Embed presentation

Download to read offline

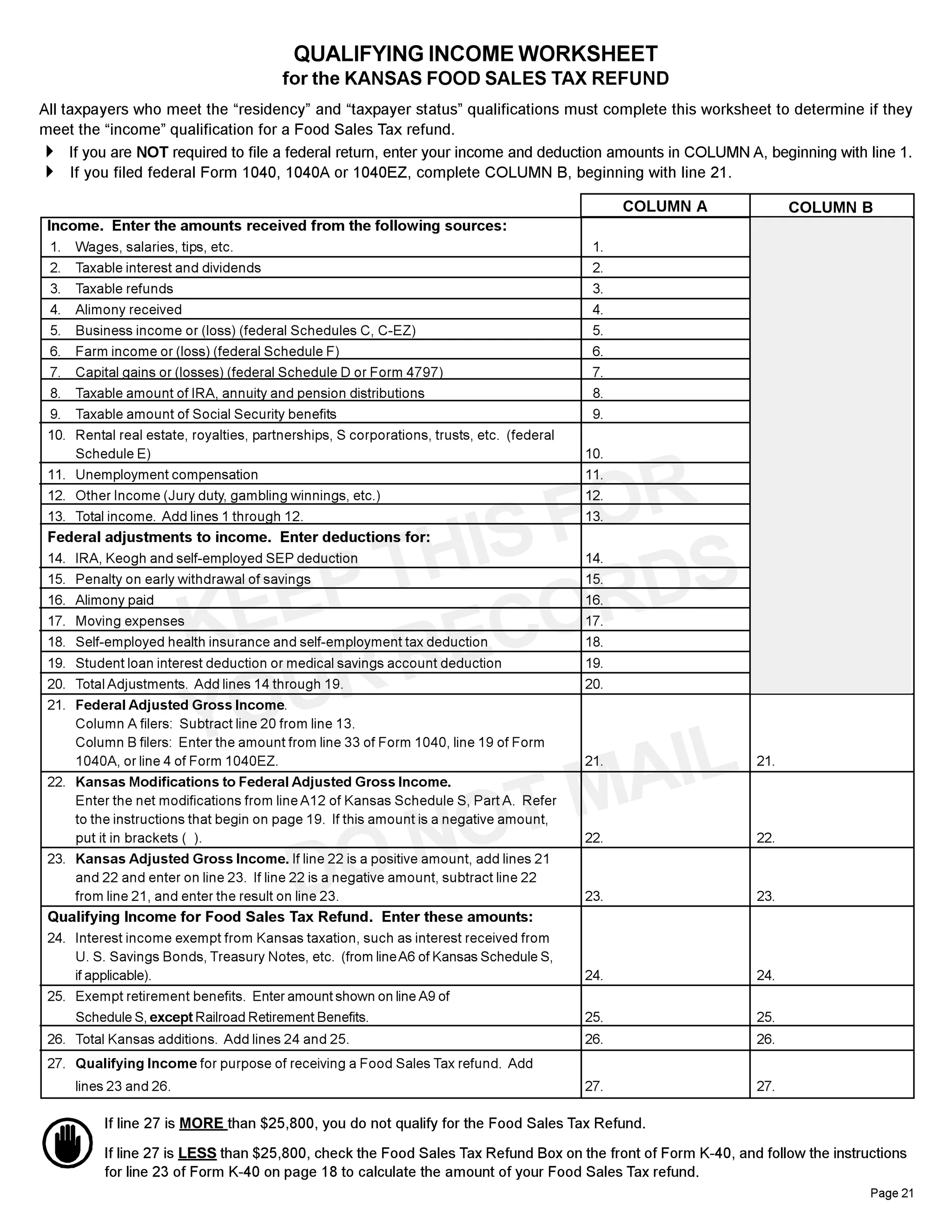

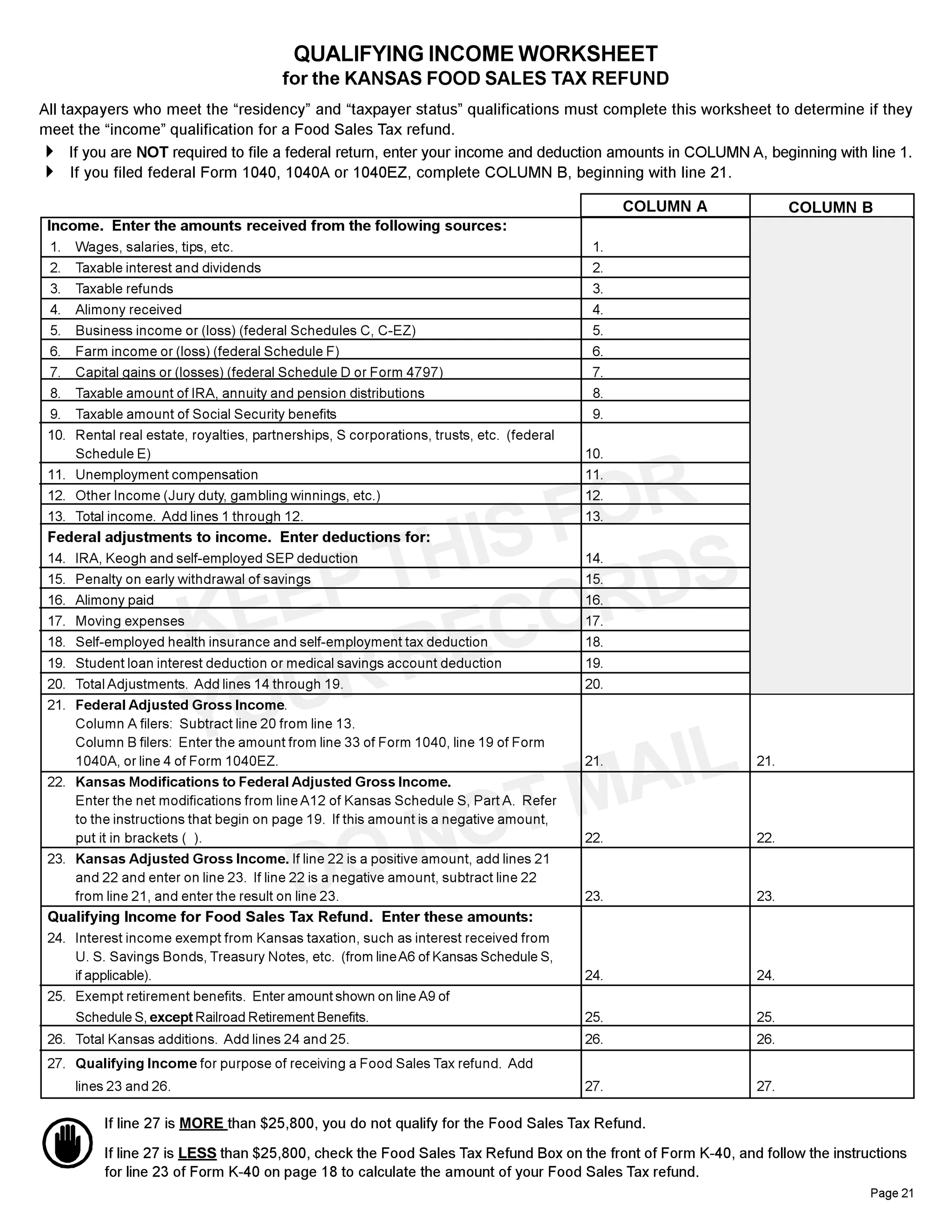

This document provides instructions for determining qualifying income for the Kansas Food Sales Tax Refund. It outlines how to complete the worksheet using either Column A for non-filers or Column B for filers. Key items to determine qualifying income include calculating federal adjusted gross income, making Kansas modifications, and adding exempt interest and retirement benefits. If the total qualifying income is less than $25,800, the taxpayer may qualify for the refund.