1) The document introduces John K. Bahr and his wealth management firm, which serves a limited number of clients through a personalized approach focused on communication, service, and education.

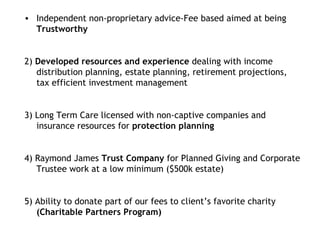

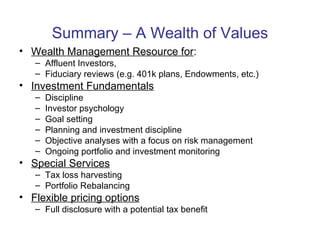

2) The firm provides a team of specialists to address clients' various financial needs, and offers services like charitable donations and investment management aimed at being trustworthy.

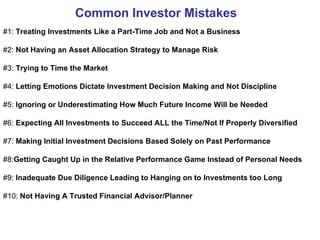

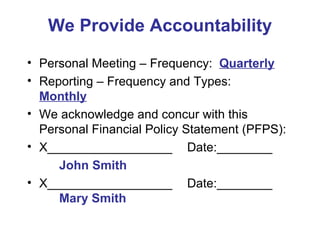

3) The document outlines common investor mistakes and emphasizes the importance of written goals, financial planning, and ongoing communication between clients and the firm.

![John K. Bahr, WMS Certified Investment Management Consultant Raymond James Private Client Group 249 E NC Hwy 54, Ste. 300 Durham, NC 27713 888-228-0931 [email_address] www.MyFamilyFoundation.org Helping People Retire Comfortably](https://image.slidesharecdn.com/RetirementPlanning-122910014161-phpapp01/85/Retirement-Planning-1-320.jpg)

![John K. Bahr, WMS Certified Investment Management Consultant Raymond James Private Client Group 249 E NC Hwy 54, Ste. 300 Durham, NC 27713 888-228-0931 [email_address]](https://image.slidesharecdn.com/RetirementPlanning-122910014161-phpapp01/85/Retirement-Planning-22-320.jpg)