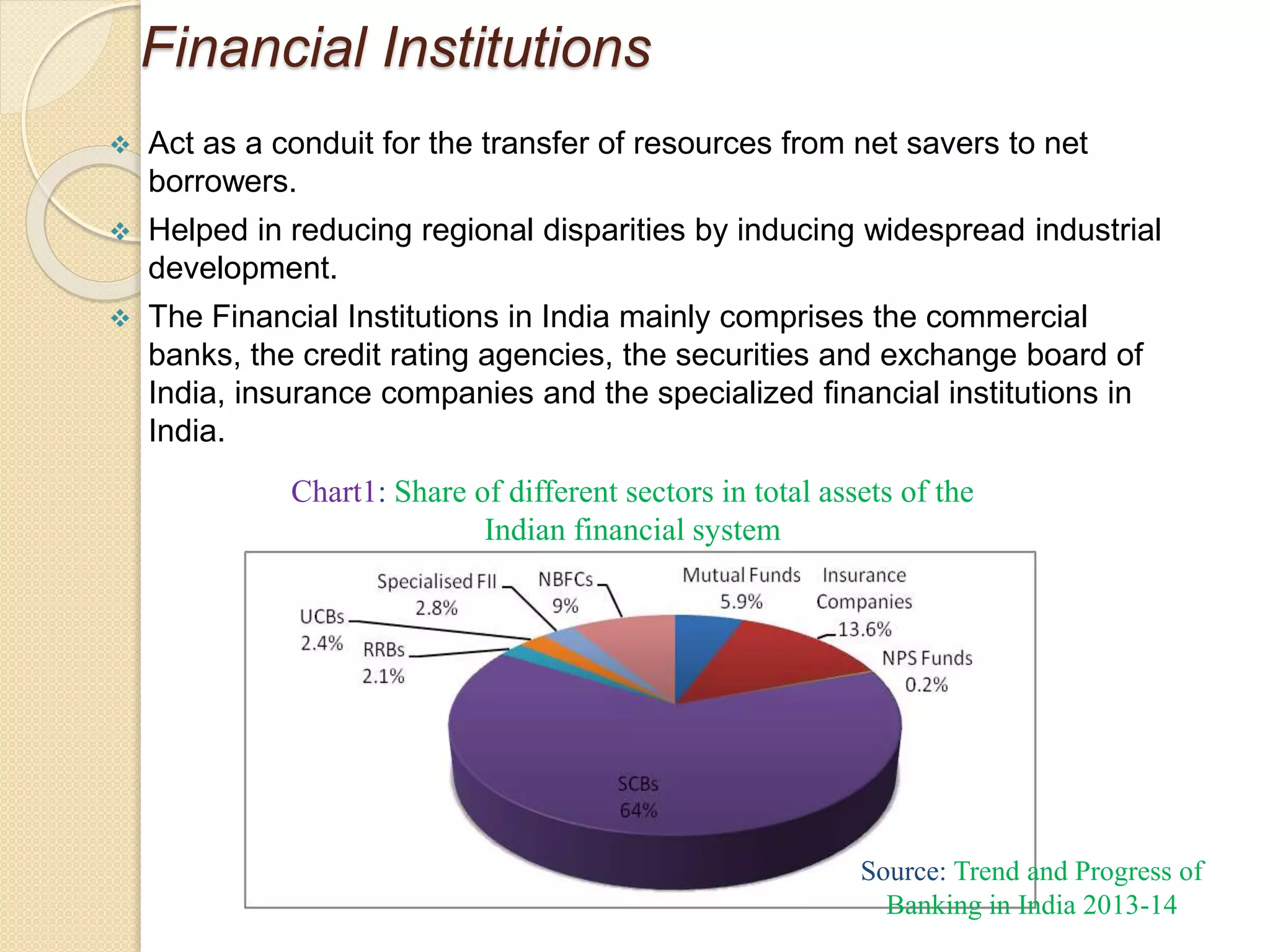

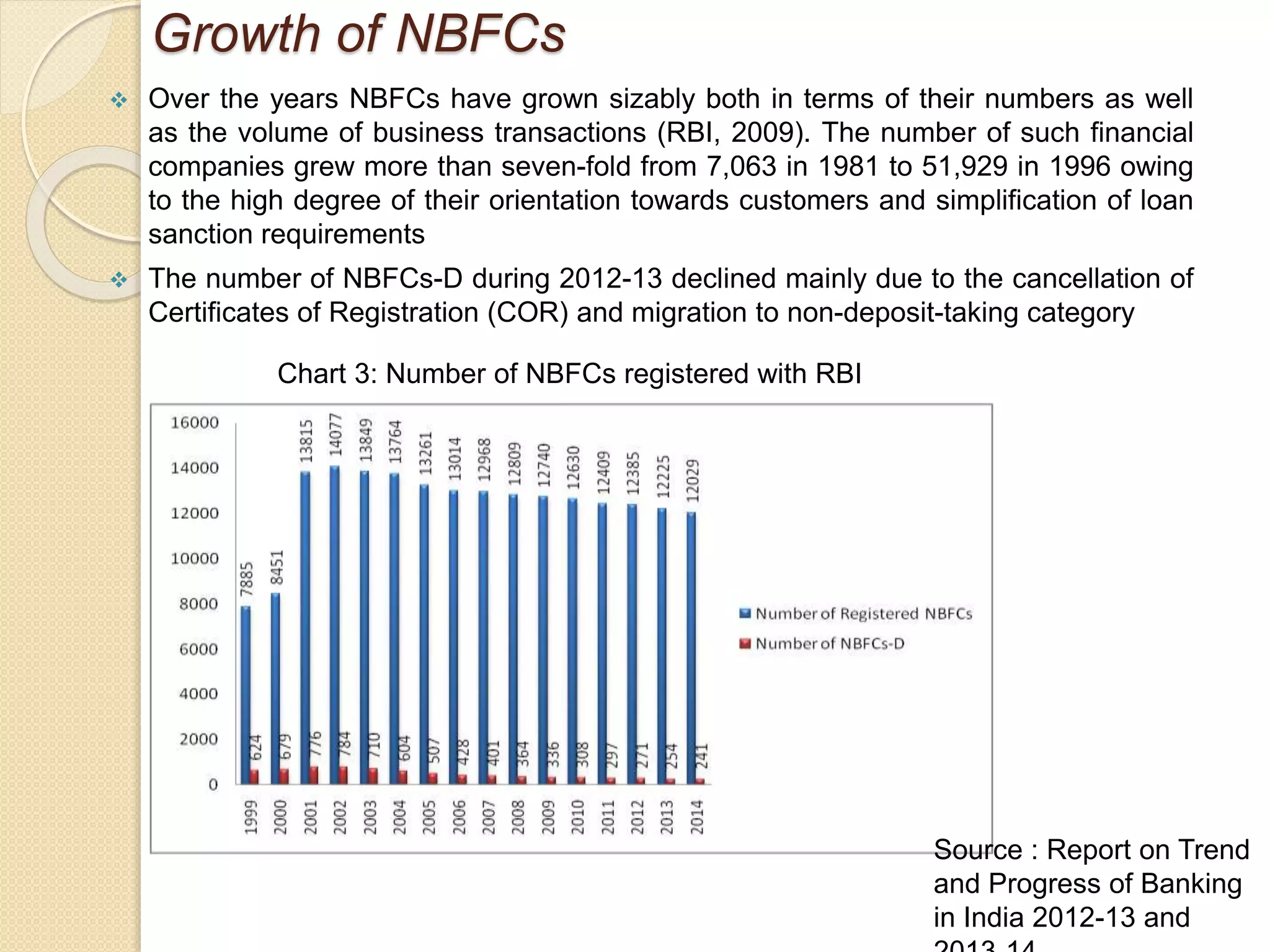

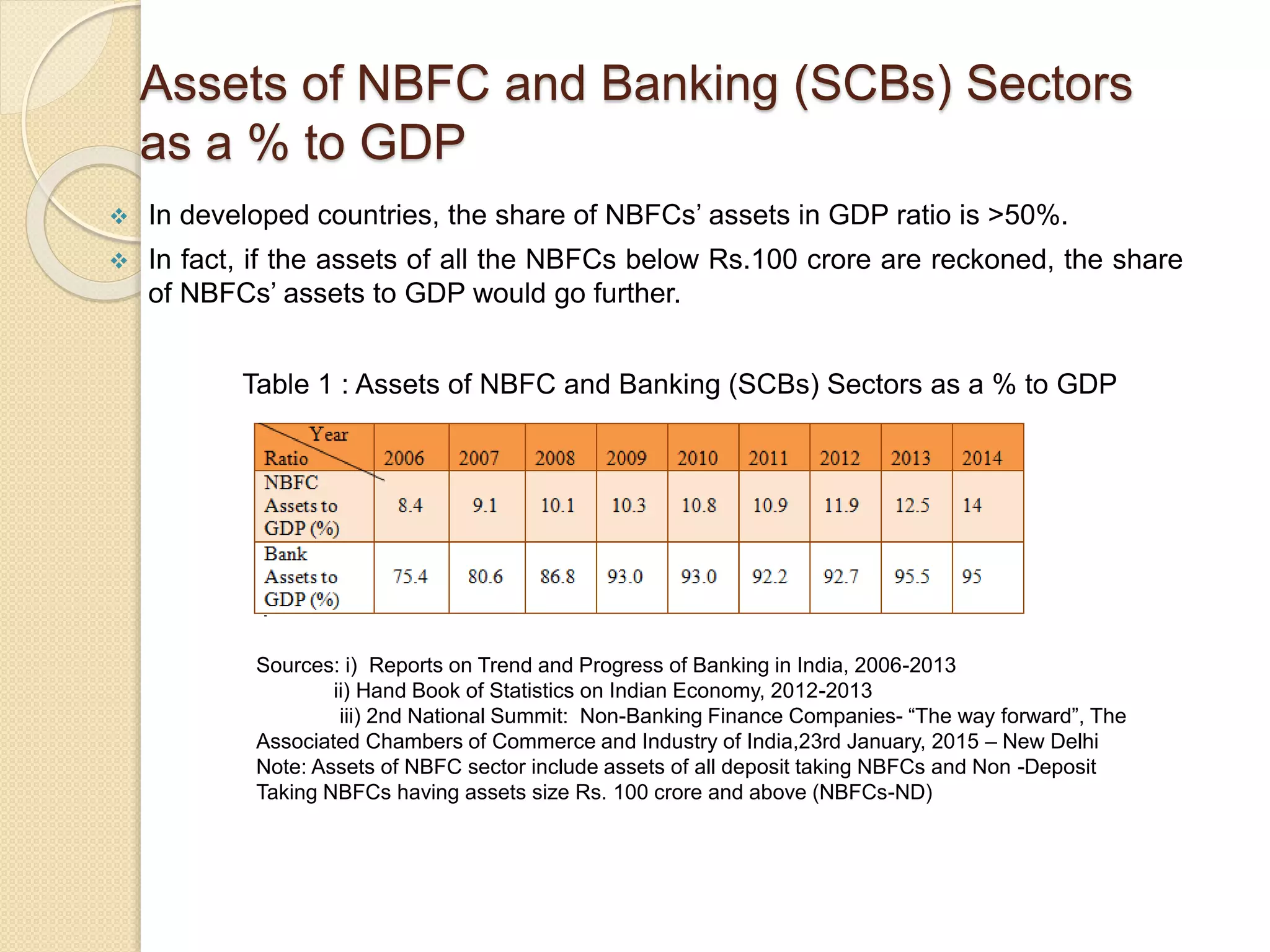

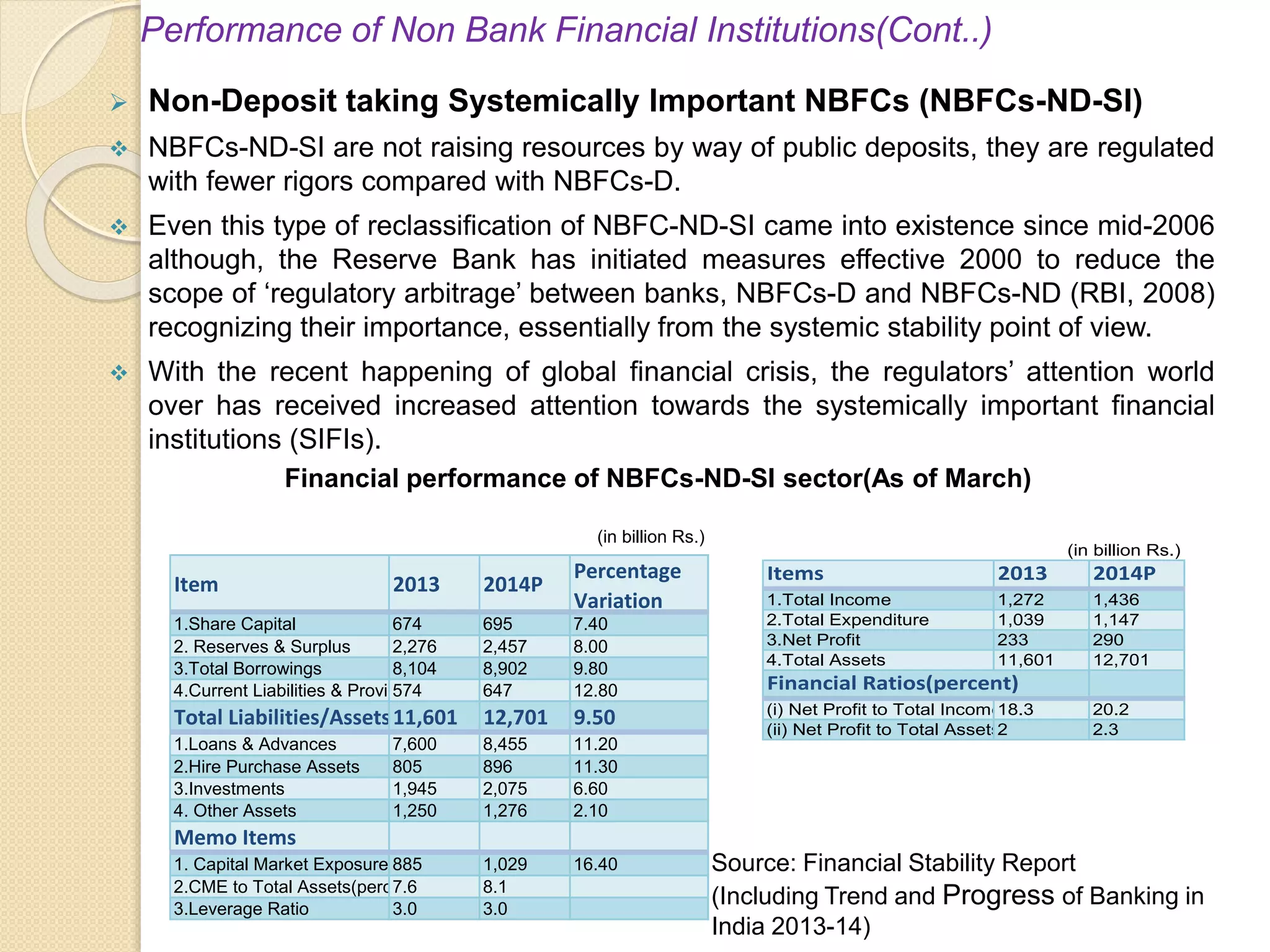

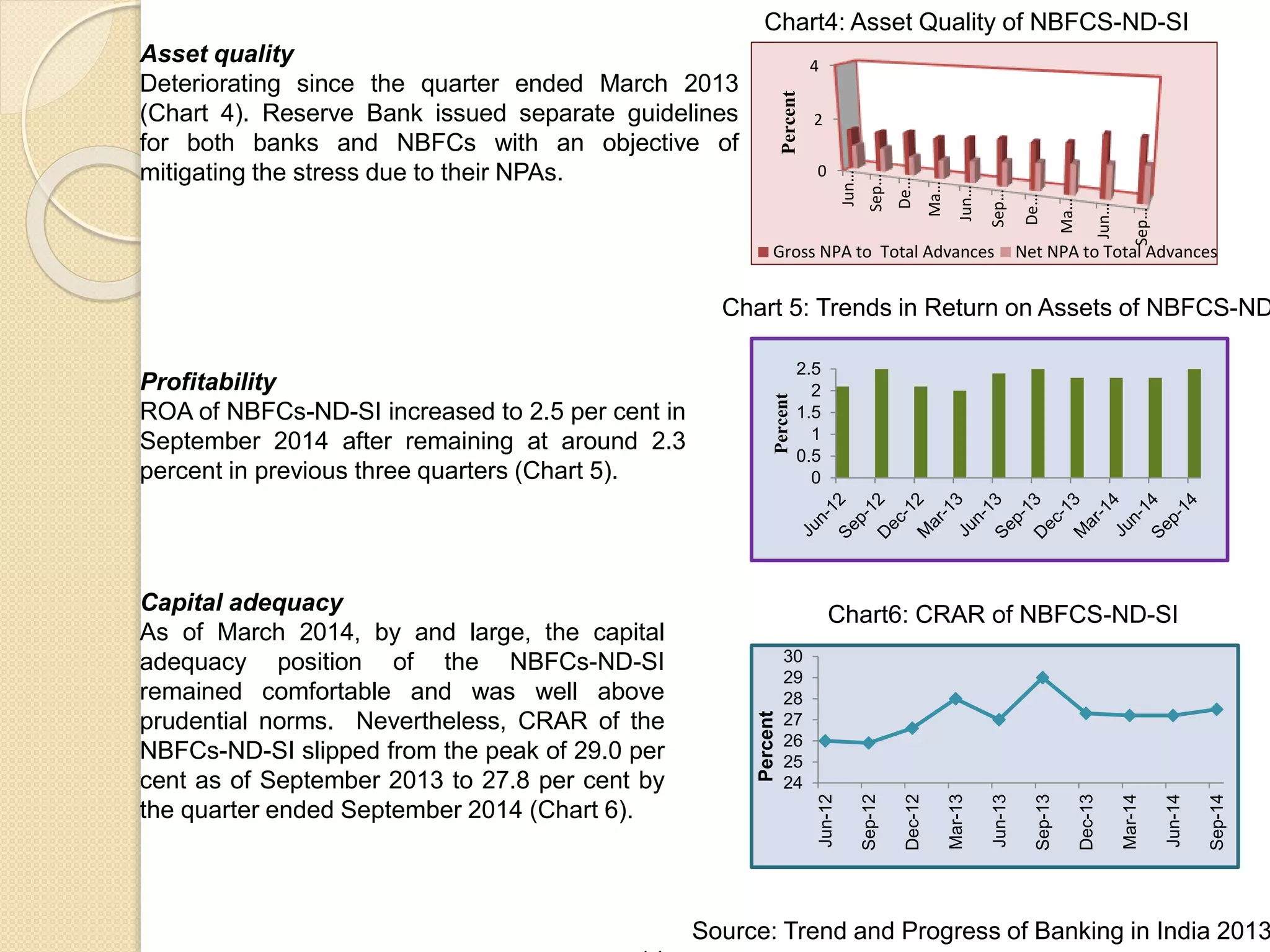

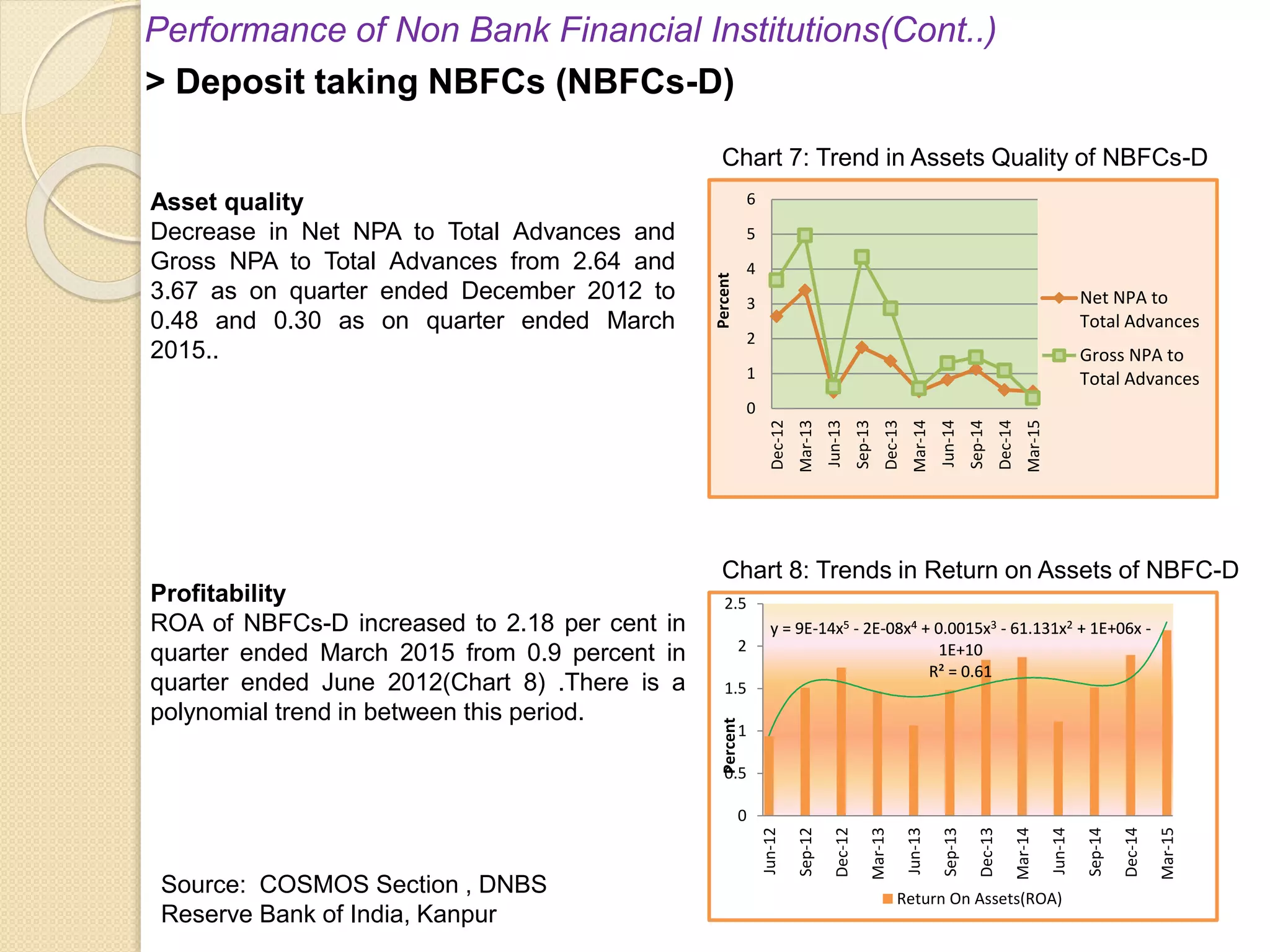

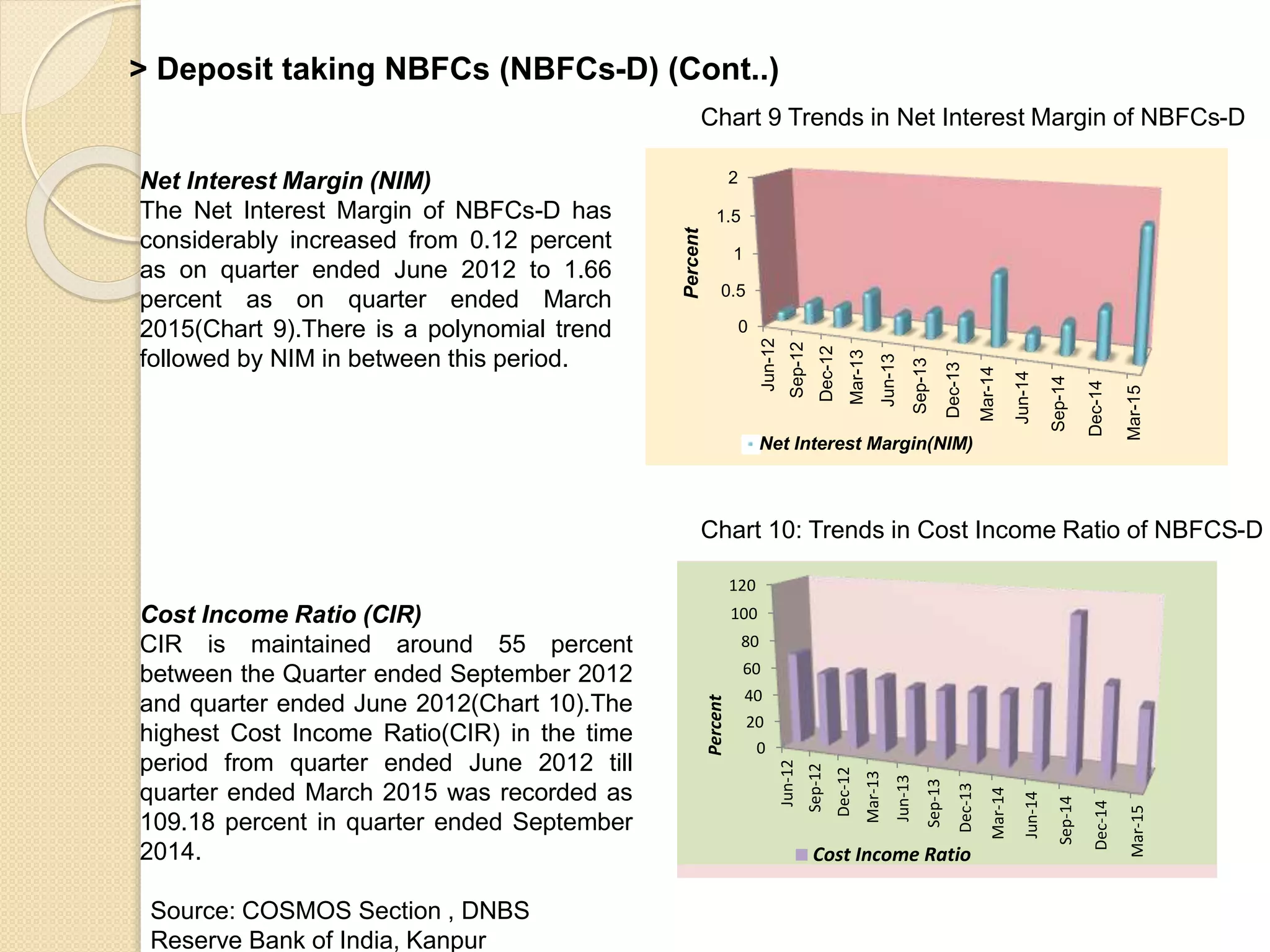

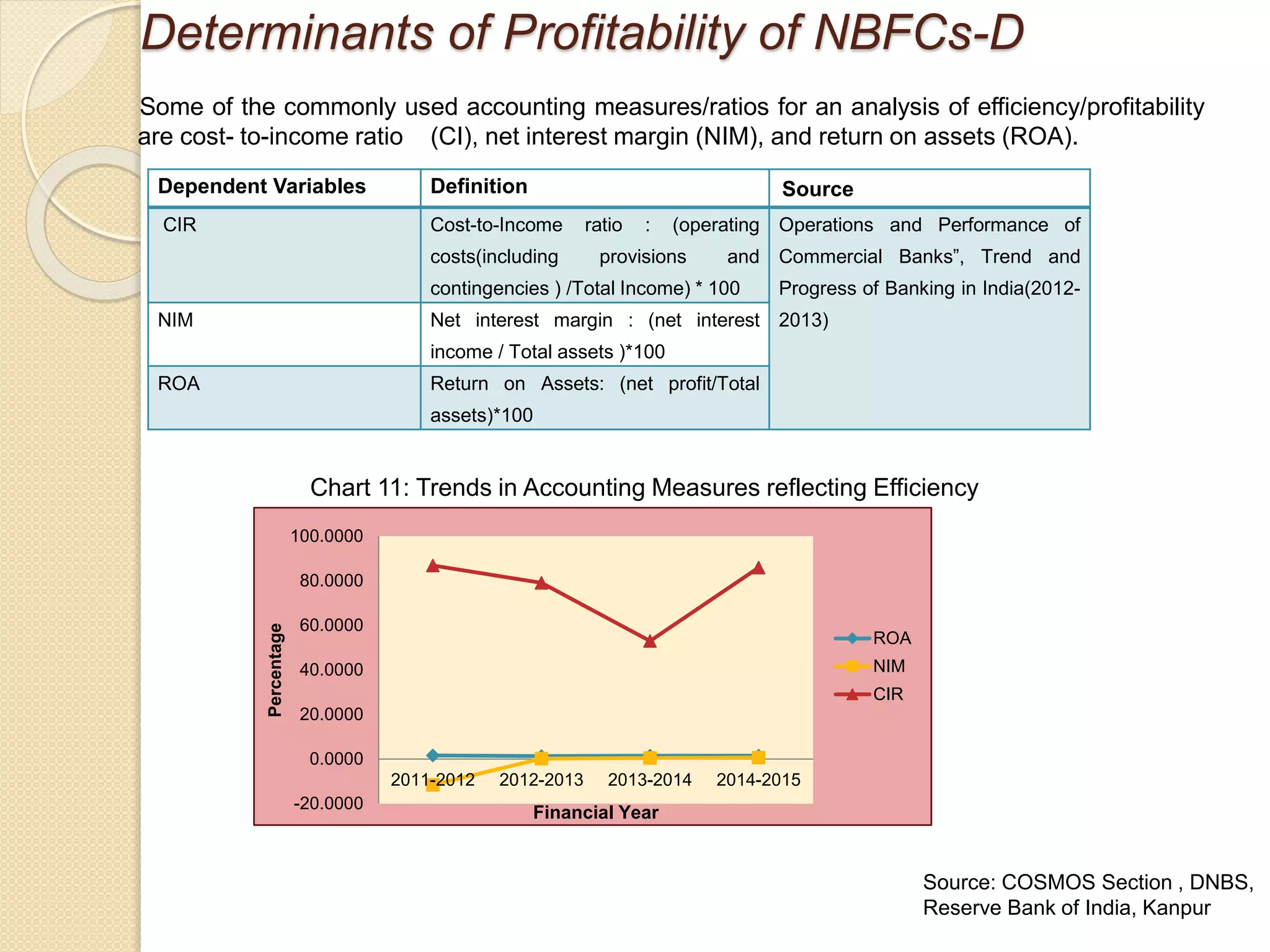

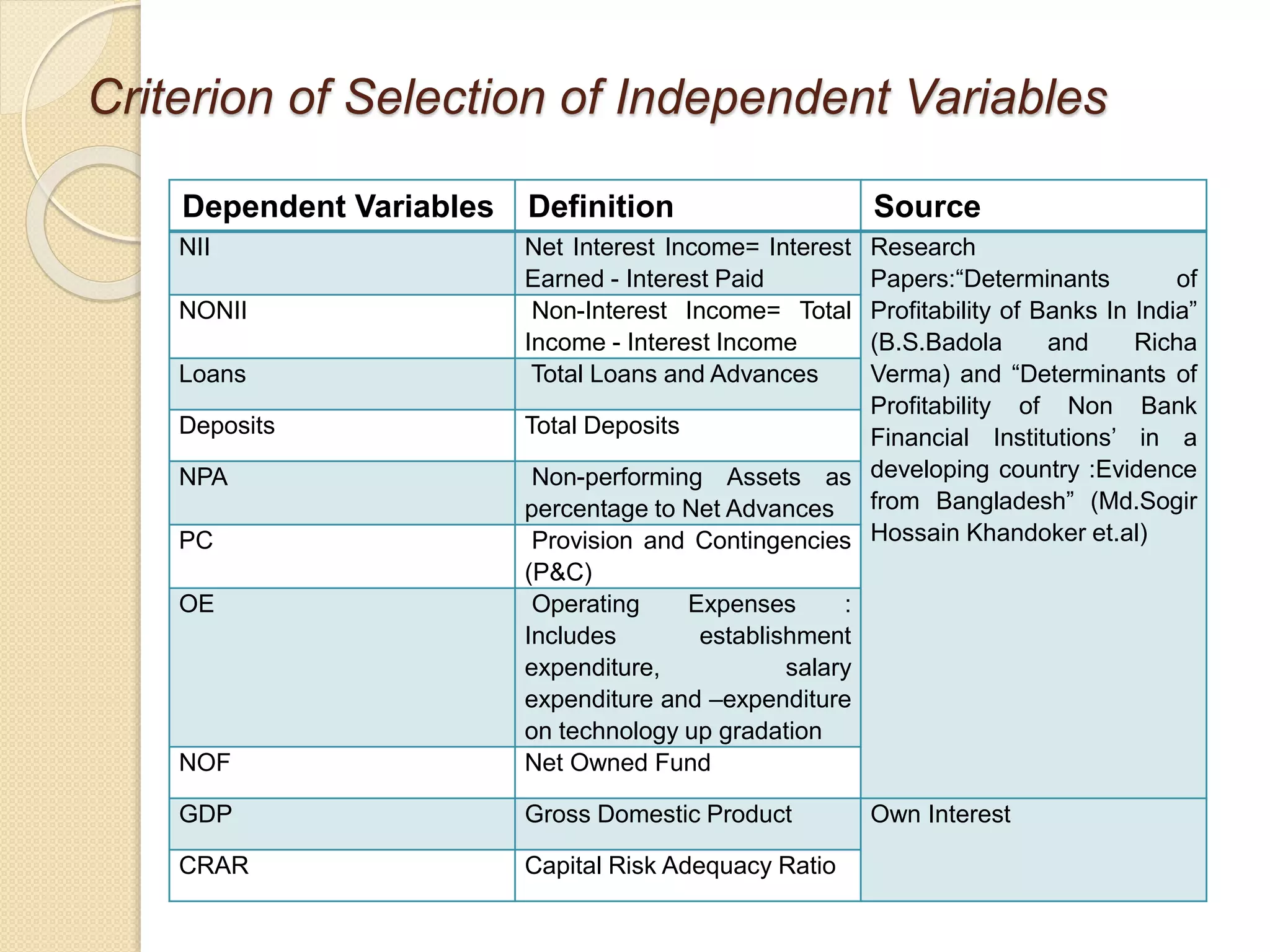

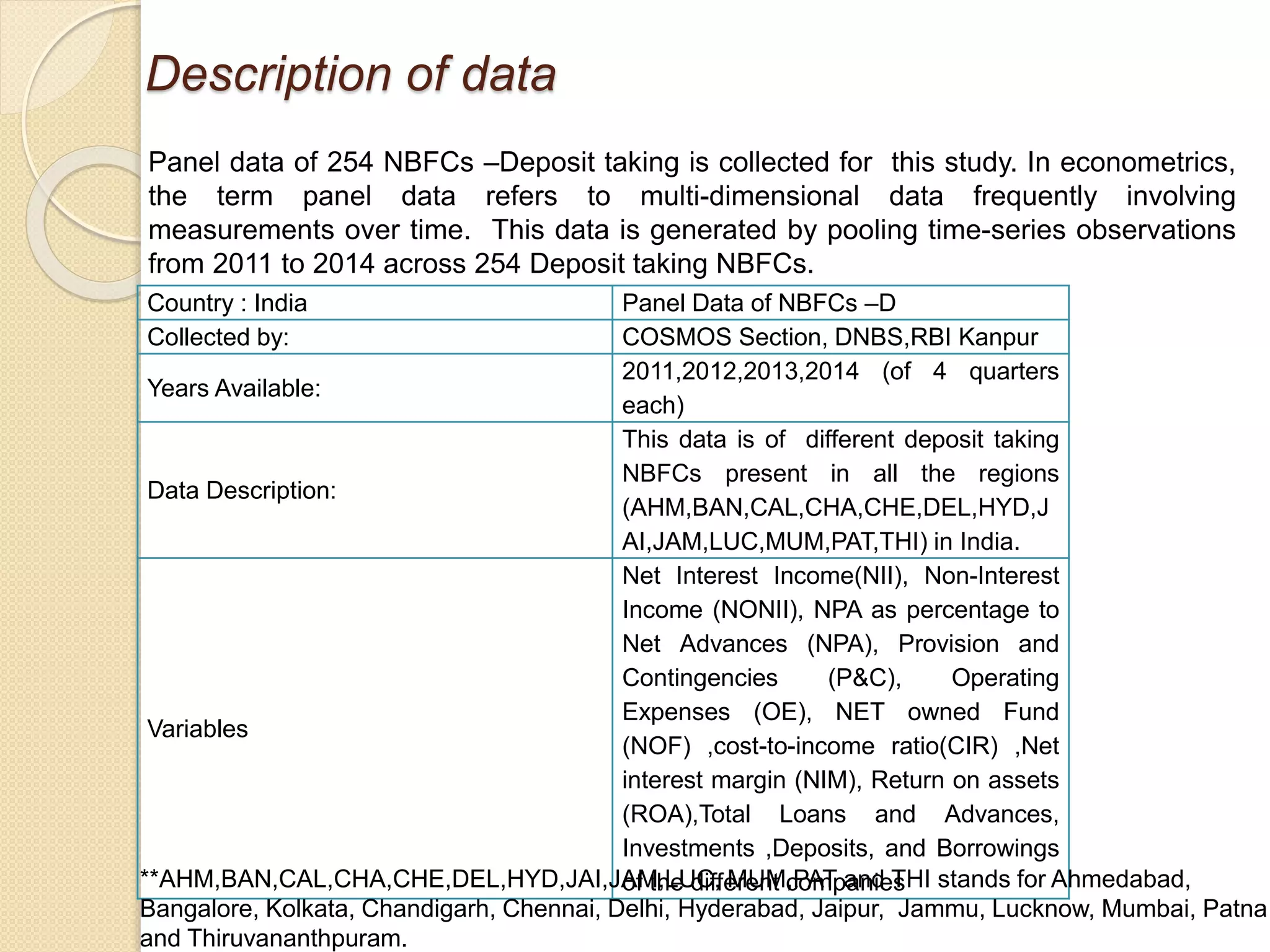

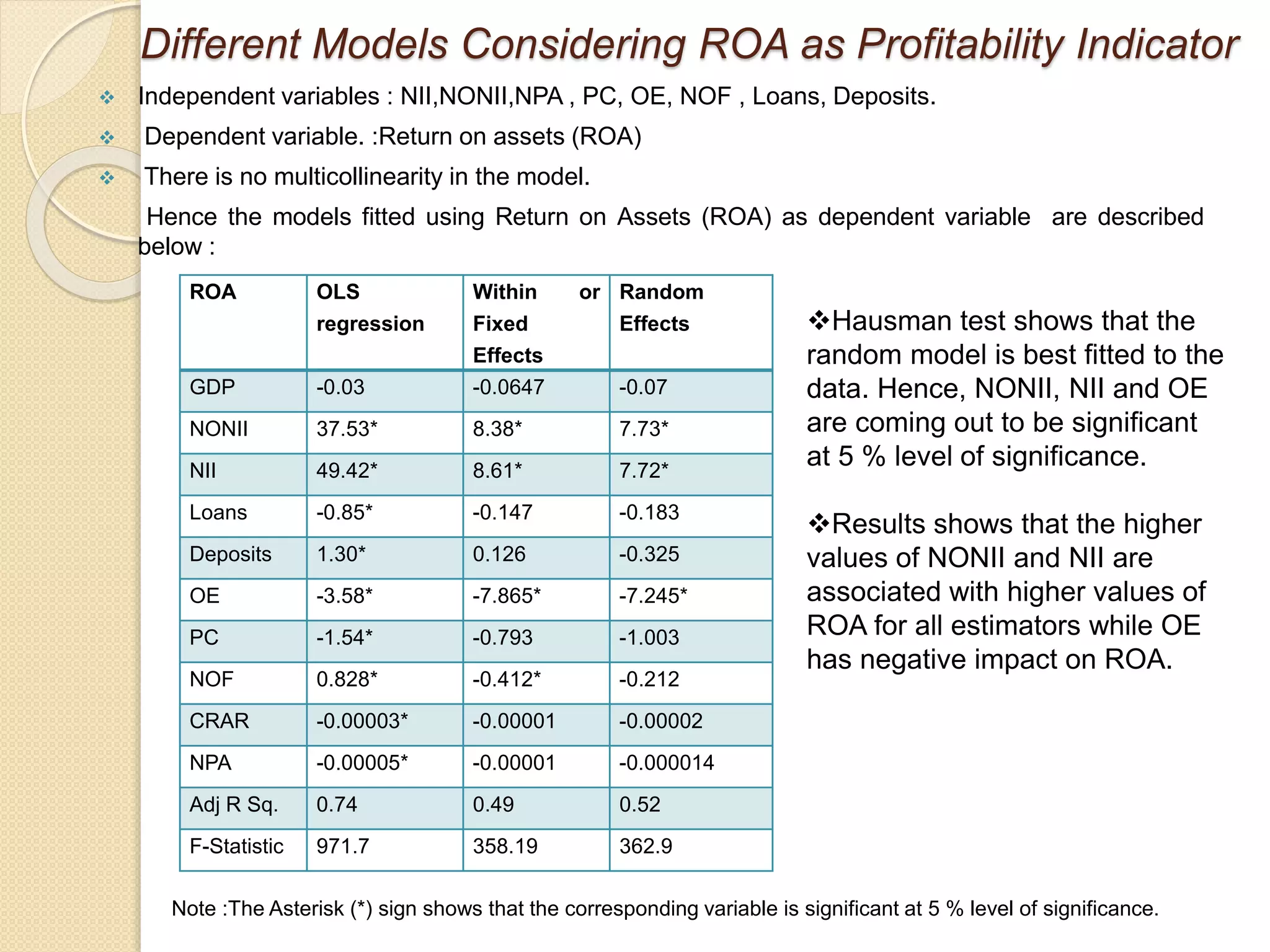

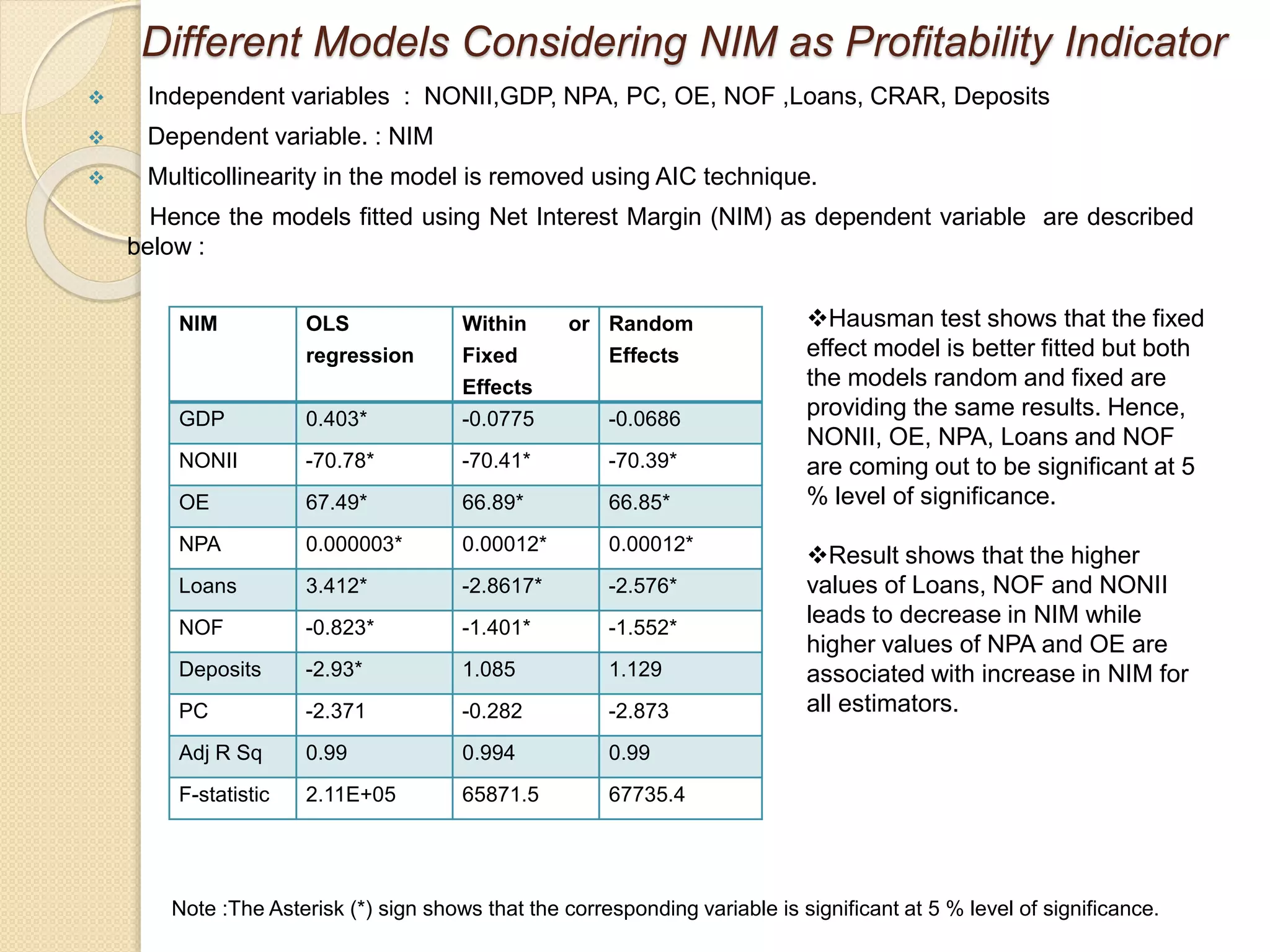

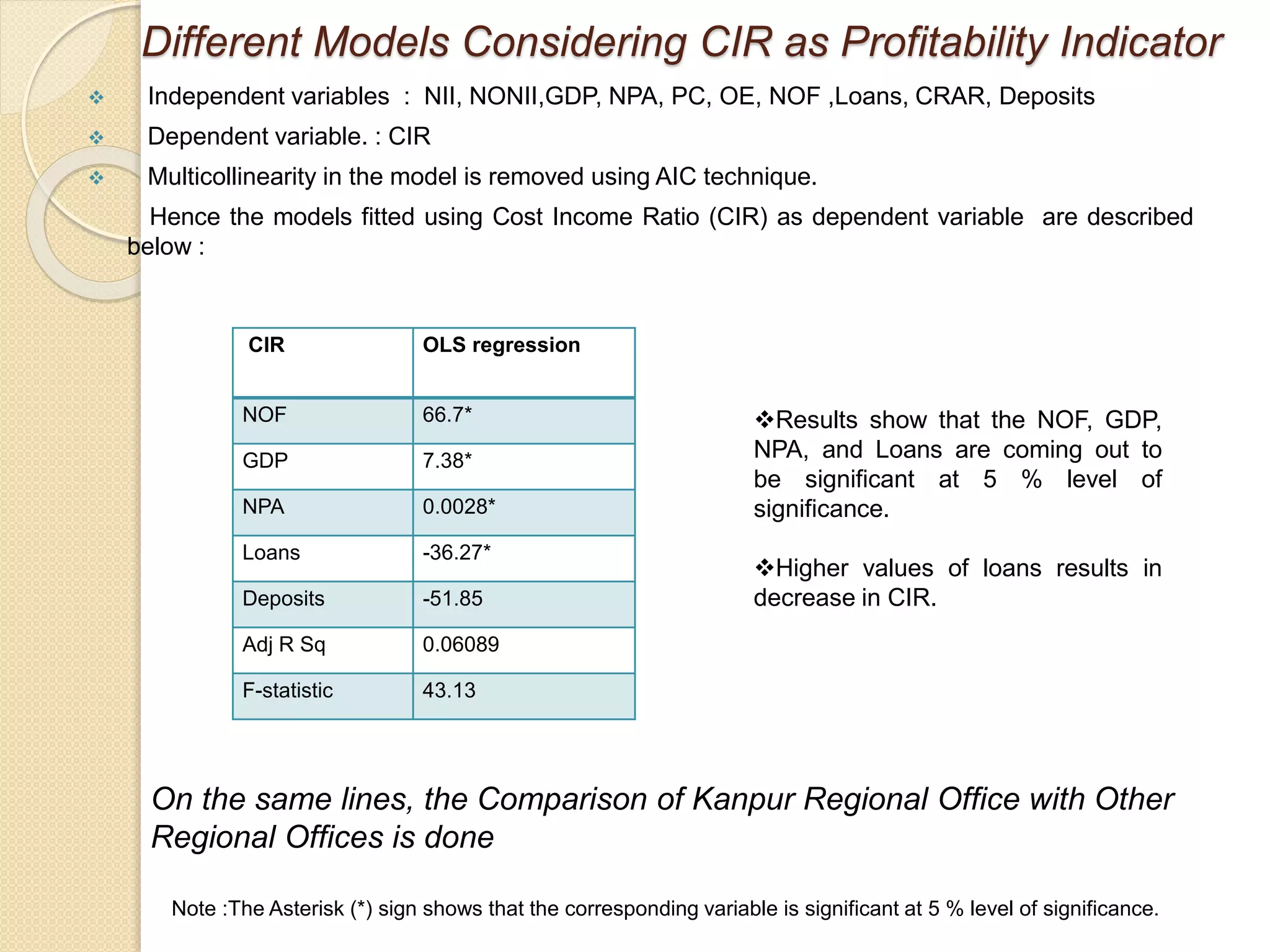

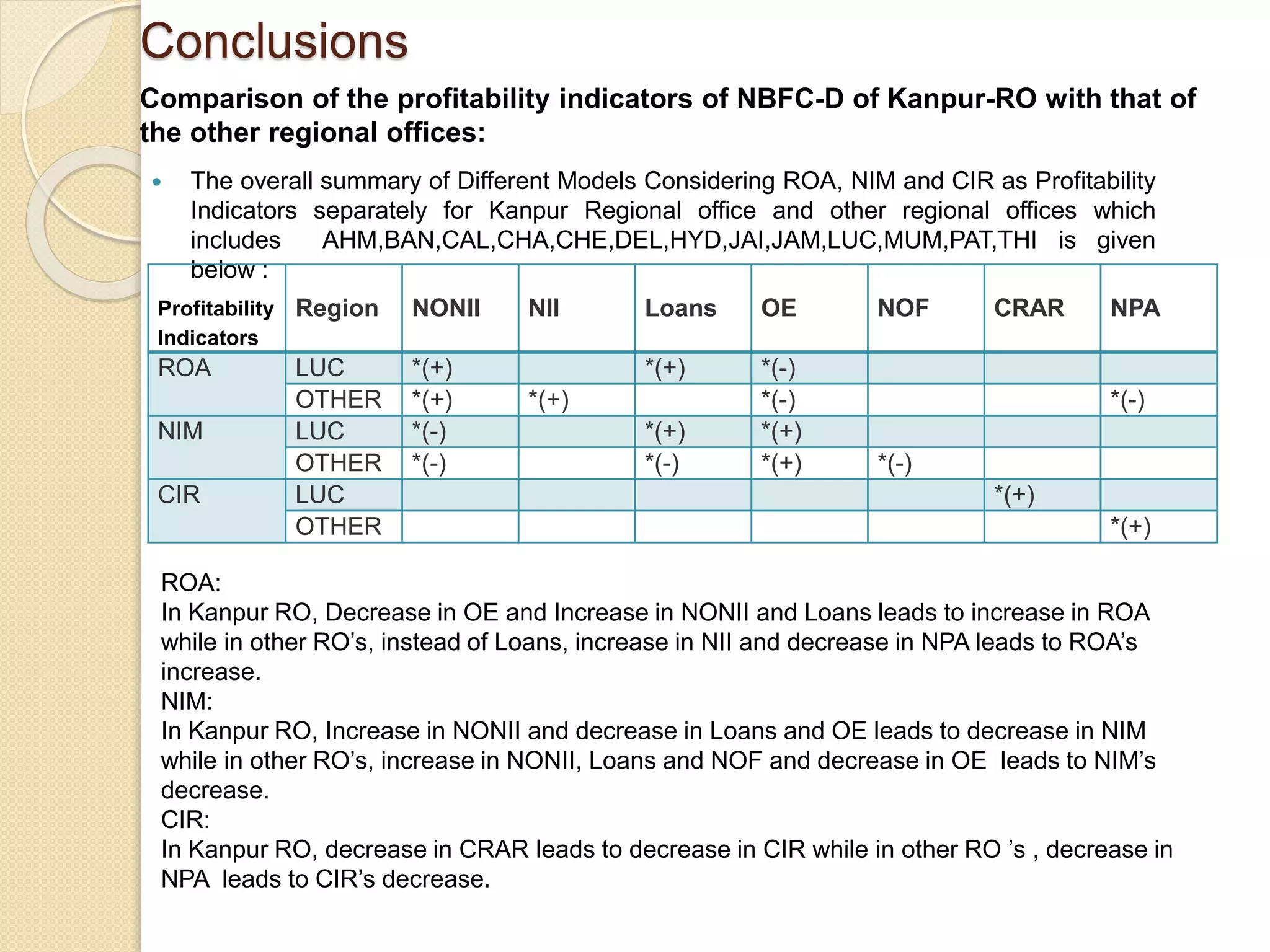

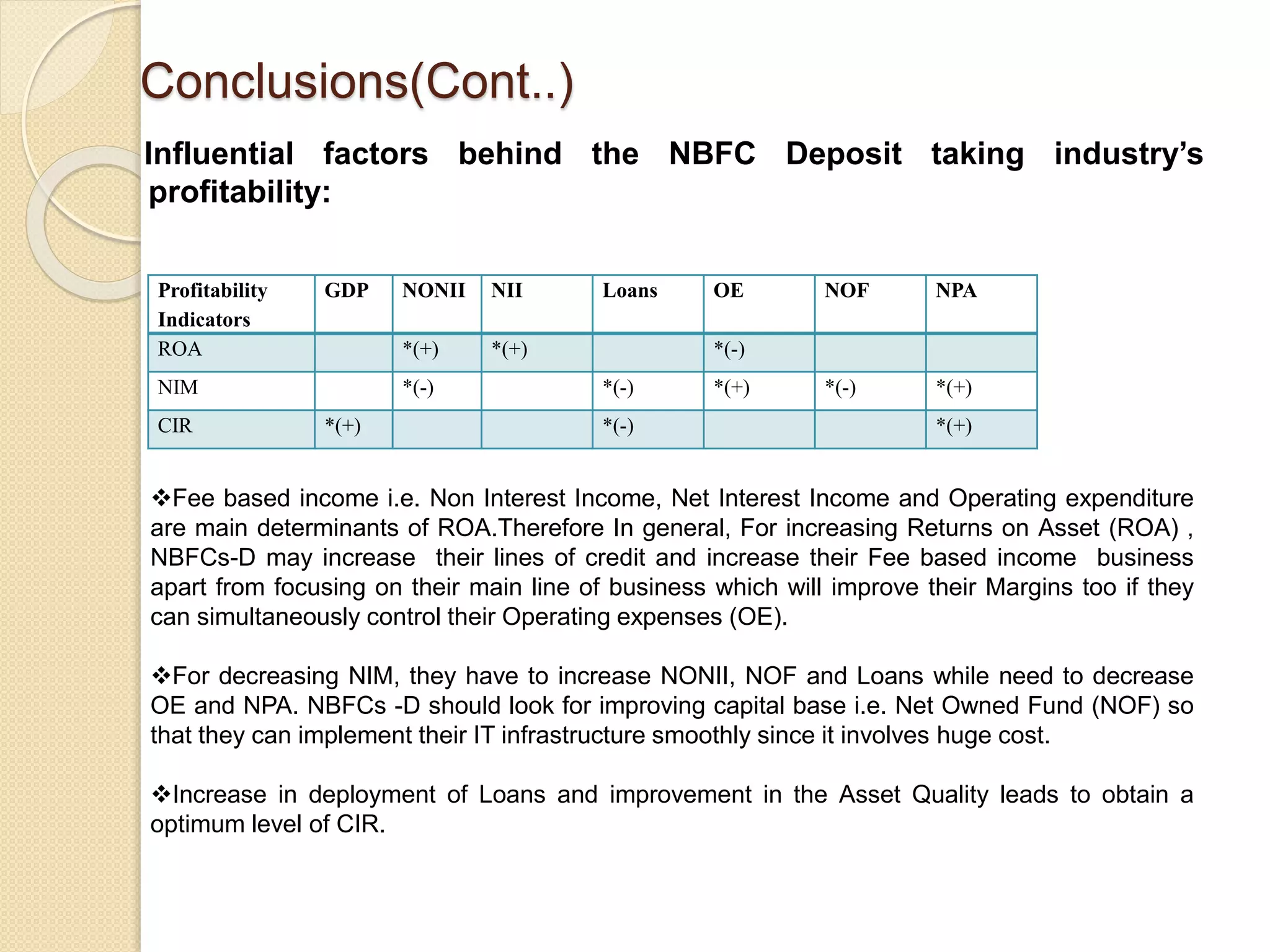

This document provides an analysis of the efficiency and profitability of Non-Banking Financial Companies (NBFCs) in India. It begins with an introduction to NBFCs and their role in the Indian financial system. It then examines the current performance of different types of NBFCs, including non-deposit taking NBFCs and deposit taking NBFCs, using various statistical techniques and financial metrics. The analysis finds that while asset quality and profitability have improved over time for most NBFCs, there is still variability in performance across different regions. Determinants of profitability for deposit-taking NBFCs are also examined.