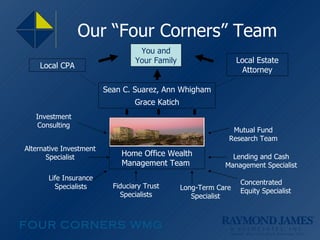

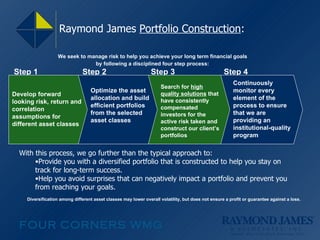

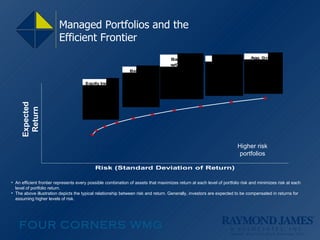

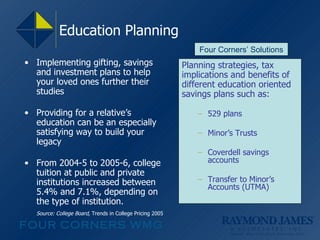

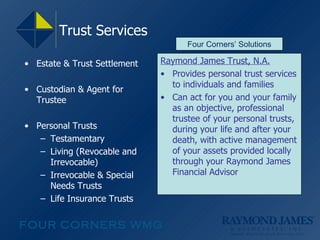

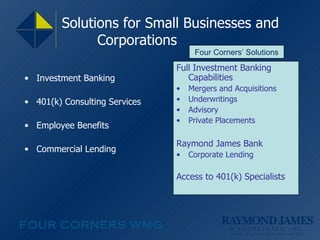

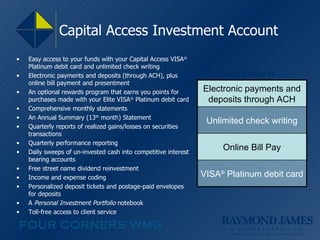

The document summarizes the services provided by Four Corners Wealth Management Group, a financial advisory firm affiliated with Raymond James. It outlines their team-based "Four Corners" process for wealth management which includes discovery of a client's goals, design of a customized plan, implementation of solutions, and ongoing monitoring. It also describes additional advisory solutions the firm offers related to areas like estate planning, education planning, insurance, and fixed income. Account features and technologies that provide clients access to their portfolio and statements are also summarized.