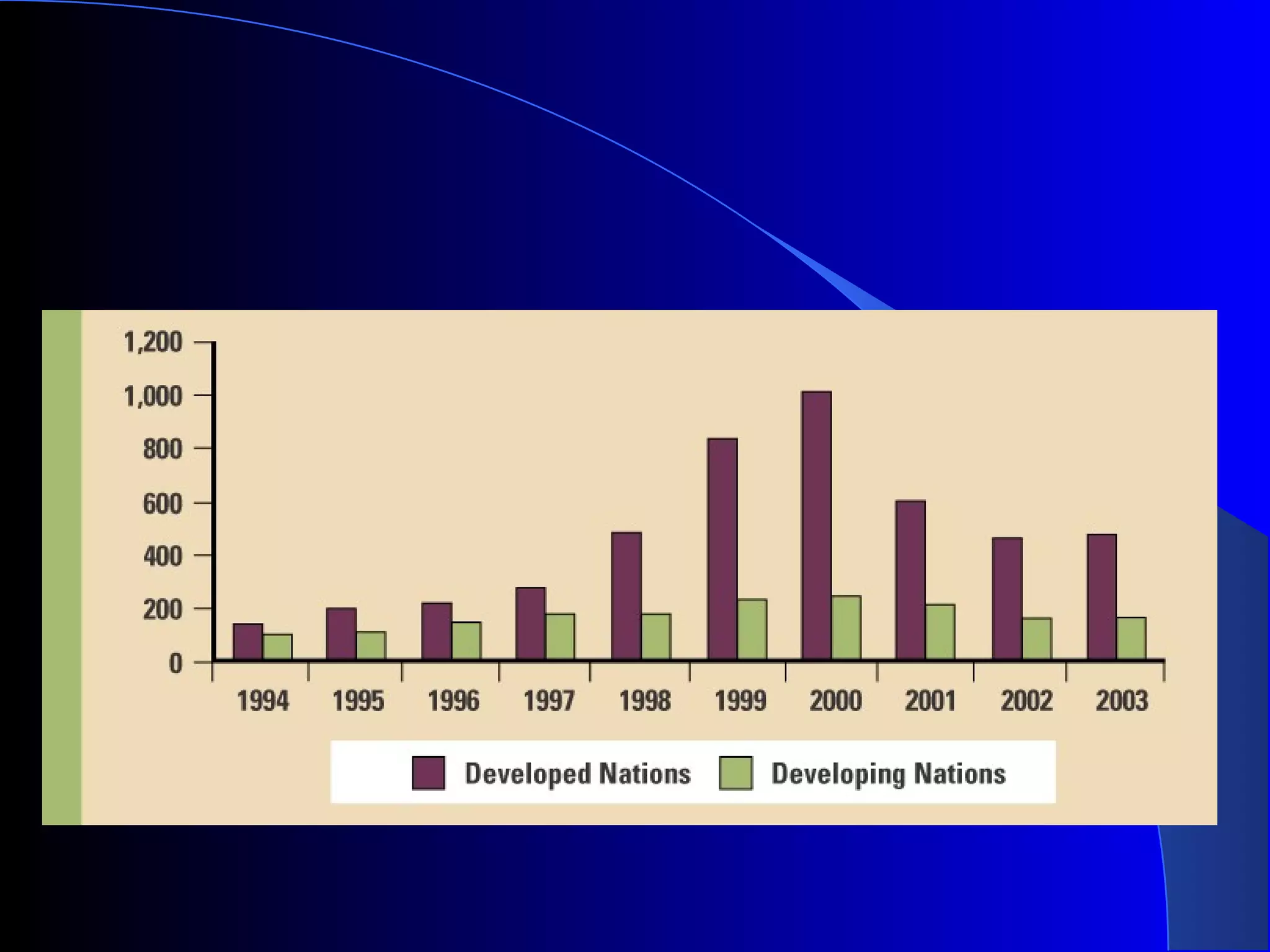

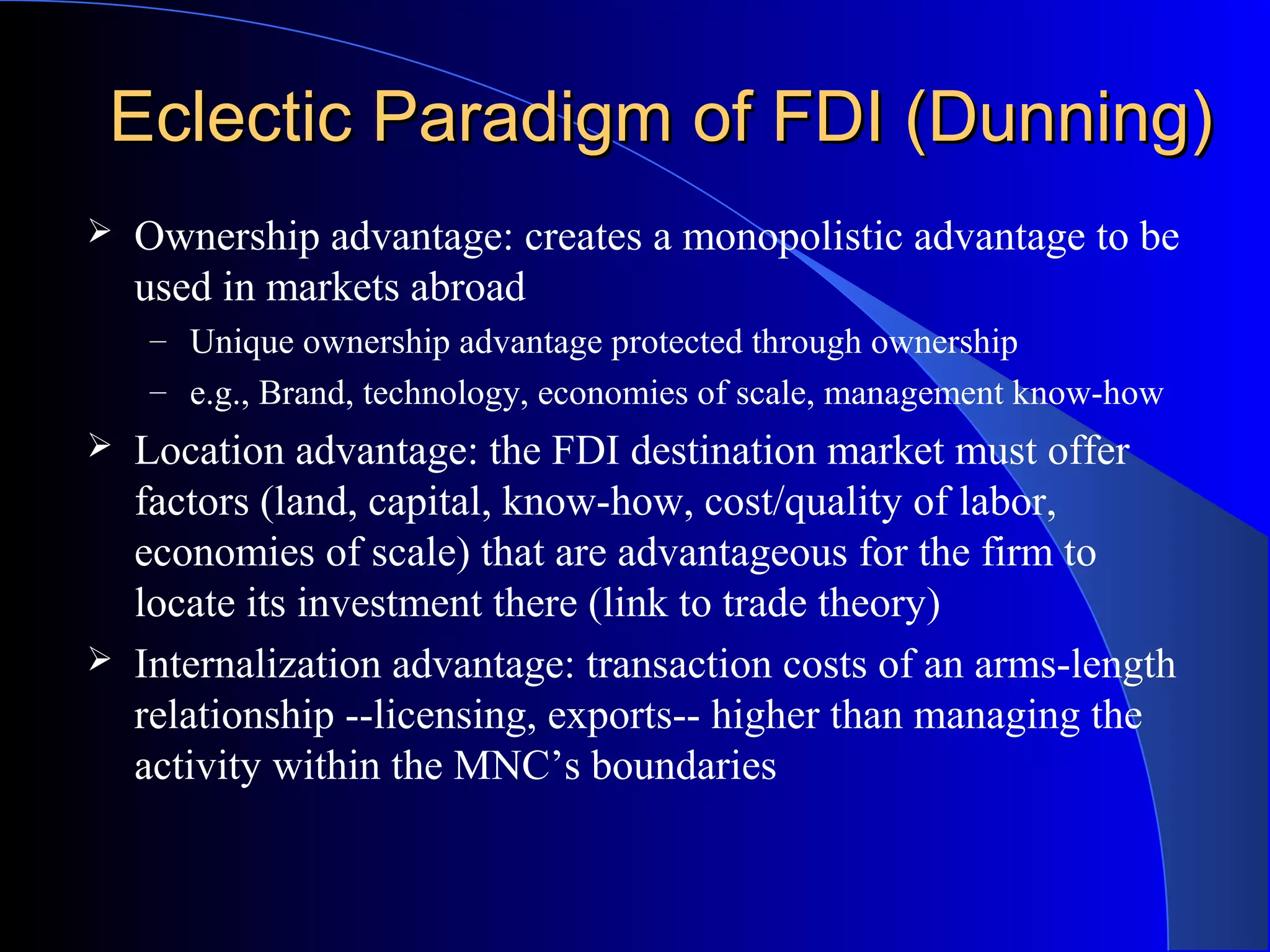

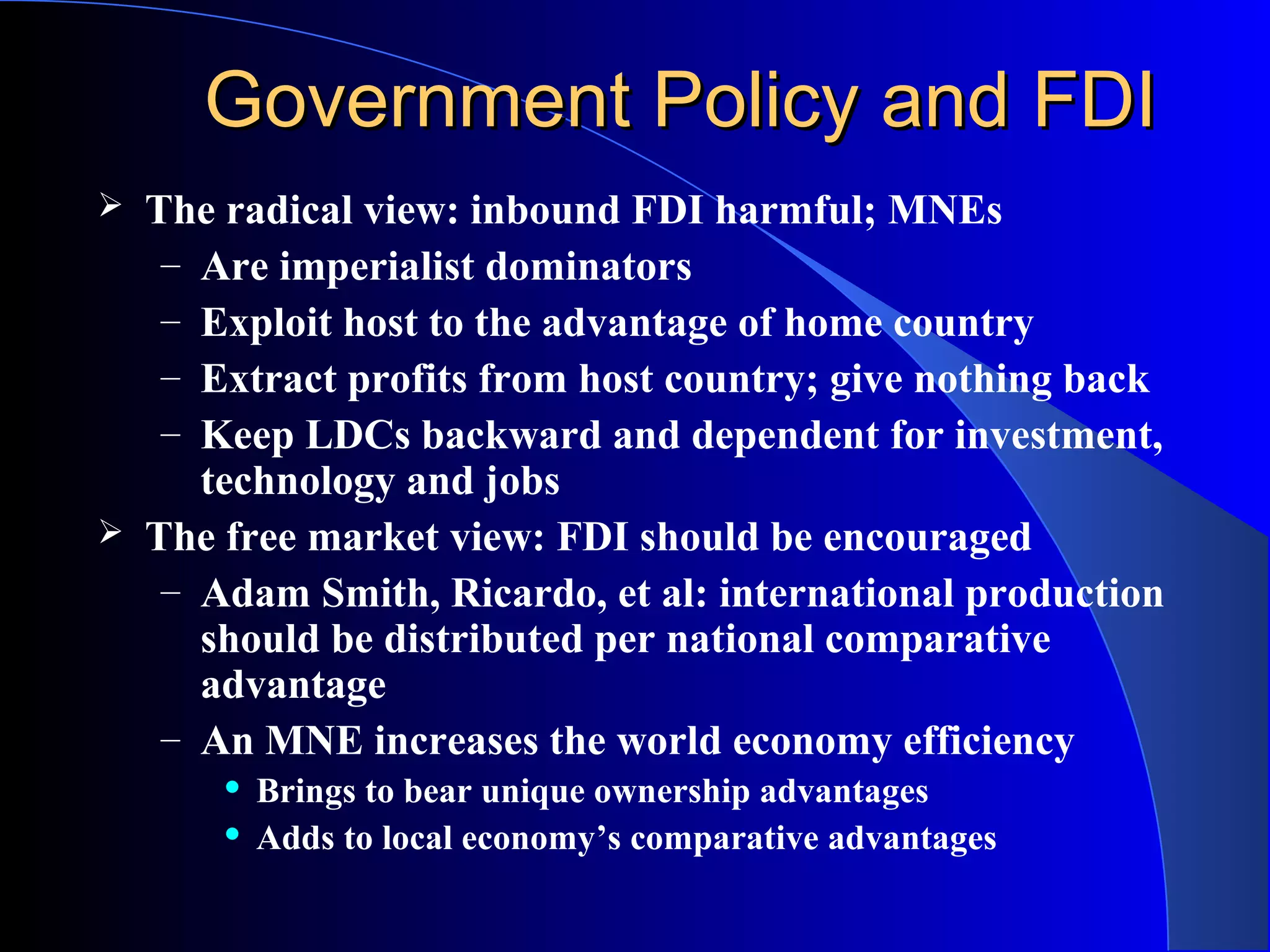

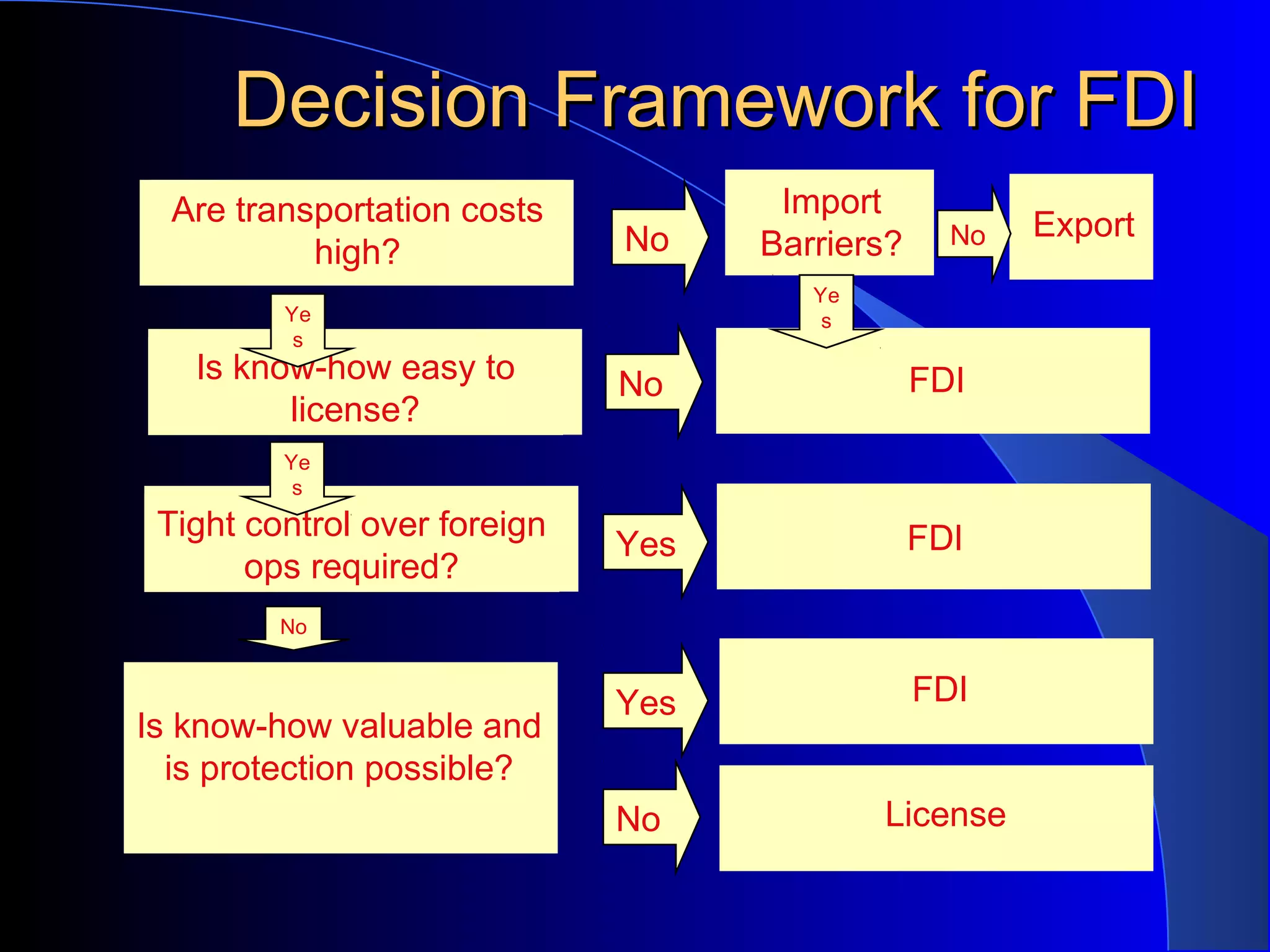

The document discusses the increasing trend of foreign direct investment (FDI) in the global economy, detailing its preferred strategies over other market entry methods, factors influencing FDI, and the growth metrics from past decades. It outlines various forms of FDI, the decision frameworks impacting FDI choices, and contrasts differing government policy perspectives on FDI benefits and costs. Additionally, it highlights the eclectic paradigm of FDI, emphasizing ownership, location, and internalization advantages for multinational enterprises.