Embed presentation

Download to read offline

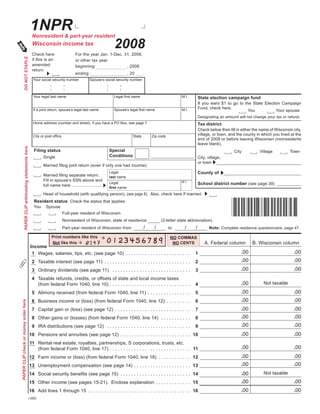

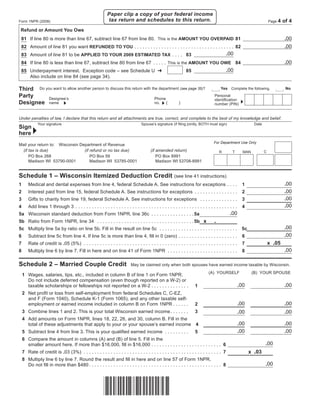

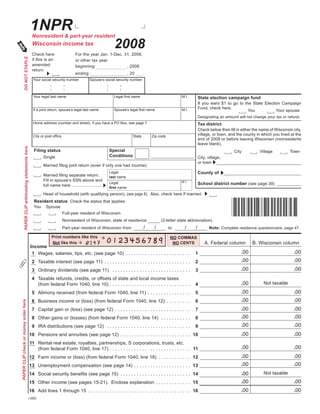

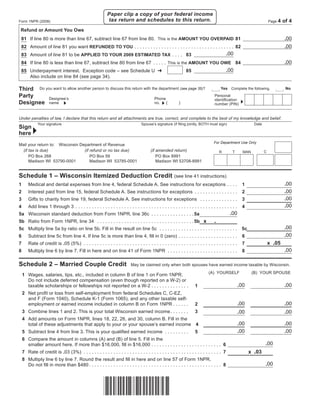

This document is a 2008 Wisconsin income tax return form for nonresidents and part-year residents. It includes sections to report income, adjustments to income, exemptions, tax credits, and calculate tax owed. Key sections include: reporting wages, business/capital gains, pensions and other income; standard/itemized deductions; personal exemptions; tax credits for rent/property taxes paid; and calculation of total tax owed taking into account applicable credits.