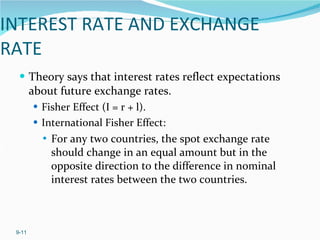

The document discusses exchange rate forecasting. Exchange rate forecasting is done by calculating the value of one currency relative to others over time. Various theories can be used for predictions, but no model is perfect. Exchange rate forecasts are required by multinational corporations, governments, financial institutions, and brokers. Fundamental analysis considers long-term economic factors, while technical analysis charts patterns in investor sentiment. Models for predicting exchange rates and prices include the random walk approach, uncovered interest rate parity, purchasing power parity, and theories related to interest rates, inflation, and investor psychology.