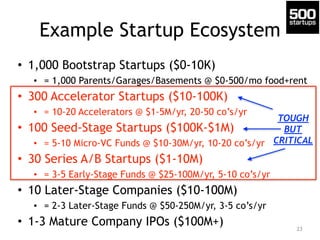

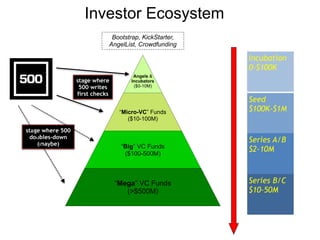

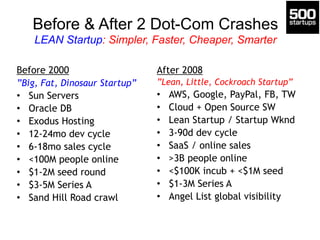

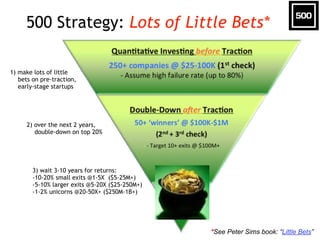

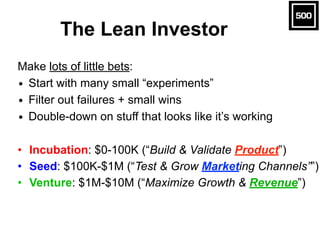

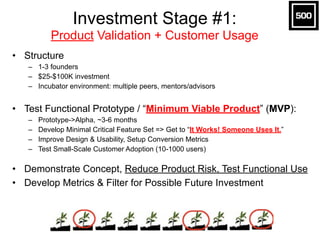

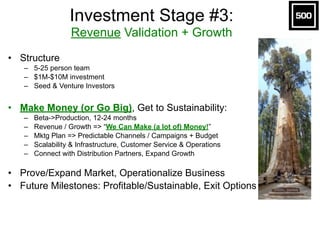

The document discusses changes in building technology startups and venture capital investing. It notes that startups now require less capital to build products and reach customers due to cloud infrastructure and online platforms. Venture capital has also changed with the rise of seed funds, accelerators, and global funding opportunities. The document advocates for a portfolio approach of making many small bets on startups, expecting most to fail but a few to have outsized returns. It outlines stages of investing from product validation to revenue growth. Finally, it discusses how startup ecosystems develop through factors like capital, talent, and successful exits that inspire future entrepreneurs.

![[ This Talk ]

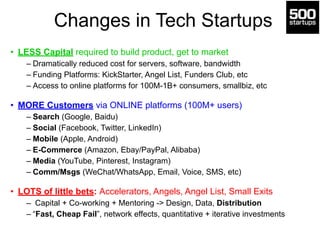

• Changes in Building Technology Startups

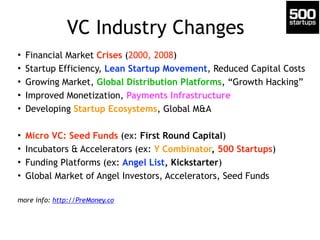

• Changes in Venture Capital Investing

• Building Startup Ecosystems](https://image.slidesharecdn.com/startup-150603201739-lva1-app6891/85/Building-Startup-Ecosystems-Berlin-June-2015-2-320.jpg)

![[ This Talk ]

• Changes in Building Technology Startups

• Changes in Venture Capital Investing

• Building Startup Ecosystems](https://image.slidesharecdn.com/startup-150603201739-lva1-app6891/85/Building-Startup-Ecosystems-Berlin-June-2015-5-320.jpg)

![Startup Founder Education

• Business Plans / Revenue Projections

• Software + Design/UX

• Lean Startups + Continuous Deploy (Iterate)

• Metrics Framework + Continuous Testing

• Functional Prototypes / Customer Development

• Scalable [Internet] Marketing & Sales

• Cash-Flow Positive Unit Economics

• Pitching + Fundraising (Angel List)

• Monetization + Payments

• Customer Service + Support

9](https://image.slidesharecdn.com/startup-150603201739-lva1-app6891/85/Building-Startup-Ecosystems-Berlin-June-2015-9-320.jpg)

![[ This Talk ]

• Changes in Building Technology Startups

• Changes in Venture Capital Investing

• Building Startup Ecosystems](https://image.slidesharecdn.com/startup-150603201739-lva1-app6891/85/Building-Startup-Ecosystems-Berlin-June-2015-10-320.jpg)

![Startup Risk Reduction

Concept

Early

Customer

Usage

Scalable

Customer

Acquisition

[about to be]

Profitable

Unit

Economics

Scalable

Profitable

Business

Functional

Prototype

PRODUCT

MARKET

REVENUE

Exit?

When 500

Likes to

Invest](https://image.slidesharecdn.com/startup-150603201739-lva1-app6891/85/Building-Startup-Ecosystems-Berlin-June-2015-16-320.jpg)

![[ This Talk ]

• Changes in Building Technology Startups

• Changes in Venture Capital Investing

• Building Startup Ecosystems](https://image.slidesharecdn.com/startup-150603201739-lva1-app6891/85/Building-Startup-Ecosystems-Berlin-June-2015-21-320.jpg)