Embed presentation

Download to read offline

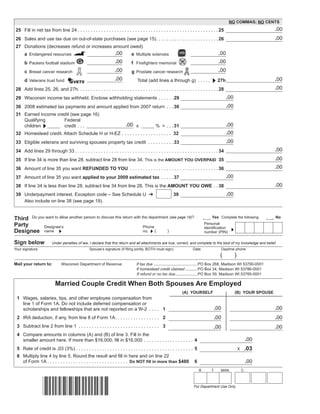

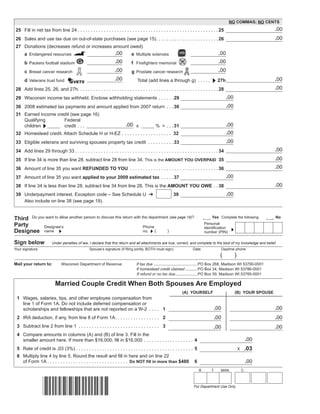

This document is a Wisconsin state income tax return form for the year 2008. It contains instructions and lines to report income, deductions, credits, tax owed or refund amount. Key details include: - The form is for an individual or married couple to file their joint return - Lines are provided to report income from wages, interest, dividends, pensions and other sources - Standard or itemized deductions can be claimed along with personal exemptions - Various tax credits can be claimed such as for property taxes paid, education expenses, or being a married couple with two incomes - The tax owed is calculated and any taxes withheld can be applied along with other credits to determine if a refund is due or additional tax