Embed presentation

Downloaded 28 times

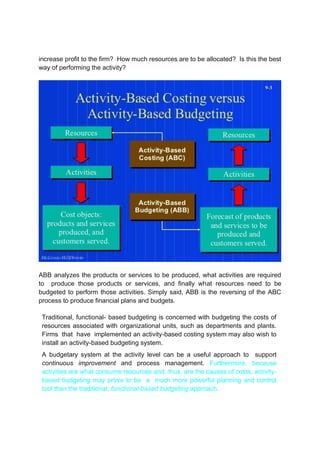

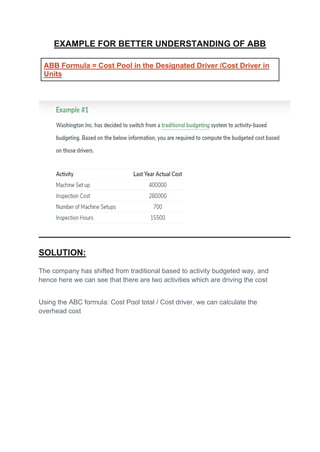

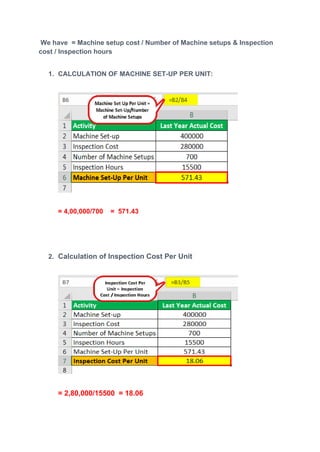

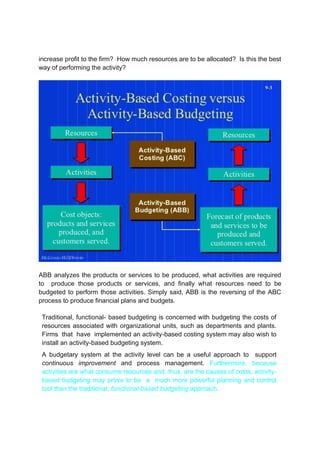

The budgeting cycle has four main phases: preparation, approval, execution, and evaluation. In the preparation phase, a budget is created by estimating expenses. The approval phase involves getting sign-off on the budget from stakeholders. During the execution phase, the approved budget is implemented by tracking spending. In the evaluation phase, the budget is reviewed and assessed to see if targets were met and inform the next budget cycle. Activity-based budgeting takes a more rigorous approach than traditional budgeting by analyzing the activities that drive costs and allocating resources based on activity levels.